Summary - 71, DURRIS DRIVE, GLENROTHES KY6 2HR

2 bed 1 bath Flat

Immediate rent with tenants in place and scope for exterior improvement.

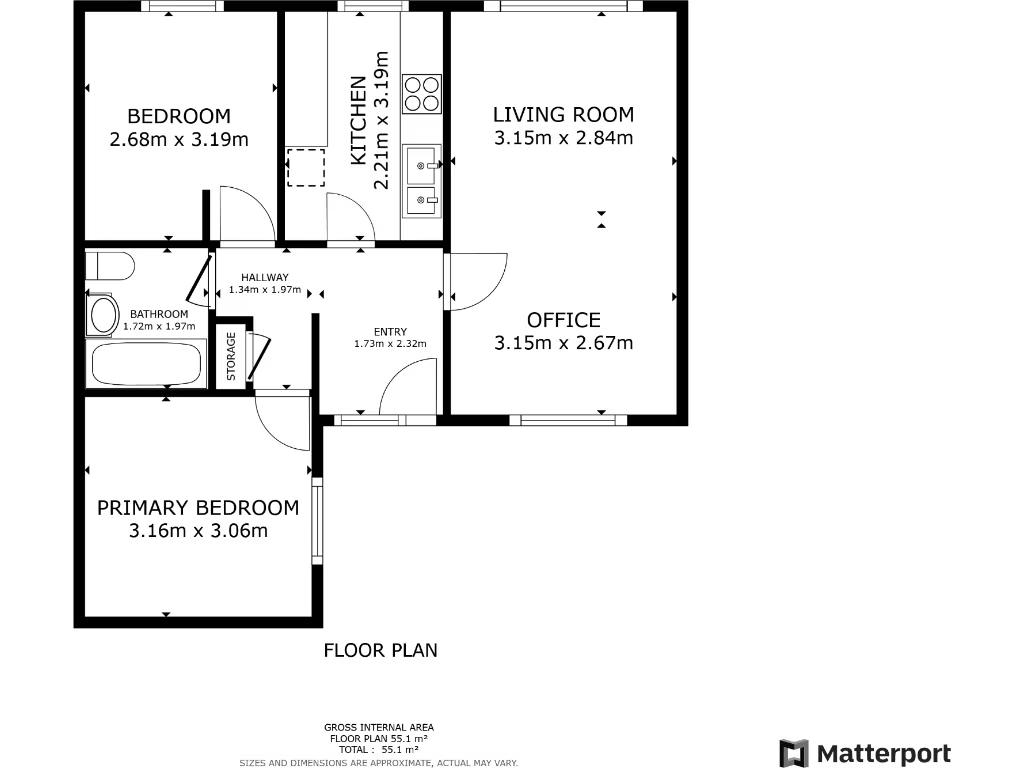

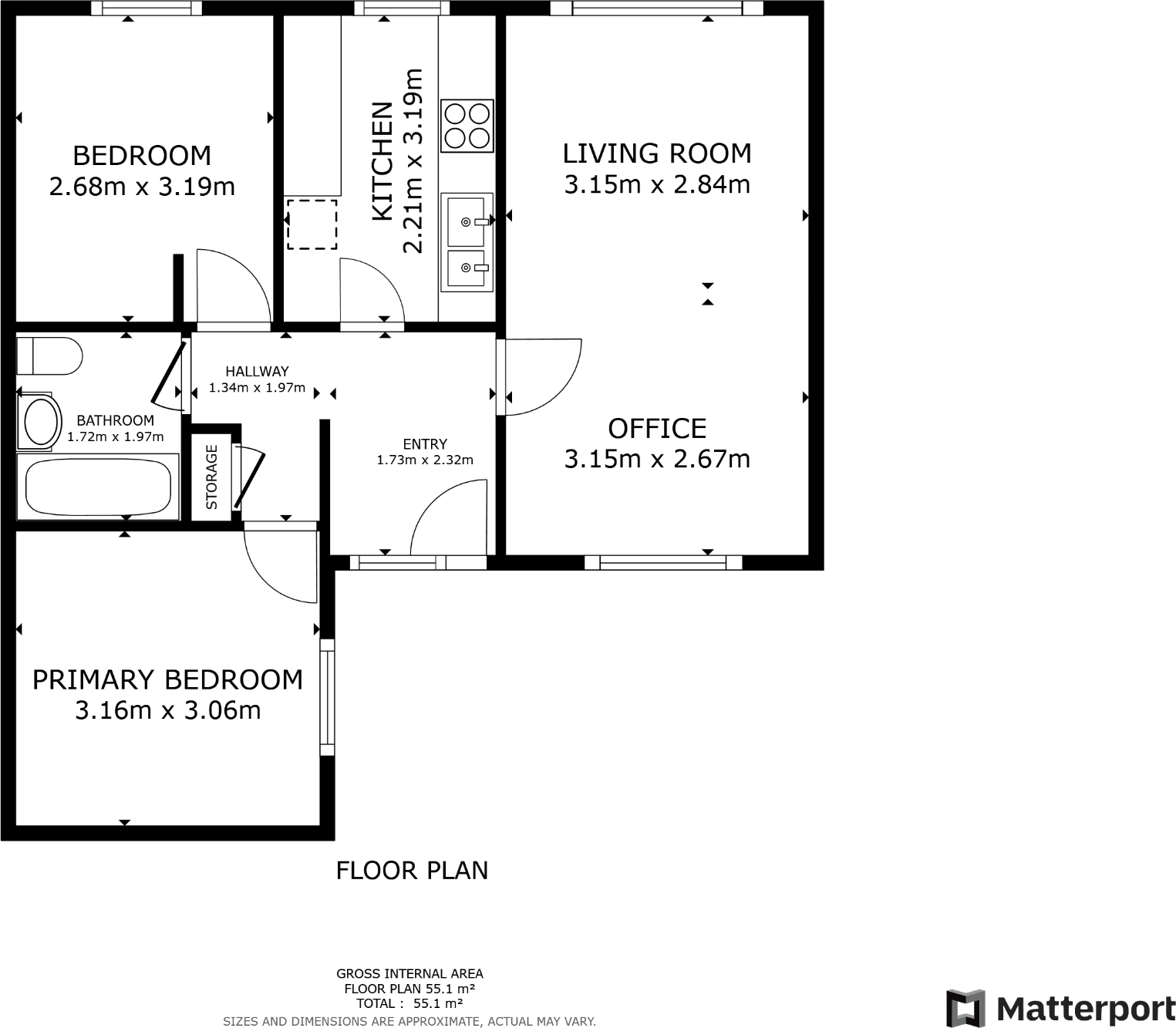

Freehold two-bedroom first-floor flat, approx 593 sqft

A compact two-bedroom first-floor flat offered freehold and currently let — a straightforward buy-to-let addition for investors seeking immediate income. The property is well kept internally with a spacious lounge, functioning three-piece bathroom and a practical kitchen; a conservatory-style light source and wooden flooring give the living space a contemporary feel.

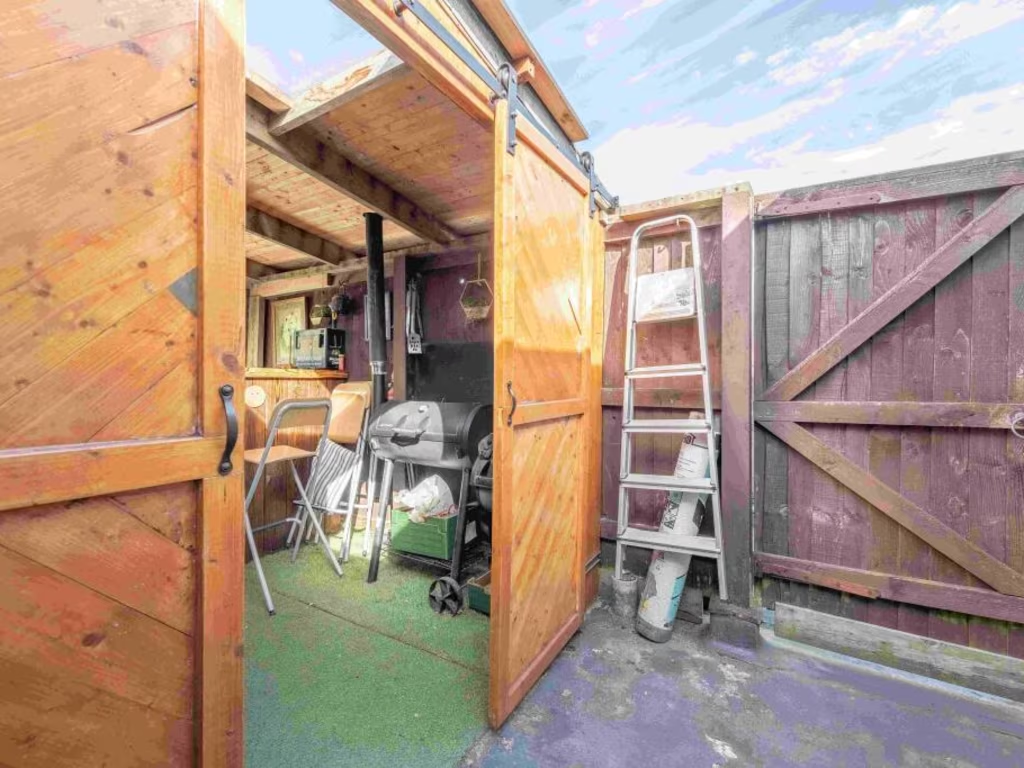

The property produces an annual gross income of £8,520 with tenants in situ who have paid rent consistently for their tenancy (under one year) and indicate they wish to remain. On-street parking and nearby garage blocks provide parking/storage options, though the garages and the terrace exterior show signs of dated mid‑20th century wear and would benefit from external investment.

Location offers easy access to local amenities and fast broadband and mobile signal, supporting rental market demand. Buyers should note the surrounding area is recorded as very deprived, which can influence tenant profiles and resale dynamics. A buyer’s premium will apply to secure the purchase.

This is a practical, income-focused purchase: low purchase price and immediate rental income make it attractive to investors and developers, but plan for external upgrades and to manage tenancy continuity given the tenant’s stated intention to stay.

2 bedroom flat for sale in Alexander Road, Glenrothes, KY7 — £53,500 • 2 bed • 1 bath • 753 ft²

2 bedroom flat for sale in Alexander Road, Glenrothes, KY7 — £53,500 • 2 bed • 1 bath • 753 ft² 2 bedroom flat for sale in St. Clair Street, Kirkcaldy, KY1 — £80,000 • 2 bed • 1 bath • 614 ft²

2 bedroom flat for sale in St. Clair Street, Kirkcaldy, KY1 — £80,000 • 2 bed • 1 bath • 614 ft² 2 bedroom flat for sale in Aitken Court, Leven, KY8 — £80,000 • 2 bed • 1 bath • 947 ft²

2 bedroom flat for sale in Aitken Court, Leven, KY8 — £80,000 • 2 bed • 1 bath • 947 ft² 1 bedroom flat for sale in Canmore Road, Glenrothes, KY7 — £50,000 • 1 bed • 1 bath

1 bedroom flat for sale in Canmore Road, Glenrothes, KY7 — £50,000 • 1 bed • 1 bath 1 bedroom flat for sale in Balfour Street, Kirkcaldy, KY2 — £45,000 • 1 bed • 1 bath • 398 ft²

1 bedroom flat for sale in Balfour Street, Kirkcaldy, KY2 — £45,000 • 1 bed • 1 bath • 398 ft² 2 bedroom flat for sale in Simon Crescent, Methilhill, Leven, KY8 — £64,500 • 2 bed • 1 bath • 683 ft²

2 bedroom flat for sale in Simon Crescent, Methilhill, Leven, KY8 — £64,500 • 2 bed • 1 bath • 683 ft²