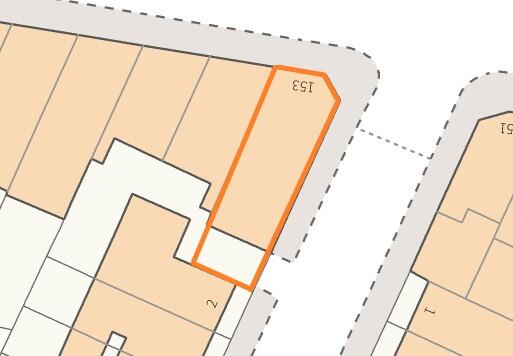

Summary - 153, HIGH ROAD NW10 2SG

1 bed 1 bath Mixed Use

Prominent refurbished retail with basement and long-term residential reversion risk..

Freehold mixed-use Victorian corner building with strong High Road frontage

A prominent Victorian corner freehold on Willesden High Road, offered as a mixed-use investment with a newly refurbished ground-floor retail unit and three residential flats sold off on long leases. The shop benefits from triple glass frontage, high ceilings and a large basement, providing strong street exposure and flexible retail or storage use. Current retail rent is £24,500 p.a., producing a gross initial yield of 5.48% at the asking price; VAT is not applicable.

The flats above have been sold on long leases (99 years from 1970) with modest ground rents currently totalling £180 p.a. and fixed increases in 2037; reversion to the freehold is due in 2070 (45 years remaining on the residential reversions). This limited remaining term is the principal material drawback: many mortgage lenders may refuse to lend against the freehold reversion, which will affect buyer pool and financing options.

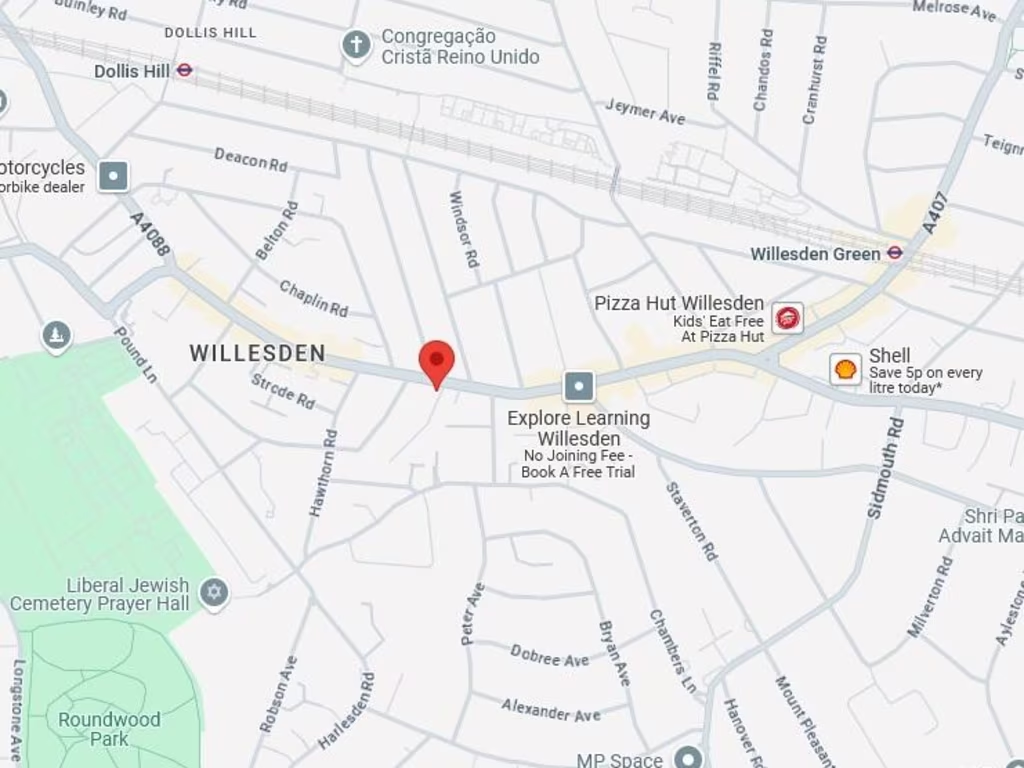

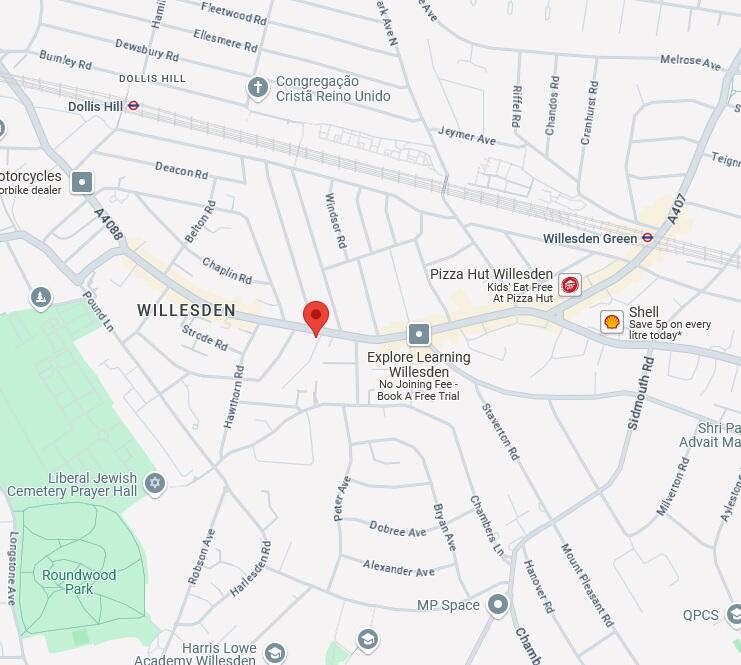

Location is practical for retail footfall and commuter access — about a 10-minute walk to Willesden Green Underground (Jubilee Line) and close to local shops and eateries. The surrounding area is an inner-city, mixed demographic of young families and students; broadband speeds are average and mobile signal is excellent. Buyers should note the neighbourhood records higher crime levels and overall area deprivation, which may impact tenant demand and rental growth prospects.

This property suits a buyer comfortable with an asset-level income and a long-term reversion profile — for example, a cash buyer, a specialist investor able to manage lease enfranchisement risk, or an occupational buyer seeking a prominent retail frontage. The retail unit’s recent refurbishment reduces immediate capital expenditure, but purchasers should budget for long-term maintenance of a Victorian building and plan for the leasehold reversion timeline when modelling exit scenarios.

High street retail property for sale in 153 High Road, London, NW10 — £350,000 • 1 bed • 1 bath • 1216 ft²

High street retail property for sale in 153 High Road, London, NW10 — £350,000 • 1 bed • 1 bath • 1216 ft² Studio flat for sale in 153 High Road, London, NW10 — £150,000 • 1 bed • 1 bath • 1970 ft²

Studio flat for sale in 153 High Road, London, NW10 — £150,000 • 1 bed • 1 bath • 1970 ft² High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft²

High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft² High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft²

High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft² Shop for sale in Harrow Road, College Park, London, NW10 — £260,000 • 1 bed • 1 bath • 706 ft²

Shop for sale in Harrow Road, College Park, London, NW10 — £260,000 • 1 bed • 1 bath • 706 ft² High street retail property for sale in 44 - 46 Birchington Road, Kilburn, NW6 4LJ, NW6 — £1,350,000 • 1 bed • 1 bath • 5477 ft²

High street retail property for sale in 44 - 46 Birchington Road, Kilburn, NW6 4LJ, NW6 — £1,350,000 • 1 bed • 1 bath • 5477 ft²