Summary - 105 SOUTHGATE STREET GLOUCESTER GL1 1UT

1 bed 1 bath Not Specified

Turnkey, high-yield mixed-use investment opposite Gloucester Quays — Grade II listed.

Freehold mixed-use: shop plus four self-contained flats, all currently let

Grade II listed — restrictions on alterations may add cost and delay works

Gross rental £53,400 pa; gross yield circa 10.7–10.9% at asking price

Shop currently a barber; retail unit with prominent Southgate Street frontage

Two 1-bed and two 2-bed flats; compact city-centre apartment stock

One off-street parking space to the rear; no private garden

Located opposite Gloucester Quays — strong pedestrian footfall for retail

Area classed as very deprived with high crime — impacts insurance/letting

This Grade II listed mixed-use freehold offers a ready-made income stream: a ground-floor barber shop plus four upper flats, all currently let. The property sits directly opposite Gloucester Quays, giving strong pedestrian exposure for the retail unit and easy access to town-centre amenities. Total gross rent at asking is £53,400 pa, producing a gross yield around 10.7–10.9% at the asking price.

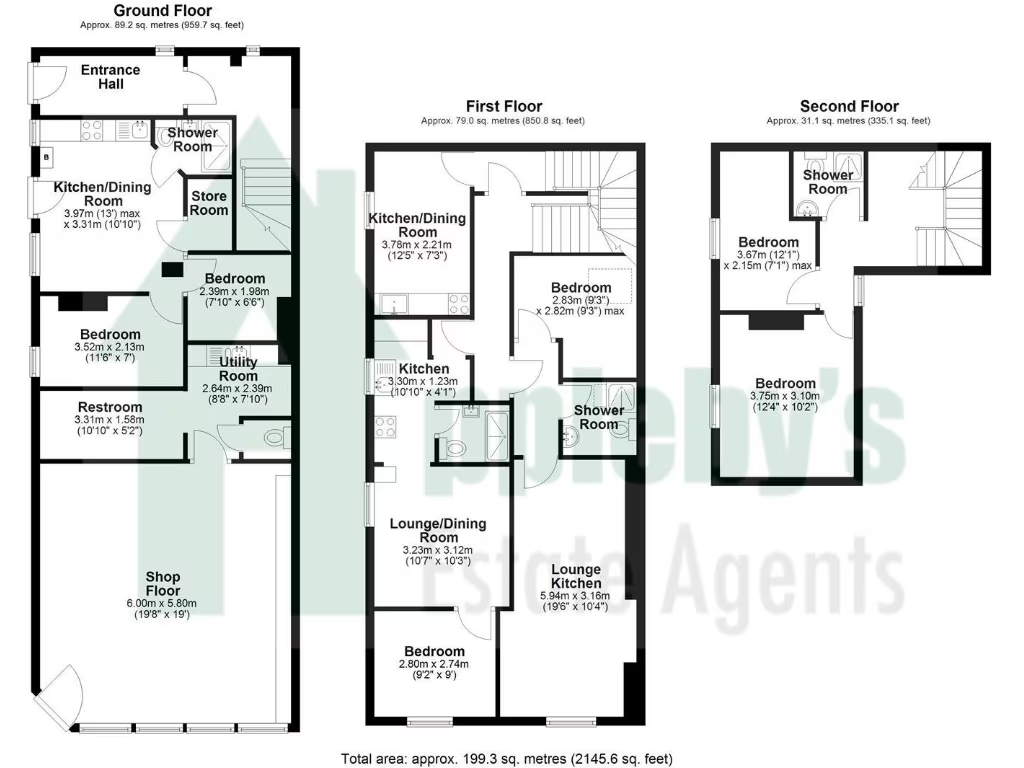

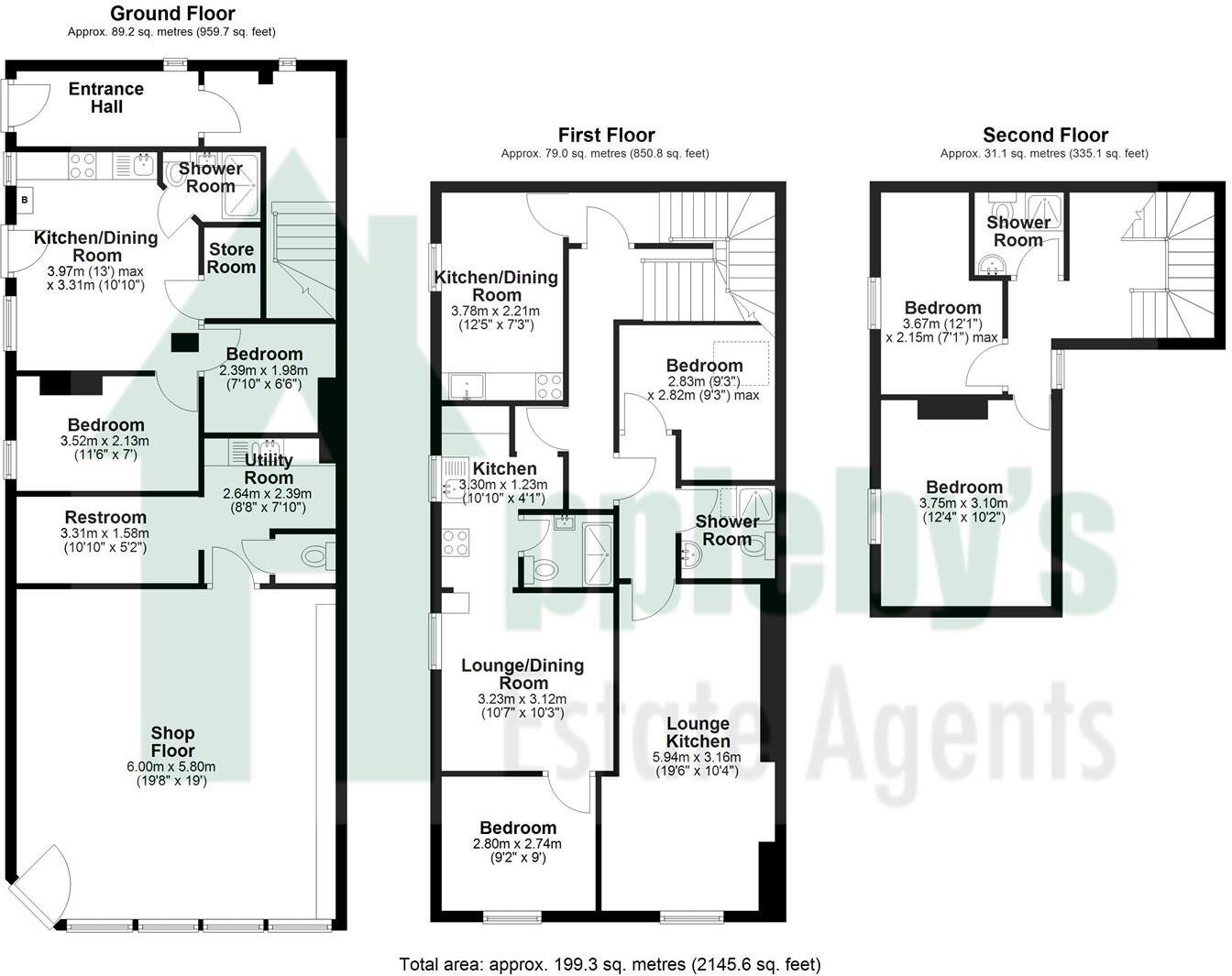

The flats are compact city-centre apartments (two 1-beds and two 2-beds) arranged over upper floors, with the shop running to approximately 5.99m x 5.79m and rear access/utility and one off-street parking space. The building’s period features and high ceilings add character and appeal to tenants, while fast broadband and excellent mobile signal suit modern lettings.

Material considerations are clear: the Grade II listing restricts external and certain internal alterations, which may complicate refurbishment or conversion plans and can add cost. The property sits in a very deprived area with higher-than-average crime statistics; while this underpins current rental levels and yield, it also affects tenant mix, insurance and long-term capital growth prospects. The footprint is relatively small with no private garden.

For an investor seeking a turnkey, city-centre lot with immediate rental income and strong yield, this is a viable pick. Buyers needing redevelopment flexibility or low-risk neighbourhoods should factor in listing constraints and local area deprivation when pricing future works and financing.

5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft²

5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft² 4 bedroom terraced house for sale in Westgate Street, Gloucester, GL1 2PG, GL1 — £425,000 • 4 bed • 4 bath • 2313 ft²

4 bedroom terraced house for sale in Westgate Street, Gloucester, GL1 2PG, GL1 — £425,000 • 4 bed • 4 bath • 2313 ft² 2 bedroom flat for sale in 2 Separate Flats, GL1 — £179,000 • 2 bed • 2 bath • 386 ft²

2 bedroom flat for sale in 2 Separate Flats, GL1 — £179,000 • 2 bed • 2 bath • 386 ft² 2 bedroom apartment for sale in Brunswick Square, Gloucester, Gloucestershire, GL1 — £150,000 • 2 bed • 1 bath

2 bedroom apartment for sale in Brunswick Square, Gloucester, Gloucestershire, GL1 — £150,000 • 2 bed • 1 bath 5 bedroom block of apartments for sale in Southgate Street, Gloucester, GL1 2EZ, GL1 — £400,000 • 5 bed • 5 bath • 2128 ft²

5 bedroom block of apartments for sale in Southgate Street, Gloucester, GL1 2EZ, GL1 — £400,000 • 5 bed • 5 bath • 2128 ft² Shop for sale in 33 Westgate Street, Gloucester, South West, GL1 — £285,000 • 1 bed • 1 bath • 632 ft²

Shop for sale in 33 Westgate Street, Gloucester, South West, GL1 — £285,000 • 1 bed • 1 bath • 632 ft²