Summary -

46 Beckford Court,Tyldesley,MANCHESTER,M29 8GF

M29 8GF

2 bed 2 bath Flat

Income-producing two-bed flat with shared parking and long-term tenant — strong gross yield potential.

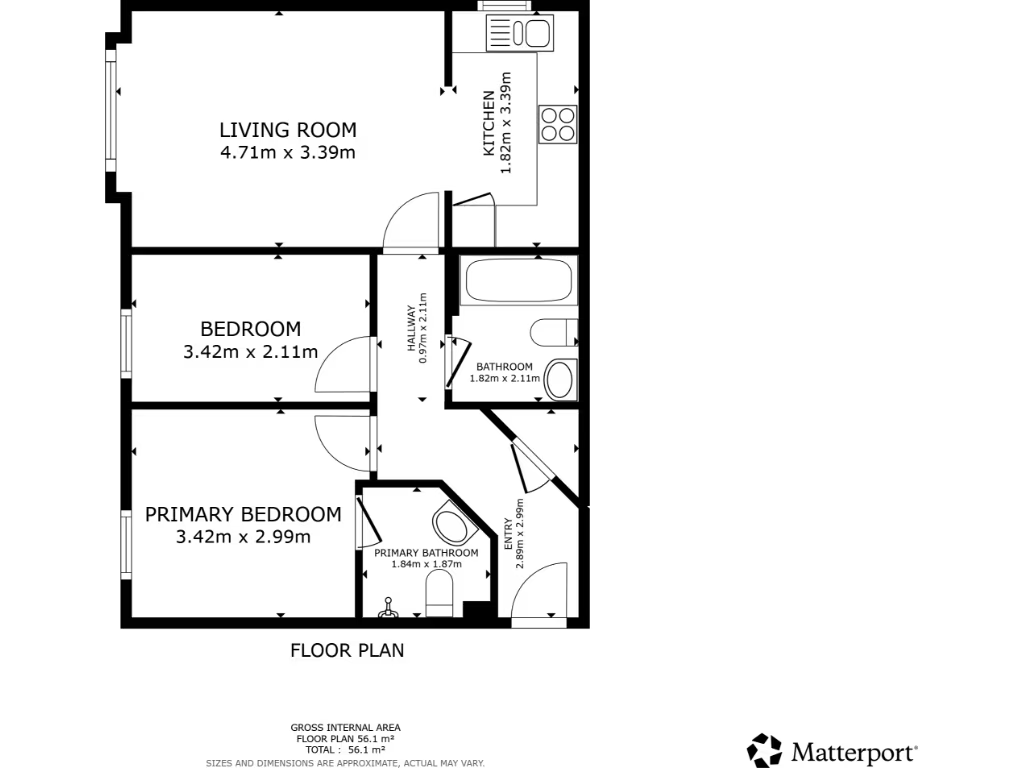

- Two bedrooms plus ensuite and separate three-piece bathroom

- Compact apartment, approximately 592 sq ft (small overall size)

- Shared private parking and communal front/back gardens

- Long-term tenant in situ producing £10,800pa income

- Approximate gross yield ~9.4% at asking price £115,000

- Leasehold tenure — check lease length, ground rent, and charges

- Area shows higher deprivation; verify local demand and risks

- Buyers Premium applies; see Let Property Pack for details

This two-bedroom leasehold apartment in Beckford Court is presented primarily as a buy-to-let opportunity. The flat is compact (approximately 592 sq ft) within a modern red-brick, low-rise block, with communal front and rear gardens and shared off-street parking — features that support steady tenant demand.

The property currently produces a gross annual income of £10,800, implying an approximate gross yield of 9.4% at the asking price of £115,000. It comes with a long-term tenant in situ who has consistently paid rent and does not intend to leave, making the sale straightforward for investors seeking immediate income.

Important considerations: this is a leasehold unit in an area with higher relative deprivation; buyers should verify the length of the lease, ground rent, service charges, and any reserve funds for communal maintenance. A Buyers Premium applies on sale, and the sales pack should be checked for full tenancy terms and any restrictions.

Overall, the flat suits investors after near-term rental income and low-external-maintenance accommodation. Developers or portfolio buyers may also consider the unit as part of a block-level strategy, but perform standard due diligence on lease terms, communal costs, and tenant arrangements before proceeding.

2 bedroom flat for sale in Beckford Court, Manchester, M29 — £115,000 • 2 bed • 2 bath • 657 ft²

2 bedroom flat for sale in Beckford Court, Manchester, M29 — £115,000 • 2 bed • 2 bath • 657 ft² 1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft²

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft² 2 bedroom flat for sale in Betsham Street, Manchester, Greater Manchester, M15 — £145,000 • 2 bed • 1 bath • 624 ft²

2 bedroom flat for sale in Betsham Street, Manchester, Greater Manchester, M15 — £145,000 • 2 bed • 1 bath • 624 ft² 1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft²

1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft² 2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft²

2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft² 2 bedroom flat for sale in Bury Old Road, M45 — £210,000 • 2 bed • 1 bath • 764 ft²

2 bedroom flat for sale in Bury Old Road, M45 — £210,000 • 2 bed • 1 bath • 764 ft²