Summary - 13, SHERWOOD STREET NG20 0JP

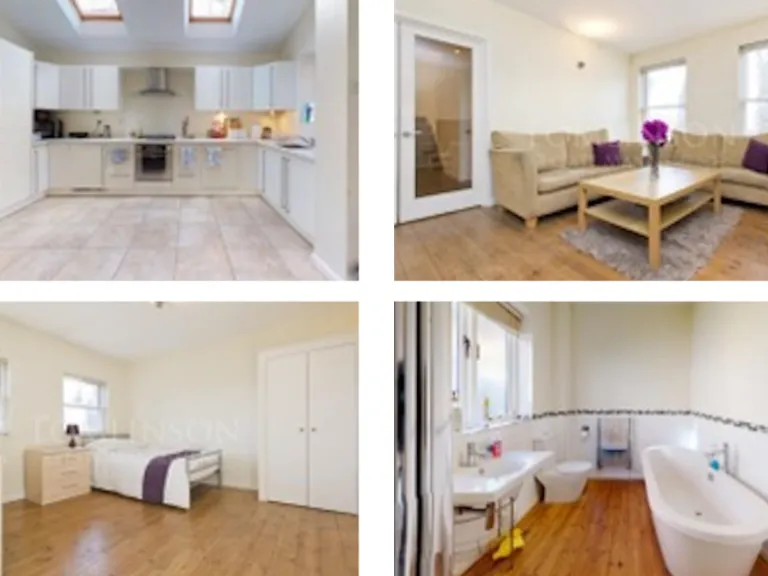

3 bed 1 bath Shop

Freehold multi-unit opportunity with immediate management and rent uplift potential.

- Freehold mixed-use portfolio: seven units, seven bedrooms total

- Includes six commercial/retail units (barber, salon, dog grooming etc.)

- First three months of portfolio management provided free

- Potential to increase rents by approximately 12%

- Can be sold as whole portfolio or may be split

- Properties pre-1900; external walls likely uninsulated

- Double glazing present, installation dates unknown

- Located in deprived, ageing-urban area; average local crime

This is a freehold mixed-use investment portfolio in Nottinghamshire, offered as seven units (seven bedrooms) across commercial and residential properties. The portfolio includes multiple trading commercial units (barber, beauty salon, dog grooming, etc.), residential flats/houses and off-street parking. A master-key system, tenant portal and three months of complimentary portfolio management are included to help with an immediate handover.

Income drivers are clear: scope to raise rents by around 12% is identified, fast broadband and excellent mobile signal suit lettings, and local amenities provide steady tenant demand. The portfolio can be sold intact or split, offering flexibility for buy-and-hold investors or those seeking smaller lots.

Buyers should note material facts: many buildings pre-date 1900 with stone walls likely uninsulated, double glazing present but install date unknown, and services/fittings have not been tested. The location sits in a deprived, ageing-urban community with average crime rates — factors that affect rental yields, void risk and long-term capital growth.

Practical points: mains electricity, gas, water and drainage are understood to be connected but unverified; purchasers must provide ID under anti-money-laundering rules. Interested parties should request the detailed brochure for full income, tenancy and planning information before viewing.

Commercial property for sale in Gateford Road, Worksop, S80 — £300,000 • 2 bed • 2 bath

Commercial property for sale in Gateford Road, Worksop, S80 — £300,000 • 2 bed • 2 bath 3 bedroom terraced house for sale in Day Street, Warsop NG20 — £97,000 • 3 bed • 2 bath • 850 ft²

3 bedroom terraced house for sale in Day Street, Warsop NG20 — £97,000 • 3 bed • 2 bath • 850 ft² Shop for sale in Patchwork Row, Shirebrook, Mansfield, Derbyshire, NG20 — £170,000 • 1 bed • 1 bath • 506 ft²

Shop for sale in Patchwork Row, Shirebrook, Mansfield, Derbyshire, NG20 — £170,000 • 1 bed • 1 bath • 506 ft² Commercial property for sale in Garden Road, Mansfield, NG18 — £300,000 • 1 bed • 1 bath • 406 ft²

Commercial property for sale in Garden Road, Mansfield, NG18 — £300,000 • 1 bed • 1 bath • 406 ft² 1 bedroom detached house for sale in Newgate Lane, Mansfield, Nottinghamshire, NG18 — £170,000 • 1 bed • 1 bath • 1161 ft²

1 bedroom detached house for sale in Newgate Lane, Mansfield, Nottinghamshire, NG18 — £170,000 • 1 bed • 1 bath • 1161 ft² Terraced house for sale in Gateford Road, Worksop, Nottinghamshire, S80 — £150,000 • 1 bed • 1 bath • 323 ft²

Terraced house for sale in Gateford Road, Worksop, Nottinghamshire, S80 — £150,000 • 1 bed • 1 bath • 323 ft²