Summary - 13 GORTON STREET HEYWOOD OL10 4ED

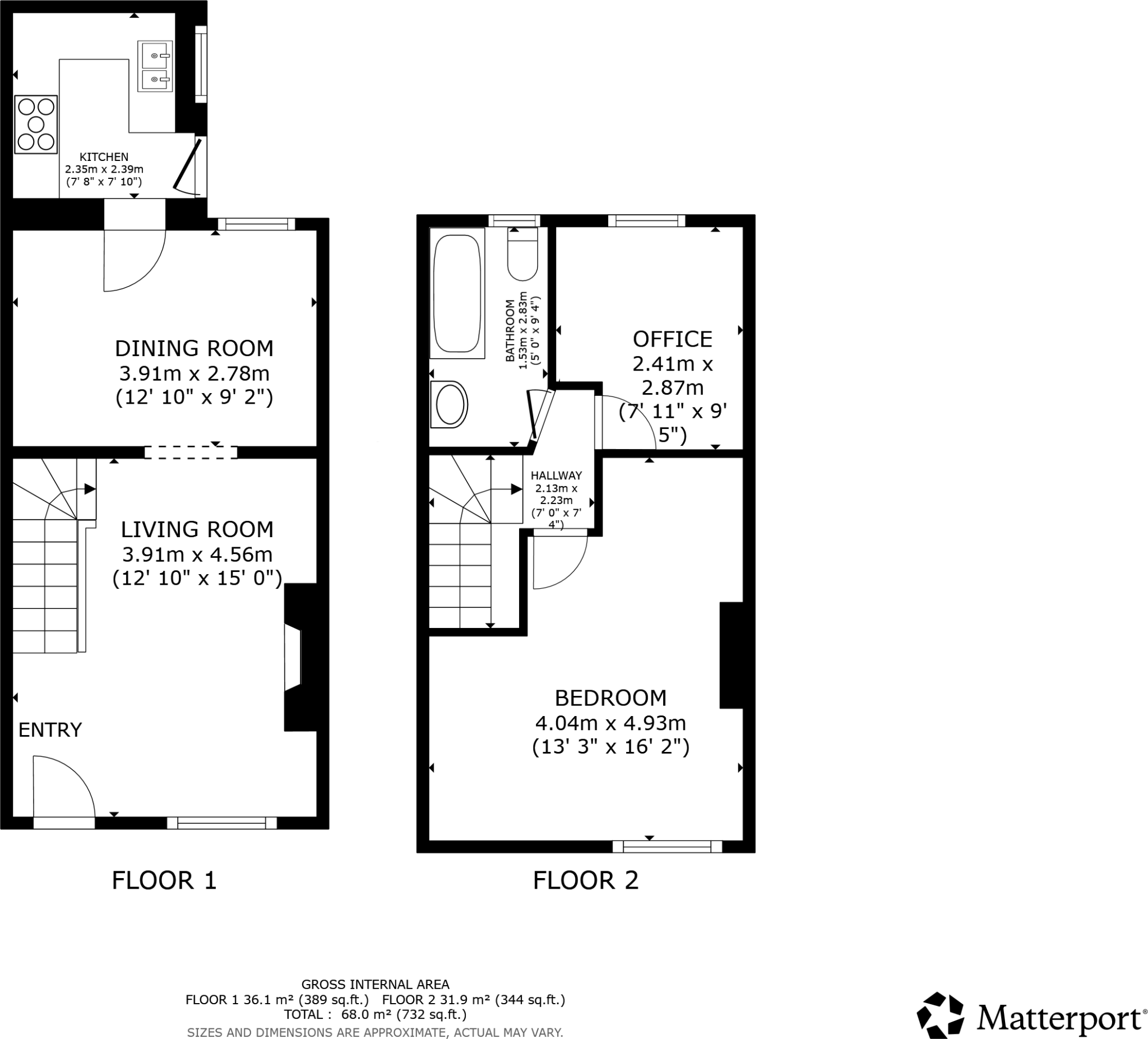

2 bed 1 bath End of Terrace

Ready-income two-bed buy-to-let in a well-served urban location.

Freehold Victorian end-terrace with private rear garden

This two-bedroom end-of-terrace in Heywood is offered as a buy-to-let with a tenant in situ, delivering immediate rental income. The freehold Victorian property sits on a small urban plot with a private rear garden and on-street parking — straightforward, low-maintenance assets for an investor seeking cash flow.

Current gross income is £9,000 per year, which equates to roughly an 8.6% gross yield at the asking price of £105,000. There is quoted additional rental uplift potential if re-let at market levels; full Let Property Pack details and tenancy documentation should be reviewed before offer.

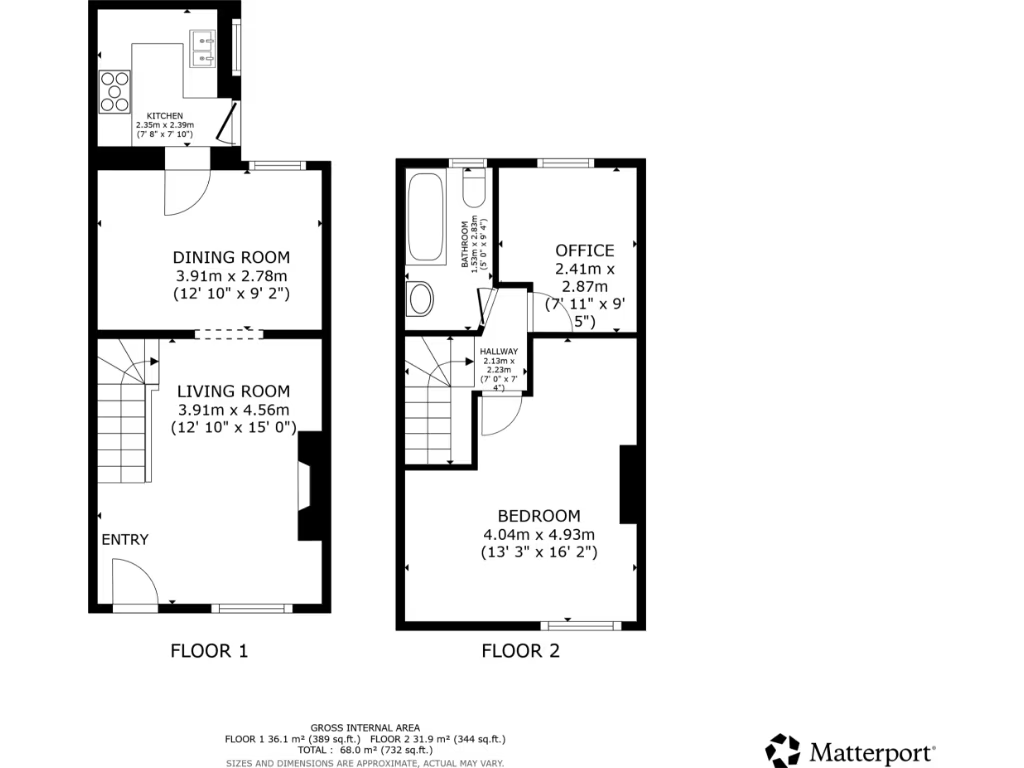

The house is modest in size (approximately 732 sq ft) and externally appears in fair condition typical of period terraces. This makes it suitable for continued long-term let or light refurbishment to increase capital value. Important matters: the property is in a deprived local area, the tenant wishes to remain, and a Buyer’s Premium will apply to the sale — all material factors for prospective purchasers to consider.

2 bedroom terraced house for sale in Claybank Street, Heywood, Greater Manchester, OL10 — £115,000 • 2 bed • 1 bath • 646 ft²

2 bedroom terraced house for sale in Claybank Street, Heywood, Greater Manchester, OL10 — £115,000 • 2 bed • 1 bath • 646 ft² 2 bedroom terraced house for sale in Middleton Road, Heywood, Greater Manchester, OL10 — £100,000 • 2 bed • 1 bath • 753 ft²

2 bedroom terraced house for sale in Middleton Road, Heywood, Greater Manchester, OL10 — £100,000 • 2 bed • 1 bath • 753 ft² 3 bedroom terraced house for sale in Green Lane, Heywood, Greater Manchester, OL10 — £118,000 • 3 bed • 2 bath • 893 ft²

3 bedroom terraced house for sale in Green Lane, Heywood, Greater Manchester, OL10 — £118,000 • 3 bed • 2 bath • 893 ft² 3 bedroom terraced house for sale in Queens Park Road, Heywood, OL10 — £117,600 • 3 bed • 1 bath • 807 ft²

3 bedroom terraced house for sale in Queens Park Road, Heywood, OL10 — £117,600 • 3 bed • 1 bath • 807 ft² 2 bedroom terraced house for sale in Mellalieu Street, Oldham, Greater Manchester, OL2 — £127,500 • 2 bed • 1 bath • 786 ft²

2 bedroom terraced house for sale in Mellalieu Street, Oldham, Greater Manchester, OL2 — £127,500 • 2 bed • 1 bath • 786 ft² 2 bedroom terraced house for sale in Whiteacre Road, Ashton-Under-Lyne, Greater Manchester, OL6 — £118,000 • 2 bed • 1 bath • 678 ft²

2 bedroom terraced house for sale in Whiteacre Road, Ashton-Under-Lyne, Greater Manchester, OL6 — £118,000 • 2 bed • 1 bath • 678 ft²