Summary - 131 - 133 ST GEORGES ROAD BRISTOL BS1 5UW

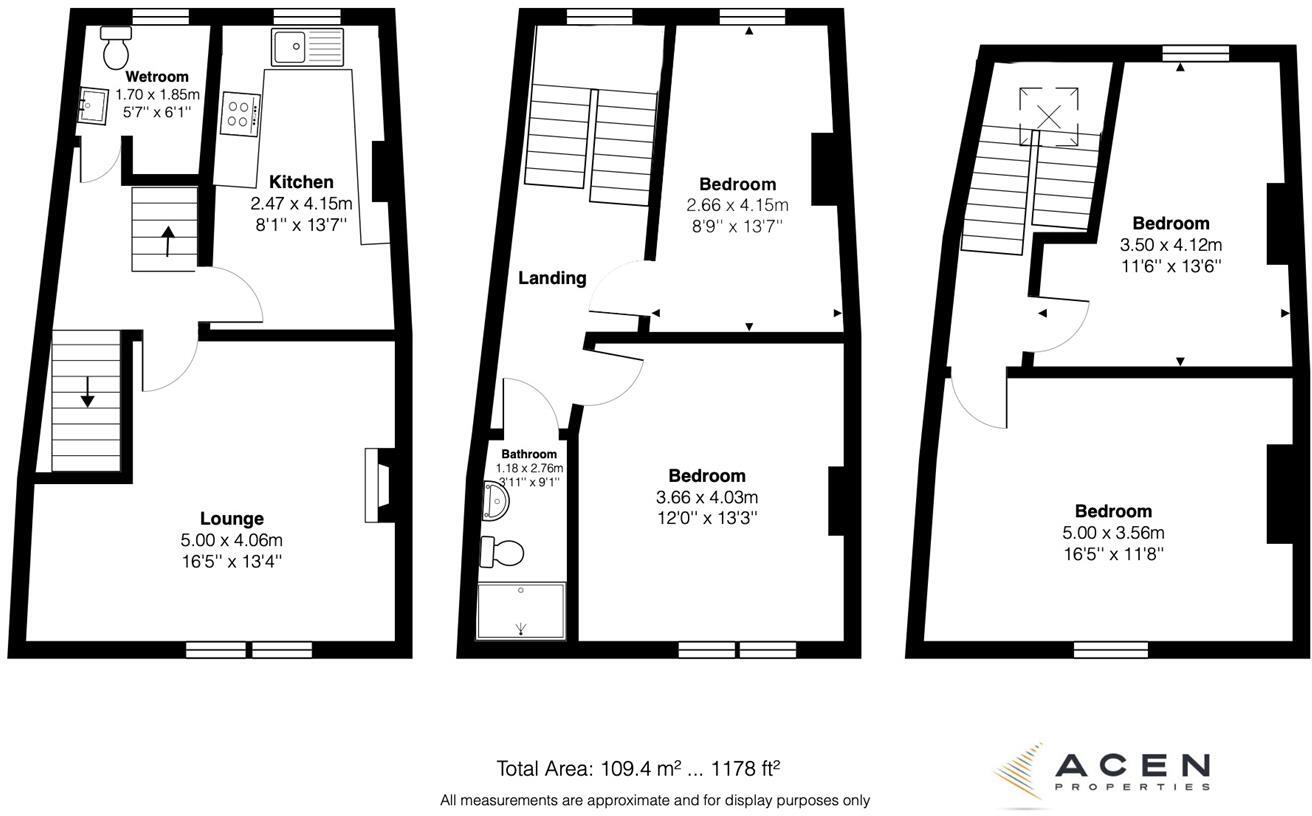

4 bed 2 bath Maisonette

Dual-income Victorian maisonette with immediate student rent and vacant retail potential in Hotwells.

Residential income from 4-bed flat currently let to students until Aug 2025

Vacant ground-floor commercial unit — scope to re-let or repurpose

Period features: high ceilings, sash windows, wooden floors throughout

Approx 1,500 sq ft across three levels, seven rooms overall

Leasehold with 86 years remaining; peppercorn ground rent applies

Local area: very high crime and deprived neighbourhood — consider tenant risk

Excellent mobile signal and fast broadband; low council tax

City-centre location close to universities, transport and amenities

Set over three storeys in a Victorian corner building in Hotwells, this mixed-use maisonette offers immediate residential income and clear scope to add value. The upper 4-bedroom flat is currently let to students until August 2025, producing a secure rental stream while the ground-floor commercial unit is vacant and ready to re-let or repurpose subject to consents.

The flat features high ceilings, large sash windows and wooden floors that retain period character, arranged across an efficient multi-storey layout. At around 1,500 sq ft, rooms are generously proportioned for an urban property and the location provides excellent transport links, strong footfall and easy access to city amenities — attractive to student and professional tenants.

Important investor considerations: the property is leasehold with 86 years remaining and peppercorn ground rent. The local area shows high crime rates and levels of deprivation, which may affect tenant mix and rental levels; these factors should be weighed against the strong rental demand from students and professionals nearby. Broadband and mobile connectivity are strong, and council tax is inexpensive — small running-cost positives.

Overall this is a straightforward dual-income investment: immediate residential yield from the student-let upper flat and an opportunity to increase total returns by letting or redeveloping the vacant ground-floor commercial unit. Buyers should budget for management, potential refurbishment of the commercial space, and factor the lease length into longer-term value projections.

High street retail property for sale in 298 Wells Road, Bristol, City Of Bristol, BS4 — £325,000 • 1 bed • 1 bath • 1363 ft²

High street retail property for sale in 298 Wells Road, Bristol, City Of Bristol, BS4 — £325,000 • 1 bed • 1 bath • 1363 ft² Commercial property for sale in St. George's Court, St. George's Road, Bristol, City of Bristol, BS1 — £2,700,000 • 1 bed • 1 bath • 6025 ft²

Commercial property for sale in St. George's Court, St. George's Road, Bristol, City of Bristol, BS1 — £2,700,000 • 1 bed • 1 bath • 6025 ft² 5 bedroom terraced house for sale in West Street, St. Philips, Bristol, BS2 — £465,000 • 5 bed • 2 bath • 2051 ft²

5 bedroom terraced house for sale in West Street, St. Philips, Bristol, BS2 — £465,000 • 5 bed • 2 bath • 2051 ft² 4 bedroom terraced house for sale in Hayward Road, Barton Hill, Bristol, Somerset, BS5 — £500,000 • 4 bed • 4 bath • 334 ft²

4 bedroom terraced house for sale in Hayward Road, Barton Hill, Bristol, Somerset, BS5 — £500,000 • 4 bed • 4 bath • 334 ft² Commercial development for sale in 4 - 6 Horfield Road, Bristol, City Of Bristol, BS2 — £340,000 • 1 bed • 1 bath • 1243 ft²

Commercial development for sale in 4 - 6 Horfield Road, Bristol, City Of Bristol, BS2 — £340,000 • 1 bed • 1 bath • 1243 ft² Commercial property for sale in 65A Whiteladies Road, Bristol, City Of Bristol, BS8 — £625,000 • 1 bed • 1 bath • 1897 ft²

Commercial property for sale in 65A Whiteladies Road, Bristol, City Of Bristol, BS8 — £625,000 • 1 bed • 1 bath • 1897 ft²