Summary - 87 THE HABITAT, WOOLPACK LANE, NOTTINGHAM, NOTTINGHAM NG1 1GJ

47 bed 1 bath Commercial Property

Scale-ready HMO and commercial portfolio with 12% rental uplift potential.

12 residential properties with 47 bedrooms

A substantial mixed-use portfolio in central Nottingham, offered freehold with HMO planning and long-standing tenancies. The lot comprises 12 residential units delivering 47 bedrooms alongside three street-level commercial units, currently generating rental income with an estimated 12% uplift potential through re-gearing and active management. Off-street parking, a tenant portal, master-key system and an initial three months of complimentary portfolio management are included to simplify transition.

The stock suits an investor targeting student and HMO demand in a cosmopolitan, multicultural area close to university and transport links. Properties include larger houses (including a six-bed and a four-bed near the university) and multiple HMOs with established leases — ideal for a buy-and-hold strategy or for breaking into smaller lots at auction.

Buyers should note material considerations: the area has high crime statistics and overall deprivation indicators, heating is primarily electric room heaters, and there appears to be only a single bathroom listed against 47 bedrooms in the summary (buyers must verify sanitary provision). Tenure details are not fully confirmed in the brochure and the sale will be conducted at auction. Prospective purchasers should commission their own surveys, checks on licences and energy infrastructure, and confirm exact rental schedules and tenancy documentation before bidding.

The offer suits investors seeking immediate rental scale with operational support and short-term hands-on management to realise rental growth. The vendor is willing to sell the whole portfolio or to split lots for more flexible acquisition strategies.

Shop for sale in Sherwood Street, NG20 — £150,000 • 3 bed • 1 bath

Shop for sale in Sherwood Street, NG20 — £150,000 • 3 bed • 1 bath Land for sale in Mansfield Road, Nottingham, NG1 — £2,100,000 • 1 bed • 1 bath

Land for sale in Mansfield Road, Nottingham, NG1 — £2,100,000 • 1 bed • 1 bath 1 bedroom flat for sale in Brightmoor Street, Nottingham, NG1 — £90,000 • 1 bed • 1 bath • 420 ft²

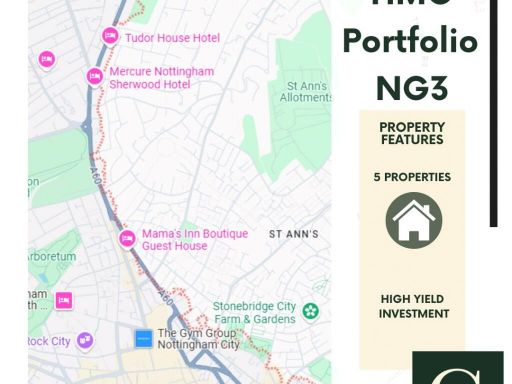

1 bedroom flat for sale in Brightmoor Street, Nottingham, NG1 — £90,000 • 1 bed • 1 bath • 420 ft² Commercial property for sale in NG3, Nottingham, Nottinghamshire, NG3 — £1,000,000 • 20 bed • 5 bath

Commercial property for sale in NG3, Nottingham, Nottinghamshire, NG3 — £1,000,000 • 20 bed • 5 bath 1 bedroom ground floor flat for sale in Lower Parliament Street, NOTTINGHAM, NG1 — £45,000 • 1 bed • 1 bath • 668 ft²

1 bedroom ground floor flat for sale in Lower Parliament Street, NOTTINGHAM, NG1 — £45,000 • 1 bed • 1 bath • 668 ft² Commercial property for sale in Commercial Property Portfolio, Nottingham, Nottinghamshire, NG4 — £725,000 • 1 bed • 1 bath

Commercial property for sale in Commercial Property Portfolio, Nottingham, Nottinghamshire, NG4 — £725,000 • 1 bed • 1 bath