Summary - 76 CHURCH STREET TEWKESBURY GL20 5RX

1 bed 1 bath House

Ready-made central investment with immediate income and short-term rental upside.

Freehold block: six one-bed flats plus ground-floor commercial unit

Sold with tenants in situ; no onward chain

Current gross income £64,500 pa; 8.06% yield at asking price

Upside to £65,880 pa if all flats let at £850 pcm (8.62% yield)

Rear off-street parking for tenants; limited external amenity

EPC around E (circa 50–68); older solid-brick walls assumed uninsulated

Some shopfront/joinery likely needs refurbishment to modern standards

Area records very high crime — factor for lettings and insurance

This freehold mixed‑use block on Church Street offers a ready-made investment in central Tewkesbury, with six one-bedroom flats above a ground-floor commercial unit. Converted in 2005 and sold with tenants in situ, the property produces a current gross income of £64,500 pa (8.06% yield at the asking price). Several flats are let below achievable market rents, giving modest upside to £65,880 pa if all units reach £850 pcm (8.62% yield).

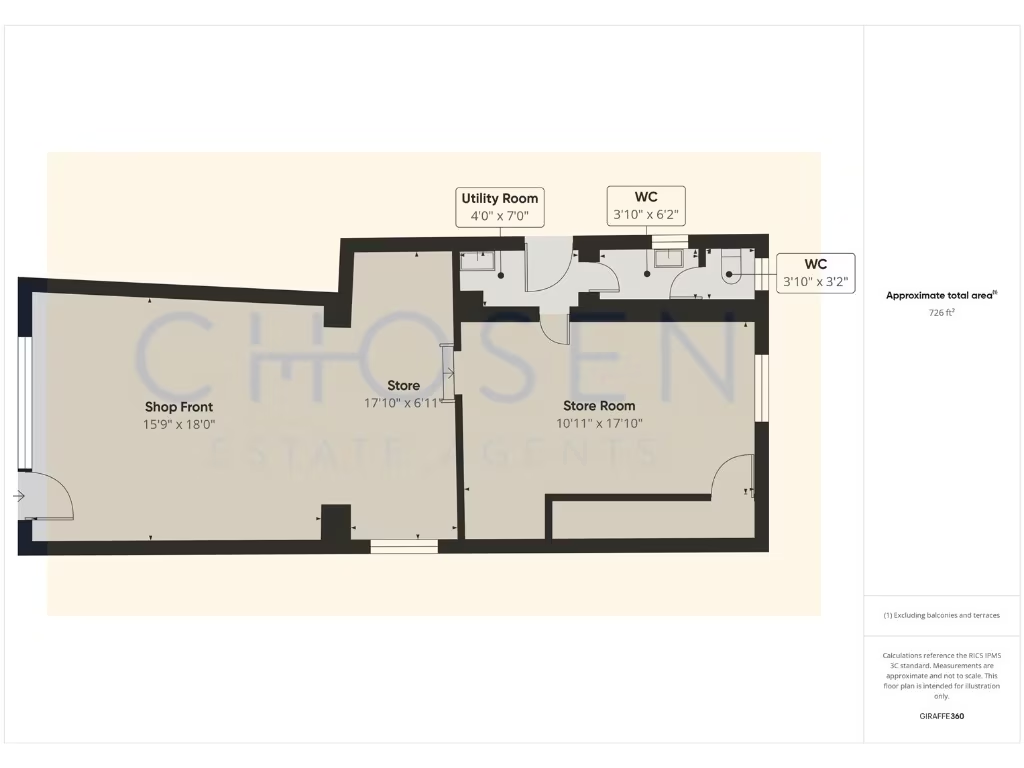

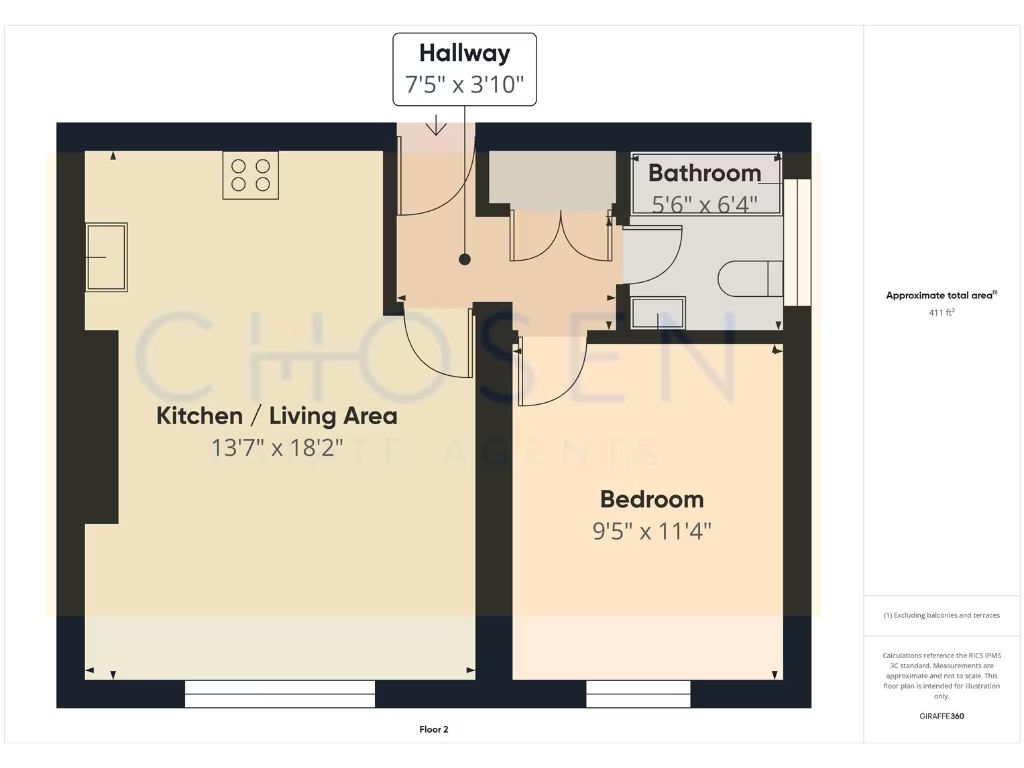

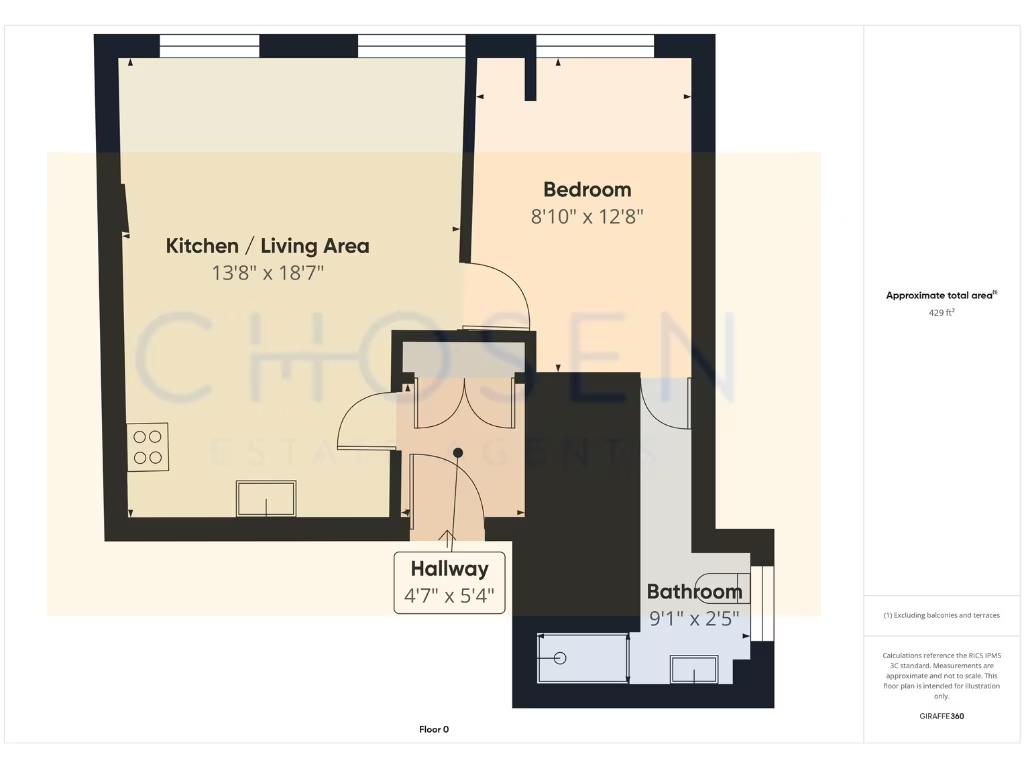

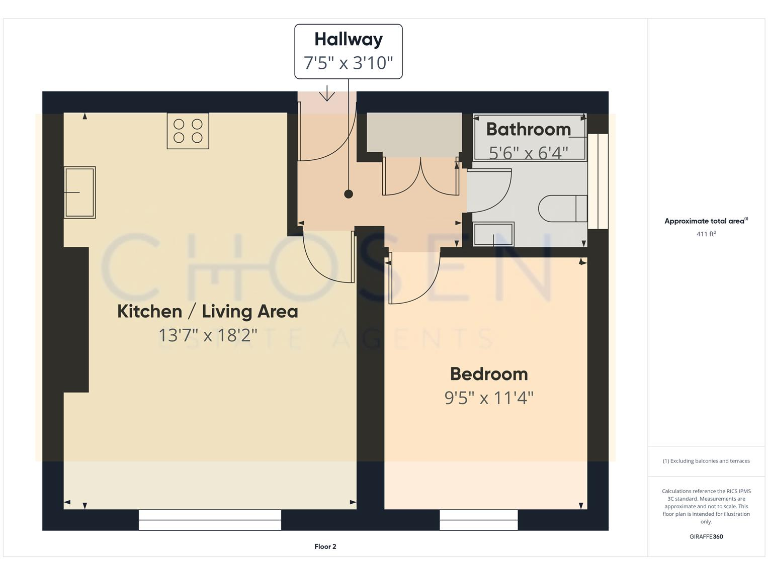

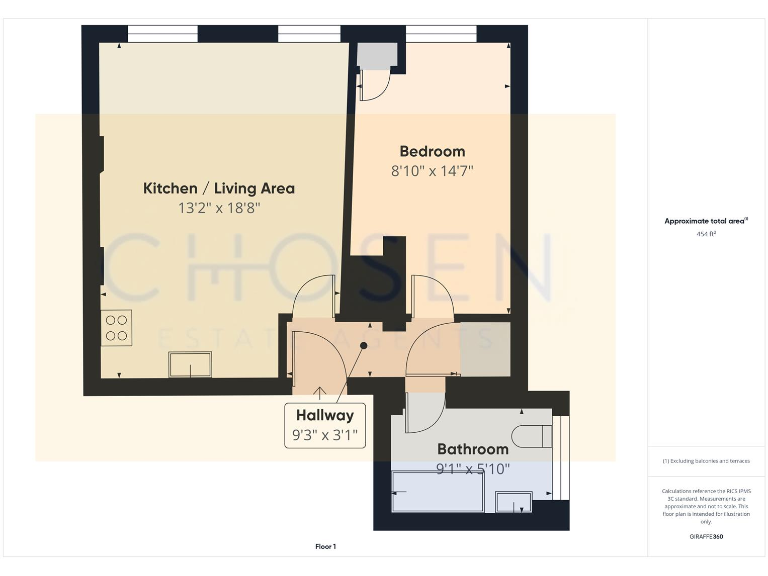

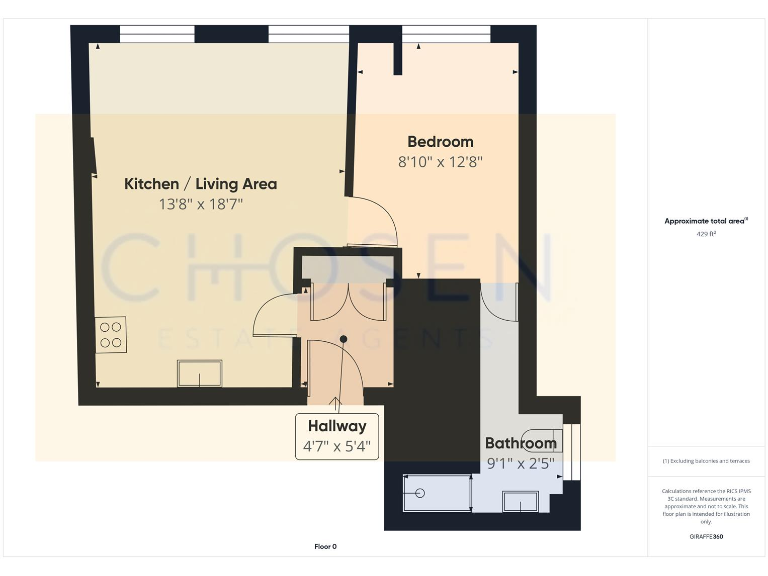

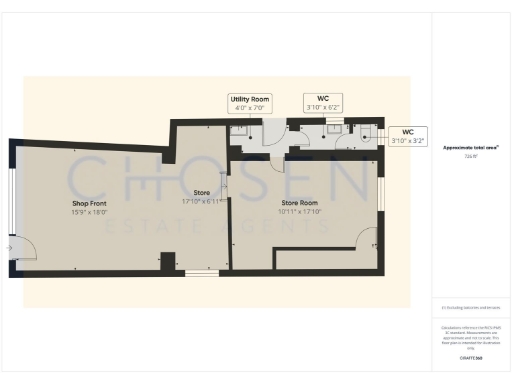

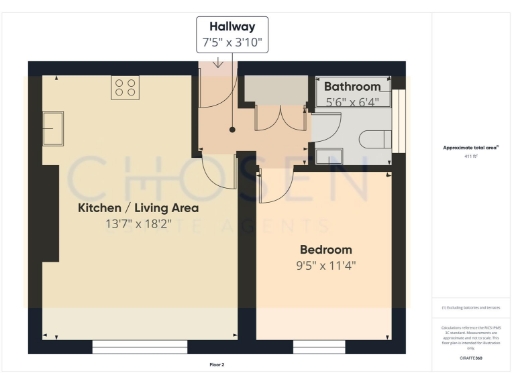

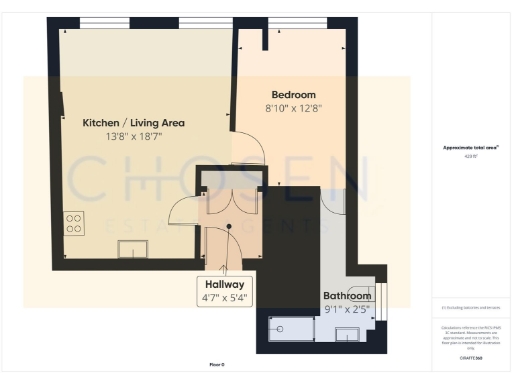

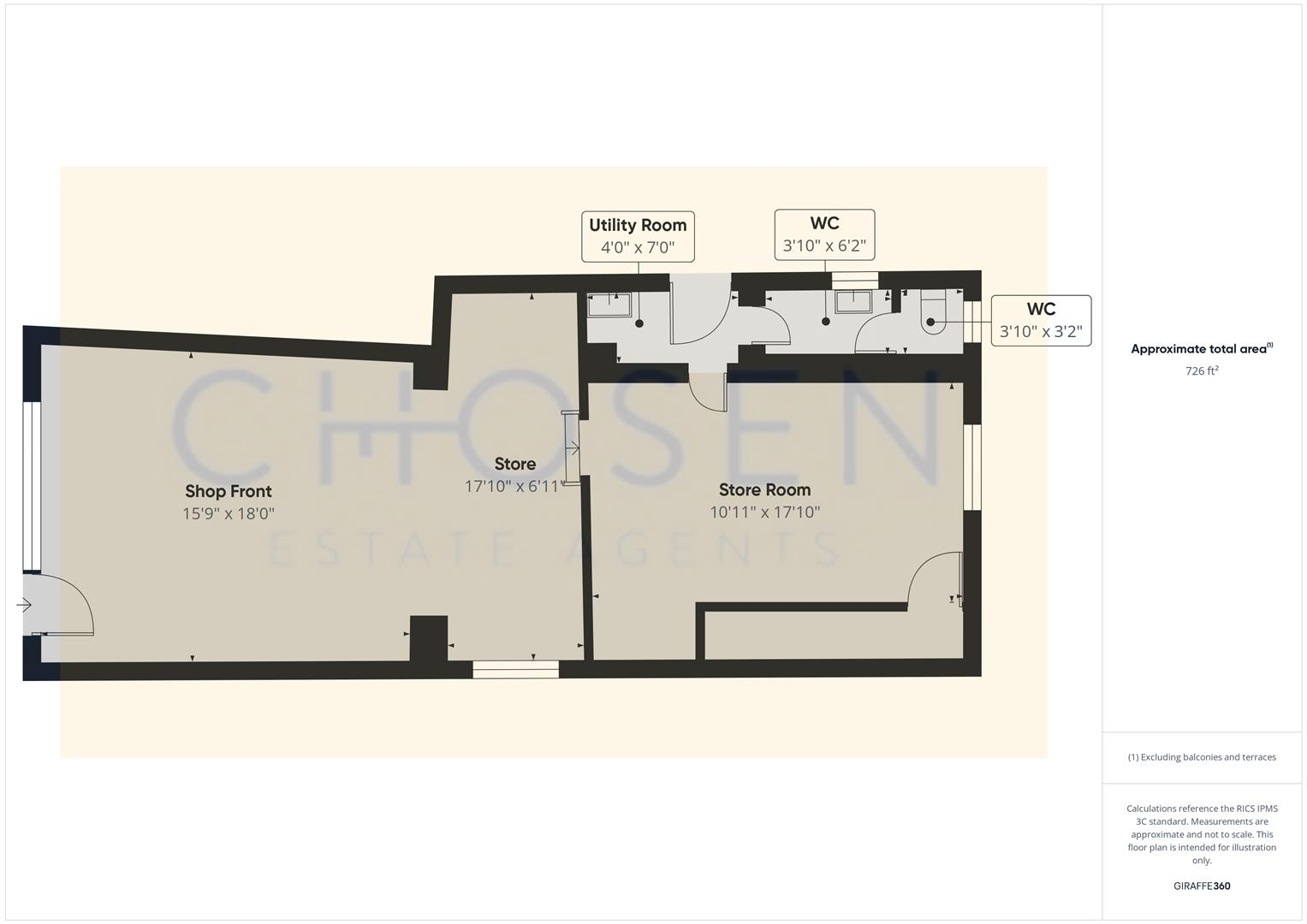

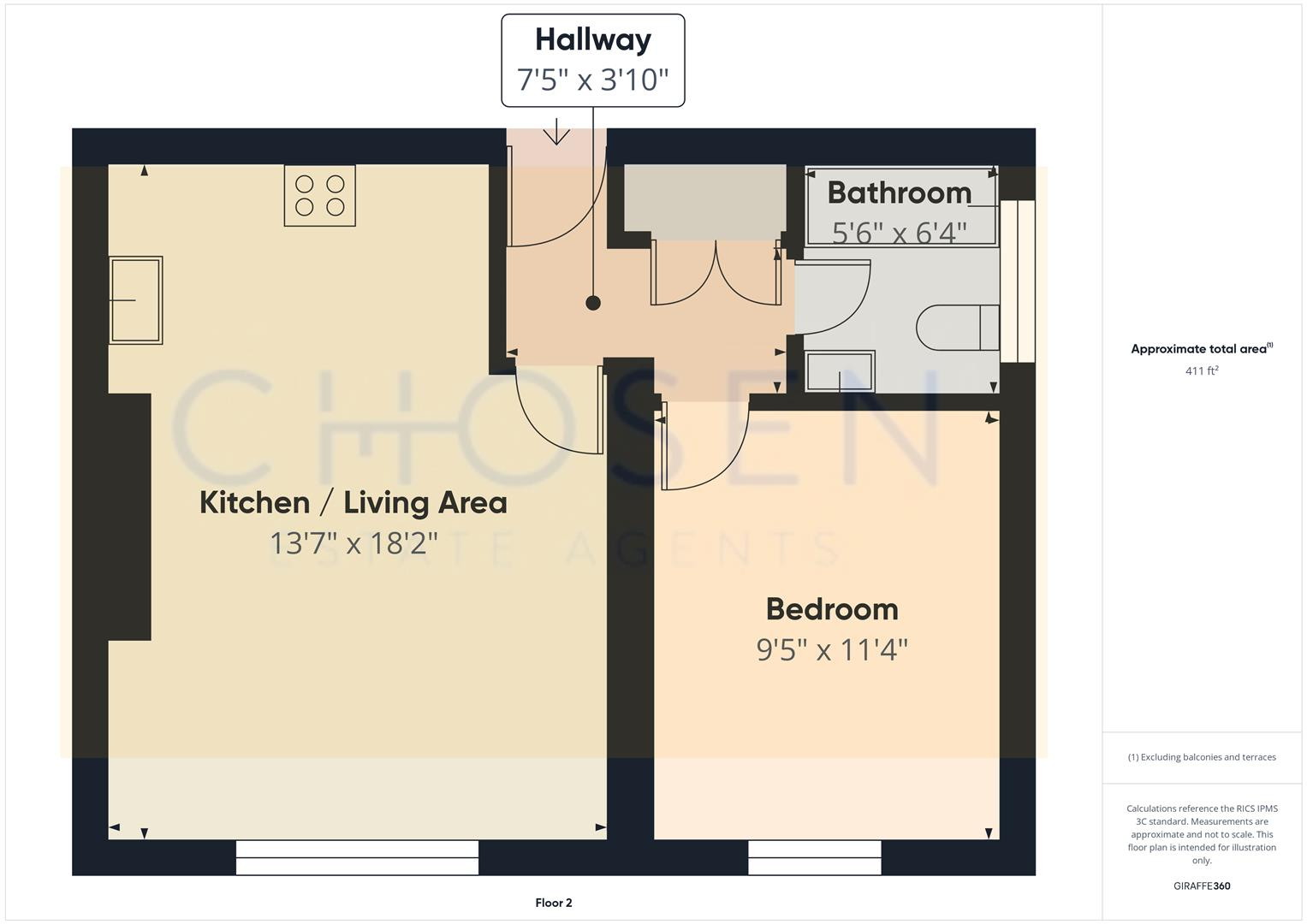

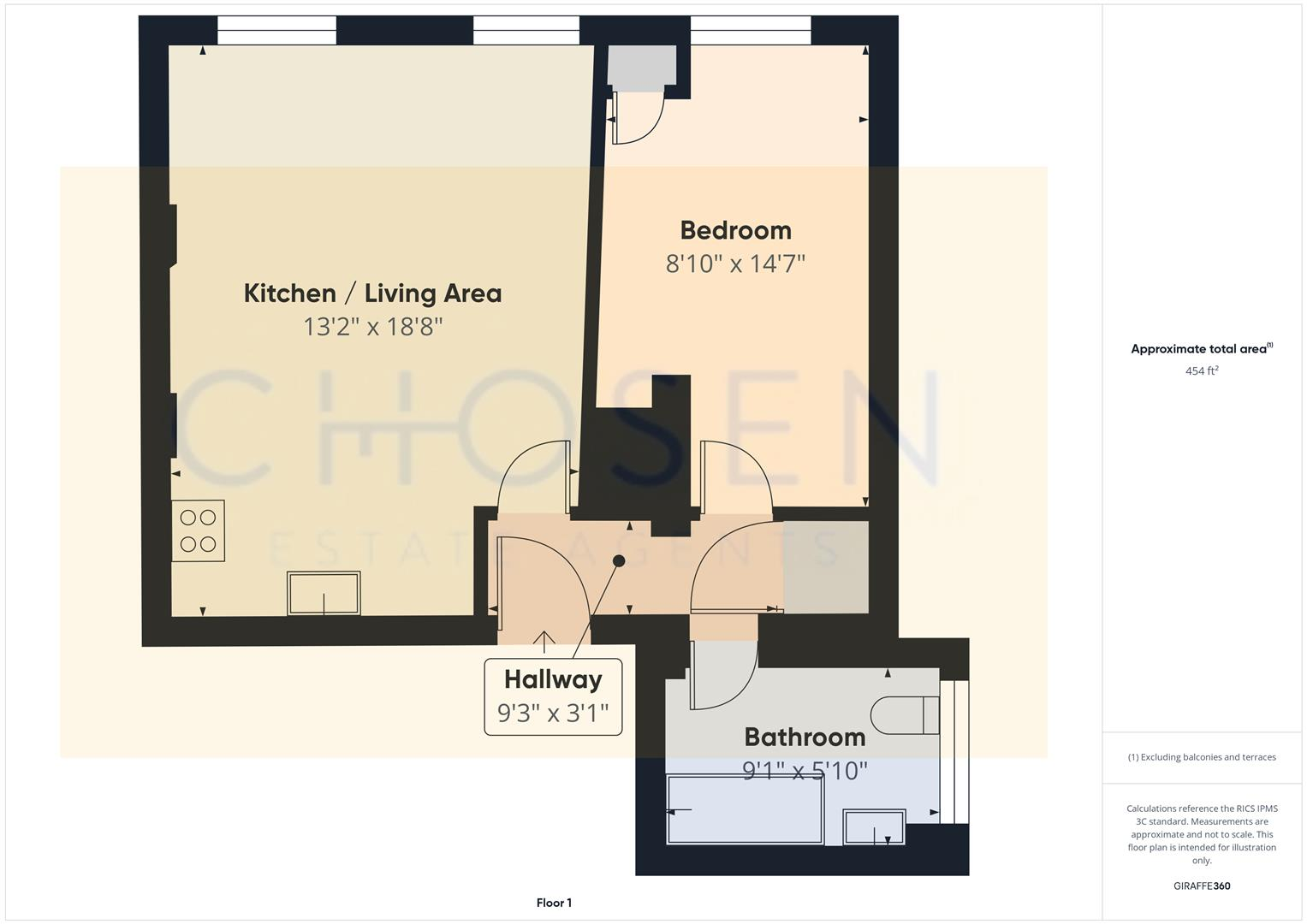

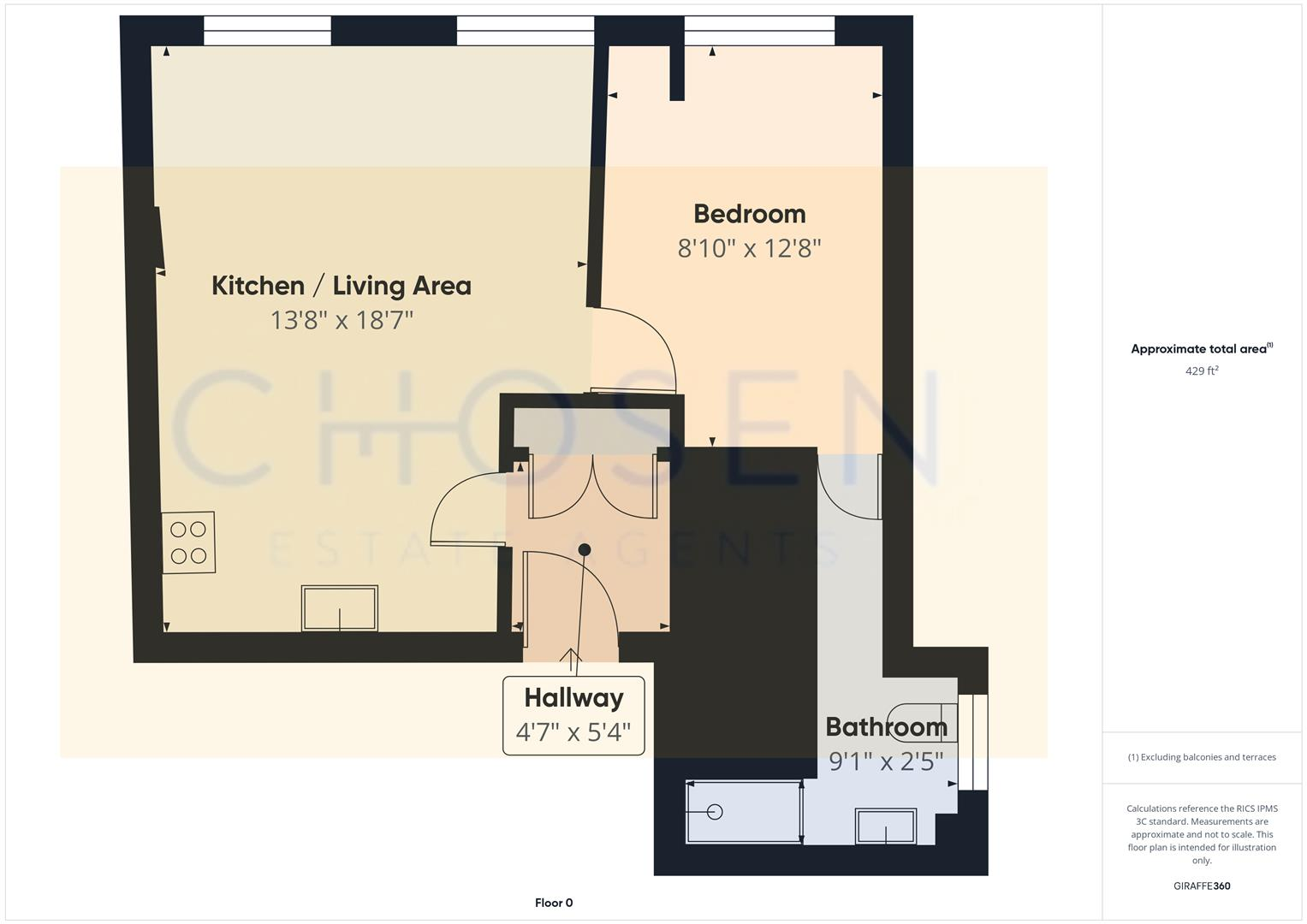

The flats are simple one-bedroom layouts with open-plan kitchen/living areas, double bedrooms and bathrooms — designed for low-maintenance lettings. The shop has separate street access and useful rear storage, utility rooms and a cloakroom. Rear off-street parking is available for tenants, a strong advantage in a town-centre location where on-street options are limited.

Drawbacks and running considerations are straightforward: the building is an older mid-terrace with assumed uninsulated solid brick walls (typical of pre-1900 construction), the EPC sits around E, and some external joinery/shopfront may benefit from refurbishment to attract higher-quality tenants or retail operators. The area records very high crime levels, which could affect demand and management costs; prospective buyers should factor this into lettings strategy and insurance.

Overall this is a practical buy-to-let asset for an investor seeking immediate income with short-term rental uplift potential. It suits a portfolio buyer who can manage tenant turnover, minor refurbishment to the shopfront and communal areas, and who values central location, rear parking and low individual flat maintenance costs.

6 bedroom block of apartments for sale in Fairview Road, Cheltenham Town Centre, GL52 — £425,000 • 6 bed • 3 bath • 397 ft²

6 bedroom block of apartments for sale in Fairview Road, Cheltenham Town Centre, GL52 — £425,000 • 6 bed • 3 bath • 397 ft² 3 bedroom block of apartments for sale in Westgate Street, City Centre, Gloucester, GL1 — £195,000 • 3 bed • 3 bath • 621 ft²

3 bedroom block of apartments for sale in Westgate Street, City Centre, Gloucester, GL1 — £195,000 • 3 bed • 3 bath • 621 ft² Property for sale in Shop & Four Flats, GL1 — £475,000 • 1 bed • 1 bath • 2145 ft²

Property for sale in Shop & Four Flats, GL1 — £475,000 • 1 bed • 1 bath • 2145 ft² 7 bedroom block of apartments for sale in Albion Street, Cheltenham, GL52 2RW, GL52 — £900,000 • 7 bed • 5 bath • 2700 ft²

7 bedroom block of apartments for sale in Albion Street, Cheltenham, GL52 2RW, GL52 — £900,000 • 7 bed • 5 bath • 2700 ft² 5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft²

5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft² 2 bedroom flat for sale in Coach House, Barton Street, Tewkesbury , GL20 5PR, GL20 — £155,000 • 2 bed • 1 bath • 539 ft²

2 bedroom flat for sale in Coach House, Barton Street, Tewkesbury , GL20 5PR, GL20 — £155,000 • 2 bed • 1 bath • 539 ft²