Summary - 16 ETON ROAD SOUTHSEA PO5 1SQ

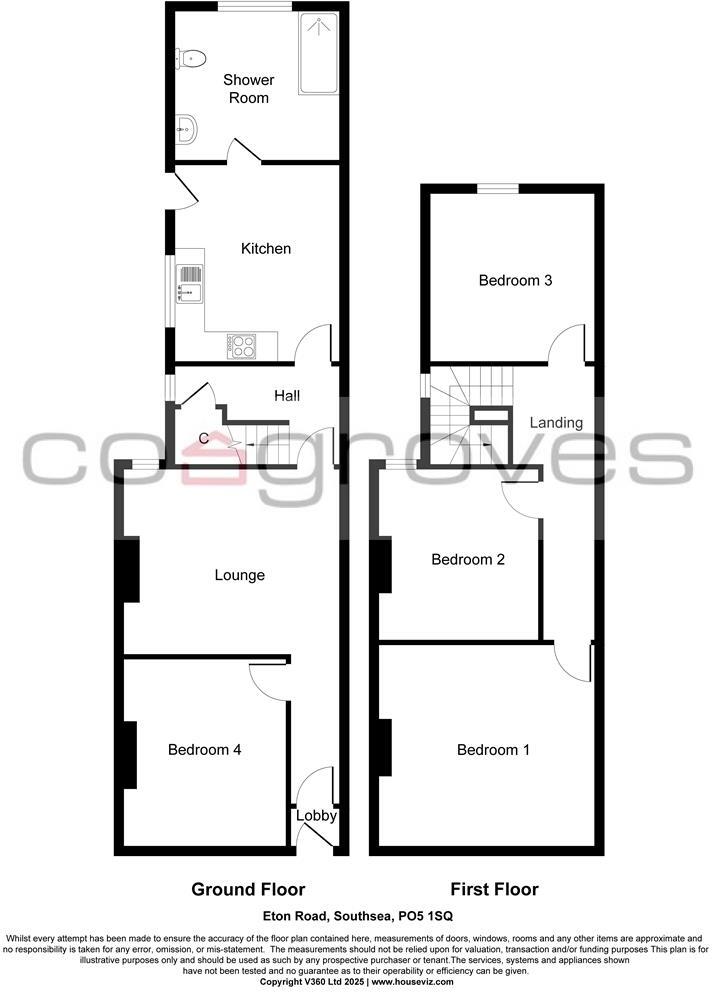

4 bed 1 bath House

Turnkey 4-bed HMO with licences, immediate income and uplift potential..

C3 & C4 licences in place suitable for HMO or household use

Let from 1 Sept for 11 months at £1,850pcm (income-producing)

Quoted gross yield c.8.14% based on asking price

Four double bedrooms — all suitable for sharers

Single ground-floor shower room for four bedrooms (limitation)

Small plot and compact internal footprint typical of terraces

Above-average local crime levels — consider management/security costs

Freehold tenure; Council Tax Band B (relatively cheap)

A practical buy-to-let in a popular Southsea rental pocket, this Victorian mid-terrace is offered with C3 and C4 licences already in place—suiting both household and HMO uses. Currently let from 1 September for an 11-month term at £1,850pcm, the property produces a quoted gross yield of c.8.14%, making it immediately income-producing for an investor seeking near-term returns.

The house provides four double bedrooms, a bright ground-floor lounge, a modern fitted kitchen with garden access and a ground-floor shower room. Rooms are well sized for sharers and the location is a key asset: close to the university, seafront, local amenities and the train station—features that support high tenant demand and lettings resilience.

Important practical points: the overall footprint is compact and the property has a single shower room serving four bedrooms, which can limit premium rental potential without further investment. The neighbourhood records above-average crime levels, and the terrace would benefit from cosmetic updating to maximise income and long-term capital growth. Buyers should verify tenancy details, licences and services; purchases should factor in minor refurbishment or reconfiguration costs.

For an investor seeking an entry-priced HMO with licences and immediate rent roll, this property offers hands-on potential—short-term uplift through targeted modernisation, or steady returns if held as a managed HMO. Its freehold tenure and proximity to high-demand student and rental catchments are the primary value drivers.

4 bedroom terraced house for sale in Britannia Road North, Southsea, PO5 — £350,000 • 4 bed • 2 bath • 1303 ft²

4 bedroom terraced house for sale in Britannia Road North, Southsea, PO5 — £350,000 • 4 bed • 2 bath • 1303 ft² 4 bedroom terraced house for sale in Boulton Road, Southsea, Hampshire, PO5 — £220,000 • 4 bed • 2 bath • 830 ft²

4 bedroom terraced house for sale in Boulton Road, Southsea, Hampshire, PO5 — £220,000 • 4 bed • 2 bath • 830 ft² 4 bedroom terraced house for sale in Westfield Road, Southsea, PO4 — £325,000 • 4 bed • 4 bath • 882 ft²

4 bedroom terraced house for sale in Westfield Road, Southsea, PO4 — £325,000 • 4 bed • 4 bath • 882 ft² 4 bedroom end of terrace house for sale in Westfield Road, Southsea, PO4 — £325,000 • 4 bed • 4 bath • 948 ft²

4 bedroom end of terrace house for sale in Westfield Road, Southsea, PO4 — £325,000 • 4 bed • 4 bath • 948 ft² 3 bedroom terraced house for sale in Goodwood Road, Southsea, Hampshire, PO5 — £260,000 • 3 bed • 2 bath • 808 ft²

3 bedroom terraced house for sale in Goodwood Road, Southsea, Hampshire, PO5 — £260,000 • 3 bed • 2 bath • 808 ft² 4 bedroom terraced house for sale in Harold Road, Southsea, PO4 — £260,000 • 4 bed • 1 bath • 958 ft²

4 bedroom terraced house for sale in Harold Road, Southsea, PO4 — £260,000 • 4 bed • 1 bath • 958 ft²