Summary - 2 SIR JAMES KNOTT HOUSE, BROADWAY WEST, DORMANSTOWN TS10 5AZ

1 bed 1 bath Flat

High-yield one-bed with tenant and low upkeep, ideal for steady rental income.

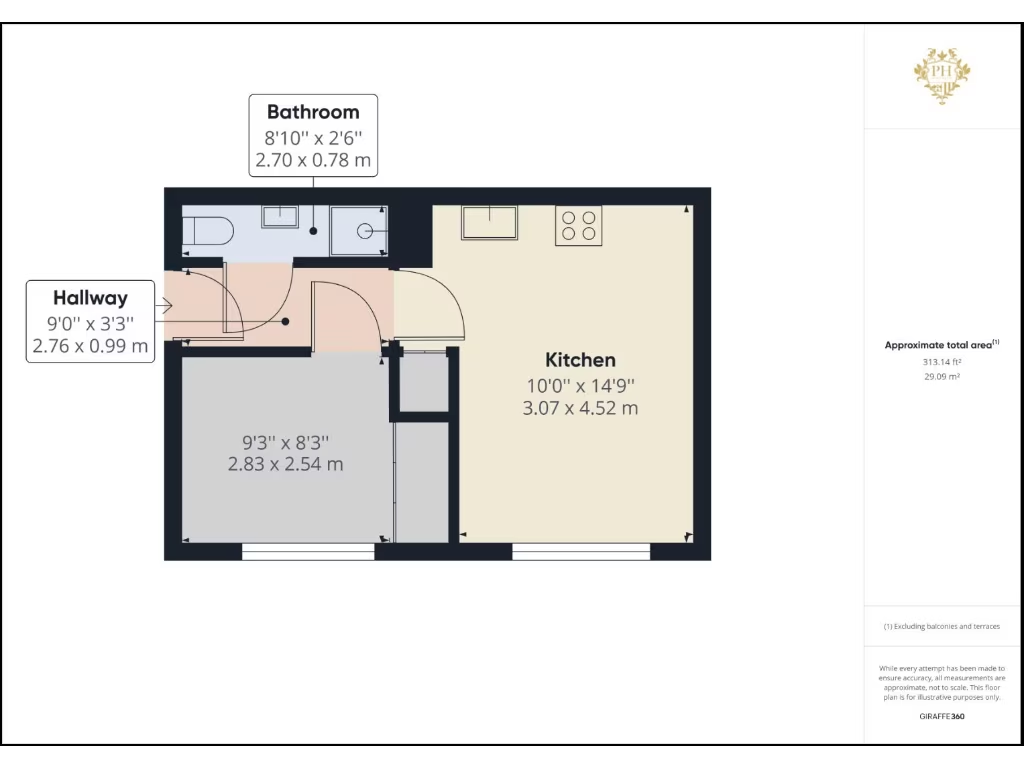

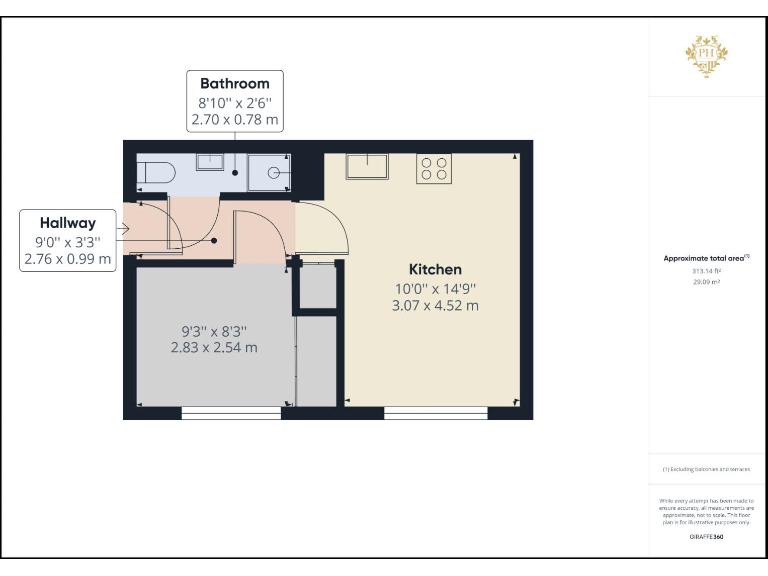

- Ground-floor one-bedroom apartment, compact 313 sq ft

- Tenant in situ paying £500 pcm, immediate rental income

- Allocated off-street parking space included

- Newly refreshed: neutral decor and new carpets

- Leasehold with c.84 years remaining

- Service charge c.£1,636 per year; ground rent £131.36

- Electric heating (room heaters) — higher running costs possible

- Located in high-crime, very deprived area (affects demand)

A compact ground-floor one-bedroom apartment positioned for buy-to-let returns. The property is presented neutrally with new carpets and laminate flooring, double glazing and electric heaters, making it low-maintenance for an investor. Allocated off-street parking and fast broadband/mobilE signal add practical appeal for tenants.

The flat is currently let at £500 pcm, producing a high gross yield around the advertised 12–13% level. The layout is efficient: entrance hall, open-plan kitchen/living, double bedroom with built-in wardrobes and a small three-piece bathroom. At about 313 sq ft this is a small home suited to single occupiers or professional tenants.

Important considerations: the flat is leasehold with approximately 84 years remaining, a service charge (c. £1,636pa reported) and an annual ground rent of £131.36. The property sits in an area with higher crime and very high deprivation statistics, which can affect tenant demand and long-term capital growth.

Overall this is a clear, hands-off rental opportunity for an investor seeking immediate income from a tenant in situ. Buyers should factor in ongoing running costs (electric heating, service charge, ground rent), the remaining lease length, and local area risk when assessing total return and exit strategy.

1 bedroom flat for sale in Coatham Road, Redcar, TS10 — £50,000 • 1 bed • 1 bath • 625 ft²

1 bedroom flat for sale in Coatham Road, Redcar, TS10 — £50,000 • 1 bed • 1 bath • 625 ft² 2 bedroom flat for sale in Harwal Road, Redcar, TS10 — £45,000 • 2 bed • 1 bath • 571 ft²

2 bedroom flat for sale in Harwal Road, Redcar, TS10 — £45,000 • 2 bed • 1 bath • 571 ft² 1 bedroom flat for sale in Clough Close, Middlesbrough, TS5 — £53,000 • 1 bed • 2 bath • 527 ft²

1 bedroom flat for sale in Clough Close, Middlesbrough, TS5 — £53,000 • 1 bed • 2 bath • 527 ft² 1 bedroom apartment for sale in Clifton Avenue 27 Clifton Avenue, Hartlepool, TS26 — £30,000 • 1 bed • 1 bath • 698 ft²

1 bedroom apartment for sale in Clifton Avenue 27 Clifton Avenue, Hartlepool, TS26 — £30,000 • 1 bed • 1 bath • 698 ft² 1 bedroom apartment for sale in Hanson Court, Hanson Street, Redcar, North Yorkshire, TS10 — £60,000 • 1 bed • 1 bath • 354 ft²

1 bedroom apartment for sale in Hanson Court, Hanson Street, Redcar, North Yorkshire, TS10 — £60,000 • 1 bed • 1 bath • 354 ft² 1 bedroom ground floor flat for sale in Thornaby Place, Stockton-On-Tees, TS17 — £33,000 • 1 bed • 1 bath • 420 ft²

1 bedroom ground floor flat for sale in Thornaby Place, Stockton-On-Tees, TS17 — £33,000 • 1 bed • 1 bath • 420 ft²