Summary - 414 NEW HALL LANE PRESTON PR1 4SX

2 bed 2 bath Terraced

Two flats with retail frontage and immediate rental income — strong gross yield for investors.

Two one-bedroom flats above ground-floor retail unit, tenants in situ

This mid-terraced, mixed-use property on New Hall Lane is offered as a two-flat portfolio with tenants in situ — a clear buy-to-let opportunity for an investor seeking immediate rental income. The building combines a ground-floor retail unit with two one-bedroom flats above, producing a current annual gross income of £14,220 (gross yield approximately 9.5% at the asking price). Freehold title and city-centre positioning support long-term rental demand from private renters and new arrivals.

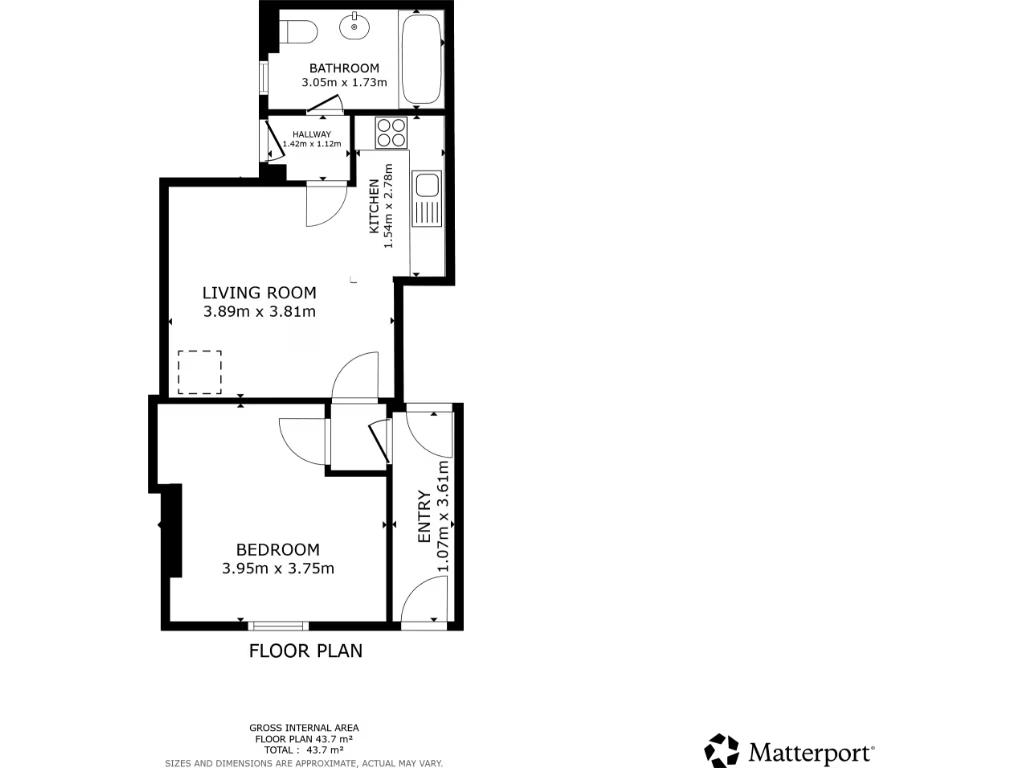

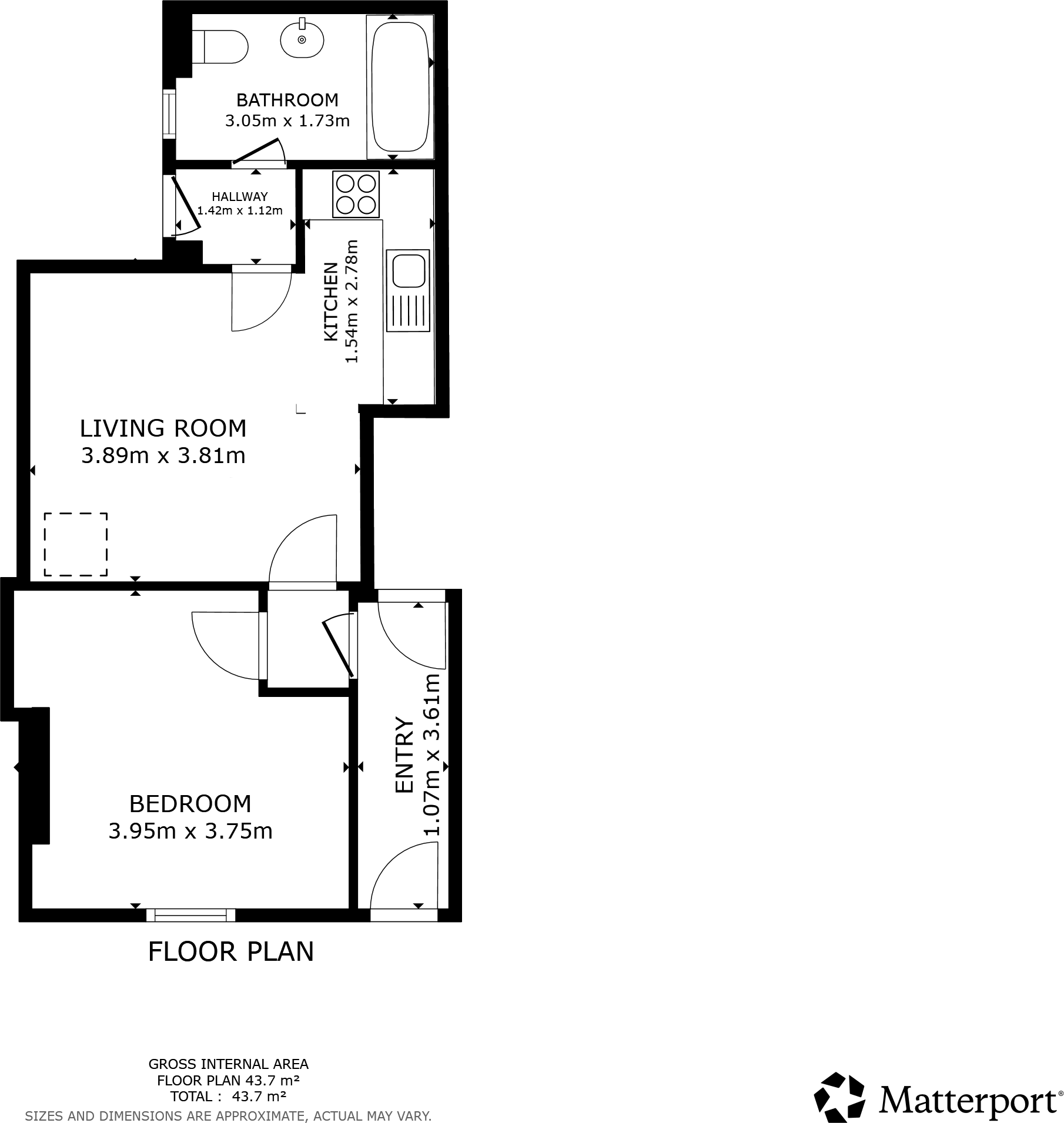

The flats are described as one-bedroom apartments each with a large bedroom, lounge, fitted kitchen and three-piece bathroom; tenants are long-term and currently situated, so the purchase delivers instant cashflow. The external appearance is Victorian period brick with a shopfront at street level and limited external space—likely a small rear yard only. Broadband and mobile signal are strong, aiding appeal to working tenants.

Notable negatives are factual and important for investor planning: the area is very deprived with above-average crime rates, which can affect tenant profiles, management costs and insurance premiums. The ground-floor retail unit shows cosmetic wear to the shopfront and the property footprint is compact with limited outdoor space. A Buyer’s Premium will apply on sale — factor this into acquisition costs. Prospective purchasers should review the full Let Property Pack for tenancy details, rents, lease terms and service/repair history before bidding.

This property suits investors or developers seeking rental income and future uplift through refurbishment or repurposing. It’s a practical, income-generating asset rather than a lifestyle purchase; buy-to-let experience and active asset management are recommended to maximise returns.

3 bedroom flat for sale in Winckley Square, Preston, PR1 — £220,000 • 3 bed • 2 bath

3 bedroom flat for sale in Winckley Square, Preston, PR1 — £220,000 • 3 bed • 2 bath 1 bedroom flat for sale in Eldon Street, Preston , PR2 — £155,000 • 1 bed • 1 bath • 839 ft²

1 bedroom flat for sale in Eldon Street, Preston , PR2 — £155,000 • 1 bed • 1 bath • 839 ft² 2 bedroom flat for sale in Mercer Street, Preston,PR1 — £106,000 • 2 bed • 1 bath • 624 ft²

2 bedroom flat for sale in Mercer Street, Preston,PR1 — £106,000 • 2 bed • 1 bath • 624 ft² 2 bedroom flat for sale in Bloomfield Grange, Preston, PR1 — £112,000 • 2 bed • 1 bath • 527 ft²

2 bedroom flat for sale in Bloomfield Grange, Preston, PR1 — £112,000 • 2 bed • 1 bath • 527 ft² 2 bedroom flat for sale in New Hall Lane, Preston, Lancashire, PR1 — £79,950 • 2 bed • 1 bath • 605 ft²

2 bedroom flat for sale in New Hall Lane, Preston, Lancashire, PR1 — £79,950 • 2 bed • 1 bath • 605 ft² Studio flat for sale in Garstang Road, Preston, PR1 — £60,000 • 1 bed • 1 bath

Studio flat for sale in Garstang Road, Preston, PR1 — £60,000 • 1 bed • 1 bath