Summary - FLAT 2/1, 1170, TOLLCROSS ROAD G32 8HE

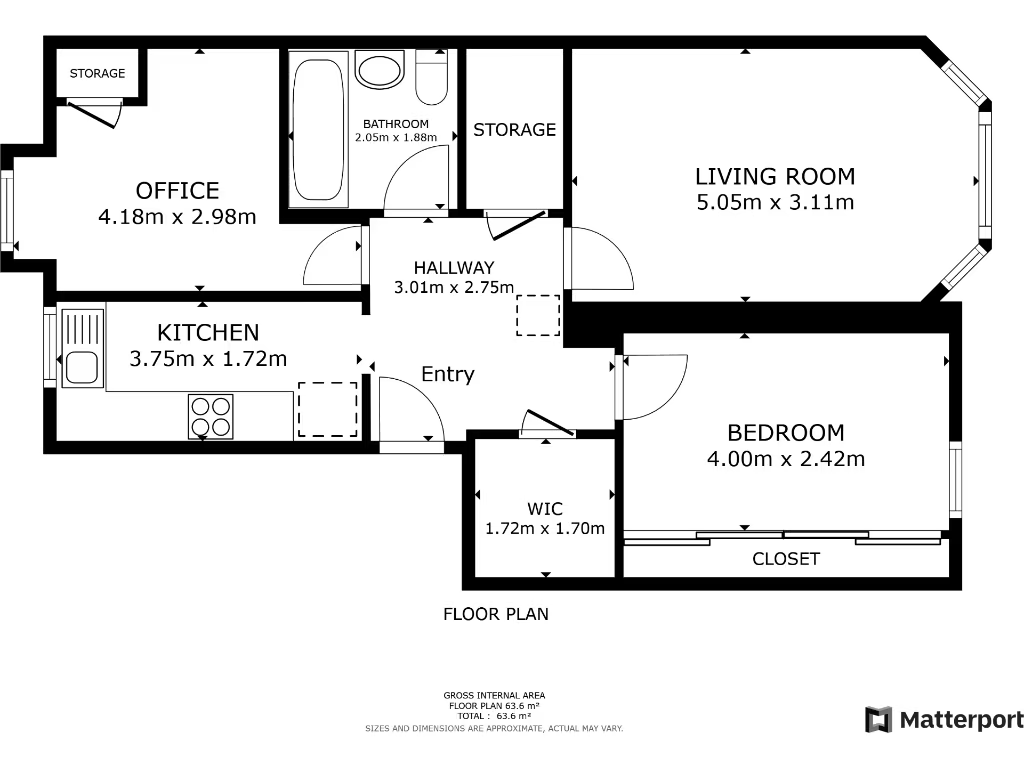

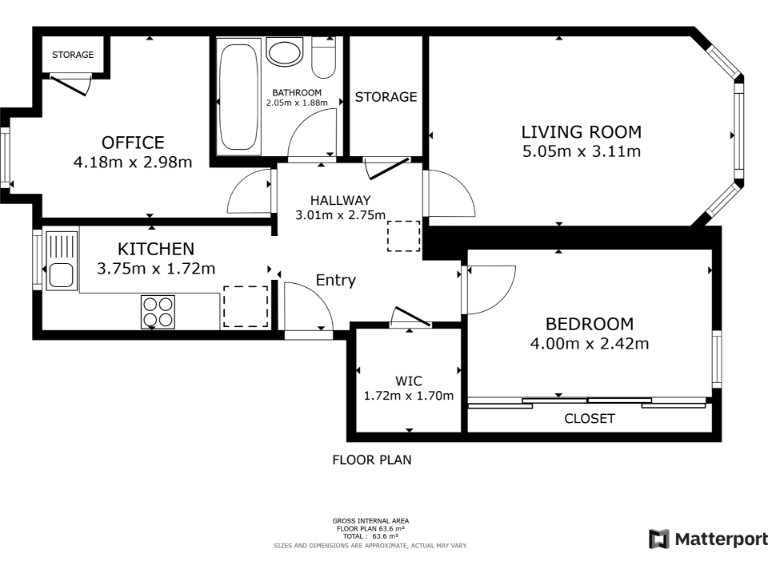

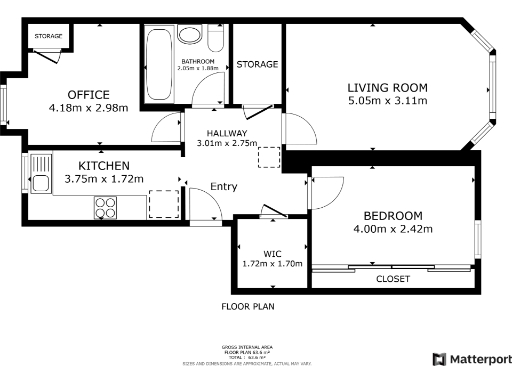

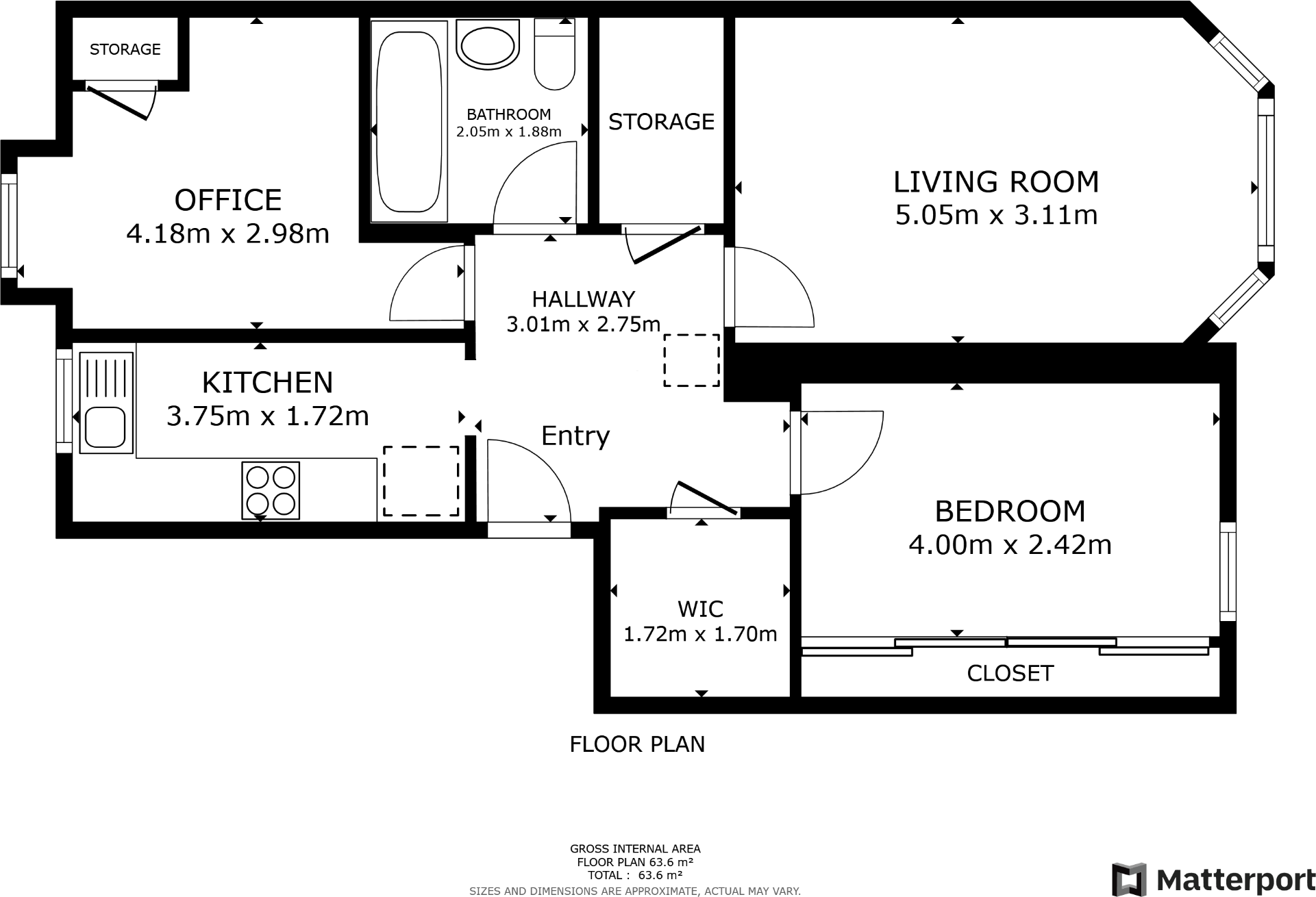

2 bed 1 bath Flat

Freehold two-bedroom buy-to-let with immediate rental income and garden.

Long-term tenants in situ producing £8,340pa gross income

This two-bedroom flat on Tollcross Road is presented as a buy-to-let opportunity with long-term tenants in situ, producing an annual gross income of £8,340. Priced at £93,000, the current income equates to a gross yield of about 9% — attractive for investors seeking immediate cashflow. The property is freehold and includes a private rear garden and on-street parking.

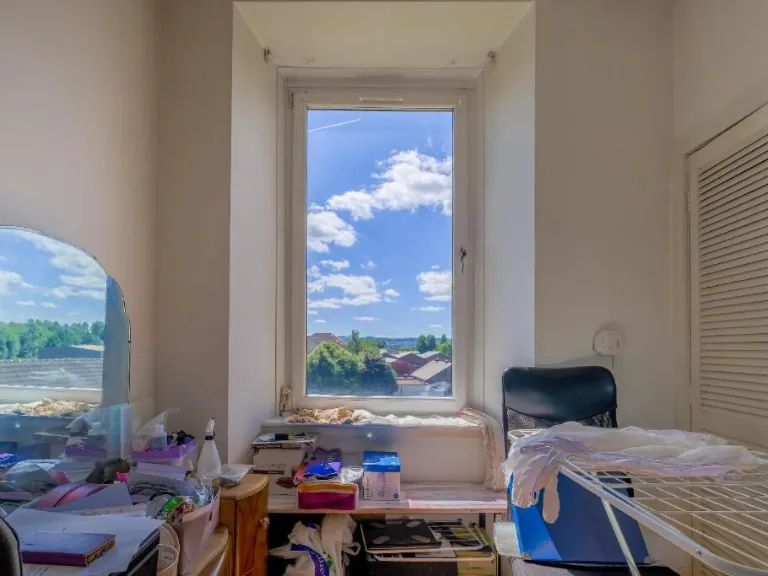

The apartment is small (approx. 614 sq ft) and sits within a traditional brick tenement. Interiors are dated and will require modernisation to increase capital value or future rents; renovation potential is clear for those willing to refurbish. Building and room sizes are typical for urban Glasgow, with standard ceiling heights and communal external space.

Tenants have occupied the flat for several years and intend to remain, offering income stability. Note the area is described as very deprived, which may affect long-term capital growth and tenant profiles. A Buyers Premium will apply on sale — factor this into purchase costs.

This listing suits investors or developers looking for steady rental returns and a manageable refurbishment project. It is less suitable for buyers seeking a move-in ready family home or significant capital-growth hotspot without targeted investment.

2 bedroom flat for sale in Ardgay Street, Glasgow, G32 — £100,000 • 2 bed • 1 bath • 775 ft²

2 bedroom flat for sale in Ardgay Street, Glasgow, G32 — £100,000 • 2 bed • 1 bath • 775 ft² 2 bedroom flat for sale in Hogganfield Street, Glasgow, G33 — £90,000 • 2 bed • 1 bath • 754 ft²

2 bedroom flat for sale in Hogganfield Street, Glasgow, G33 — £90,000 • 2 bed • 1 bath • 754 ft² 2 bedroom flat for sale in Wallace Street, Glasgow, G5 — £99,000 • 2 bed • 2 bath • 667 ft²

2 bedroom flat for sale in Wallace Street, Glasgow, G5 — £99,000 • 2 bed • 2 bath • 667 ft² 2 bedroom flat for sale in Croftend Avenue, Glasgow, G44 — £120,000 • 2 bed • 1 bath • 721 ft²

2 bedroom flat for sale in Croftend Avenue, Glasgow, G44 — £120,000 • 2 bed • 1 bath • 721 ft² 2 bedroom flat for sale in Dornoch Place, East Kilbride, G74 — £72,500 • 2 bed • 1 bath • 689 ft²

2 bedroom flat for sale in Dornoch Place, East Kilbride, G74 — £72,500 • 2 bed • 1 bath • 689 ft² 1 bedroom flat for sale in Ashvale Crescent, Glasgow, G21 — £65,000 • 1 bed • 1 bath • 635 ft²

1 bedroom flat for sale in Ashvale Crescent, Glasgow, G21 — £65,000 • 1 bed • 1 bath • 635 ft²