Summary - 153, HIGH ROAD NW10 2SG

1 bed 1 bath Retail Property (high street)

Income-producing triple-frontage retail with 7% yield and long leasehold.

Prominent corner retail with triple frontage and high visibility

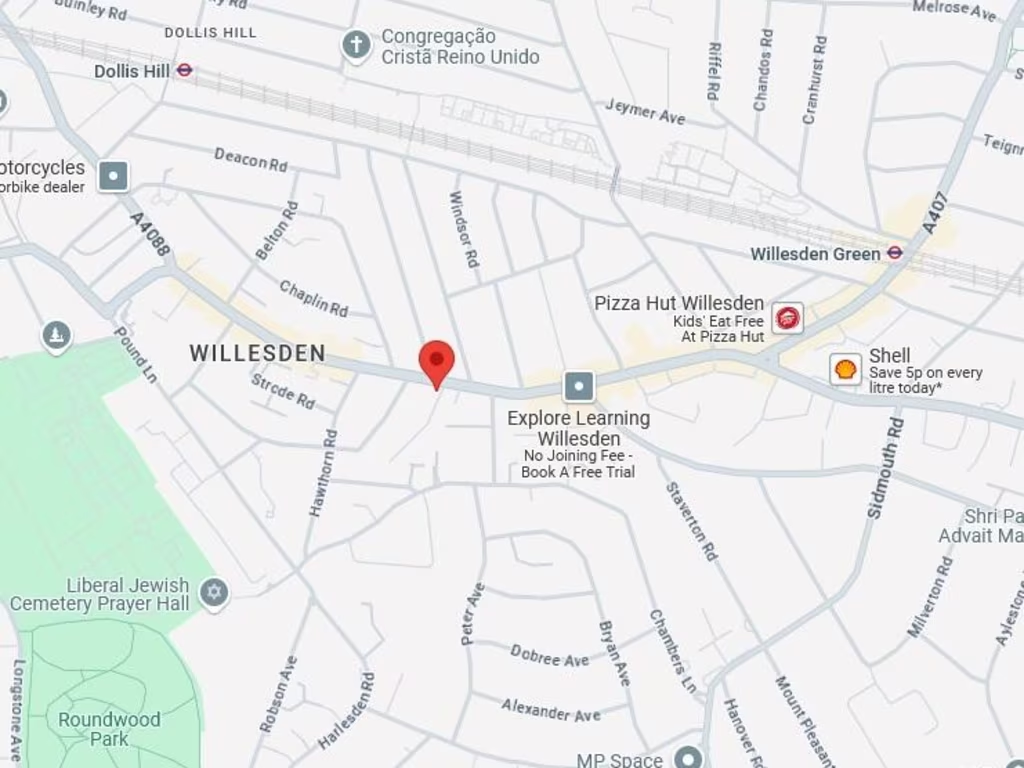

A well-located corner retail investment on Willesden High Road, offered with a long 999-year lease and a current income of £24,500 p.a. The property occupies a prominent triple-frontage position (High Road and Gowan Road) with generous ground-floor retail (721 sq ft) and a large basement (495 sq ft), creating flexible space for a wide range of Class E uses.

The lot delivers a gross initial yield of 7.00% at the asking price of £350,000. The current lease (10 years from 14 August 2025) is on full repairing and insuring terms and includes an RPI-linked rent review in August 2030. A tenant option to determine in August 2030 introduces re-letting risk from that point; a deposit of £6,125 is held.

Strengths include high street visibility, triple frontage, generous internal area (1,216 sq ft GIA), proximity to Willesden Green Underground (approx. 0.5 miles) and a VAT-exempt sale. Material considerations: the area records higher crime and local deprivation indices, broadband speeds are average, and the property appears to need some refurbishment (Edwardian frontage and mixed modern features). These factors should be weighed against the yield and location-driven footfall potential.

This opportunity suits buyers seeking an income-producing retail asset with upside from active asset management or reconfiguration for alternative Class E occupiers. Investors should allow for refurbishment costs, local market volatility, and the tenant’s break option when modelling returns.

Mixed use property for sale in 153 High Road, London, NW10 2SG, NW10 — £450,000 • 1 bed • 1 bath • 1216 ft²

Mixed use property for sale in 153 High Road, London, NW10 2SG, NW10 — £450,000 • 1 bed • 1 bath • 1216 ft² High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft²

High street retail property for sale in High Road, Willesden, NW10 — £750,000 • 2 bed • 2 bath • 1575 ft² Shop for sale in Harrow Road, College Park, London, NW10 — £260,000 • 1 bed • 1 bath • 706 ft²

Shop for sale in Harrow Road, College Park, London, NW10 — £260,000 • 1 bed • 1 bath • 706 ft² High street retail property for sale in 44 - 46 Birchington Road, Kilburn, NW6 4LJ, NW6 — £1,350,000 • 1 bed • 1 bath • 5477 ft²

High street retail property for sale in 44 - 46 Birchington Road, Kilburn, NW6 4LJ, NW6 — £1,350,000 • 1 bed • 1 bath • 5477 ft² Studio flat for sale in 153 High Road, London, NW10 — £150,000 • 1 bed • 1 bath • 1970 ft²

Studio flat for sale in 153 High Road, London, NW10 — £150,000 • 1 bed • 1 bath • 1970 ft² High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft²

High street retail property for sale in 49 Craven Park Road, Harlesden, London, NW10 8SE, NW10 — £550,000 • 1 bed • 1 bath • 2145 ft²