Summary - Garstang Road, Preston, PR1 PR1 1AL

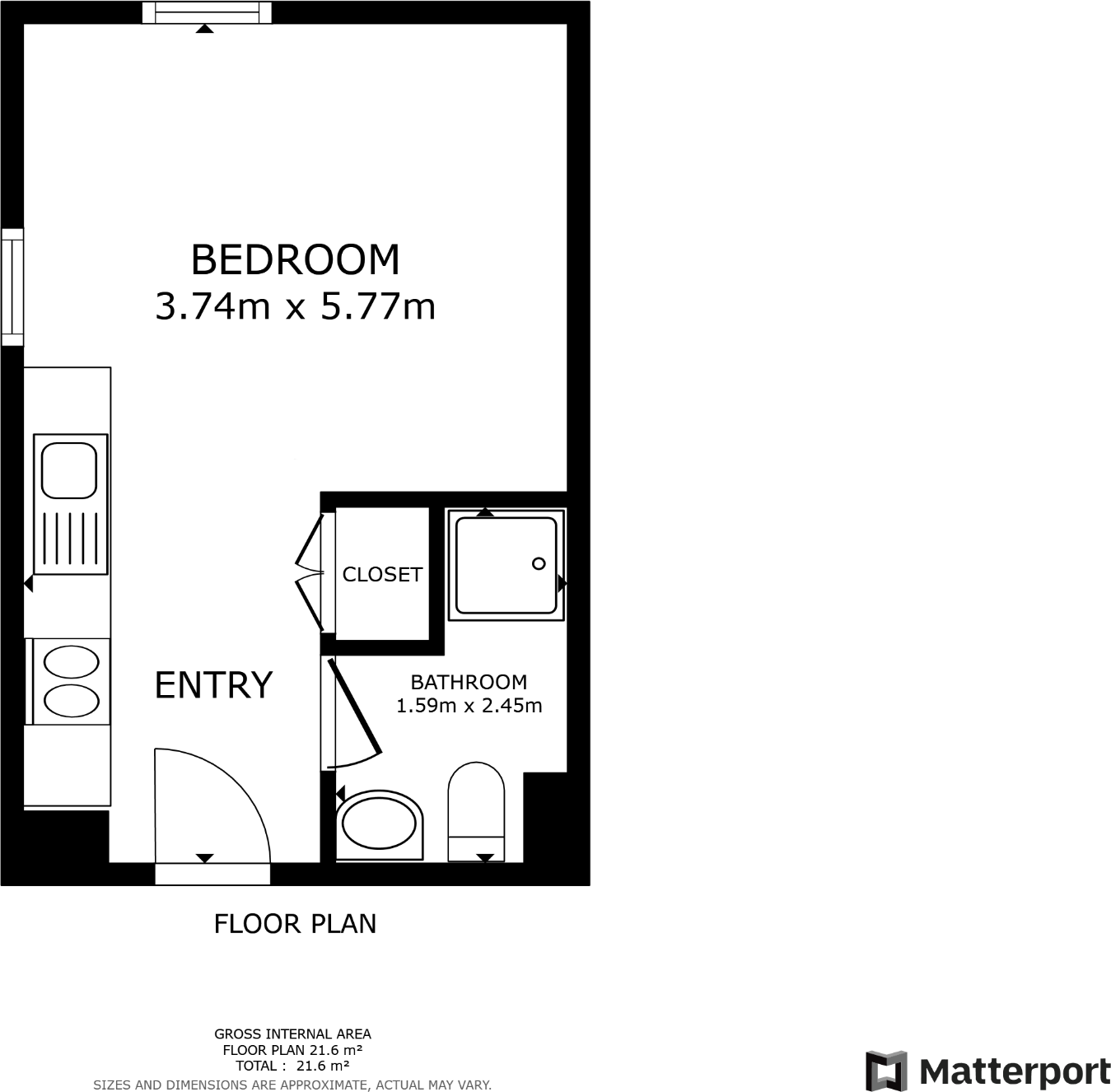

1 bed 1 bath Flat

Long-term tenant and strong gross returns for portfolio buyers.

- Long-term tenant in place providing immediate rental income

- Annual gross income reported at £9,180

- Guide price £57,000 indicates high gross return

- Leasehold tenure; review lease length and charges

- No private garden; street parking only

- Located in deprived, high-crime PR1 area

- Student-focused neighbourhood may limit owner-occupier appeal

- Average broadband; excellent mobile signal

A compact, leasehold studio in PR1 currently occupied by a long-term tenant, offering immediate rental income and strong gross returns. The property sits in a modern apartment block close to city amenities and student-focused facilities, making it attractive to buy-to-let portfolios and developers seeking assured occupancy.

The flat generates a reported annual gross income of £9,180 against a guide price of £57,000, producing an exceptional gross return for investors. The tenant has remained in situ for several years and intends to stay, providing predictable cashflow and minimal void risk. The building is contemporary and low-maintenance, with a small fitted kitchen and standard ceiling heights.

Buyers should note material considerations: the property is leasehold, located in a deprived, high-crime postcode and within a student-communal neighbourhood. There is no private outdoor space and parking is on-street only. Broadband speeds are average, though mobile signal is excellent. A buyers’ premium applies on sale, and the tenancy terms and Let Property Pack should be reviewed prior to purchase.

Overall, this is a straightforward acquisition for investors focused on yield and immediate income rather than owner-occupation. The combination of long-standing tenancy, central location and low running upkeep makes it a practical portfolio addition, provided purchasers accept the leasehold status and local area characteristics.

3 bedroom flat for sale in Samuel Street, Preston, PR1 — £45,000 • 3 bed • 1 bath • 861 ft²

3 bedroom flat for sale in Samuel Street, Preston, PR1 — £45,000 • 3 bed • 1 bath • 861 ft² 1 bedroom flat for sale in Barleyfield, Clayton-le-Woods, Preston, PR5 — £50,000 • 1 bed • 1 bath

1 bedroom flat for sale in Barleyfield, Clayton-le-Woods, Preston, PR5 — £50,000 • 1 bed • 1 bath 1 bedroom flat for sale in Barleyfield, Clayton-le-Woods, Preston PR5 — £50,000 • 1 bed • 1 bath

1 bedroom flat for sale in Barleyfield, Clayton-le-Woods, Preston PR5 — £50,000 • 1 bed • 1 bath 1 bedroom flat for sale in Lune Street, Preston, Lancashire, PR1 — £47,500 • 1 bed • 1 bath

1 bedroom flat for sale in Lune Street, Preston, Lancashire, PR1 — £47,500 • 1 bed • 1 bath 1 bedroom flat for sale in Lune Street, Preston, Lancashire, PR1 — £47,500 • 1 bed • 1 bath

1 bedroom flat for sale in Lune Street, Preston, Lancashire, PR1 — £47,500 • 1 bed • 1 bath 1 bedroom flat for sale in Bishopgate, Preston, Lancashire, PR1 — £125,000 • 1 bed • 1 bath • 470 ft²

1 bedroom flat for sale in Bishopgate, Preston, Lancashire, PR1 — £125,000 • 1 bed • 1 bath • 470 ft²