Summary - 17 PERCY ROAD SOUTHSEA PO4 0BH

4 bed 2 bath Terraced

Tenanted HMO with garage and immediate rental income in a vibrant student area.

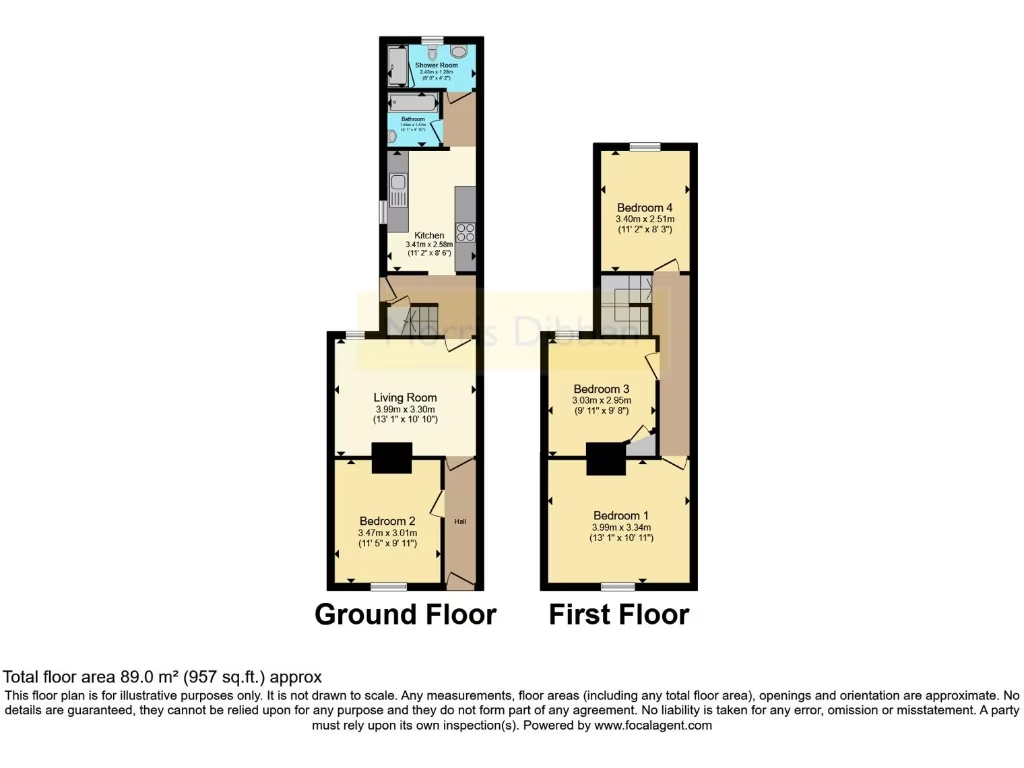

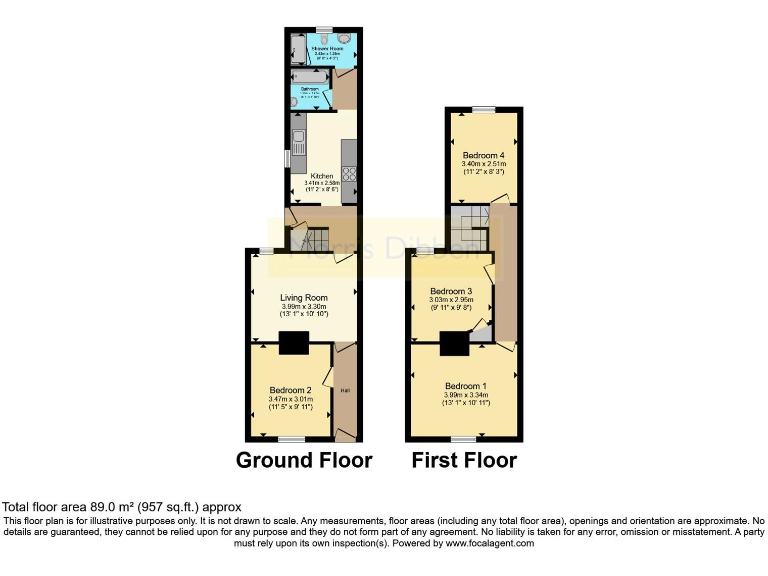

- Four double bedrooms and two bathrooms, arranged as an HMO

- Tenants in situ; immediate rental income for buyer

- Garage provides off-street parking and storage

- Cavity walls assumed uninsulated; efficiency improvements likely needed

- Double glazing installed before 2002 may require replacement

- Property built c.1900–1929; period maintenance foreseeable

- Small rear courtyard garden; limited outdoor space

- Local area: student-dominated, above-average crime rate

A four-bedroom mid-terrace HMO in Southsea, offered with tenants in situ and a garage, presents a clear rental-income opportunity. The property has four double bedrooms, two bathrooms, gas central heating and double glazing, providing immediate let-ready accommodation and straightforward management for an investor seeking steady yield.

Set within a cosmopolitan student neighbourhood, the house benefits from fast broadband, excellent mobile signal and a wide range of local amenities and transport links — features that support consistent tenancy and short void periods. The garage and small courtyard garden add practical value for storing bikes or secure tenant parking in a city location.

There are material points to note: the property dates from c.1900–1929 and the cavity walls are assumed uninsulated, so energy efficiency may be poor and improvement work could be required to reduce running costs. Double glazing was fitted before 2002 and may be nearing the end of its effective life. The area records above-average crime — important for tenant screening and insurance considerations.

Overall this terraced townhouse suits a hands-on investor seeking an established HMO with tenants already in place. It offers immediate rental income and scope for efficiency upgrades and cosmetic refurbishment to improve returns, though buyers should budget for insulation, possible window replacement and routine maintenance.

4 bedroom terraced house for sale in Boulton Road, Southsea, Hampshire, PO5 — £220,000 • 4 bed • 2 bath • 830 ft²

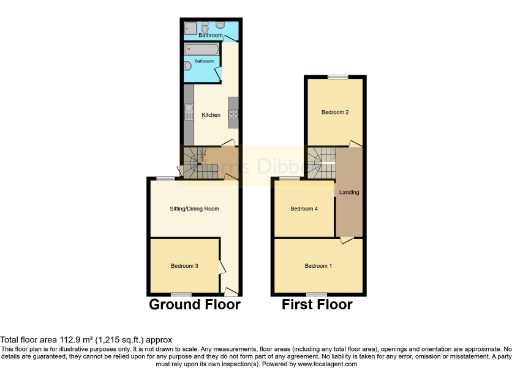

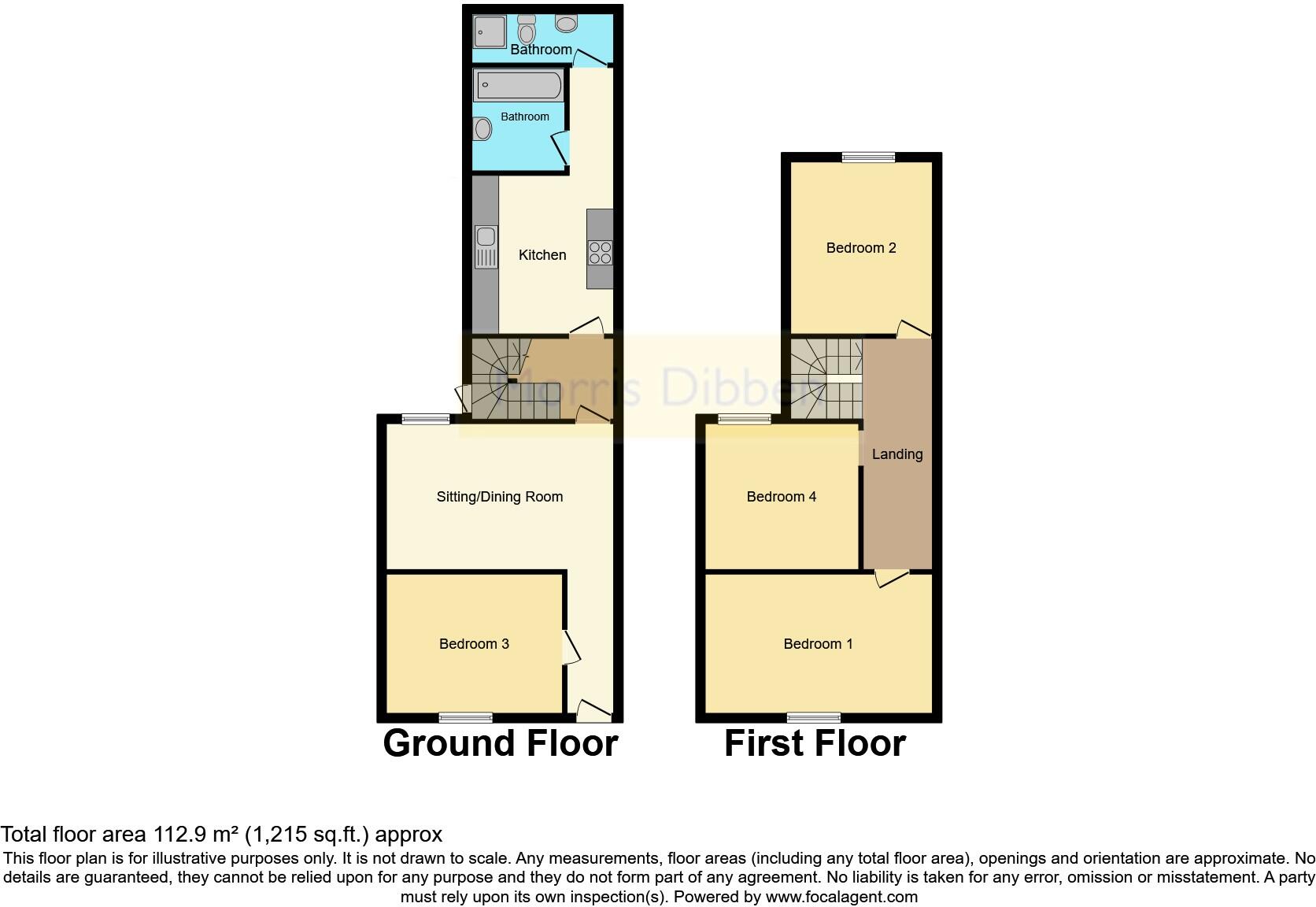

4 bedroom terraced house for sale in Boulton Road, Southsea, Hampshire, PO5 — £220,000 • 4 bed • 2 bath • 830 ft² 5 bedroom terraced house for sale in Fawcett Road, Southsea, Hampshire, PO4 — £375,000 • 5 bed • 2 bath • 1224 ft²

5 bedroom terraced house for sale in Fawcett Road, Southsea, Hampshire, PO4 — £375,000 • 5 bed • 2 bath • 1224 ft² 4 bedroom house for sale in Eton Road, Southsea, PO5 — £250,000 • 4 bed • 1 bath • 712 ft²

4 bedroom house for sale in Eton Road, Southsea, PO5 — £250,000 • 4 bed • 1 bath • 712 ft² 5 bedroom terraced house for sale in Wyndcliffe Road, Southsea, Hampshire, PO4 — £325,000 • 5 bed • 1 bath • 1128 ft²

5 bedroom terraced house for sale in Wyndcliffe Road, Southsea, Hampshire, PO4 — £325,000 • 5 bed • 1 bath • 1128 ft² 5 bedroom terraced house for sale in Fawcett Road, Southsea, Hampshire, PO4 — £375,000 • 5 bed • 1 bath • 1102 ft²

5 bedroom terraced house for sale in Fawcett Road, Southsea, Hampshire, PO4 — £375,000 • 5 bed • 1 bath • 1102 ft² 5 bedroom terraced house for sale in Manners Road, Southsea, Hampshire, PO4 — £325,000 • 5 bed • 1 bath • 1025 ft²

5 bedroom terraced house for sale in Manners Road, Southsea, Hampshire, PO4 — £325,000 • 5 bed • 1 bath • 1025 ft²