Summary - Talbot Road, Manchester, M16 M16 0UE

1 bed 1 bath Flat

Income-producing one-bedroom flat with long-term tenant and strong gross yield.

Long-term tenant in situ with consistent rental payments

Current gross income £13,200 per year; potential £13,800 at market rent

Small one-bedroom flat — about 409 sq ft

Leasehold tenure; check remaining lease and service charges

Buyers Premium applies on completion — factor into total cost

Located in deprived area but with very low local crime levels

Close to amenities, university, shops, and good transport links

Fast broadband and excellent mobile signal, suited to renters

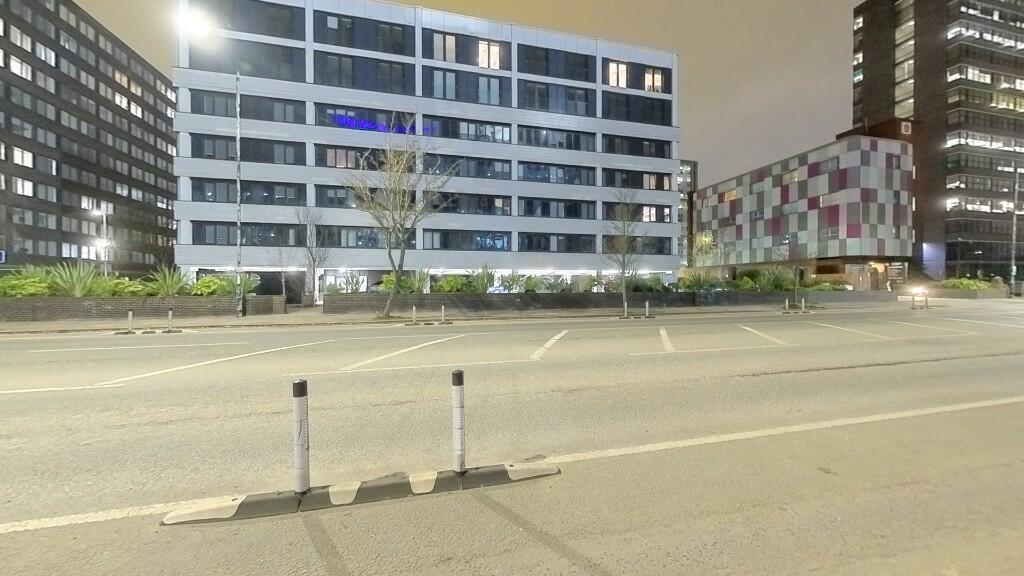

Located on Talbot Road, this compact one-bedroom flat is presented as a clear buy-to-let proposition for investors seeking immediate income. The property sits in a modern multi-storey building close to shops, transport links and a university, and benefits from fast broadband and excellent mobile signal — useful for long-term rentalability in an inner-city market.

A long-term tenant currently occupies the flat, producing an annual gross income of £13,200; the vendor's pack indicates potential to lift this to about £13,800 at market rent. At the current £110,000 asking price this equates to a strong gross yield for investors. The apartment includes a modern kitchen and a three-piece bathroom and is described as well-kept internally.

Important considerations: the property is leasehold, sits in an area classified as deprived, and is small (c. 409 sq ft). A Buyers Premium will apply on sale completion. The tenant intends to remain, so this is a purchase for an investor wanting an income stream rather than vacant-possession redevelopment.

Overall this is a straightforward, income-producing unit that suits portfolio investors or developers buying multiple lots. It offers immediate cashflow and modest upside by aligning rent to current market levels, but buyers should allow for leasehold terms, the building’s urban location and the listed buyer’s premium when modelling returns.

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft²

1 bedroom flat for sale in John William Street, Manchester, M30 — £120,000 • 1 bed • 1 bath • 441 ft² 1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft²

1 bedroom flat for sale in Chester Road, Manchester, M16 — £102,500 • 1 bed • 1 bath • 484 ft² Studio flat for sale in Chester Road, Manchester, M16 — £115,000 • 1 bed • 1 bath

Studio flat for sale in Chester Road, Manchester, M16 — £115,000 • 1 bed • 1 bath 2 bedroom flat for sale in Joiner Street, Manchester, M4 — £123,000 • 2 bed • 1 bath • 656 ft²

2 bedroom flat for sale in Joiner Street, Manchester, M4 — £123,000 • 2 bed • 1 bath • 656 ft² 1 bedroom flat for sale in Oxford Road, Manchester, Greater Manchester, M1 — £109,000 • 1 bed • 1 bath • 530 ft²

1 bedroom flat for sale in Oxford Road, Manchester, Greater Manchester, M1 — £109,000 • 1 bed • 1 bath • 530 ft² 2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft²

2 bedroom flat for sale in Stretford Road, Manchester, M15 — £158,000 • 2 bed • 1 bath • 646 ft²