Summary -

19 Beckford Court,Tyldesley,MANCHESTER,M29 8GF

M29 8GF

2 bed 2 bath Flat

Income-producing 2-bed flat with tenant in situ and shared parking — ideal for investors..

Long-term tenant in situ with stable rent payments

Produces £9,540 gross annual income (approx 8.3% gross yield)

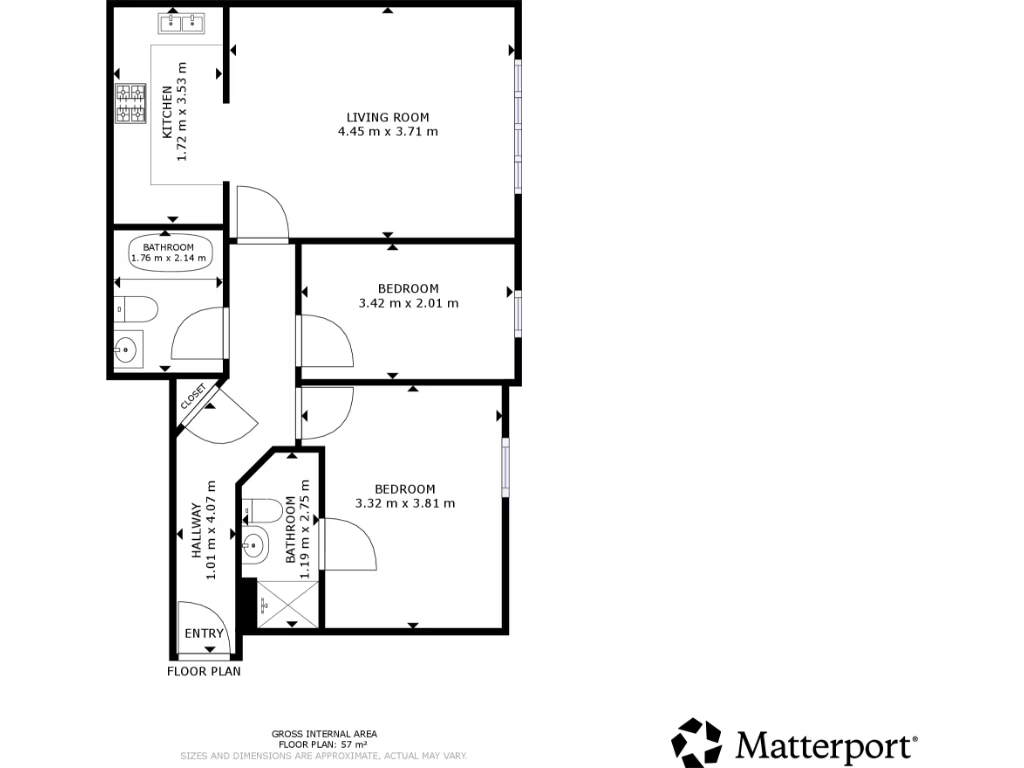

Two bedrooms, ensuite plus separate three-piece bathroom

657 sq ft — described as average-sized flat

Shared private parking and communal front/back gardens

Leasehold tenure; Buyers Premium payable on purchase

Located in M29 area with higher deprivation — affects growth prospects

No flood risk; very low local crime rate

This two-bedroom, two-bathroom flat in Beckford Court is offered as a buy-to-let opportunity with a long-term tenant in situ. At 657 sq ft, the home provides a practical layout with an open-plan living room and fitted kitchen, communal front and rear gardens, and shared private parking — functional features that appeal to rental demand.

Financially the property is already income-producing, generating £9,540 gross per year from the current tenancy, which equates to roughly an 8.3% gross yield at the listed price. Rental continuity is a clear plus: the existing tenants have a stable payment record and intend to remain, supporting immediate cashflow for a portfolio buyer.

Important considerations: the property is leasehold and a Buyers Premium applies to secure purchase, which will affect acquisition costs. The wider M29 area shows higher levels of deprivation, which can influence capital growth prospects and tenant profiles. Internal photos are limited and the flat is described as average-sized, so purchasers should allow for potential minor works or updates after inspection.

Overall this is a straightforward, low-maintenance investment for buyers seeking immediate rental income and a unit that fits easily into a broader portfolio. For detailed investment figures and tenancy documentation, refer to the Let Property Pack before proceeding.

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft²

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft² 2 bedroom flat for sale in Betsham Street, Manchester, Greater Manchester, M15 — £145,000 • 2 bed • 1 bath • 624 ft²

2 bedroom flat for sale in Betsham Street, Manchester, Greater Manchester, M15 — £145,000 • 2 bed • 1 bath • 624 ft² 1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft²

1 bedroom flat for sale in Talbot Road, Manchester, M16 — £110,000 • 1 bed • 1 bath • 409 ft² 2 bedroom flat for sale in Gibstone Close, Atherton, Manchester M46 — £108,000 • 2 bed • 1 bath • 657 ft²

2 bedroom flat for sale in Gibstone Close, Atherton, Manchester M46 — £108,000 • 2 bed • 1 bath • 657 ft² 2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft²

2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft² 1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft²

1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft²