Summary - Apartment 1002 City View, Highclere Avenue M7 4ZU

2 bed 1 bath Flat

High-yield two-bedroom investment with lift access and gated parking close to transport links.

- Currently let, generating £12,600 pa (over 10% gross yield)

- Tenth-floor apartment with lift and panoramic city views

- Two double bedrooms and open-plan living/kitchen

- Gated residents parking and tended communal gardens

- Long lease (circa 977 years) and low ground rent (£100)

- Service charge approximately £2,646 per year

- Electric wall heaters — higher running costs than gas

- High-rise concrete block; potential communal maintenance costs

A straightforward cash investment: tenth-floor two-bedroom apartment currently producing £12,600 per year. The income equates to a gross yield in excess of 10% on the asking price, supported by long leasehold security (around 977 years remaining).

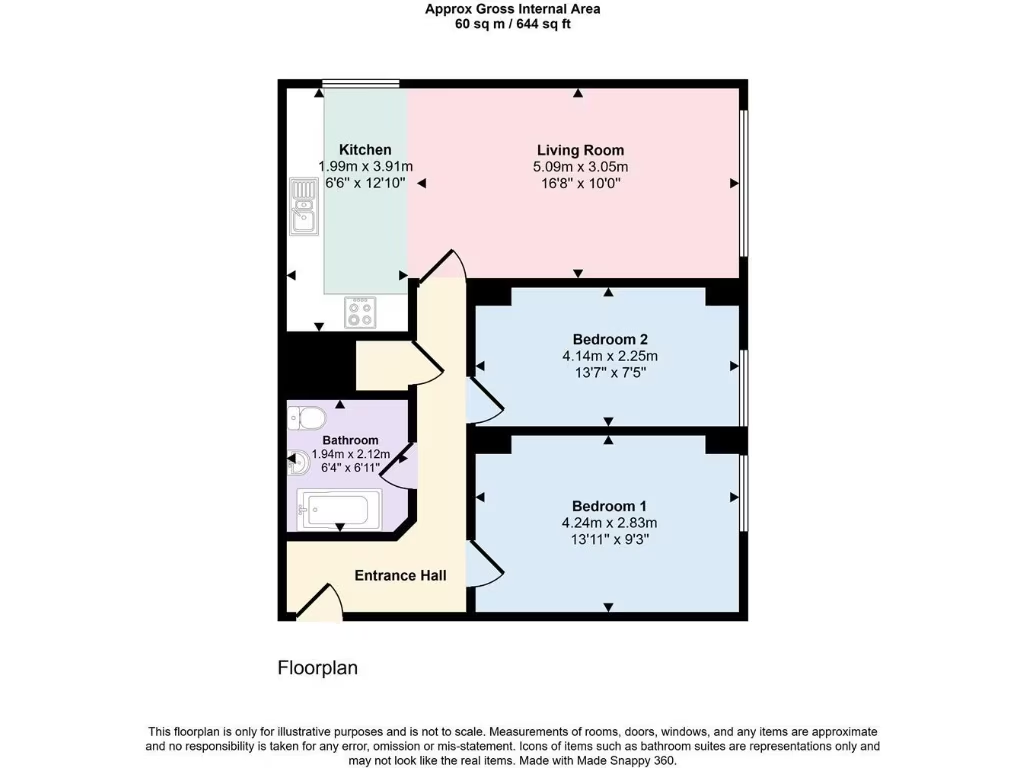

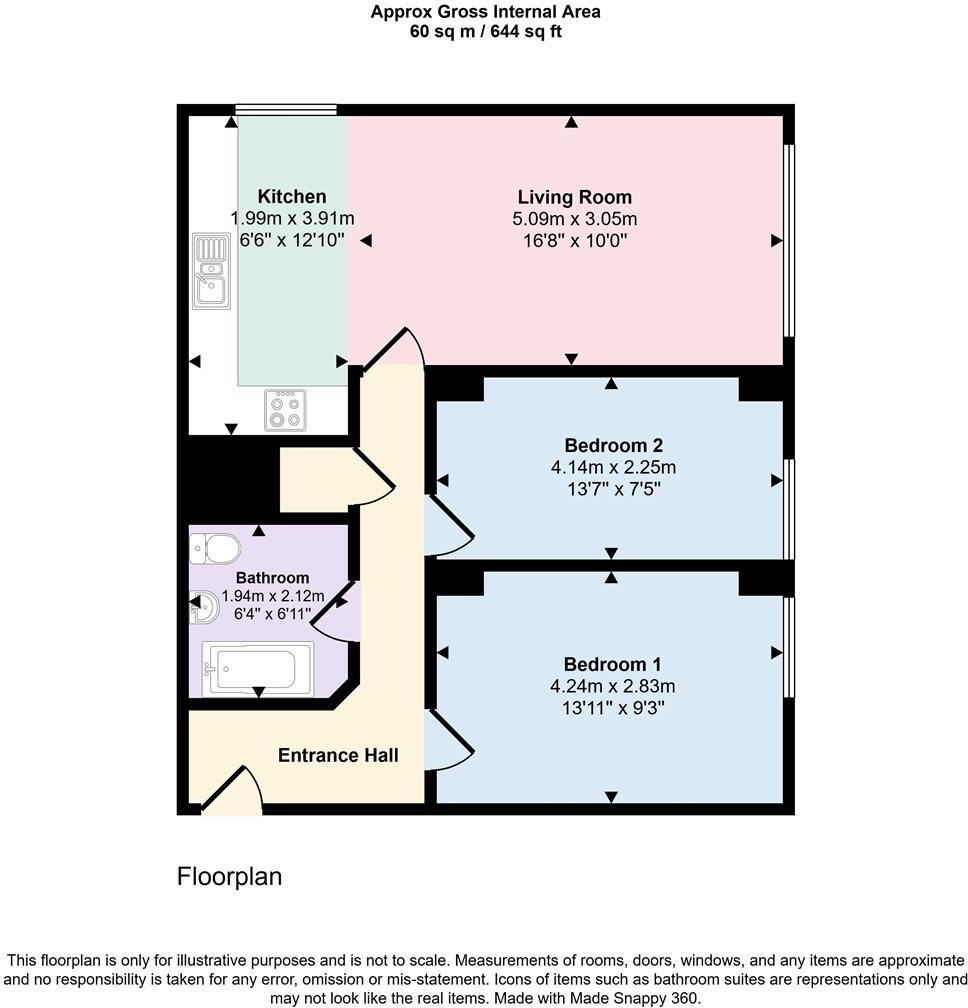

The flat benefits from lift access, gated residents’ parking, uPVC double glazing and elevated panoramic city views. The layout is practical with an open-plan living/kitchen, two double bedrooms and a fully tiled bathroom. Wall-mounted electric heating offers simplicity but can raise running costs compared with gas central heating.

Buyers should note a service charge averaging £2,646 per year and a nominal ground rent of £100. The building’s high-rise, concrete Brutalist construction may carry ongoing maintenance requirements typical of multi-storey blocks. The local area is an urban cultural mix with good transport links, but the wider locality scores as very deprived, which may affect long-term capital growth expectations.

This property suits a cash purchaser or investor seeking immediate rental income and a high yield. It is presented ready for continued letting with minimal immediate work, but investors should allow for block maintenance liabilities and higher energy costs due to electric heating.

2 bedroom flat for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £95,000 • 2 bed • 1 bath • 678 ft²

2 bedroom flat for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £95,000 • 2 bed • 1 bath • 678 ft² 2 bedroom flat for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £89,000 • 2 bed • 1 bath • 667 ft²

2 bedroom flat for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £89,000 • 2 bed • 1 bath • 667 ft² 2 bedroom flat for sale in Highclere Avenue, City View, M7 — £75,000 • 2 bed • 1 bath • 636 ft²

2 bedroom flat for sale in Highclere Avenue, City View, M7 — £75,000 • 2 bed • 1 bath • 636 ft² 2 bedroom apartment for sale in City View, Highclere Avenue, Salford, M7 — £90,000 • 2 bed • 1 bath • 657 ft²

2 bedroom apartment for sale in City View, Highclere Avenue, Salford, M7 — £90,000 • 2 bed • 1 bath • 657 ft² 2 bedroom flat for sale in Highclere Avenue, City View, M7 — £85,000 • 2 bed • 1 bath • 636 ft²

2 bedroom flat for sale in Highclere Avenue, City View, M7 — £85,000 • 2 bed • 1 bath • 636 ft² 2 bedroom apartment for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £85,000 • 2 bed • 1 bath • 657 ft²

2 bedroom apartment for sale in City View, Highclere Avenue, Salford, M7 4ZU, M7 — £85,000 • 2 bed • 1 bath • 657 ft²