Summary - 99 KINGSTON AVENUE NEWCASTLE UPON TYNE NE6 2SS

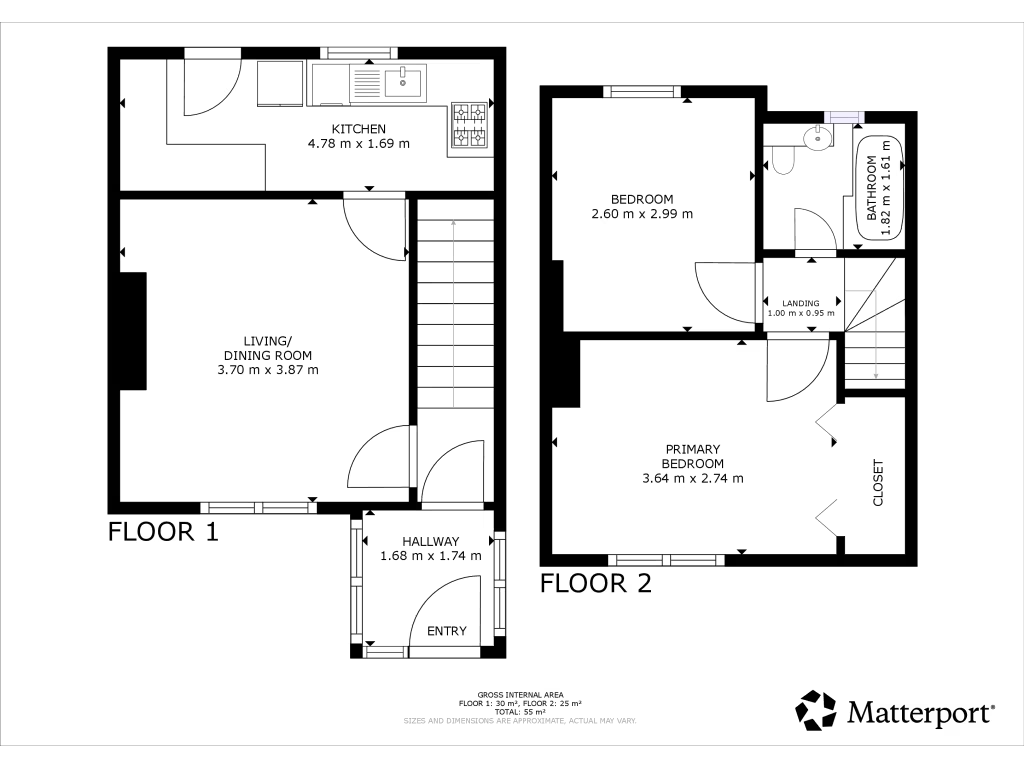

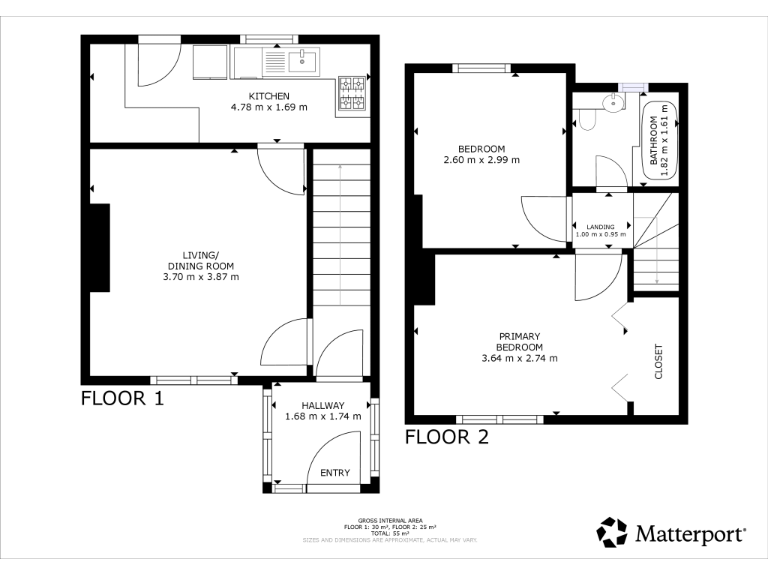

2 bed 1 bath Terraced

Two-bed terrace with tenant and immediate income—refurbishment upside for investors..

Long-term tenant in situ producing £9,600 gross pa

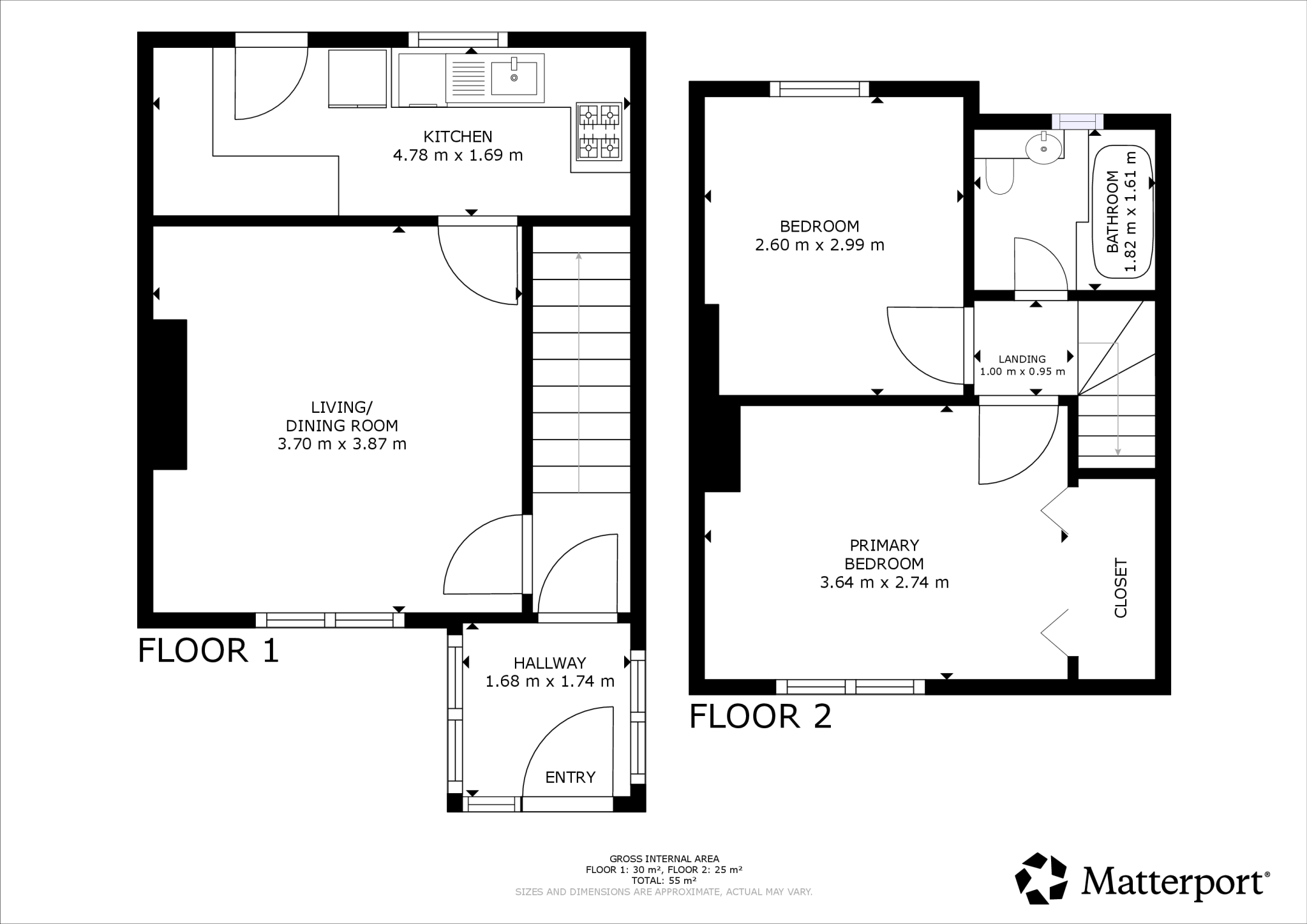

Freehold mid-terrace, approx. 646 sq ft, two bedrooms

Private front and rear garden; small paved front area

On-street parking only; no off-street parking

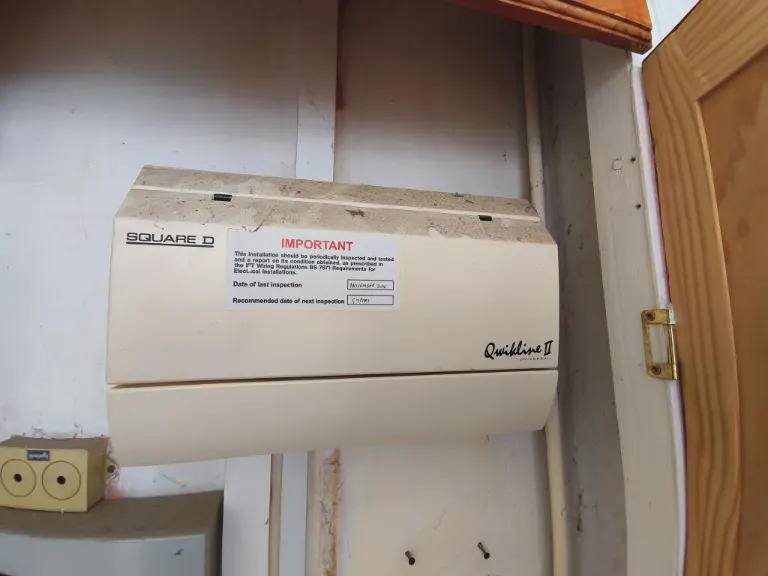

Dated exterior and interior elements — refurbishment likely required

Area graded very deprived with high local crime rates

Excellent mobile signal and fast broadband — attractive to tenants

Buyers Premium applies; serious investor interest expected

This mid-terrace two-bedroom house on Kingston Avenue is presented as a clear buy-to-let opportunity with a long-term tenant in situ producing a current gross annual income of £9,600. The property is freehold, of average overall size (approximately 646 sq ft), and sits in a major conurbation with excellent mobile signal and fast broadband — practical features for letting.

Internally the house is traditionally laid out with two bedrooms, a lounge, kitchen and bathroom; images suggest medium-sized rooms and hardwood floors in the living room. Externally the property is a mid-20th-century brick terrace with pebble-dash and a small paved front area plus a private rear garden; parking is on-street only.

Important investor considerations: the area is classified as very deprived with high local crime rates and is likely to attract interest mainly from serious investors and developers. The exterior and some internal elements are dated and will require refurbishment or updating to maximise rental value. A Buyers Premium applies to secure the sale — check the Let Property Pack for full investment figures and tenancy documentation.

For a buyer seeking an income-producing asset, this house offers immediate rent roll and scope to increase value through targeted refurbishment or longer-term portfolio strategies. However, be realistic about re-investment costs, local market risks and the responsibilities of purchasing with sitting tenants.

3 bedroom terraced house for sale in Byrness, Newcastle Upon Tyne, NE5 — £125,000 • 3 bed • 2 bath • 915 ft²

3 bedroom terraced house for sale in Byrness, Newcastle Upon Tyne, NE5 — £125,000 • 3 bed • 2 bath • 915 ft² 2 bedroom terraced house for sale in Waterbeach Place, Newcastle Upon Tyne, NE5 — £110,000 • 2 bed • 1 bath • 829 ft²

2 bedroom terraced house for sale in Waterbeach Place, Newcastle Upon Tyne, NE5 — £110,000 • 2 bed • 1 bath • 829 ft² 2 bedroom flat for sale in Grace Street, Newcastle Upon Tyne, NE6 — £65,000 • 2 bed • 1 bath • 560 ft²

2 bedroom flat for sale in Grace Street, Newcastle Upon Tyne, NE6 — £65,000 • 2 bed • 1 bath • 560 ft² 2 bedroom terraced house for sale in Garth Twentyseven, Newcastle Upon Tyne, NE12 — £105,000 • 2 bed • 1 bath • 718 ft²

2 bedroom terraced house for sale in Garth Twentyseven, Newcastle Upon Tyne, NE12 — £105,000 • 2 bed • 1 bath • 718 ft² 3 bedroom end of terrace house for sale in Bruce Close, Newcastle Upon Tyne, NE5 — £120,000 • 3 bed • 1 bath • 764 ft²

3 bedroom end of terrace house for sale in Bruce Close, Newcastle Upon Tyne, NE5 — £120,000 • 3 bed • 1 bath • 764 ft² 3 bedroom terraced house for sale in Benwell Lane, Newcastle Upon Tyne, NE15 — £95,000 • 3 bed • 1 bath • 861 ft²

3 bedroom terraced house for sale in Benwell Lane, Newcastle Upon Tyne, NE15 — £95,000 • 3 bed • 1 bath • 861 ft²