Summary - 7, Fore Street, Devonport, PLYMOUTH PL1 4DW

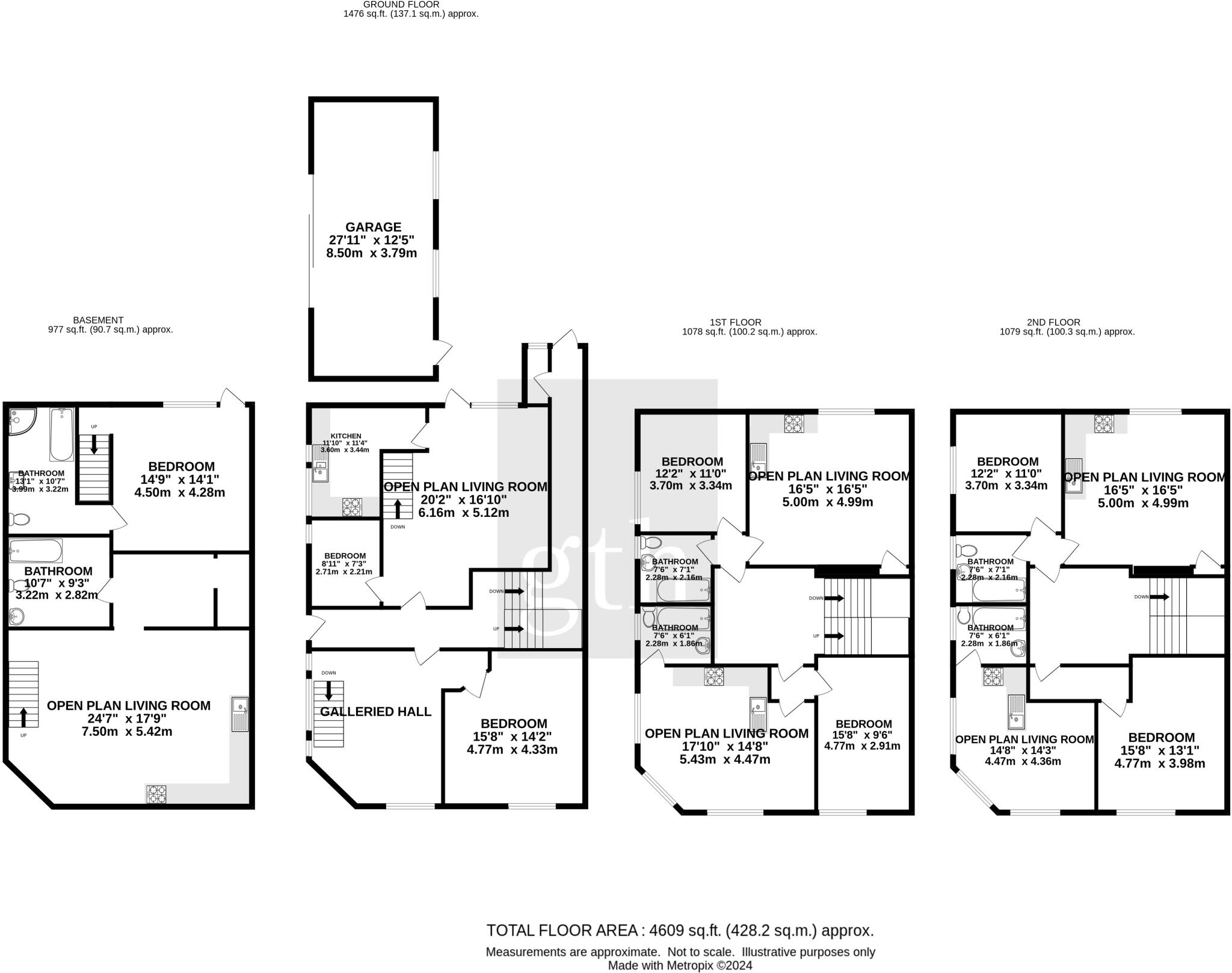

6 bed 6 bath End of Terrace

Prominent Victorian corner building — six flats with immediate rental income and refurbishment upside.

6 self-contained flats sold as a single freehold investment

Projected annual income c. £43,440 (circa 8% yield)

Large Victorian corner building with high ceilings and period features

Two duplexes and four one-bed apartments; tenants currently in situ

Separate stone-built garage rented at £120 pcm

Located in a very deprived area with high local crime levels

May require refurbishment and ongoing maintenance to boost rents

Fast broadband, excellent mobile signal; no flood risk

A substantial Victorian end-of-terrace converted into six self-contained flats and sold as a single freehold investment with tenants in situ. The building sits prominently on a corner plot in Devonport and offers a projected annual income of about £43,440 (circa 8% yield) including a separately rented stone-built garage. High ceilings, large rooms and period sash windows give the apartments character and potential to enhance value with sensitive refurbishment.

The six flats comprise two duplexes and four one-bed apartments, all currently occupied and producing rental income. Broadband speeds are fast and mobile signal is excellent, supporting demand from working tenants. The property benefits from close access to Plymouth city centre, public transport and local amenities, and there is no flood risk on the site.

Key investment considerations: the area records high crime levels and is classified as very deprived, which affects tenant profiles and resale prospects. The building presents renovation potential rather than turnkey luxury—ongoing maintenance and upgrading of communal areas or individual flats may be required to sustain rents and reduce void risk. The property is large (about 4,609 sq ft) with a decent plot and private rear courtyard shared by flats.

This opportunity suits a buyer seeking an income-producing, freehold, multi-unit period building with clear scope to add value through targeted improvements. Expect working with existing tenants in situ and budgeting for ongoing maintenance and possible modernisation to maximise long-term returns.

7 bedroom end of terrace house for sale in North Street, TF, Plymouth, PL4 — £290,000 • 7 bed • 2 bath • 834 ft²

7 bedroom end of terrace house for sale in North Street, TF, Plymouth, PL4 — £290,000 • 7 bed • 2 bath • 834 ft² Terraced house for sale in Hill Park Crescent, Plymouth, Devon, PL4 — £350,000 • 1 bed • 1 bath

Terraced house for sale in Hill Park Crescent, Plymouth, Devon, PL4 — £350,000 • 1 bed • 1 bath 6 bedroom terraced house for sale in Plymouth, Devon, PL1 — £335,000 • 6 bed • 6 bath • 2058 ft²

6 bedroom terraced house for sale in Plymouth, Devon, PL1 — £335,000 • 6 bed • 6 bath • 2058 ft² 3 bedroom terraced house for sale in Bedford Park, Plymouth, PL4 — £300,000 • 3 bed • 3 bath

3 bedroom terraced house for sale in Bedford Park, Plymouth, PL4 — £300,000 • 3 bed • 3 bath 14 bedroom detached house for sale in Outland Road, Plymouth, Devon, PL2 — £800,000 • 14 bed • 10 bath

14 bedroom detached house for sale in Outland Road, Plymouth, Devon, PL2 — £800,000 • 14 bed • 10 bath 5 bedroom character property for sale in Paradise Road, Plymouth, PL1 — £300,000 • 5 bed • 3 bath

5 bedroom character property for sale in Paradise Road, Plymouth, PL1 — £300,000 • 5 bed • 3 bath