Summary - 31, RAEBURN CRESCENT, BATHGATE, WHITBURN EH47 8HQ

2 bed 1 bath Flat

Long-term tenant producing steady income and immediate cashflow.

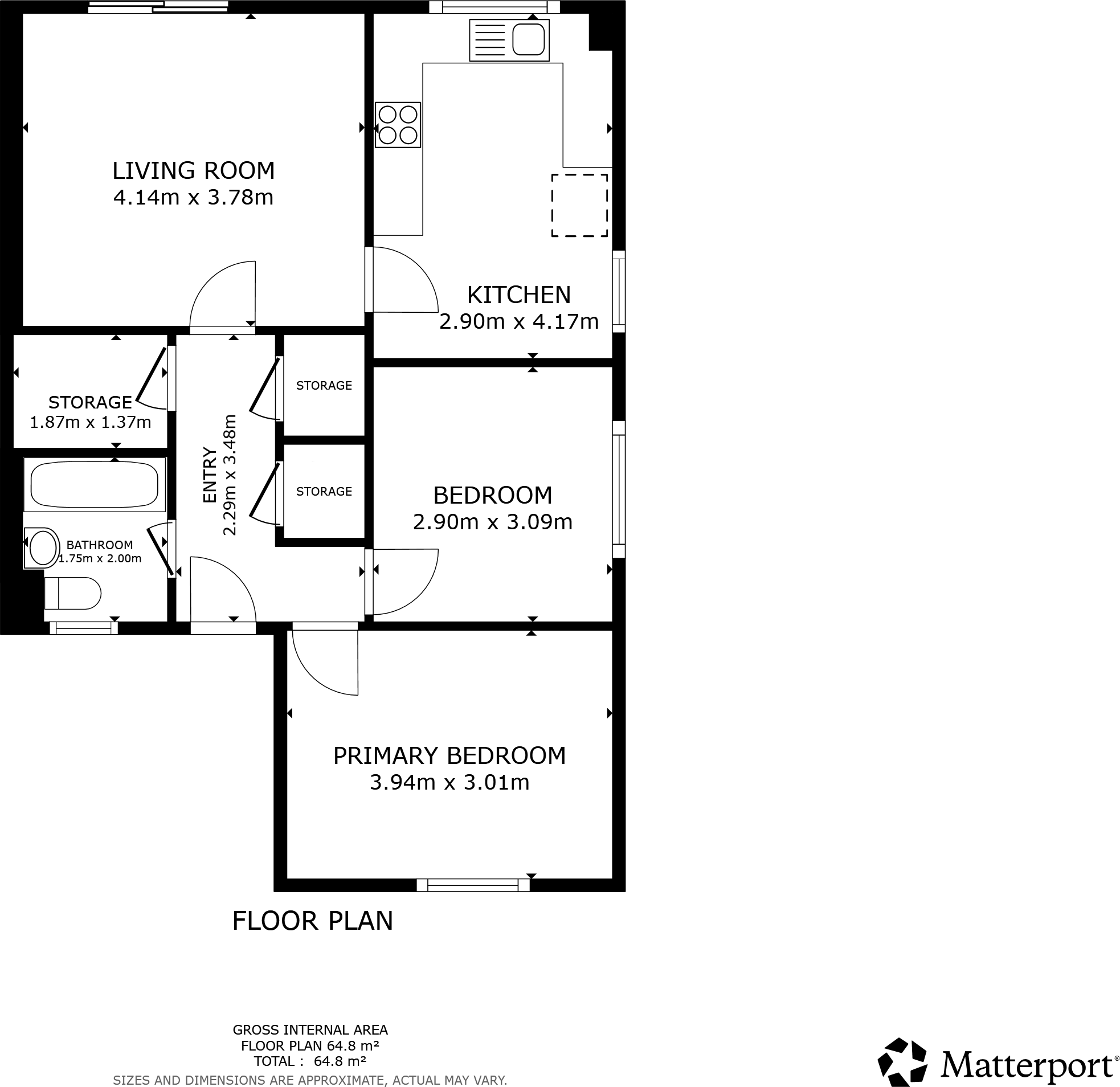

- Freehold two-bedroom flat with average overall size (approx. 721 sq ft)

- Long-term tenant in situ producing £6,540 annual gross income

- Immediate cashflow; suitable for buy-to-let investors or portfolio buyers

- Broadband fast and mobile signal excellent for tenants

- Wider area records high deprivation; consider long-term capital growth risk

- Internal condition and exact layout unverified; requires inspection and photos

- Buyers premium applies on completion; include in cost calculations

This freehold, two-bedroom flat on Raeburn Crescent is offered as a buy-to-let with a long-term tenant in situ, producing an annual gross income of £6,540. The property occupies an average-sized footprint (around 721 sq ft) and sits in a modern, low-rise residential setting close to local amenities including supermarkets and schools. Broadband and mobile signal are reported as fast and excellent respectively — practical for tenants.

The building appears externally well maintained and the flat is described as having a generous living area, fitted kitchen and three-piece bathroom. For investors this is a straightforward income purchase: immediate cashflow from a stable tenant and clear rental demand in a central Bathgate location. The Let Property Pack should be reviewed for full tenancy documents, rent schedule and potential yields.

Important drawbacks are declared plainly. The wider area records high deprivation indices, which can affect long-term capital growth and tenant risk. Internal condition and exact layout cannot be verified from the supplied material; a full inspection, internal photographs and a current floorplan are advised. A buyers premium applies on completion — factor this into your purchase costs.

This listing will suit buy-to-let investors seeking immediate rental income and a hands-off tenancy, or developers wanting portfolio stock. Serious purchasers should review the Let Property Pack, verify the tenancy documents, and arrange a physical inspection before bid or offer.

2 bedroom end of terrace house for sale in Sylvan Way, Bathgate, EH48 — £80,000 • 2 bed • 1 bath • 817 ft²

2 bedroom end of terrace house for sale in Sylvan Way, Bathgate, EH48 — £80,000 • 2 bed • 1 bath • 817 ft² 1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft²

1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft² 2 bedroom flat for sale in Northfield Court, West Calder, EH55 — £88,000 • 2 bed • 1 bath • 517 ft²

2 bedroom flat for sale in Northfield Court, West Calder, EH55 — £88,000 • 2 bed • 1 bath • 517 ft² 2 bedroom flat for sale in Haymarket Crescent, Livingston, EH54 — £120,000 • 2 bed • 1 bath • 538 ft²

2 bedroom flat for sale in Haymarket Crescent, Livingston, EH54 — £120,000 • 2 bed • 1 bath • 538 ft² 1 bedroom terraced house for sale in Malcolm Court, Bathgate, West Lothian, EH48 — £95,000 • 1 bed • 1 bath • 468 ft²

1 bedroom terraced house for sale in Malcolm Court, Bathgate, West Lothian, EH48 — £95,000 • 1 bed • 1 bath • 468 ft² 2 bedroom flat for sale in Almondell Road, Broxburn, EH52 — £100,000 • 2 bed • 1 bath • 753 ft²

2 bedroom flat for sale in Almondell Road, Broxburn, EH52 — £100,000 • 2 bed • 1 bath • 753 ft²