Summary - 12, MALCOLM COURT, BATHGATE EH48 2SW

1 bed 1 bath Terraced

Low-maintenance one-bed let with immediate rental income and allocated parking.

Investment purchase only — sold with tenant in situ

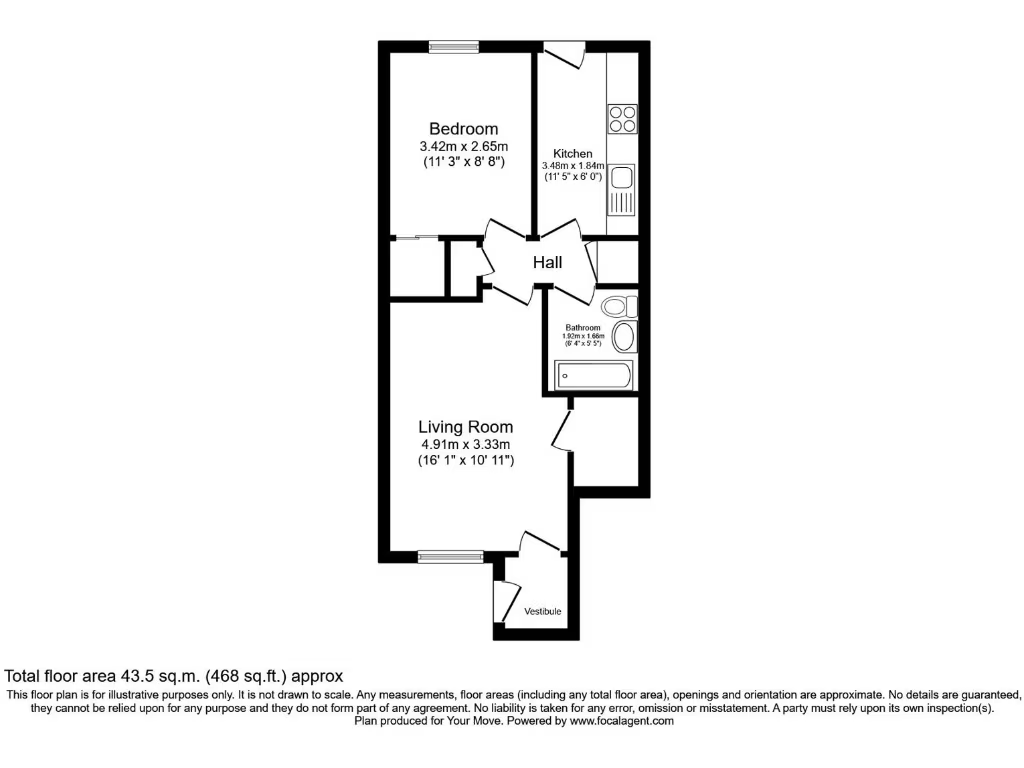

Sold specifically as an investment and offered as a going concern with a tenant in situ, this ground-floor one-bedroom property in Bathgate is aimed at buy-to-let purchasers seeking straightforward income. The flat is presented in tidy, neutral order with a comfortable living room, fitted kitchen, double bedroom with wardrobes and a three-piece bathroom. The compact footprint and low-maintenance paved rear garden reduce void and upkeep risk.

Practical features support rental appeal: one allocated off-street parking space, freehold tenure, fast broadband and excellent mobile signal. The current rent is £575 pcm, which the listing states equates to a gross yield of about 7% at the asking price of £95,000 — useful for portfolio calculations but worth verifying against your finance and tax position.

Be clear about the material negatives: the sale is for investment purchasers only and the property is sold with the existing tenancy. EPC rating D and the wider area is recorded as very deprived, which may affect rental demand, tenant mix and long-term capital growth. The flat is small (approximately 468 sq ft) and best suited to single occupancy or couples rather than families.

For an investor wanting a low-management let in a central Bathgate location, this property offers immediate income and basic, move-in-ready accommodation. Budget for routine upkeep and check tenancy details, compliance records and energy/utility certificates before committing.

2 bedroom flat for sale in Raeburn Crescent, Bathgate, EH47 — £85,000 • 2 bed • 1 bath • 721 ft²

2 bedroom flat for sale in Raeburn Crescent, Bathgate, EH47 — £85,000 • 2 bed • 1 bath • 721 ft² 1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft²

1 bedroom flat for sale in Park View, Stoneyburn, Bathgate, EH47 — £56,000 • 1 bed • 1 bath • 301 ft² 1 bedroom ground floor flat for sale in Mid Street, Bathgate, EH48 — £94,000 • 1 bed • 1 bath • 426 ft²

1 bedroom ground floor flat for sale in Mid Street, Bathgate, EH48 — £94,000 • 1 bed • 1 bath • 426 ft² 3 bedroom ground floor flat for sale in 141A/25 Marina Road, Bathgate, EH48 1RS, EH48 — £160,000 • 3 bed • 2 bath • 806 ft²

3 bedroom ground floor flat for sale in 141A/25 Marina Road, Bathgate, EH48 1RS, EH48 — £160,000 • 3 bed • 2 bath • 806 ft² 2 bedroom ground floor flat for sale in 53 South Loch Park, Bathgate, West Lothian, EH48 — £134,000 • 2 bed • 1 bath • 582 ft²

2 bedroom ground floor flat for sale in 53 South Loch Park, Bathgate, West Lothian, EH48 — £134,000 • 2 bed • 1 bath • 582 ft² 1 bedroom ground floor flat for sale in 43 Nettlehill Road, Uphall Station, Livingston, West Lothian, EH54 5PP, EH54 — £90,000 • 1 bed • 1 bath • 400 ft²

1 bedroom ground floor flat for sale in 43 Nettlehill Road, Uphall Station, Livingston, West Lothian, EH54 5PP, EH54 — £90,000 • 1 bed • 1 bath • 400 ft²