Summary -

19, Betsham Street,MANCHESTER,M15 5JN

M15 5JN

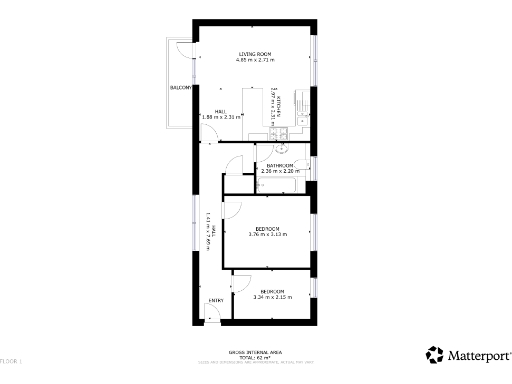

2 bed 1 bath Flat

Let property producing immediate income — ideal for buy-to-let investors..

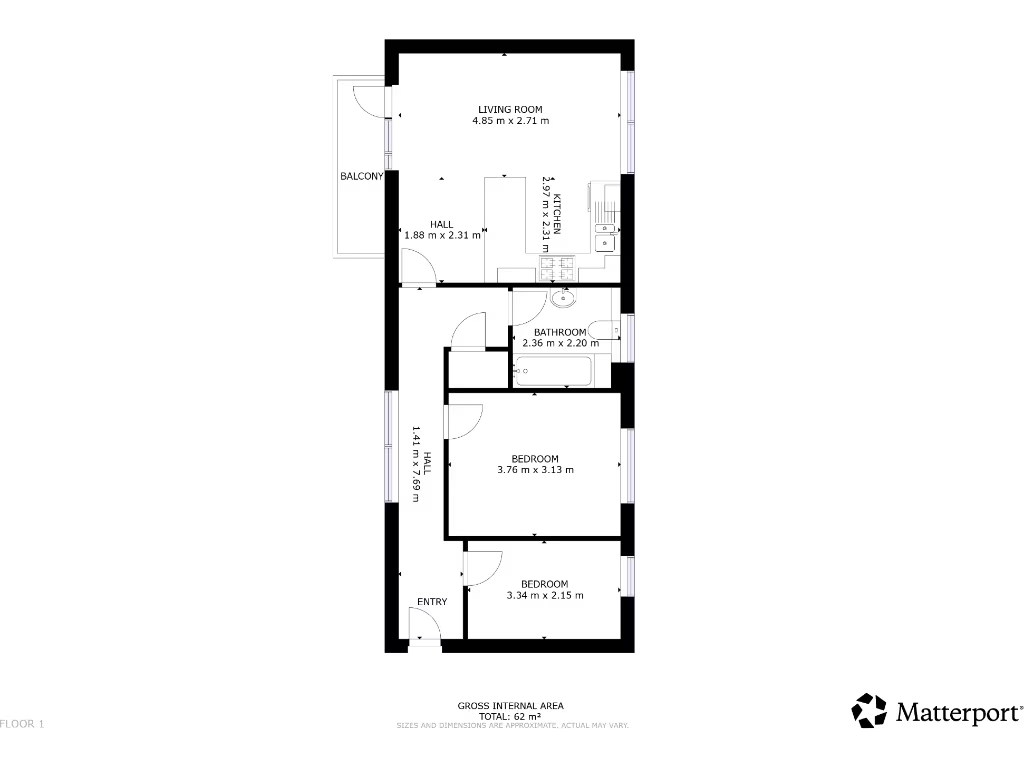

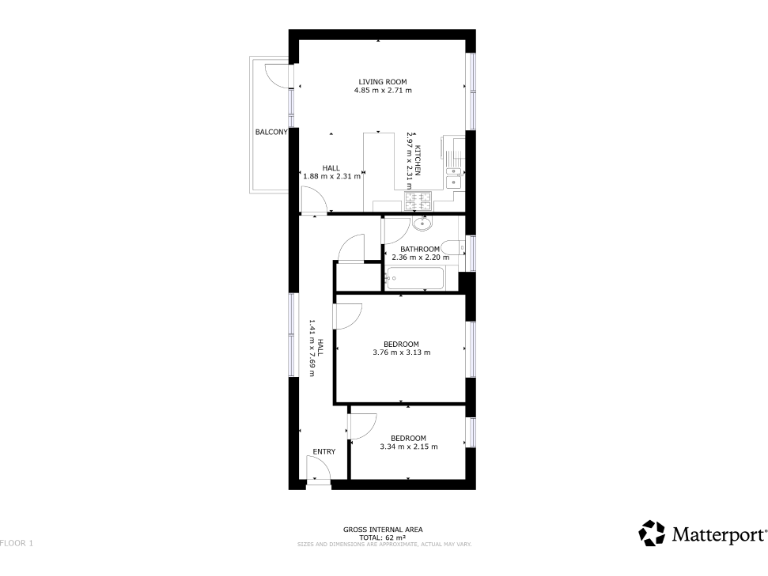

2 bedrooms, 624 sq ft — average-sized two-bed flat

Currently tenanted; annual gross income £10,200

Leasehold tenure — confirm lease length and ground rent

Buyers Premium applies on purchase

Limited private outdoor space; communal courtyard/balcony only

No internal photos provided — viewing and checks advised

On-street parking only; confirm parking availability

Excellent mobile signal; broadband speeds average

This two-bedroom Manchester flat occupies an average-sized 624 sq ft footprint within a contemporary mid-rise block in the M15 postcode. The property is currently let to long-term tenants generating a gross annual income of £10,200, making it a straightforward buy-to-let addition for investors seeking immediate rental return.

Practical benefits include low local crime, excellent mobile signal and nearby amenities and transport links that support steady tenant demand from students and professionals. The building appears modern with communal access and external balconies; private outdoor space is limited to small communal areas and no private garden is visible.

Important considerations: the tenure is leasehold and a Buyers Premium will apply on sale. The sale includes sitting tenants who have indicated they intend to remain, so purchaser occupation would not be immediate. No internal photographs are supplied in the listing, and broadband speeds are only average — factors to confirm in the Let Property Pack before purchase.

Overall, this property will suit investors seeking an income-producing flat in an inner-city Manchester location. It offers immediate rental income and typical modern-block conveniences, but buyers should factor in leasehold terms, the Buyers Premium, tenant continuity and limited private outdoor space.

2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft²

2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft² 2 bedroom flat for sale in Joiner Street, Manchester, M4 — £123,000 • 2 bed • 1 bath • 656 ft²

2 bedroom flat for sale in Joiner Street, Manchester, M4 — £123,000 • 2 bed • 1 bath • 656 ft² 2 bedroom flat for sale in Middlewood Street, Manchester, M5 — £113,000 • 2 bed • 1 bath • 527 ft²

2 bedroom flat for sale in Middlewood Street, Manchester, M5 — £113,000 • 2 bed • 1 bath • 527 ft² 2 bedroom flat for sale in Spinners Way, Manchester, M15 — £430,000 • 2 bed • 2 bath • 836 ft²

2 bedroom flat for sale in Spinners Way, Manchester, M15 — £430,000 • 2 bed • 2 bath • 836 ft² 1 bedroom flat for sale in John William Street, Manchester, M30 — £115,000 • 1 bed • 1 bath • 441 ft²

1 bedroom flat for sale in John William Street, Manchester, M30 — £115,000 • 1 bed • 1 bath • 441 ft² 1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft²

1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft²