Summary - 29 LASCELLES STREET ST. HELENS WA9 1BA

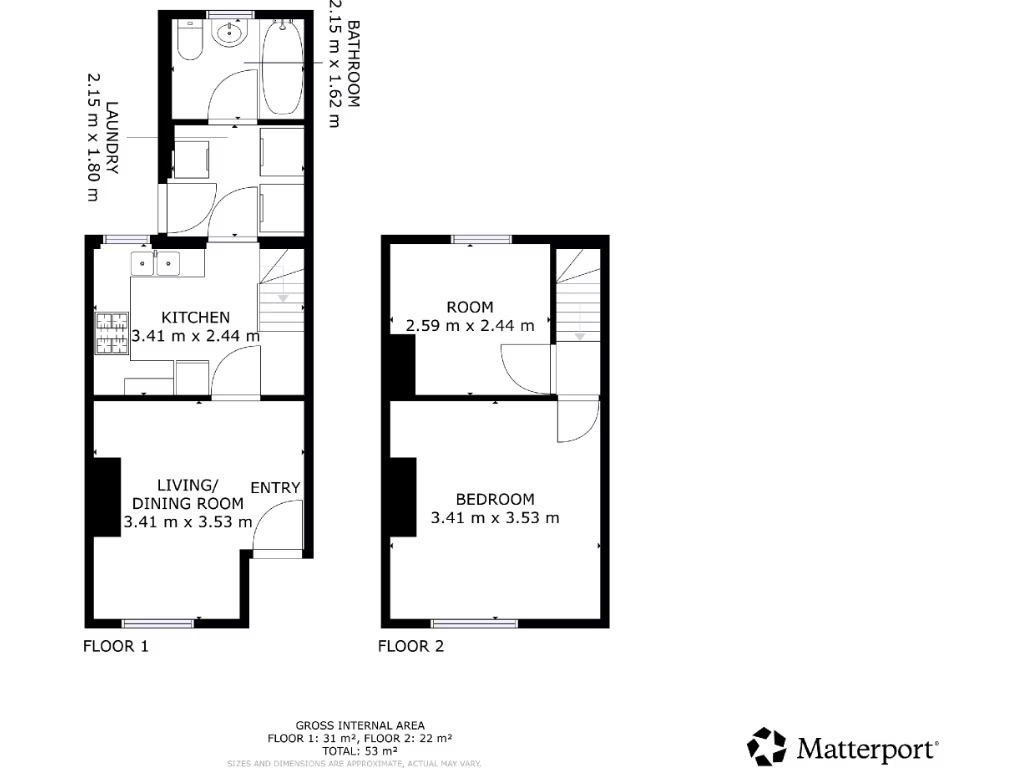

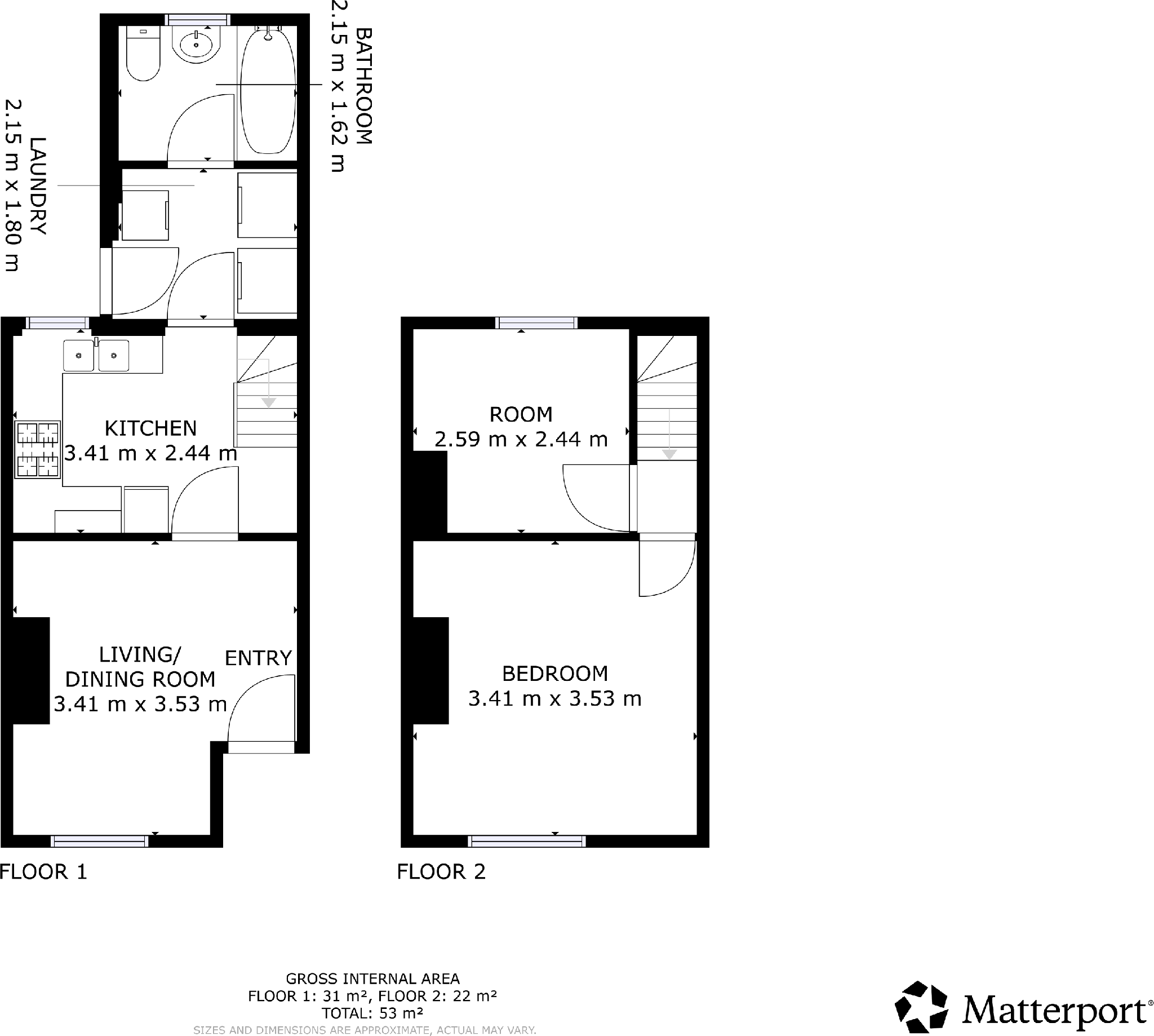

2 bed 1 bath Terraced

Low-cost investment with immediate rental income and refurbishment upside.

Freehold Victorian mid-terrace producing £4,800 gross annually

This small two-bedroom Victorian mid-terrace on Lascelles Street is presented as a clear buy-to-let opportunity with a long-term tenant in situ. The property produces a current gross annual income of £4,800 and is offered freehold, making it straightforward for investors seeking immediate rental return. The rear yard provides modest private outdoor space; parking is on-street.

The house requires updating and modernisation — descriptions note dated finishes and visible damp in the living room — so there is scope to add value through refurbishment or reconfiguration. Its compact footprint (approximately 570 sq ft) suits single lets or a low-cost refurbishment for stronger rental yield. A buyer should budget for works and an inspection to confirm condition details such as electrics and damp treatment.

Important transactional notes: the property sits in a very deprived area with very high local crime statistics, which can affect tenant demand and resale values. A buyer’s premium applies on purchase, and the current tenants intend to remain, meaning the purchase will likely be as an investment with the tenant continuing their tenancy. These factors make it best suited to experienced landlords or developers comfortable managing tenancies and local-area risks.

Overall, this is a low-entry-price investment with immediate income and clear upsides for refurbishment. It will most appeal to investors seeking portfolio additions or small-scale developers prepared to carry out repairs and accept the constraints of a tightly constrained urban market.

2 bedroom terraced house for sale in Gladstone Street, St. Helens, WA10 — £110,000 • 2 bed • 1 bath • 506 ft²

2 bedroom terraced house for sale in Gladstone Street, St. Helens, WA10 — £110,000 • 2 bed • 1 bath • 506 ft² 2 bedroom end of terrace house for sale in Charles Street, St. Helens, WA10 — £95,000 • 2 bed • 1 bath • 1001 ft²

2 bedroom end of terrace house for sale in Charles Street, St. Helens, WA10 — £95,000 • 2 bed • 1 bath • 1001 ft² 3 bedroom terraced house for sale in Lugsmore Lane, St. Helens, WA10 — £120,000 • 3 bed • 1 bath • 958 ft²

3 bedroom terraced house for sale in Lugsmore Lane, St. Helens, WA10 — £120,000 • 3 bed • 1 bath • 958 ft² 3 bedroom end of terrace house for sale in Campbell Street, St. Helens, Merseyside, WA10 — £115,000 • 3 bed • 1 bath • 958 ft²

3 bedroom end of terrace house for sale in Campbell Street, St. Helens, Merseyside, WA10 — £115,000 • 3 bed • 1 bath • 958 ft² 2 bedroom flat for sale in Prescot Road, St. Helens, Merseyside, WA10 — £130,000 • 2 bed • 2 bath • 710 ft²

2 bedroom flat for sale in Prescot Road, St. Helens, Merseyside, WA10 — £130,000 • 2 bed • 2 bath • 710 ft² 2 bedroom semi-detached house for sale in Knowles House Avenue, St. Helens, Merseyside, WA10 — £155,000 • 2 bed • 1 bath • 700 ft²

2 bedroom semi-detached house for sale in Knowles House Avenue, St. Helens, Merseyside, WA10 — £155,000 • 2 bed • 1 bath • 700 ft²