Summary - 24, DORNOCH PLACE, GLASGOW, EAST KILBRIDE G74 1DJ

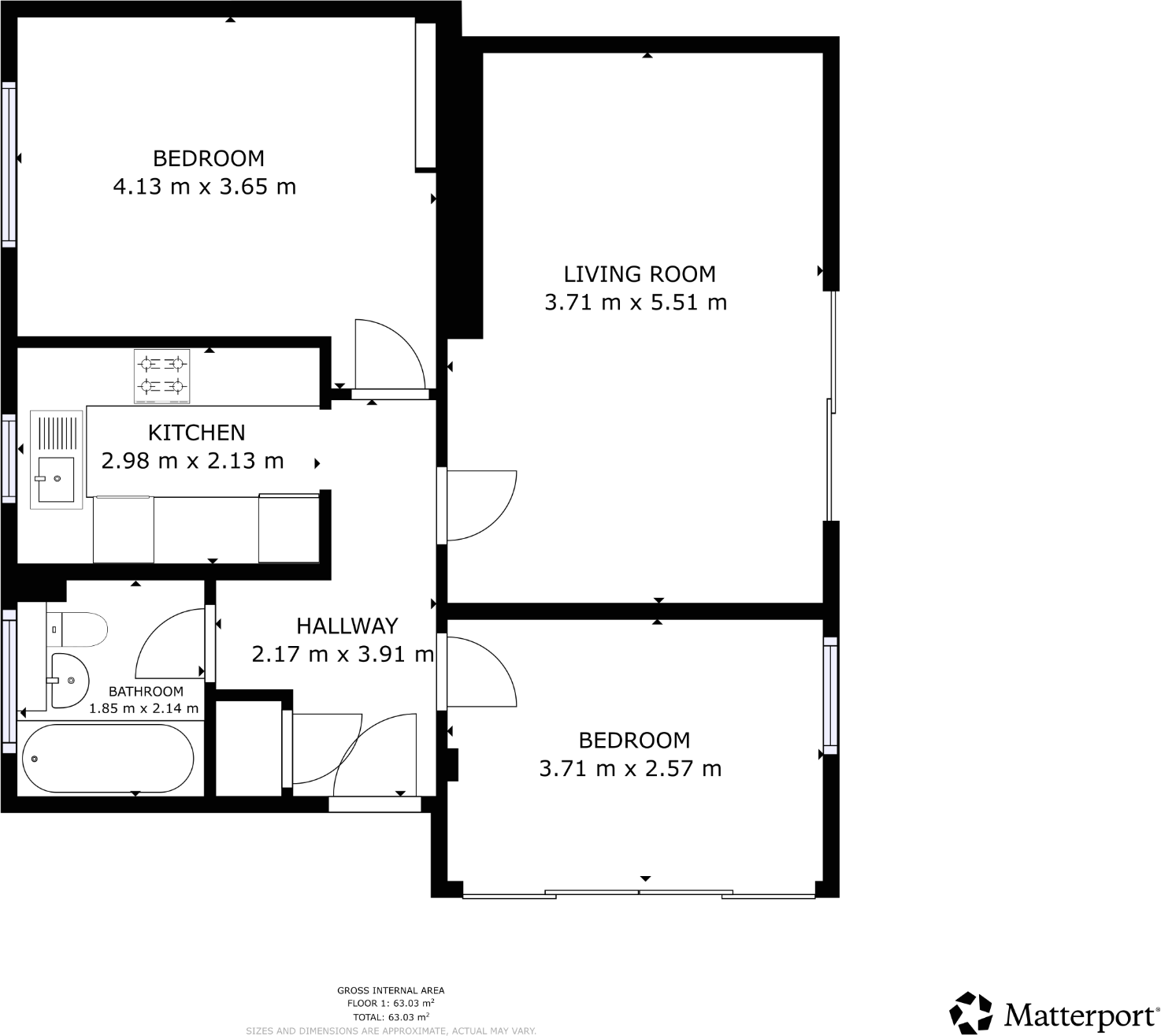

2 bed 1 bath Flat

Income-producing two-bedroom flat with refurbishment potential for investor buyers.

Current gross annual income £6,180 (tenant in situ)

Approximate gross yield ~8.5% at asking price £72,500

Freehold flat in mid‑20th century low‑rise block

Shared front and rear communal garden space

On-street parking; excellent mobile and fast broadband

Building exterior dated; potential communal maintenance

Located in a very deprived area — affects growth prospects

Buyers Premium applies to secure purchase

This two-bedroom flat in East Kilbride is offered as a buy-to-let opportunity with a long-term tenant in situ. The property generates a current gross annual income of £6,180, giving an approximate gross yield of 8.5% at the asking price of £72,500. Its position in a low-rise, mid‑20th century block with communal grounds and on-street parking makes it straightforward to manage within a rental portfolio.

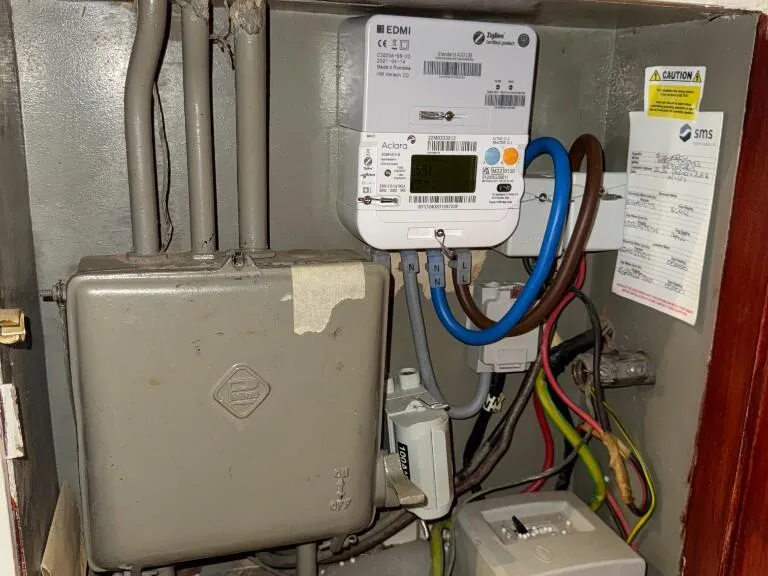

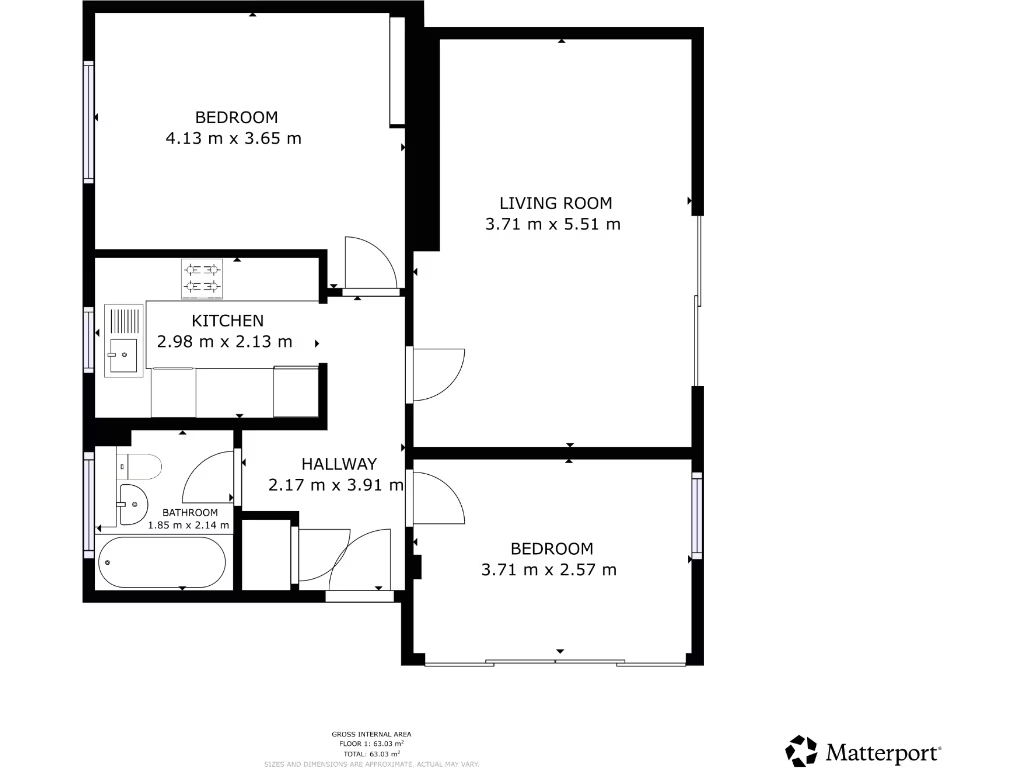

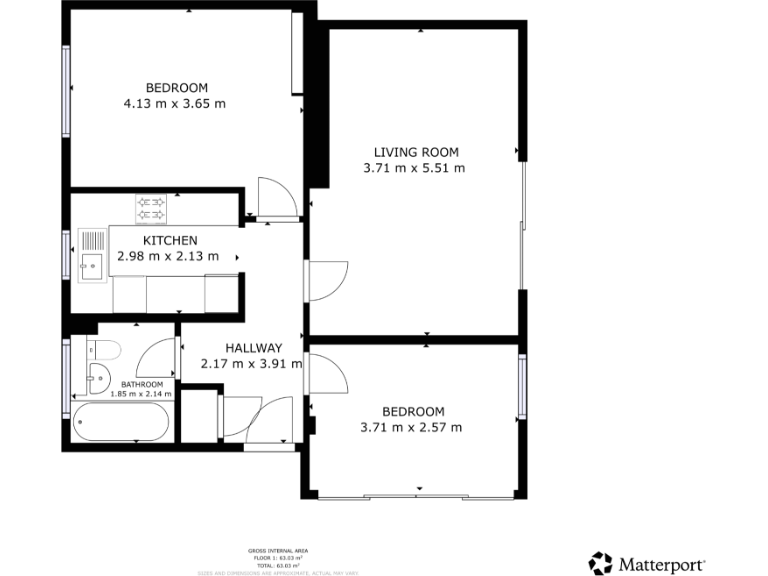

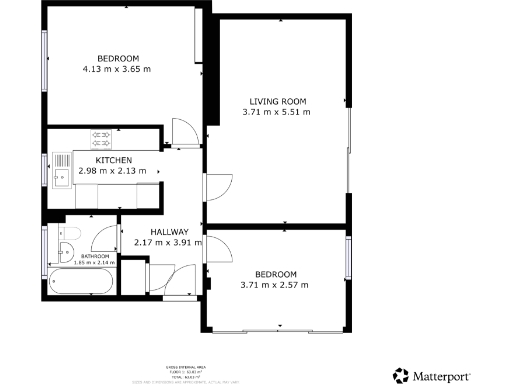

Practical positives include freehold tenure, shared front and back garden space, excellent mobile signal and fast broadband — all attractive to tenants. The building exterior appears dated and the flat is described as average in size (around 689 sq ft), so there is potential to increase value through targeted refurbishment or hands-off continued rental income.

Material considerations are clear: the wider area is classified as very deprived, which can affect capital growth and tenant demand over time. The building is mid‑century with a dated facade and communal maintenance responsibilities; further inspection is recommended to confirm internal condition and any required works. A Buyers Premium applies to secure the sale.

For investors, this is a compact, income-producing asset that may suit buy-to-let portfolios or developers seeking modest refurbishment opportunities. Detailed investment figures and tenancy information are available in the Let Property Pack — purchasers should review that pack and arrange a survey before committing.

2 bedroom flat for sale in Station Road, Glasgow, G72 — £165,000 • 2 bed • 1 bath • 797 ft²

2 bedroom flat for sale in Station Road, Glasgow, G72 — £165,000 • 2 bed • 1 bath • 797 ft² 1 bedroom flat for sale in Clyde Tower, East Kilbride, G74 — £50,000 • 1 bed • 1 bath • 495 ft²

1 bedroom flat for sale in Clyde Tower, East Kilbride, G74 — £50,000 • 1 bed • 1 bath • 495 ft² 2 bedroom flat for sale in Sandaig Road, Glasgow, G33 — £75,000 • 2 bed • 1 bath • 990 ft²

2 bedroom flat for sale in Sandaig Road, Glasgow, G33 — £75,000 • 2 bed • 1 bath • 990 ft² 2 bedroom flat for sale in Glen Isla East, Kilbride, Glasgow, G74 — £70,000 • 2 bed • 1 bath • 681 ft²

2 bedroom flat for sale in Glen Isla East, Kilbride, Glasgow, G74 — £70,000 • 2 bed • 1 bath • 681 ft² 2 bedroom flat for sale in Boydstone Road, Glasgow, G46 — £91,500 • 2 bed • 1 bath • 732 ft²

2 bedroom flat for sale in Boydstone Road, Glasgow, G46 — £91,500 • 2 bed • 1 bath • 732 ft² 1 bedroom flat for sale in Fraser River Tower, East Kilbride, G75 — £38,000 • 1 bed • 1 bath • 517 ft²

1 bedroom flat for sale in Fraser River Tower, East Kilbride, G75 — £38,000 • 1 bed • 1 bath • 517 ft²