Summary - 39 BYRNESS NEWCASTLE UPON TYNE NE5 2HA

3 bed 2 bath Terraced

Long-term let mid-terrace with refurbishment upside for active investors.

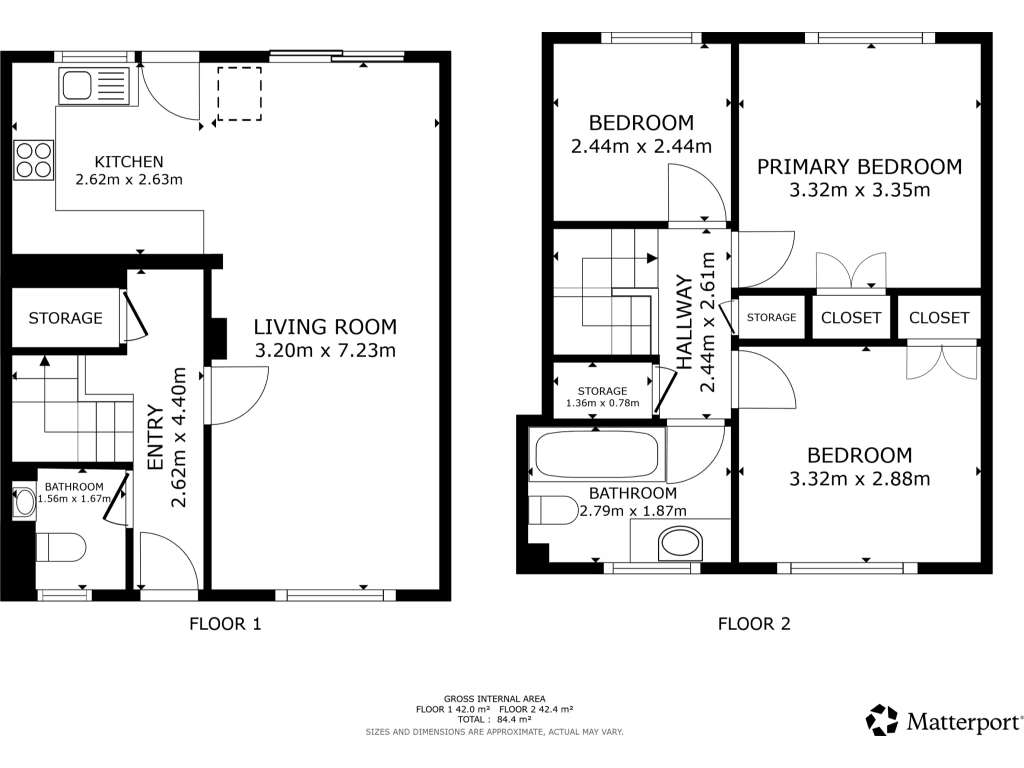

3 bedrooms, 2 bathrooms across two storeys

Gross annual income £6,600 — approx. 5.5% gross yield

Long-term tenants in situ (5 years); not seeking to vacate

Private front and rear gardens; communal private parking

Interior dated; living room carpeted and needs modernisation

High local crime and very deprived area — affects demand

Small plot size and average overall property size

Buyer’s premium applies to the sale

This three-bedroom mid-terrace in Byrness, Newcastle upon Tyne, is presented as a buy-to-let opportunity with long-term tenants in place. The property offers private front and rear gardens, communal private parking, and an average overall size across two storeys. It currently produces a gross annual rental income of £6,600, equating to an approximate gross yield of 5.5% at the listed price of £120,000.

The interior shows signs of age and will suit an investor prepared to manage refurbishment and ongoing maintenance; the living room and fittings are dated and would benefit from modernization to increase future rents or resale value. The property sits in a very deprived area with high local crime rates and challenged community indicators, which will influence letting demand and capital growth prospects.

Tenants have occupied the property for five years and intend to remain, so an investor buying with tenants in situ should expect rental continuity but limited immediate vacant possession. A buyer’s premium is noted as part of the sale process and should be factored into acquisition costs. Broadband and mobile signal are strong, and local schools and transport links are nearby—useful for tenant demand.

Overall this is a straightforward portfolio addition for a hands-on investor or developer able to accept a property in a challenged neighbourhood, manage tenant relations, and invest in targeted refurbishment to improve income and capital performance.

3 bedroom end of terrace house for sale in Bruce Close, Newcastle Upon Tyne, NE5 — £120,000 • 3 bed • 1 bath • 764 ft²

3 bedroom end of terrace house for sale in Bruce Close, Newcastle Upon Tyne, NE5 — £120,000 • 3 bed • 1 bath • 764 ft² 2 bedroom terraced house for sale in Waterbeach Place, Newcastle Upon Tyne, NE5 — £105,000 • 2 bed • 1 bath • 829 ft²

2 bedroom terraced house for sale in Waterbeach Place, Newcastle Upon Tyne, NE5 — £105,000 • 2 bed • 1 bath • 829 ft² 3 bedroom terraced house for sale in Benwell Lane, Newcastle Upon Tyne, NE15 — £93,000 • 3 bed • 1 bath • 861 ft²

3 bedroom terraced house for sale in Benwell Lane, Newcastle Upon Tyne, NE15 — £93,000 • 3 bed • 1 bath • 861 ft² 2 bedroom terraced house for sale in Kingston Avenue, Newcastle Upon Tyne, NE6 — £110,000 • 2 bed • 1 bath • 646 ft²

2 bedroom terraced house for sale in Kingston Avenue, Newcastle Upon Tyne, NE6 — £110,000 • 2 bed • 1 bath • 646 ft² 3 bedroom semi-detached house for sale in Winton Way, Newcastle Upon Tyne, NE3 — £140,000 • 3 bed • 1 bath • 893 ft²

3 bedroom semi-detached house for sale in Winton Way, Newcastle Upon Tyne, NE3 — £140,000 • 3 bed • 1 bath • 893 ft² 3 bedroom terraced house for sale in Ambergate Way, Newcastle Upon Tyne, NE3 — £160,000 • 3 bed • 3 bath • 1087 ft²

3 bedroom terraced house for sale in Ambergate Way, Newcastle Upon Tyne, NE3 — £160,000 • 3 bed • 3 bath • 1087 ft²