Summary - Waterloo House Waterloo House Waterloo House Thornaby Place, Stockton-On-Tees, TS17 TS17 6SA

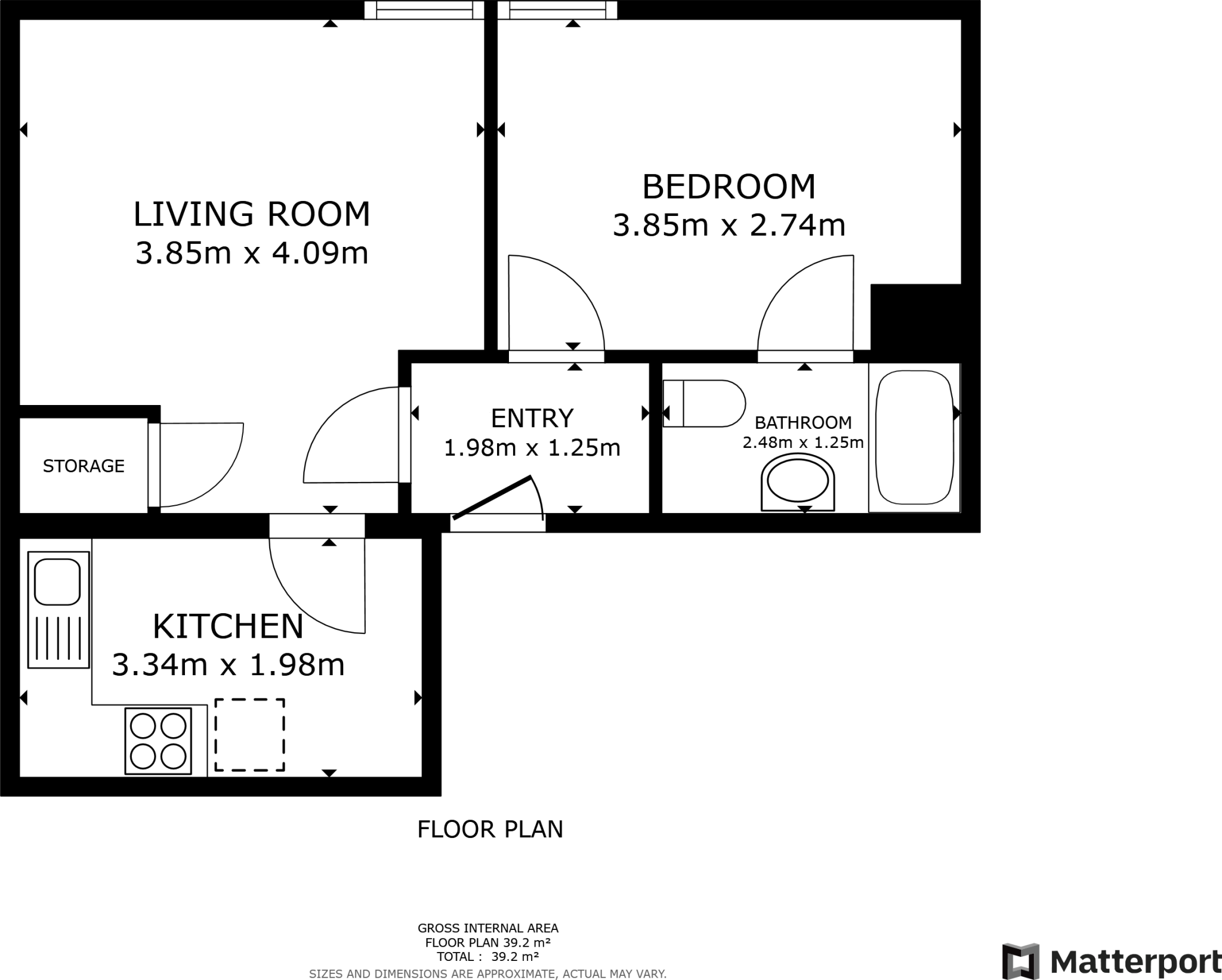

1 bed 1 bath Ground Flat

Income-producing 1-bed flat with long-term tenant — cash buyers only.

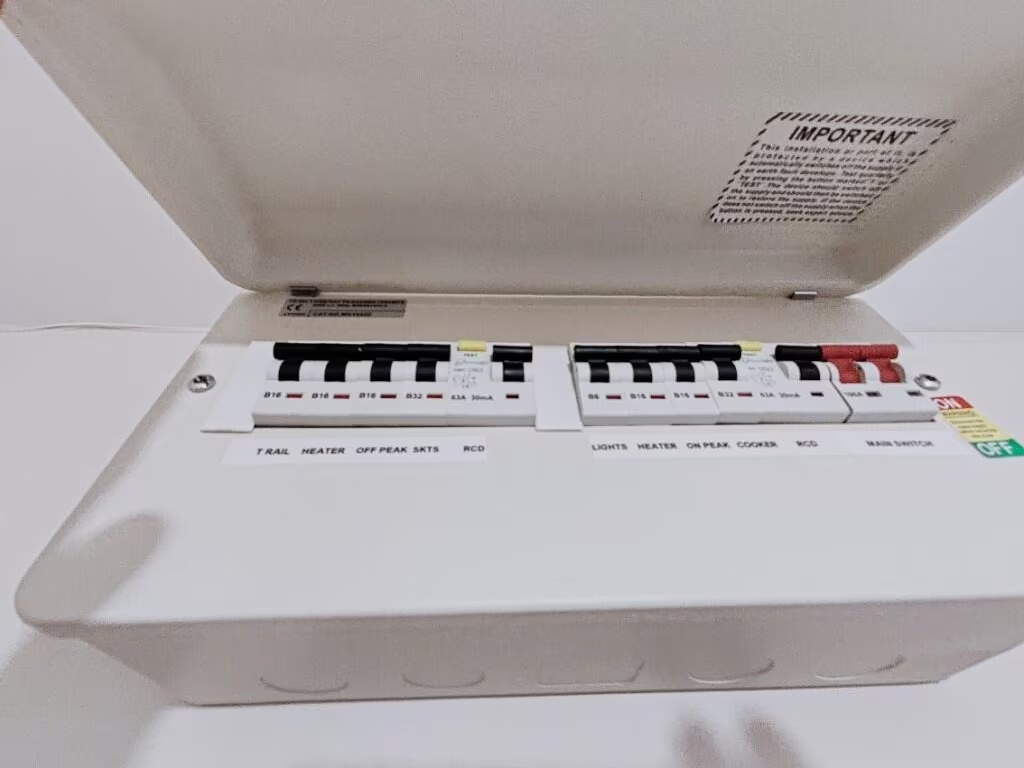

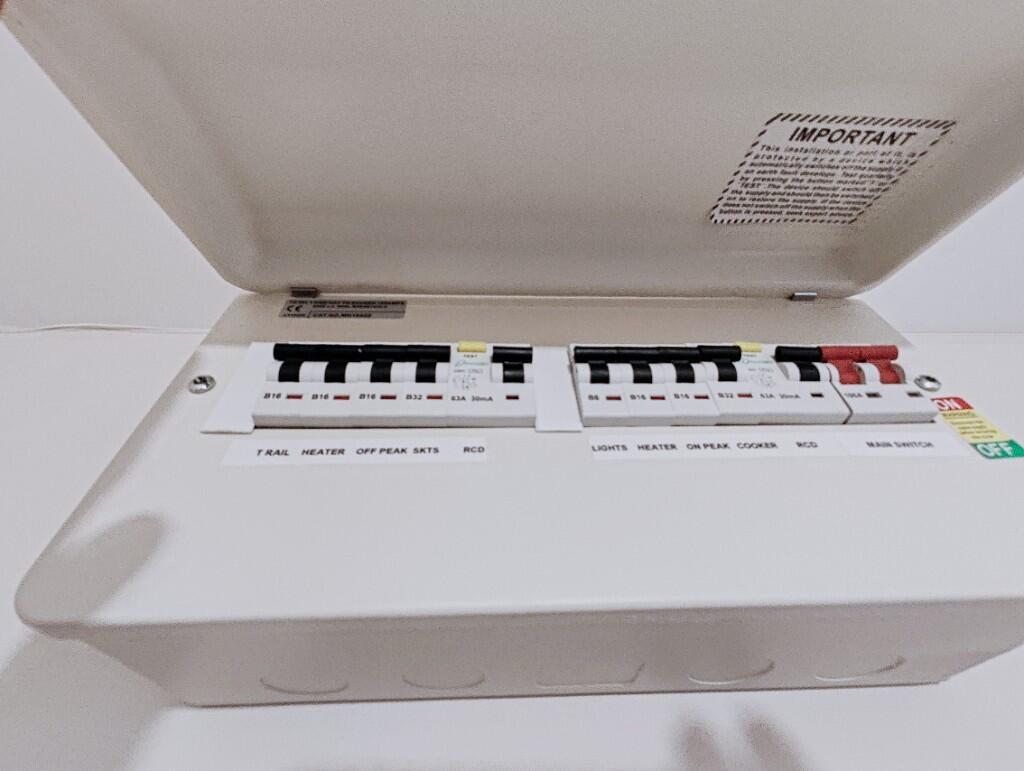

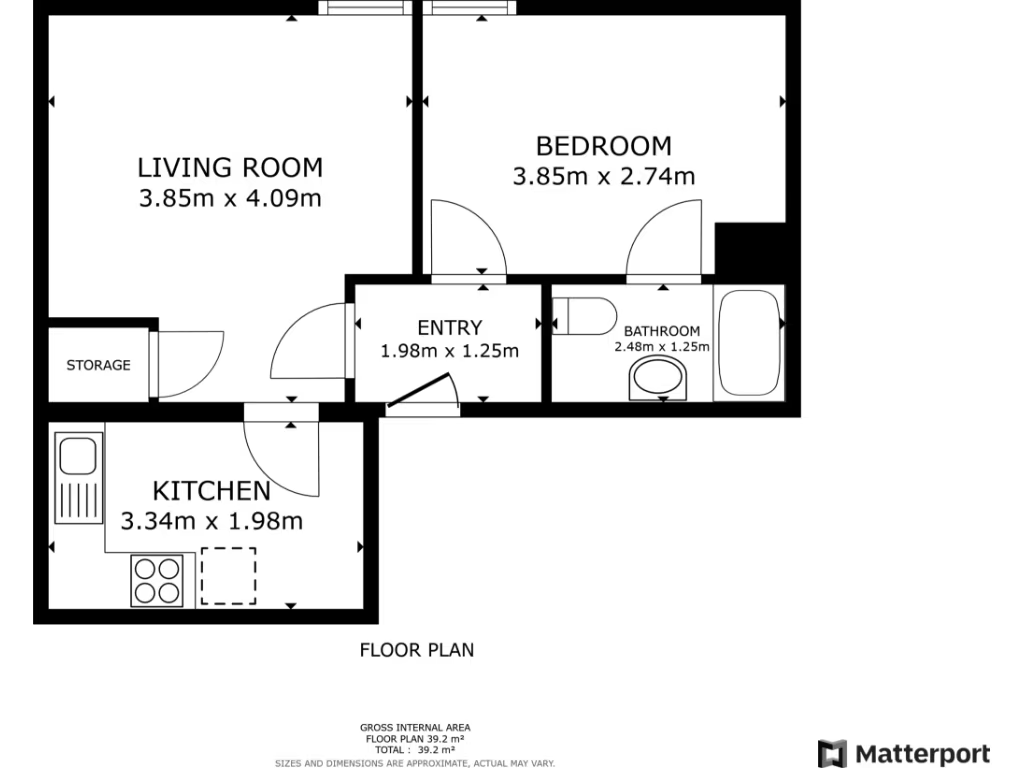

1. Ground-floor 1-bed flat, approximately 420 sq ft

2. Long-term tenant in situ, producing £6,300 gross pa

3. Cash purchase only; buyer’s premium will apply

4. Leasehold tenure — check service charges and lease length

5. Shared off-street parking; no private garden

6. Located in a deprived area with very high local crime rate

7. Suitable for investor targeting students/professionals

8. Fast broadband; immediate rental income but limited capital upside

A compact one-bedroom ground-floor flat in Waterloo House, Thornaby Place, presented as a buy-to-let opportunity with a long-term tenant in situ. The property includes a lounge, kitchen and bathroom across approximately 420 sq ft and benefits from off-street shared parking. It currently produces a gross annual income of £6,300, offering an income-generating asset for a cash purchaser.

This is a straightforward acquisition for investors seeking immediate rental income. The tenant has occupied the flat for several years and intends to remain, so the purchase delivers continuity of cashflow. The building appears modern with a brick exterior and communal entrance; local broadband is fast and the area is convenient for transport and nearby amenities.

Buyers should note material constraints: the sale is leasehold and a cash-only purchase is required. The location sits within a deprived area with a very high local crime rate — factors that can affect tenant demand, insurance costs and resale prospects. There is no private garden; the flat is small and best suited to single professionals or students rather than a family.

Full investment figures and tenancy documentation are available in the Let Property Pack and should be reviewed before bidding. A buyer’s premium applies to secure the property; purchasers must factor in this fee and any leasehold charges or management costs when calculating yield and total return.

1 bedroom flat for sale in Cardwell Walk, Stockton-On-Tees, TS17 — £50,000 • 1 bed • 1 bath • 538 ft²

1 bedroom flat for sale in Cardwell Walk, Stockton-On-Tees, TS17 — £50,000 • 1 bed • 1 bath • 538 ft² 1 bedroom flat for sale in Clough Close, Middlesbrough, TS5 — £55,000 • 1 bed • 2 bath • 527 ft²

1 bedroom flat for sale in Clough Close, Middlesbrough, TS5 — £55,000 • 1 bed • 2 bath • 527 ft² 1 bedroom apartment for sale in Clifton Avenue 27 Clifton Avenue, Hartlepool, TS26 — £30,000 • 1 bed • 1 bath • 698 ft²

1 bedroom apartment for sale in Clifton Avenue 27 Clifton Avenue, Hartlepool, TS26 — £30,000 • 1 bed • 1 bath • 698 ft² 1 bedroom flat for sale in Etherley Close, Stockton-On-Tees, TS19 — £45,000 • 1 bed • 1 bath • 485 ft²

1 bedroom flat for sale in Etherley Close, Stockton-On-Tees, TS19 — £45,000 • 1 bed • 1 bath • 485 ft² 3 bedroom semi-detached house for sale in Deal Close, Stockton-On-Tees, Durham, TS19 — £90,000 • 3 bed • 1 bath • 958 ft²

3 bedroom semi-detached house for sale in Deal Close, Stockton-On-Tees, Durham, TS19 — £90,000 • 3 bed • 1 bath • 958 ft² 3 bedroom detached house for sale in St. Anthonys Road, Middlesbrough,TS3 — £135,000 • 3 bed • 2 bath • 807 ft²

3 bedroom detached house for sale in St. Anthonys Road, Middlesbrough,TS3 — £135,000 • 3 bed • 2 bath • 807 ft²