Summary - 5, MILLSIDE TERRACE, PETERCULTER AB14 0WB

2 bed 1 bath Flat

Compact freehold flat with strong rental yield and tenant in place.

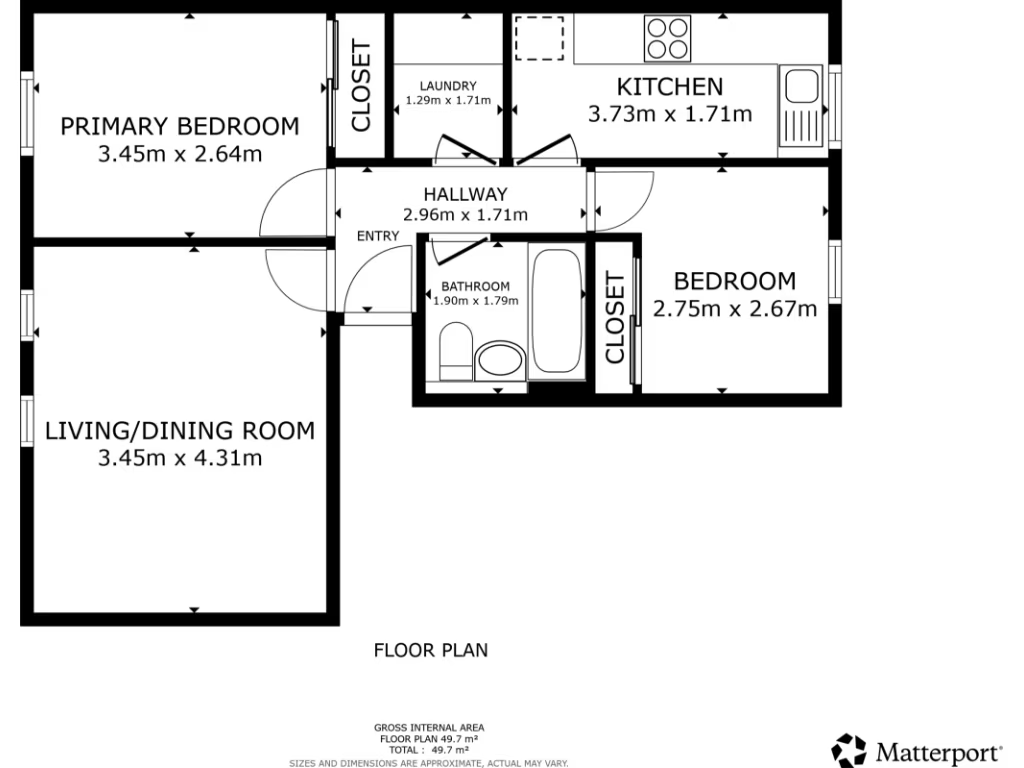

2 bedrooms in a compact 560 sq ft flat

Long-term tenant in situ with reliable rent payments

Annual gross income £6,780 (approx. 9.4% gross yield)

Freehold tenure; communal lawned grounds

On-street parking only; no dedicated off-street parking

Located in a deprived area; may affect capital growth prospects

Average broadband speeds; mobile signal excellent

Buyers Premium applies to complete the purchase

This two-bedroom flat in Peterculter is presented primarily as a buy-to-let opportunity with a long-term tenant in situ. The property is freehold, produces an annual gross income of £6,780 and sits within a multi-unit residential block with communal green space. Its compact footprint (approx. 560 sq ft) suits investors seeking an income-producing, low-management addition to a portfolio.

The current tenancy has lasted over three years with consistent payments; tenants do not intend to vacate. The purchase price of £72,500 gives a gross yield of about 9.4% based on current income, which is attractive for yield-focused buyers. On-street parking and communal lawns add practical appeal for occupiers.

Buyers should note material factors plainly: the flat is small, located in an area recorded as deprived, and broadband speeds are average. A Buyers Premium will apply to secure the sale. These points will affect future resale or repositioning plans and should be factored into offer decisions.

For a serious investor, the property offers immediate rental income with modest management needs and potential to re-let or improve returns subject to market movement. Full investment figures and tenancy paperwork are available in the Let Property Pack for due diligence.

2 bedroom flat for sale in Bankhead Avenue, Aberdeen, AB21 — £85,000 • 2 bed • 1 bath • 603 ft²

2 bedroom flat for sale in Bankhead Avenue, Aberdeen, AB21 — £85,000 • 2 bed • 1 bath • 603 ft² 2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft²

2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft² 2 bedroom flat for sale in Tullos Place, Aberdeen, Aberdeenshire, AB11 — £73,000 • 2 bed • 1 bath • 657 ft²

2 bedroom flat for sale in Tullos Place, Aberdeen, Aberdeenshire, AB11 — £73,000 • 2 bed • 1 bath • 657 ft² 2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft²

2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft² 1 bedroom flat for sale in Earns Heugh Crescent, Aberdeen, AB12 — £75,000 • 1 bed • 1 bath • 420 ft²

1 bedroom flat for sale in Earns Heugh Crescent, Aberdeen, AB12 — £75,000 • 1 bed • 1 bath • 420 ft² 4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath

4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath