Summary - 36 FLATS 1-3 WESTGATE STREET GLOUCESTER GL1 2NG

3 bed 3 bath Block of Apartments

Chain-free three-flat investment near Gloucester Cathedral — tenants in situ, strong yield potential..

- Chain-free three one-bedroom leasehold flats, tenants in situ

- Current income £20,580 pa; potential £23,400 pa (approx 12% gross yield)

- Prime city-centre Westgate Street location near Gloucester Cathedral

- Lease approx. 102 years remaining; service charge £1,716.76 pa

- Electric room heating throughout; EPC rating E (upgrade likely needed)

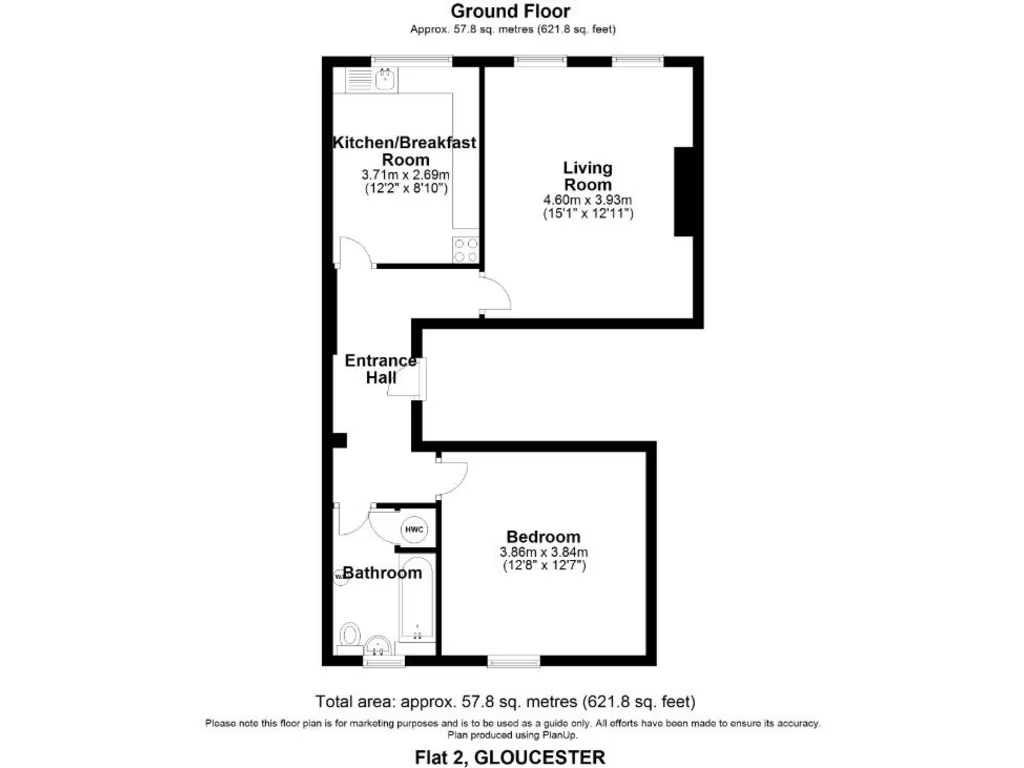

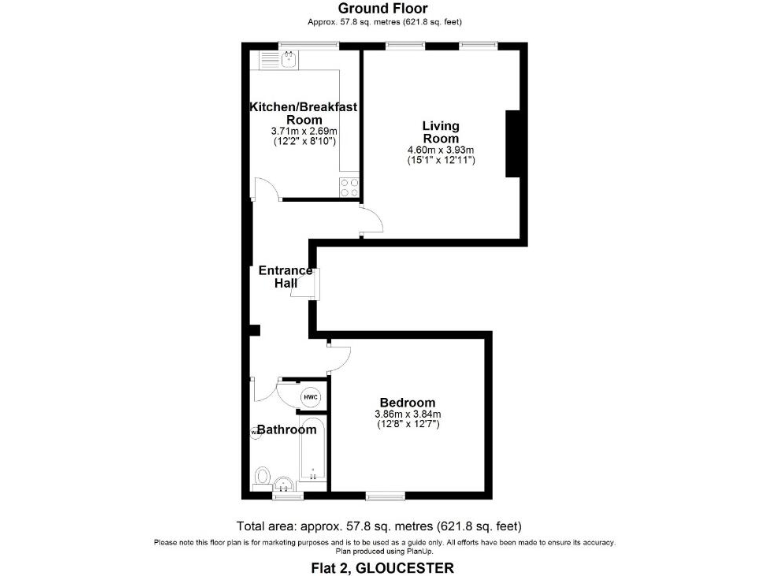

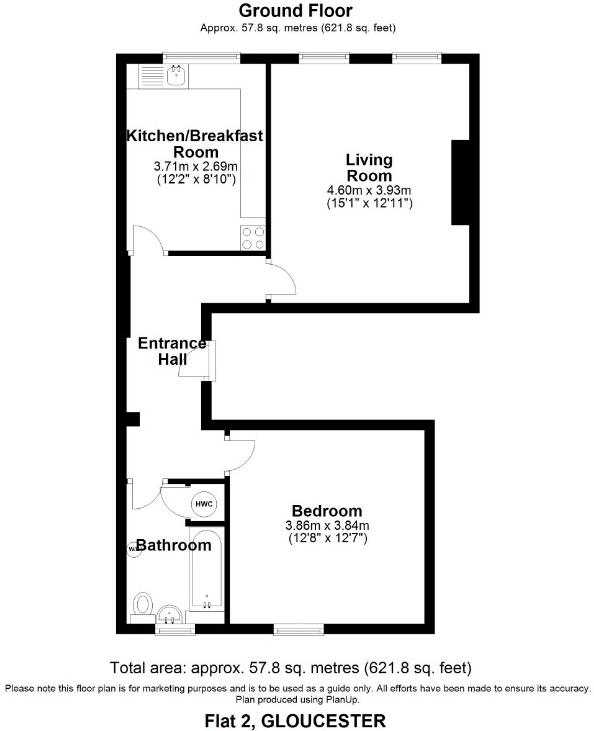

- Above commercial premises; small total internal area (621 sqft)

- Local area: very high crime and very deprived — tenant risk considerations

- Council Tax Band A (very low), no flood risk

A compact, chain-free investment block of three one-bedroom leasehold apartments in Gloucester city centre, sold with tenants in situ and showing strong rental yield potential. Located on Westgate Street beside the Cathedral and city amenities, the block benefits from excellent transport links, busy footfall and easy access to shops, cafes and Gloucester Quays.

The three flats produce current rent of approximately £20,580 pa with potential rent of about £23,400 pa (circa 12% gross yield at the asking price). Each apartment is finished to a reasonable standard and separately metered; the site sits above commercial premises and attracts city-centre demand from students, professionals and migrant families.

Buyers should note material points plainly: the property is leasehold with 102 years remaining, an EPC band E, electric room heating throughout, and an annual service charge of £1,716.76. The immediate area records very high crime levels and is classed as very deprived, which may affect tenant turnover and long-term capital growth timing.

This is a straightforward, ready-made income portfolio for an investor seeking immediate cashflow rather than a hands-off, long-term capital play. The block suits an investor prepared to manage tenanted flats in a busy city-centre location and consider modest upgrades to improve EPC and rents.

5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft²

5 bedroom semi-detached house for sale in 3 Flats, GL1 — £480,000 • 5 bed • 3 bath • 625 ft² 1 bedroom flat for sale in Commercial Road, City Centre, Gloucester, GL1 — £90,000 • 1 bed • 1 bath • 344 ft²

1 bedroom flat for sale in Commercial Road, City Centre, Gloucester, GL1 — £90,000 • 1 bed • 1 bath • 344 ft² 3 bedroom block of apartments for sale in Oxford Street, Gloucester, GL1 — £275,000 • 3 bed • 3 bath • 1197 ft²

3 bedroom block of apartments for sale in Oxford Street, Gloucester, GL1 — £275,000 • 3 bed • 3 bath • 1197 ft² 4 bedroom terraced house for sale in Westgate Street, Gloucester, GL1 2PG, GL1 — £425,000 • 4 bed • 4 bath • 2313 ft²

4 bedroom terraced house for sale in Westgate Street, Gloucester, GL1 2PG, GL1 — £425,000 • 4 bed • 4 bath • 2313 ft² 1 bedroom flat for sale in Southgate Street, Gloucester, GL1 — £80,000 • 1 bed • 1 bath • 465 ft²

1 bedroom flat for sale in Southgate Street, Gloucester, GL1 — £80,000 • 1 bed • 1 bath • 465 ft² House for sale in Church Street, Tewkesbury, GL20 — £800,000 • 1 bed • 1 bath • 2020 ft²

House for sale in Church Street, Tewkesbury, GL20 — £800,000 • 1 bed • 1 bath • 2020 ft²