Summary - 102, Hardshaw Street, ST. HELENS WA10 1JR

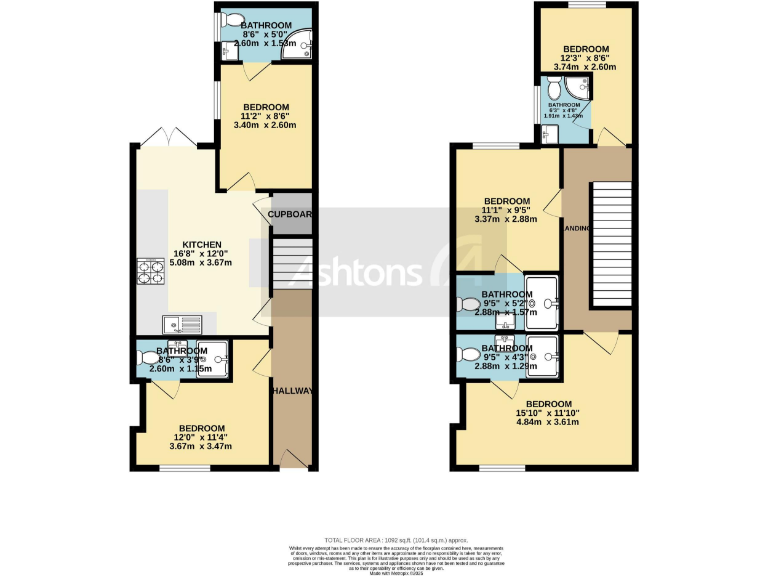

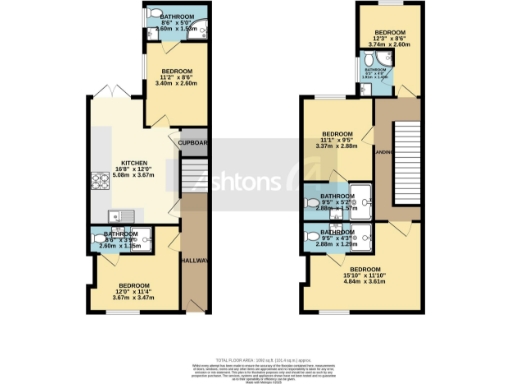

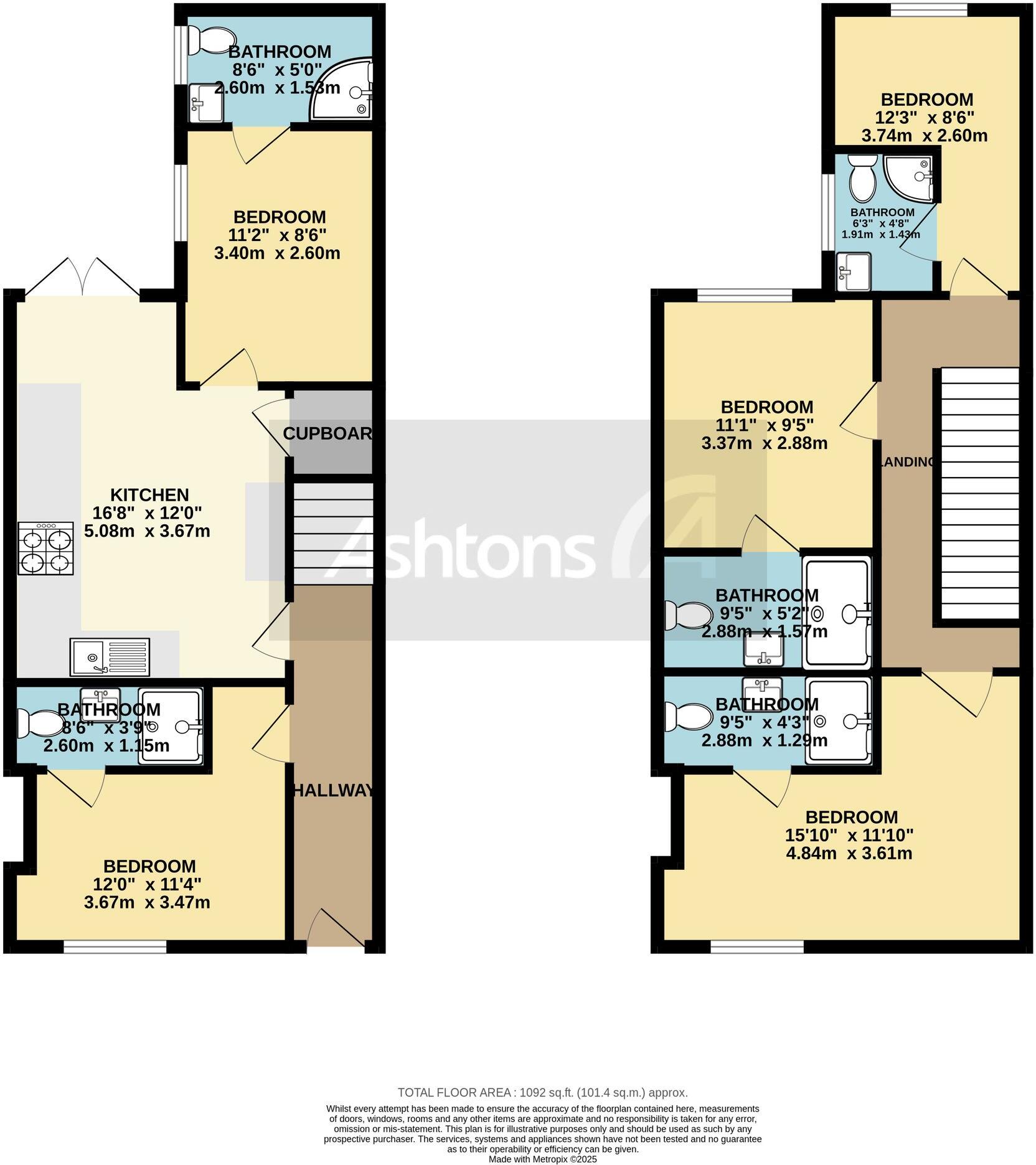

5 bed 5 bath Terraced

Fully let five-bed HMO near transport hubs — immediate income, managed and ready for investors..

High gross yield 13.9% (net 10.3%)

Five bedrooms each with private bathroom

Fully let HMO; some long‑standing tenants

Managed by an established property management company

Short walk to train, bus station and town centre

Leasehold tenure — check term and ground rent

Located in very deprived area; above‑average crime

Small Victorian mid‑terrace; periodic maintenance likely

This fully let five-bedroom HMO on Hardshaw Street delivers an impressive 13.9% gross (10.3% net) yield, making it a clear prospect for buy-to-let investors seeking immediate income. Each bedroom has a private bathroom, and the property is managed by an experienced company, offering a hands-off ownership option with established tenancy stability and some long-standing occupiers.

Situated a short walk from the train station, bus station and town centre, the house benefits from excellent transport links and nearby amenities that keep demand strong. Internally the property is well presented throughout with a modern kitchen/diner, double glazing and gas central heating; there is a useful rear garden with storage and an EPC rating of D.

Material points to note: the property is leasehold, located in a very deprived area with above‑average crime, and the building is a small Victorian mid‑terrace (circa 1900–1929) with cavity walls and internal insulation. Council tax is low, broadband and mobile signal are good, and there is no flood risk. These factors affect tenant profiles and long‑term capital appreciation and should be weighed alongside the strong rental return.

Overall this is a practical, income-focused investment: ready-made cashflow with a professional management structure, but situated in a constrained rental market where maintenance and tenant turnover considerations are important.

4 bedroom terraced house for sale in North Road, St. Helens, WA10 — £225,000 • 4 bed • 2 bath • 1058 ft²

4 bedroom terraced house for sale in North Road, St. Helens, WA10 — £225,000 • 4 bed • 2 bath • 1058 ft² 6 bedroom terraced house for sale in Dentons Green Lane, St. Helens, Merseyside, WA10 — £320,000 • 6 bed • 5 bath

6 bedroom terraced house for sale in Dentons Green Lane, St. Helens, Merseyside, WA10 — £320,000 • 6 bed • 5 bath 5 bedroom house for sale in Wrightington Street, Wigan, WN1 — £228,000 • 5 bed • 1 bath • 1098 ft²

5 bedroom house for sale in Wrightington Street, Wigan, WN1 — £228,000 • 5 bed • 1 bath • 1098 ft² 7 bedroom semi-detached house for sale in Warbreck Road, Liverpool, Merseyside, L9 — £295,000 • 7 bed • 5 bath • 1884 ft²

7 bedroom semi-detached house for sale in Warbreck Road, Liverpool, Merseyside, L9 — £295,000 • 7 bed • 5 bath • 1884 ft² 3 bedroom terraced house for sale in Brynn Street, St. Helens, WA10 — £115,000 • 3 bed • 1 bath • 915 ft²

3 bedroom terraced house for sale in Brynn Street, St. Helens, WA10 — £115,000 • 3 bed • 1 bath • 915 ft² 6 bedroom terraced house for sale in Folly Lane, Warrington, Cheshire, WA5 — £220,000 • 6 bed • 3 bath • 1103 ft²

6 bedroom terraced house for sale in Folly Lane, Warrington, Cheshire, WA5 — £220,000 • 6 bed • 3 bath • 1103 ft²