Summary - 20 ABBOT STREET LINCOLN LN5 7SN

5 bed 2 bath Terraced

Five-bed Victorian HMO with immediate rental income in central Lincoln.

Licensed five-bedroom HMO generating £21,840 per annum

Central Lincoln location — walking distance to city amenities and universities

Victorian mid-terrace with high ceilings and bay windows (period character)

Small enclosed courtyard garden — low maintenance outdoor space

Solid brick walls likely uninsulated; energy efficiency may be poor

Double glazing fitted before 2002; may need upgrading

High local crime and area deprivation — tenant profile concentrated renters

Sold as an operating article with reliable long-term tenants

A five-bedroom licensed HMO in central Lincoln, currently let to reliable tenants and generating £21,840 per annum. The mid-terrace Victorian property spreads over three storeys with high ceilings and period bay windows, offering authentic character and steady income from day one. Its small enclosed courtyard is low-maintenance and the property is sold as an operating article, making it suitable for an investor wanting immediate rental returns.

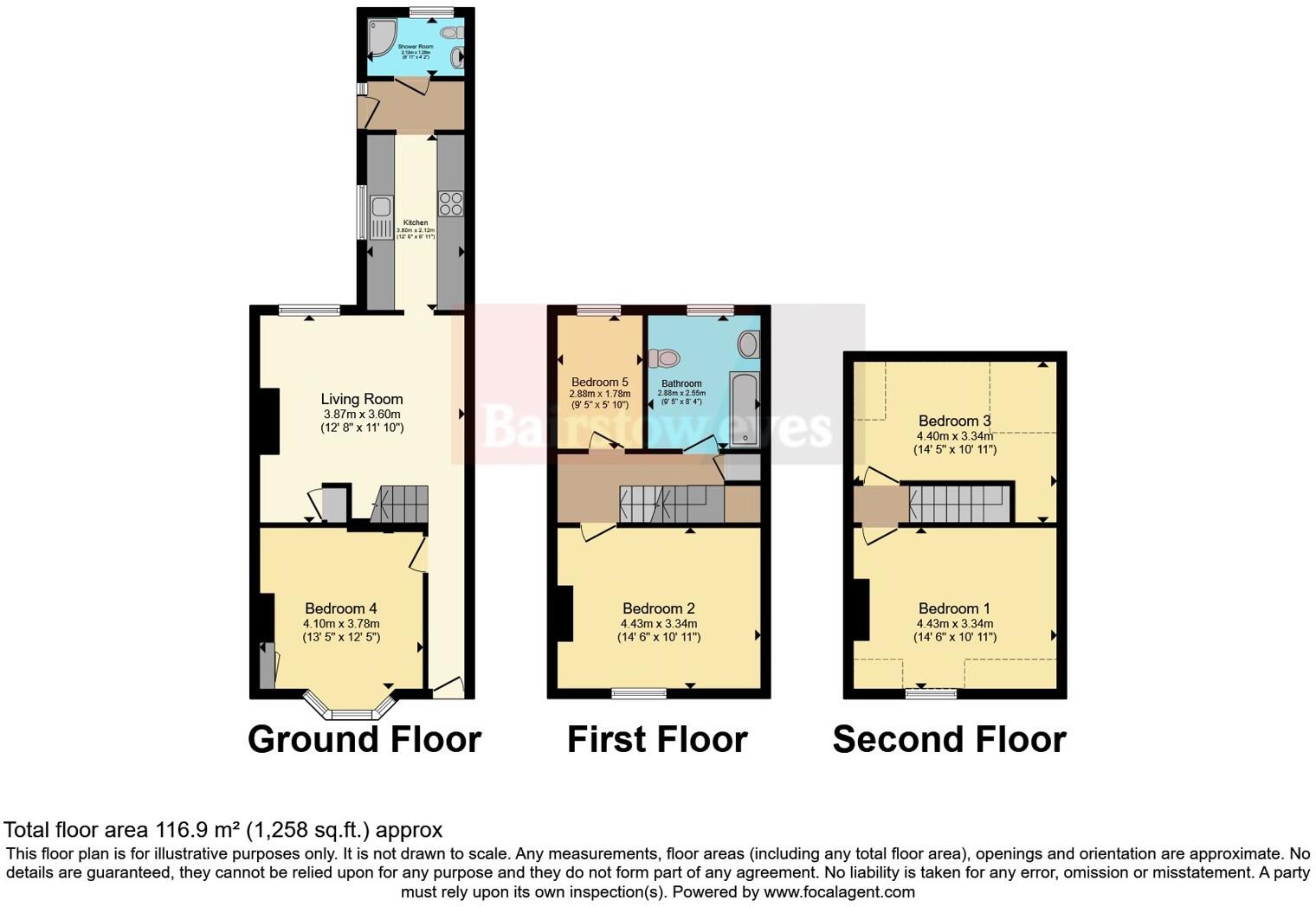

The building is traditional solid-brick construction (circa 1900–1929) with double glazing installed before 2002, mains gas boiler heating and typical period features. Internally accommodation includes five bedrooms, two bathrooms, a reception room and a galley kitchen with fitted appliances. Council tax levels are very low, which supports tenant affordability in this constrained-renter location.

Important considerations: the area records higher crime and deprivation indicators and the property footprint and plot are small; external outlook is limited to the street. The walls are assumed to be solid brick with no cavity insulation, and glazing is older — both factors that may affect energy efficiency and running costs. The kitchen shows some signs of wear and the layout is compact, so medium-term refurbishment or targeted updates should be budgeted for to protect long-term rental values.

For an investor focused on central-city lets—students and young professionals—this HMO offers immediate income with room to improve returns via managed upgrades. Its central location places amenities and university facilities within walking distance, supporting ongoing demand despite local area constraints.

5 bedroom terraced house for sale in Portland Street, Lincoln, LN5 — £220,000 • 5 bed • 2 bath • 1087 ft²

5 bedroom terraced house for sale in Portland Street, Lincoln, LN5 — £220,000 • 5 bed • 2 bath • 1087 ft² 4 bedroom terraced house for sale in Newland Street West, Lincoln, LN1 — £212,000 • 4 bed • 2 bath • 961 ft²

4 bedroom terraced house for sale in Newland Street West, Lincoln, LN1 — £212,000 • 4 bed • 2 bath • 961 ft² 5 bedroom terraced house for sale in Ripon Street, Lincoln, LN5 — £190,000 • 5 bed • 2 bath • 1013 ft²

5 bedroom terraced house for sale in Ripon Street, Lincoln, LN5 — £190,000 • 5 bed • 2 bath • 1013 ft² 5 bedroom terraced house for sale in Richmond Road, Lincoln, LN1 — £290,000 • 5 bed • 2 bath • 1668 ft²

5 bedroom terraced house for sale in Richmond Road, Lincoln, LN1 — £290,000 • 5 bed • 2 bath • 1668 ft² 6 bedroom semi-detached house for sale in Boultham Park Road, Lincoln, Lincolnshire, LN6 — £250,000 • 6 bed • 2 bath • 1377 ft²

6 bedroom semi-detached house for sale in Boultham Park Road, Lincoln, Lincolnshire, LN6 — £250,000 • 6 bed • 2 bath • 1377 ft² 3 bedroom terraced house for sale in Newland Street West, Lincoln, LN1 — £140,000 • 3 bed • 1 bath • 743 ft²

3 bedroom terraced house for sale in Newland Street West, Lincoln, LN1 — £140,000 • 3 bed • 1 bath • 743 ft²