Summary - PALACE COURT APARTMENT 17 WARDLE STREET STOKE-ON-TRENT ST6 6AL

2 bed 1 bath Flat

Ready-made rental with long-term tenants and private parking for pragmatic investors.

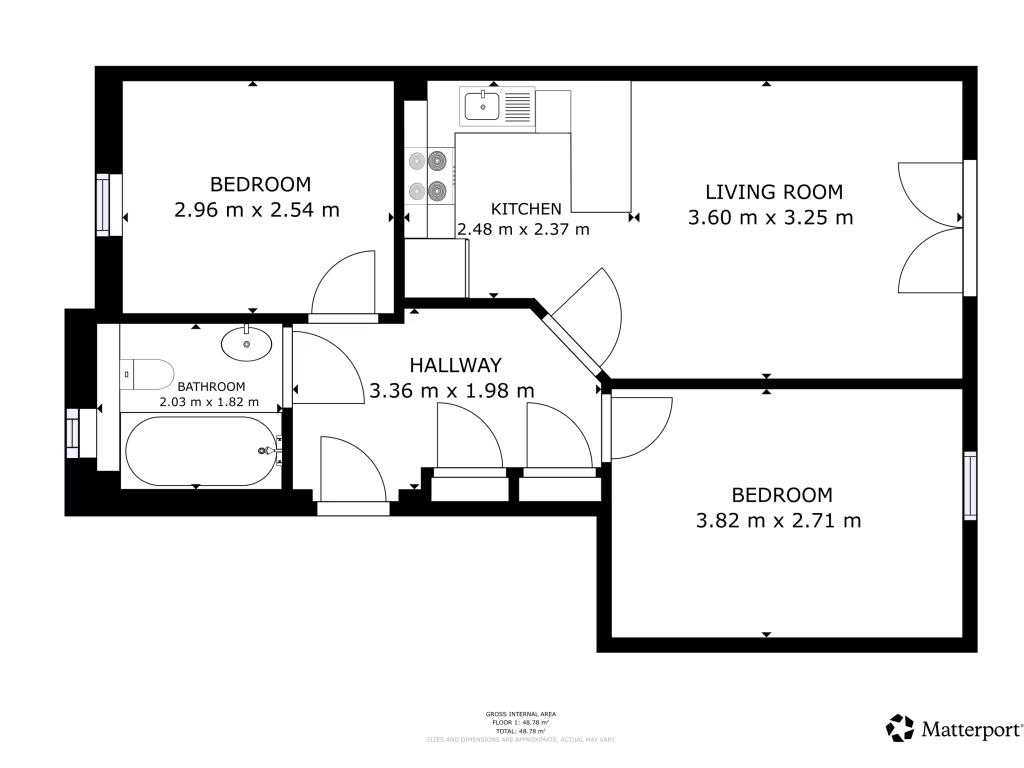

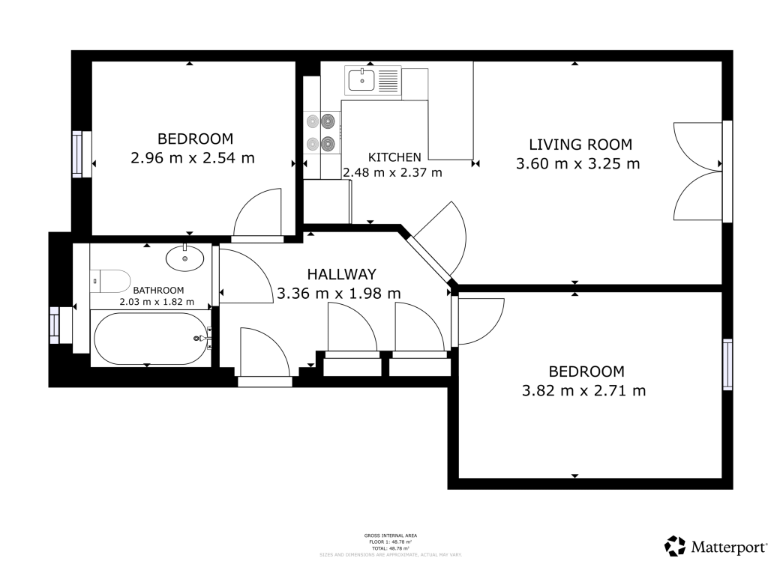

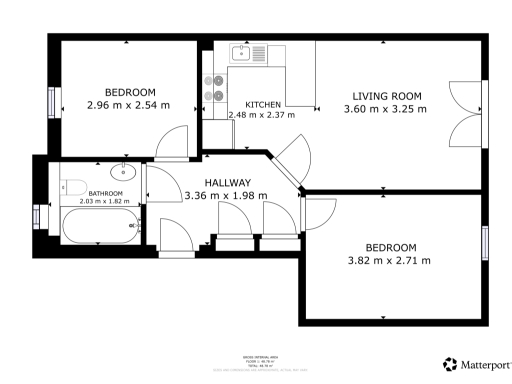

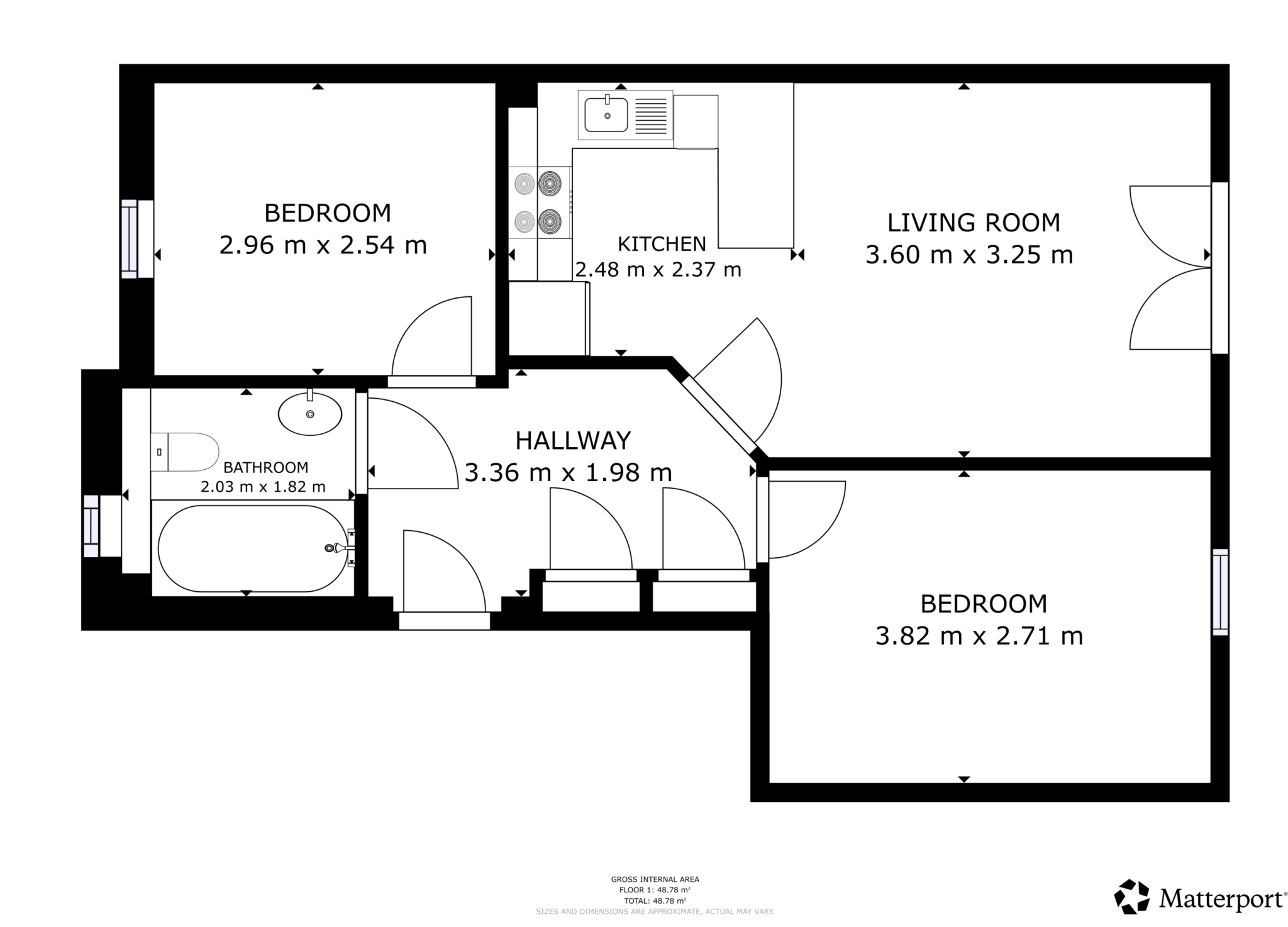

Two-bedroom leasehold flat, approximately 549 sq ft

A compact two-bedroom leasehold flat in Stoke-on-Trent, presented as a ready-made buy-to-let with long-term tenants in situ. The property produces a gross annual income of £5,040 and benefits from communal private parking and a straightforward traditional layout.

The flat offers practical, low-maintenance accommodation across approximately 549 sq ft: two bedrooms, a lounge with balcony, kitchen and a three-piece bathroom. The current tenants have occupied the property for 13 years and intend to remain, providing immediate rental income and minimised void risk for an investor.

Important considerations are factual and material. The property sits in an area classed as deprived with very high local crime levels, which will affect tenant demand and re-letting strategy. It is sold leasehold (982 years remaining) and a buyer’s premium applies to the sale process.

This is best suited to buyers seeking an income-producing addition to a portfolio rather than an owner-occupier looking to move in. The combination of long lease, existing tenancy, and communal parking makes it a straightforward rental asset, while the local market characteristics require realistic rental and management expectations.

2 bedroom flat for sale in Wardle Street, Stoke-On-Trent, ST6 — £70,000 • 2 bed • 1 bath • 538 ft²

2 bedroom flat for sale in Wardle Street, Stoke-On-Trent, ST6 — £70,000 • 2 bed • 1 bath • 538 ft² 2 bedroom flat for sale in Federation Road, Stoke-On-Trent, Staffordshire, ST6 — £55,000 • 2 bed • 1 bath • 581 ft²

2 bedroom flat for sale in Federation Road, Stoke-On-Trent, Staffordshire, ST6 — £55,000 • 2 bed • 1 bath • 581 ft² 1 bedroom flat for sale in Marsh Parade, Newcastle Under Lyme, Staffordshire, ST5 — £100,000 • 1 bed • 1 bath • 377 ft²

1 bedroom flat for sale in Marsh Parade, Newcastle Under Lyme, Staffordshire, ST5 — £100,000 • 1 bed • 1 bath • 377 ft² 2 bedroom flat for sale in Glebedale Court, Fenton, Stoke-on-Trent, ST4 3LT, ST4 — £80,000 • 2 bed • 1 bath • 472 ft²

2 bedroom flat for sale in Glebedale Court, Fenton, Stoke-on-Trent, ST4 3LT, ST4 — £80,000 • 2 bed • 1 bath • 472 ft² 2 bedroom apartment for sale in Grove Road, Stoke-on-Trent, ST4 — £60,000 • 2 bed • 1 bath • 421 ft²

2 bedroom apartment for sale in Grove Road, Stoke-on-Trent, ST4 — £60,000 • 2 bed • 1 bath • 421 ft² 2 bedroom terraced house for sale in Summerbank Road, Stoke-On-Trent, ST6 — £172,000 • 2 bed • 3 bath • 1055 ft²

2 bedroom terraced house for sale in Summerbank Road, Stoke-On-Trent, ST6 — £172,000 • 2 bed • 3 bath • 1055 ft²