Summary - 83, VICTORIA STREET, LIVINGSTON EH54 5BH

2 bed 1 bath Flat

Immediate income with long-term tenants and strong gross yield — investor opportunity..

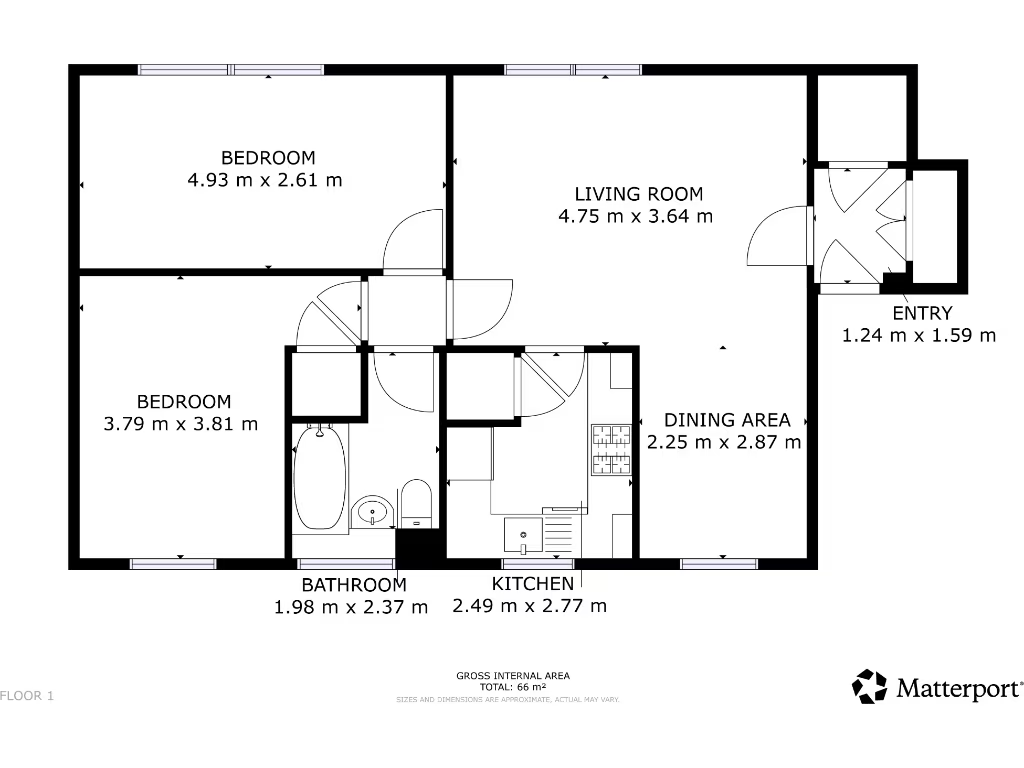

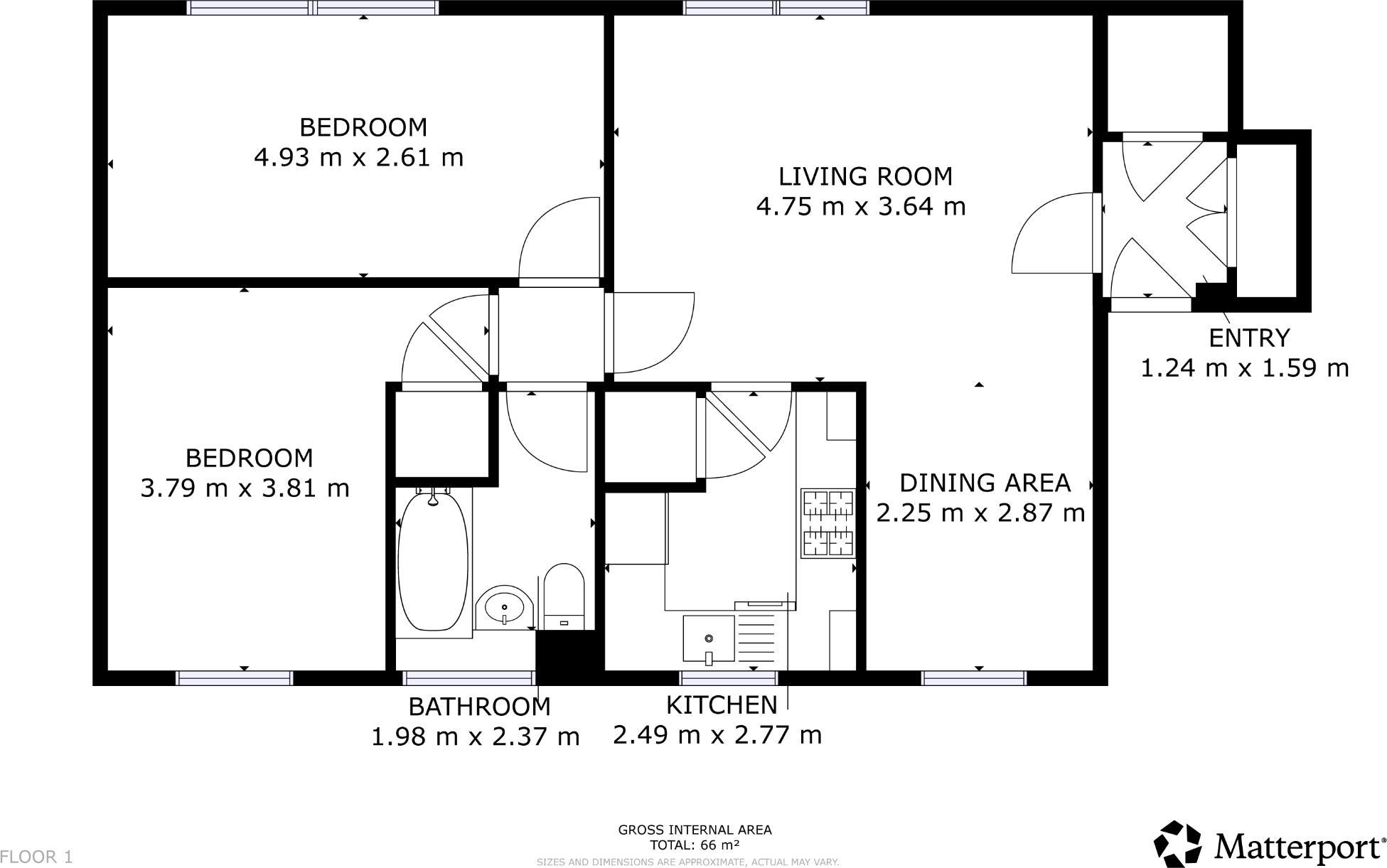

Two bedrooms, one bathroom, approximately 700 sq ft

A straightforward buy-to-let with strong headline yield and a long-term tenant in place. Priced at £60,000 with current gross rental income of £6,300, the property delivers an approximate gross yield of 10.5% — attractive for investors seeking immediate income.

The flat is a conventional two-bedroom, one-bathroom home of around 700 sq ft within a mid-20th century, post-war concrete block. Accommodation is average in size with a living room and kitchen overlooking communal green space. The building and grounds are functional and maintained, suitable for steady rental demand.

Tenants have occupied the flat for several years and indicate intent to remain, offering continuity of income but meaning viewings and vacant possession rely on tenancy terms. Buyers should note a Buyers Premium will apply to secure purchase. The area is described as very deprived and serves a constrained-renter market — expect tenant profile and management considerations typical of that context.

This is best suited to investors or portfolio buyers who prioritise reliable cash flow over immediate capital growth. The property’s condition appears serviceable rather than premium; factor in routine maintenance and possible refurbishment to improve rent or re-let prospects. Full tenancy and investment details are available in the Let Property Pack for due diligence.

2 bedroom flat for sale in Haymarket Crescent, Livingston, EH54 — £130,000 • 2 bed • 1 bath • 538 ft²

2 bedroom flat for sale in Haymarket Crescent, Livingston, EH54 — £130,000 • 2 bed • 1 bath • 538 ft² 2 bedroom flat for sale in Leven Walk, Livingston, West Lothian, EH54 — £60,000 • 2 bed • 1 bath • 549 ft²

2 bedroom flat for sale in Leven Walk, Livingston, West Lothian, EH54 — £60,000 • 2 bed • 1 bath • 549 ft² 2 bedroom flat for sale in Waverley Crescent, Livingston, EH54 — £128,000 • 2 bed • 1 bath • 667 ft²

2 bedroom flat for sale in Waverley Crescent, Livingston, EH54 — £128,000 • 2 bed • 1 bath • 667 ft² 3 bedroom flat for sale in Victoria Street, Livingston, West Lothian, EH54 — £70,000 • 3 bed • 1 bath • 678 ft²

3 bedroom flat for sale in Victoria Street, Livingston, West Lothian, EH54 — £70,000 • 3 bed • 1 bath • 678 ft² 2 bedroom flat for sale in Raeburn Crescent, Bathgate, EH47 — £85,000 • 2 bed • 1 bath • 721 ft²

2 bedroom flat for sale in Raeburn Crescent, Bathgate, EH47 — £85,000 • 2 bed • 1 bath • 721 ft² 1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft²

1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft²