Summary - 253 ABINGDON ROAD OXFORD OX1 4TH

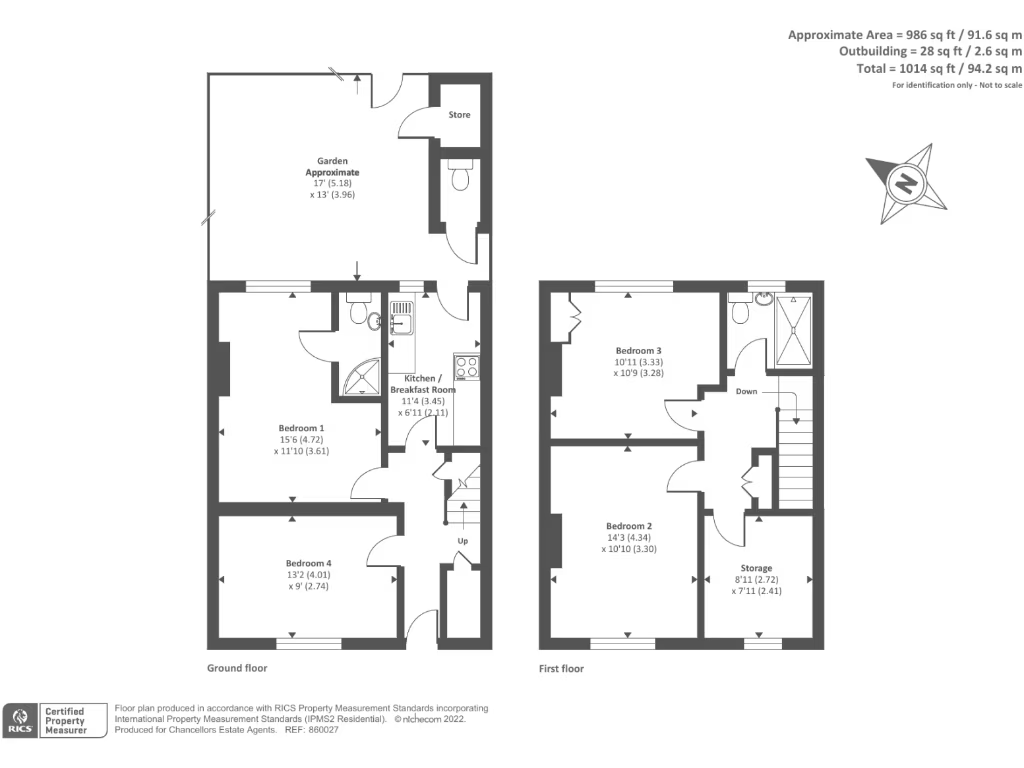

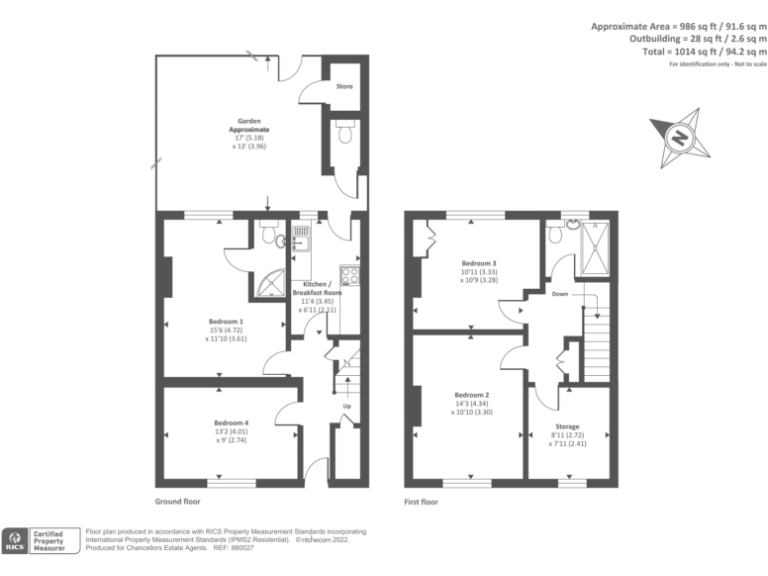

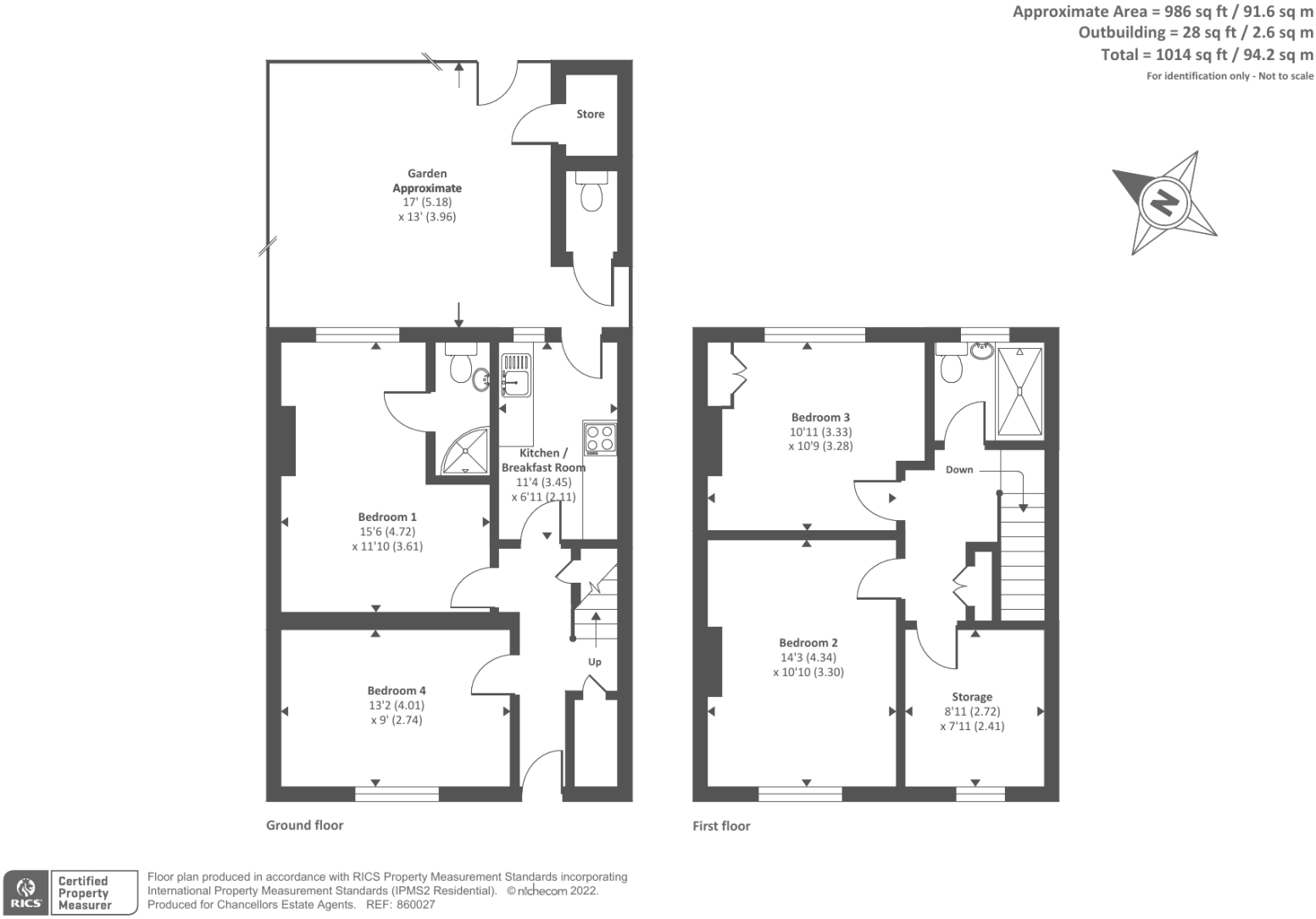

4 bed 2 bath Terraced

Immediate income in central Oxford with strong licence protections.

Licensed four-bedroom HMO in an Article 4 area

Projected income £3,100 pcm (approx. 7.83% gross yield)

Driveway parking for two cars—a rare local benefit

Sold with professional tenants in situ; immediate income

High local flood risk—material for insurance and mitigation

Above-average crime rate in the area

Solid brick walls assumed uninsulated; retrofit likely needed

Double glazing dated (installed before 2002); modernisation required

This mid-terrace four-bedroom property is offered chain free and currently operates as a licensed HMO, delivering an estimated rental income of £3,100 pcm and a gross yield of about 7.83%. The HMO licence in an Article 4 area is a strong asset, limiting new competition and supporting long-term tenant demand in central Oxford.

The house includes driveway parking (space for two cars), is within close reach of amenities and transport, and sits about 1.2 miles from Oxford city centre — attractive features for student and professional tenants. It is sold with professional tenants in situ, so rental income is immediate for a buyer seeking an income-producing investment.

Buyers should note important condition and location considerations. The property was built circa 1900–1929 with solid brick walls assumed to lack insulation, and double glazing was installed before 2002. Flooding risk is high for the location, and local crime rates are above average; both are material factors for insurance, management and future refurbishment costs.

Overall, this is a ready-made HMO investment in a constrained Article 4 market with immediate income potential. The building offers refurbishment upside—improving insulation, window upgrades and general modernisation would increase appeal and reduce running costs, but these works and flood mitigation should be budgeted for before or shortly after purchase.

5 bedroom semi-detached house for sale in East Oxford, Oxford, OX4 — £650,000 • 5 bed • 2 bath • 1453 ft²

5 bedroom semi-detached house for sale in East Oxford, Oxford, OX4 — £650,000 • 5 bed • 2 bath • 1453 ft² 4 bedroom flat for sale in East Oxford, Oxford, OX4 — £525,000 • 4 bed • 2 bath • 1356 ft²

4 bedroom flat for sale in East Oxford, Oxford, OX4 — £525,000 • 4 bed • 2 bath • 1356 ft² 6 bedroom terraced house for sale in Iffley Road, Oxford, Oxfordshire, OX4 — £1,195,000 • 6 bed • 2 bath • 1561 ft²

6 bedroom terraced house for sale in Iffley Road, Oxford, Oxfordshire, OX4 — £1,195,000 • 6 bed • 2 bath • 1561 ft² 5 bedroom semi-detached house for sale in Headington, Oxford, OX3 — £650,000 • 5 bed • 1 bath • 1162 ft²

5 bedroom semi-detached house for sale in Headington, Oxford, OX3 — £650,000 • 5 bed • 1 bath • 1162 ft² 6 bedroom semi-detached house for sale in Ridgefield Road, Oxford, Oxfordshire, OX4 — £695,000 • 6 bed • 3 bath • 1087 ft²

6 bedroom semi-detached house for sale in Ridgefield Road, Oxford, Oxfordshire, OX4 — £695,000 • 6 bed • 3 bath • 1087 ft² 5 bedroom end of terrace house for sale in East Oxford, Oxford, OX4 — £700,000 • 5 bed • 2 bath • 1259 ft²

5 bedroom end of terrace house for sale in East Oxford, Oxford, OX4 — £700,000 • 5 bed • 2 bath • 1259 ft²