Summary - 84, BANKHEAD AVENUE AB21 9EY

2 bed 1 bath Flat

Occupied two-bed with immediate rental income and refurbishment upside for yield-focused buyers.

- Two-bedroom flat producing £7,200 gross annual income

- Approximate gross yield c.8.5% at £85,000 asking price

- Long-term tenant in situ; tenant intends to remain

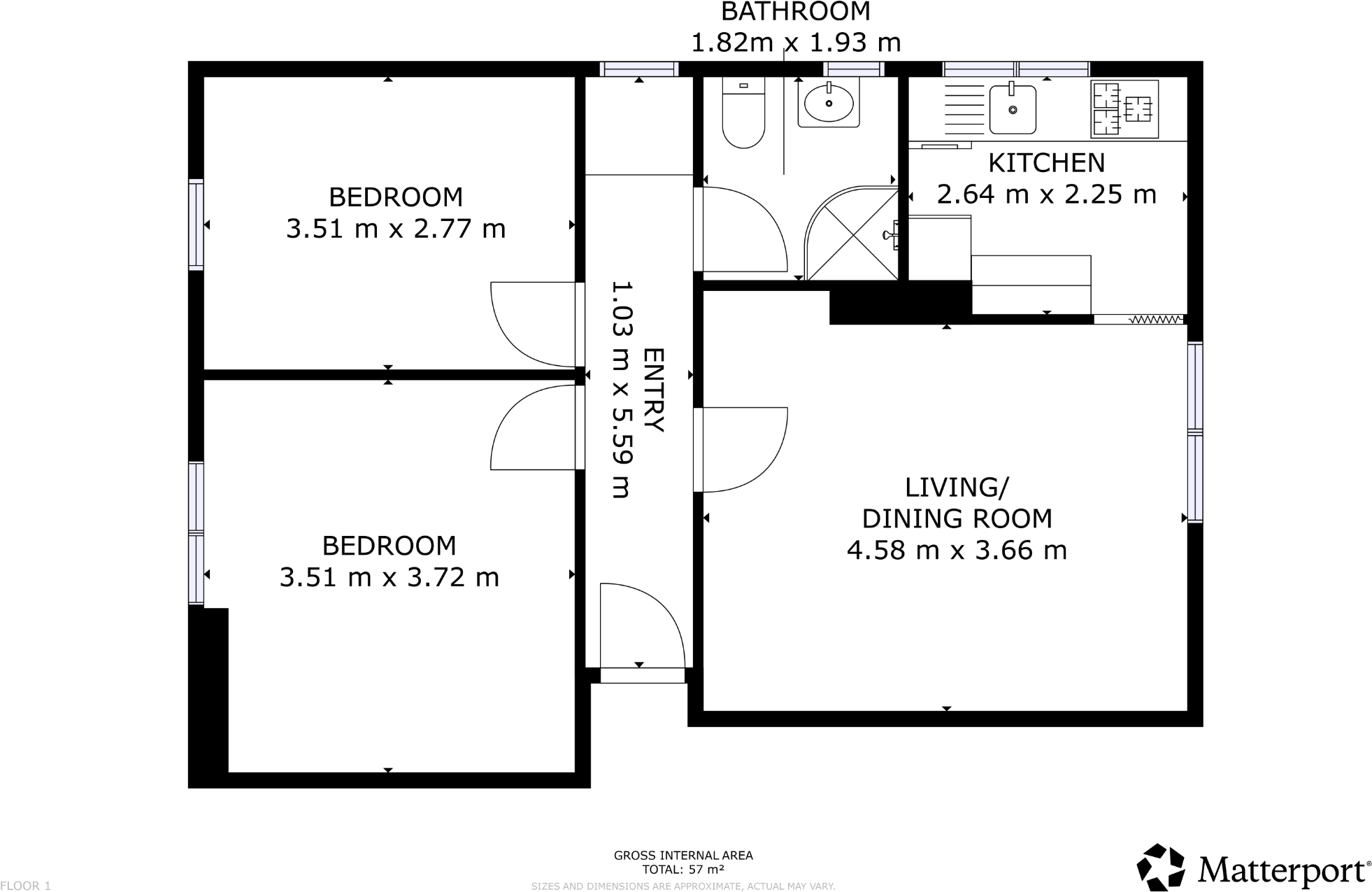

- Small overall size: c.603 sq ft, six rooms total

- Shared front and rear garden; on-street parking only

- Requires cosmetic updating; renovation potential to add value

- Located in a very deprived outer-city area; constrained renters

- Tenure not specified and a Buyers Premium will apply

A practical buy-to-let opportunity in Bankhead Avenue, Aberdeen, currently let to a long-term tenant producing a gross annual income of £7,200. At an asking price of £85,000 the property produces an approximate gross yield of c.8.5%, making it attractive for investors seeking immediate rental income. The flat is small (approx. 603 sq ft) and arranged over one level within a post‑war, two‑storey block.

Accommodation comprises two bedrooms, lounge, kitchen and bathroom, with shared front and rear garden ground and on‑street parking. The interior is functional but will benefit from updating in places, presenting straightforward scope for cosmetic refurbishment to increase rental value. Mobile signal and broadband speeds are described as strong.

Buyers should note the location is in an outer‑city area classified as very deprived and constrained renters; this supports steady demand from local tenants but may limit capital growth compared with stronger neighbourhoods. Tenure is not stated and a Buyers Premium will apply to secure a purchase—both matters to clarify before exchange. Overall, this is a clear cash‑flow focused investment for buyers prioritising yield and an occupied income stream over immediate capital upside.

2 bedroom flat for sale in Victoria Road, Aberdeen, AB11 — £80,000 • 2 bed • 1 bath • 743 ft²

2 bedroom flat for sale in Victoria Road, Aberdeen, AB11 — £80,000 • 2 bed • 1 bath • 743 ft² 4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath

4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath 2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft²

2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft² 2 bedroom flat for sale in Tullos Place, Aberdeen, Aberdeenshire, AB11 — £75,000 • 2 bed • 1 bath • 657 ft²

2 bedroom flat for sale in Tullos Place, Aberdeen, Aberdeenshire, AB11 — £75,000 • 2 bed • 1 bath • 657 ft² 2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft²

2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft² 2 bedroom flat for sale in Union Street, Aberdeen, Aberdeenshire, AB11 — £95,000 • 2 bed • 2 bath • 657 ft²

2 bedroom flat for sale in Union Street, Aberdeen, Aberdeenshire, AB11 — £95,000 • 2 bed • 2 bath • 657 ft²