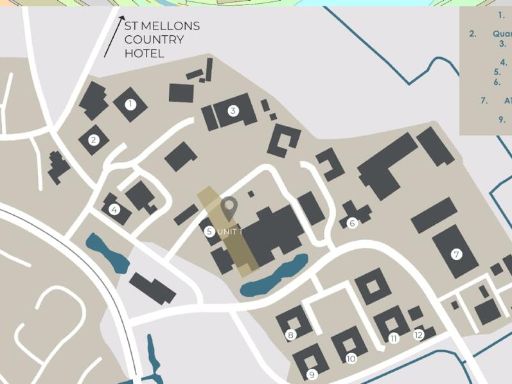

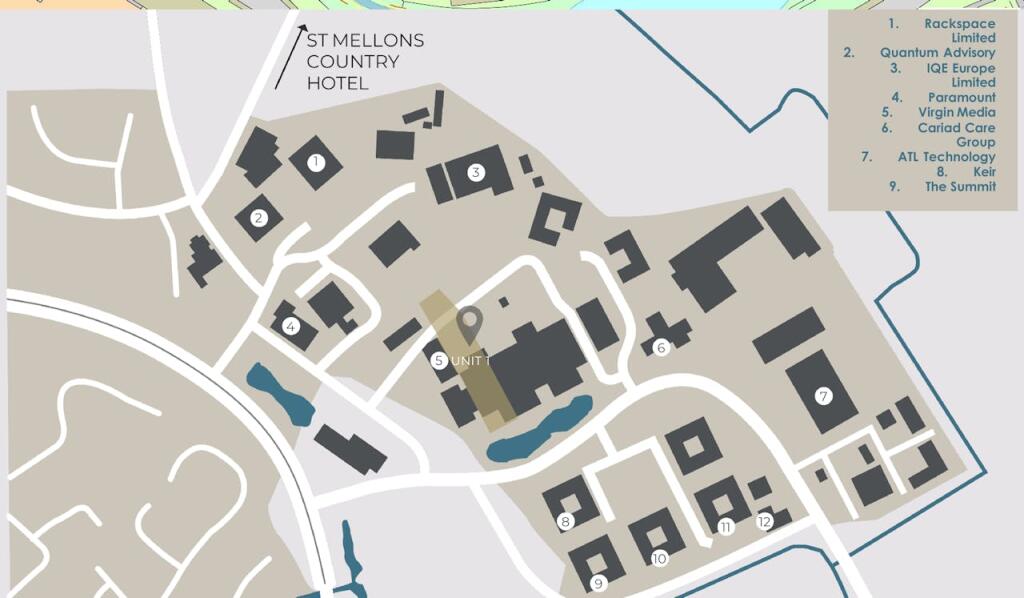

Summary - Modern Industrial Site, Unit 1 Lakeside, Fountain Lane, Cardiff, CF3 0FB CF3 0FB

1 bed 1 bath Warehouse

Large freehold warehouse with strong covenant and reversionary rental upside.

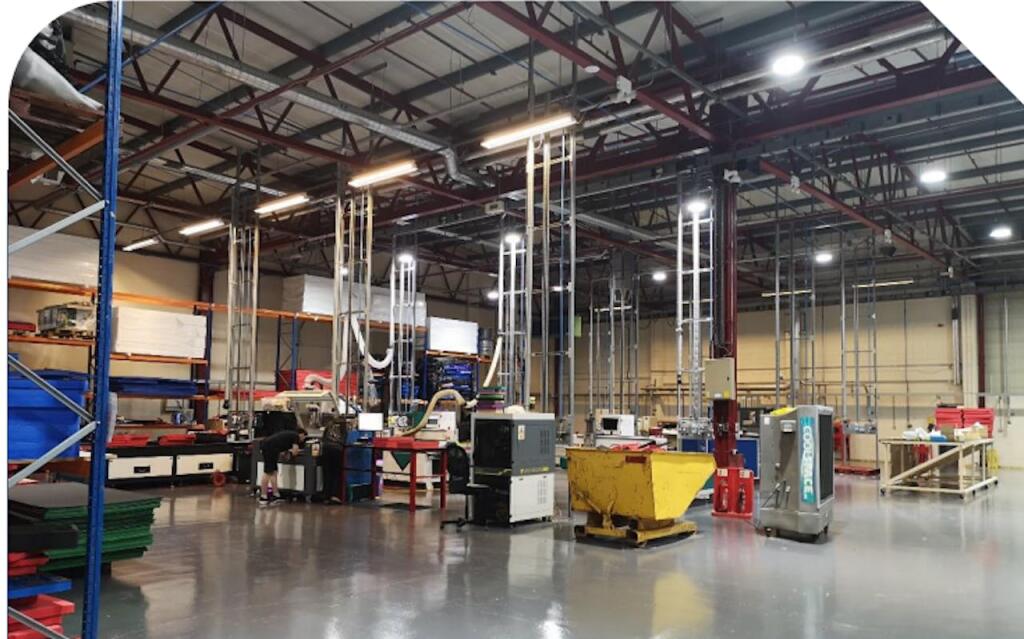

- 30,553 sqft modern industrial unit with 6.0m minimum eaves

- Single-let to the BBC on FRI lease until 30 June 2031

- Tenant break option at end of 10th year creates near-term vacancy risk

- Low passing rent £137,277 pa (£4.49/sqft) — reversionary rental potential

- Site 1.52 acres with secure 0.39 acre concrete yard and dock doors

- Two first-floor office suites with air conditioning and raised floors

- Freehold sale; offers in excess of £2,000,000 reflecting 6.46% net yield

- Local area: slow broadband and high deprivation may affect operations

A substantial modern industrial freehold in St Mellons Business Park, offered with a strong single tenant covenant: the BBC occupies the 30,553 sqft unit on an FRI lease from 17 August 2020 to 30 June 2031. The building is steel portal frame with part masonry and insulated steel cladding, a minimum eaves height of 6.0m and two dock-level loading doors — practical specification for distribution or light industrial occupiers.

The site extends to 1.52 acres (approximately 46% site cover) with a secure 0.39 acre concrete yard to the front, car parking, dock loading and landscaped rear amenity. Internally there are two separate first-floor office suites with air conditioning and raised floors, plus staff WCs and kitchen facilities, making the unit ready for operational use without major reconfiguration.

Investment strengths include the undoubted covenant of a national broadcaster, clear motorway connectivity via the A48(M)/M4, and a low passing rent of £137,277 pa (£4.49/sqft) which produces a net initial yield of c.6.46% at the guide price. Key risks to note are the tenant’s contractual break option toward the end of the 10th year and the comparatively low passing rent relative to market which creates reversionary upside but short-term income risk.

Practical considerations: the freehold title and modern build reduce near-term capital expenditure, but the wider area records slow broadband and a high level of local deprivation which may affect local staffing and amenity appeal. Offers in excess of £2,000,000 are invited, reflecting the current income profile and stated reversionary yield potential.

Warehouse for sale in Wroughton Place, Ely, Cardiff, CF5 4AB, CF5 — POA • 1 bed • 1 bath • 14856 ft²

Warehouse for sale in Wroughton Place, Ely, Cardiff, CF5 4AB, CF5 — POA • 1 bed • 1 bath • 14856 ft² Distribution warehouse for sale in Millgrove House, Parc Ty Glas, Llanishen, CF14 5DU, CF14 — POA • 1 bed • 1 bath • 20101 ft²

Distribution warehouse for sale in Millgrove House, Parc Ty Glas, Llanishen, CF14 5DU, CF14 — POA • 1 bed • 1 bath • 20101 ft² Distribution warehouse for sale in Former RPC Containers, Llantrisant Business Park, Ynysmaerdy, Pontyclun, CF72 8LF, CF72 — £4,000,000 • 1 bed • 1 bath • 366 ft²

Distribution warehouse for sale in Former RPC Containers, Llantrisant Business Park, Ynysmaerdy, Pontyclun, CF72 8LF, CF72 — £4,000,000 • 1 bed • 1 bath • 366 ft² Office for sale in Unit, R2 Capital Business Park, Parkway, CF3 2PU , CF3 — £250,000 • 1 bed • 1 bath • 1684 ft²

Office for sale in Unit, R2 Capital Business Park, Parkway, CF3 2PU , CF3 — £250,000 • 1 bed • 1 bath • 1684 ft² Business park for sale in Unit 4 Melyn Mair, Wentloog, Cardiff CF3 2EX, CF3 — £260,000 • 1 bed • 1 bath • 3532 ft²

Business park for sale in Unit 4 Melyn Mair, Wentloog, Cardiff CF3 2EX, CF3 — £260,000 • 1 bed • 1 bath • 3532 ft² Terraced house for sale in Unit 3, Clos Marion, Cardiff, CF10 4LJ, CF10 — £335,000 • 1 bed • 1 bath • 4609 ft²

Terraced house for sale in Unit 3, Clos Marion, Cardiff, CF10 4LJ, CF10 — £335,000 • 1 bed • 1 bath • 4609 ft²