Summary - 132 EUREKA PLACE EBBW VALE NP23 6LN

4 bed 1 bath End of Terrace

Four-bed end-terrace investment lot with rental income and refurbishment potential.

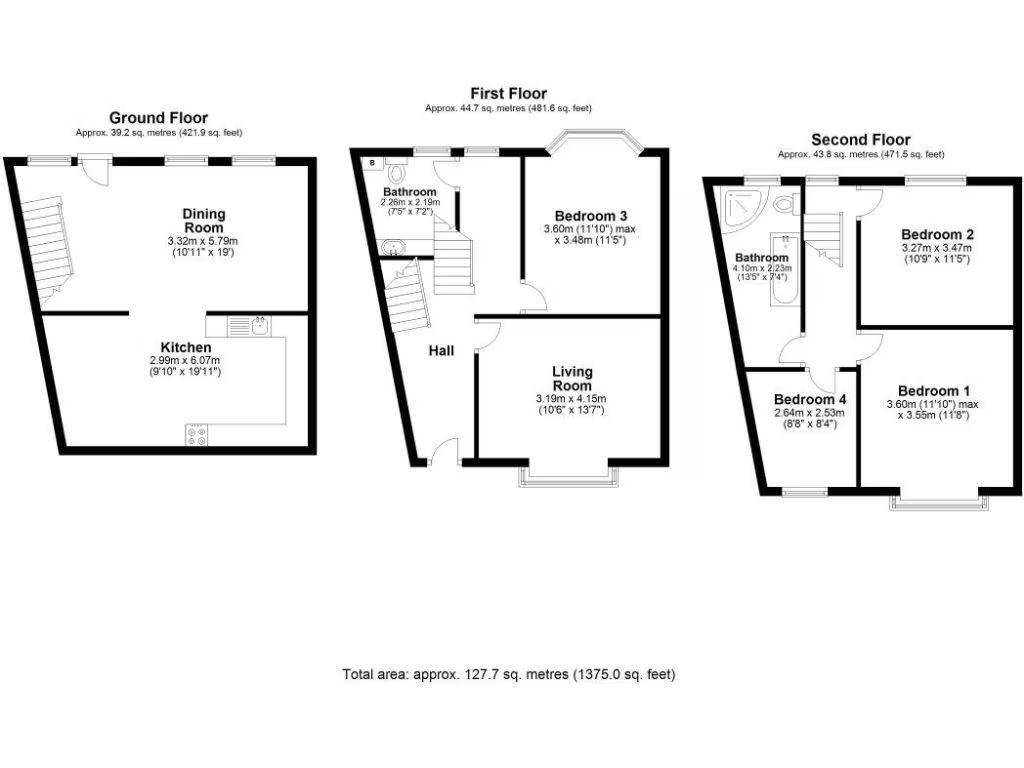

4 bedrooms over three storeys, approx. 1,375 sq ft

Currently let at £600 pcm — potential gross yield ~8.3% at guide price

Sold at unconditional online auction on 08/10/2025, buyer’s premium applies

Freehold (to be verified); no flood risk, gas central heating, double glazing

Requires maintenance and internal modernisation; small plot and room sizes

Single shower-room and one WC only; limited facilities for larger households

Located in a very deprived area with high crime — let demand may be constrained

Fast broadband and excellent mobile signal; close to transport and local shops

This three-storey, four-bedroom end-of-terrace is offered for sale at online auction with vacant possession sold subject to a residential occupational contract currently yielding £600 pcm. The property is Freehold, sits on a small plot and totals about 1,375 sq ft — providing a straightforward buy-to-let or refurbishment opportunity for an investor prepared for some upkeep.

The house benefits from gas central heating, double glazing, no flood risk, and fast broadband with excellent mobile signal — useful for letting demand. The current tenant has a long-term occupation and would ideally like to remain, so the sale is likely to continue as a let sale. The guide price is £87,000 and the property will be sold at unconditional auction on 08/10/2025.

Notable negatives: the area is very deprived with high local crime levels and constrained rental market classification, and the house requires maintenance and updating internally. There is a single shower-room and small to medium room sizes, so expect some investment to modernise and improve rental value. Buyers should allow for the buyer’s premium charged at auction (minimum £995 inc. VAT) and verify tenure and tenancy details prior to purchase.

Overall, this property suits an investor focused on income and capital uplift through refurbishment in a budget price-band. The stated rent equates to a gross yield of approximately 8.3% at the guide price, but buyers should factor in refurbishment costs, potential voids, and the local socio-economic constraints when assessing returns.

2 bedroom end of terrace house for sale in 1 , George Street, Blaenavon, Torfaen NP4 9EX, NP4 — £55,000 • 2 bed • 1 bath • 883 ft²

2 bedroom end of terrace house for sale in 1 , George Street, Blaenavon, Torfaen NP4 9EX, NP4 — £55,000 • 2 bed • 1 bath • 883 ft² 1 bedroom end of terrace house for sale in 16A Aberfan Road, Aberfan, Merthyr Tydfil, Merthyr Tydfil, CF48 4QL, CF48 — £72,000 • 1 bed • 1 bath • 611 ft²

1 bedroom end of terrace house for sale in 16A Aberfan Road, Aberfan, Merthyr Tydfil, Merthyr Tydfil, CF48 4QL, CF48 — £72,000 • 1 bed • 1 bath • 611 ft² 3 bedroom terraced house for sale in 26 Coronation Place, Aberfan, Merthyr Tydfil, Merthyr Tydfil CF48 4QW, CF48 — £69,000 • 3 bed • 1 bath • 926 ft²

3 bedroom terraced house for sale in 26 Coronation Place, Aberfan, Merthyr Tydfil, Merthyr Tydfil CF48 4QW, CF48 — £69,000 • 3 bed • 1 bath • 926 ft² 2 bedroom terraced house for sale in 89 King Street, Nantyglo, Ebbw Vale, Gwent, NP23 4JW, NP23 — £59,000 • 2 bed • 1 bath • 678 ft²

2 bedroom terraced house for sale in 89 King Street, Nantyglo, Ebbw Vale, Gwent, NP23 4JW, NP23 — £59,000 • 2 bed • 1 bath • 678 ft² 4 bedroom semi-detached house for sale in 7 Caeracca Villas, Pant, Merthyr Tydfil, CF48 2AS, CF48 — £150,000 • 4 bed • 1 bath • 1340 ft²

4 bedroom semi-detached house for sale in 7 Caeracca Villas, Pant, Merthyr Tydfil, CF48 2AS, CF48 — £150,000 • 4 bed • 1 bath • 1340 ft² 2 bedroom end of terrace house for sale in 10 Snatchwood Terrace, Abersychan, Pontypool, Gwent, NP4 7BP, NP4 — £93,000 • 2 bed • 2 bath • 918 ft²

2 bedroom end of terrace house for sale in 10 Snatchwood Terrace, Abersychan, Pontypool, Gwent, NP4 7BP, NP4 — £93,000 • 2 bed • 2 bath • 918 ft²