Summary - FREDERICK STREET BUSINESS CENTRE, FREDERICK STREET AB24 5HY

2 bed 1 bath Flat

Current annual gross rent £7,500; tenant long‑term and intends to remain

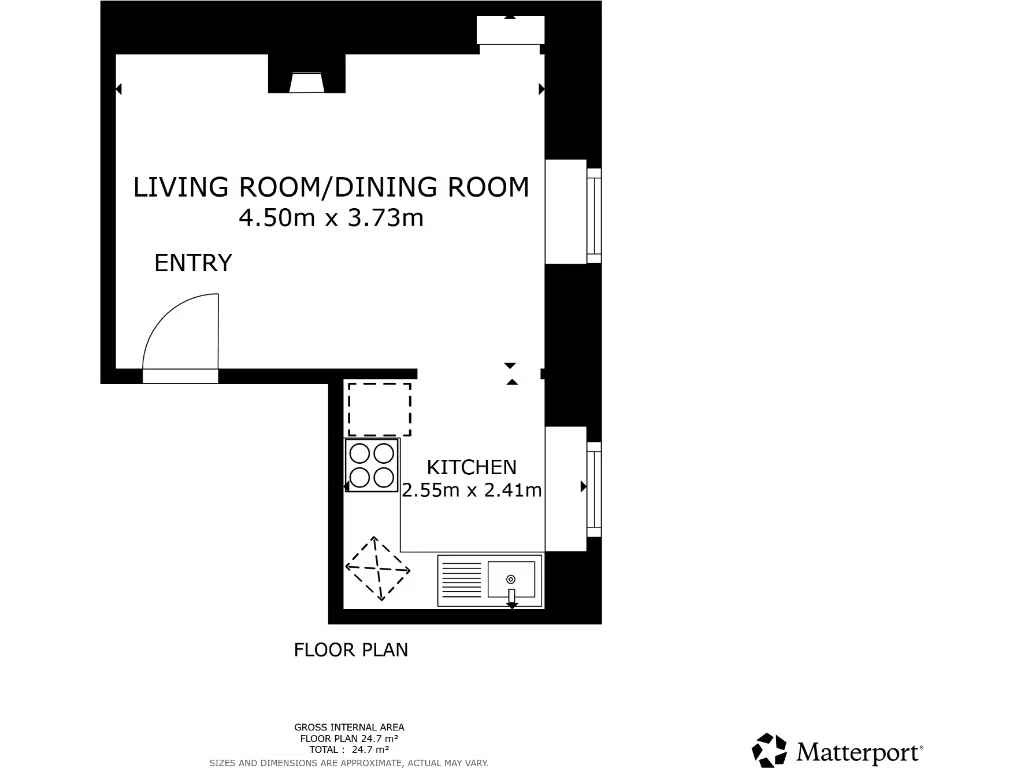

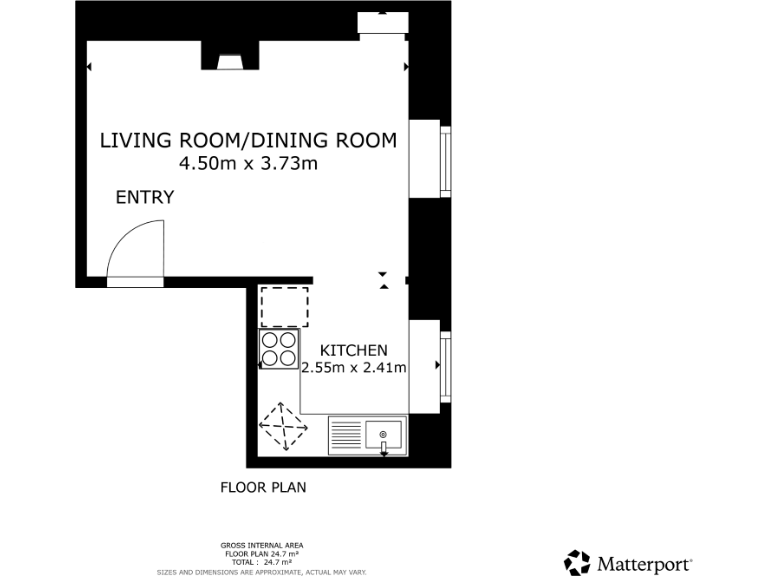

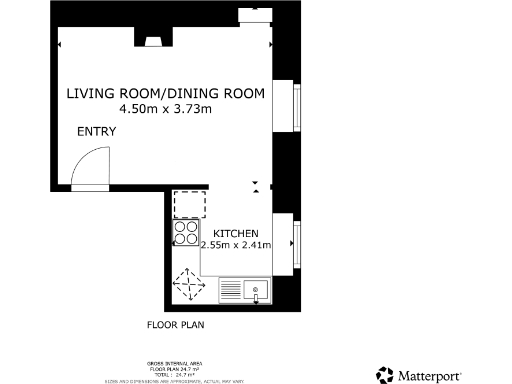

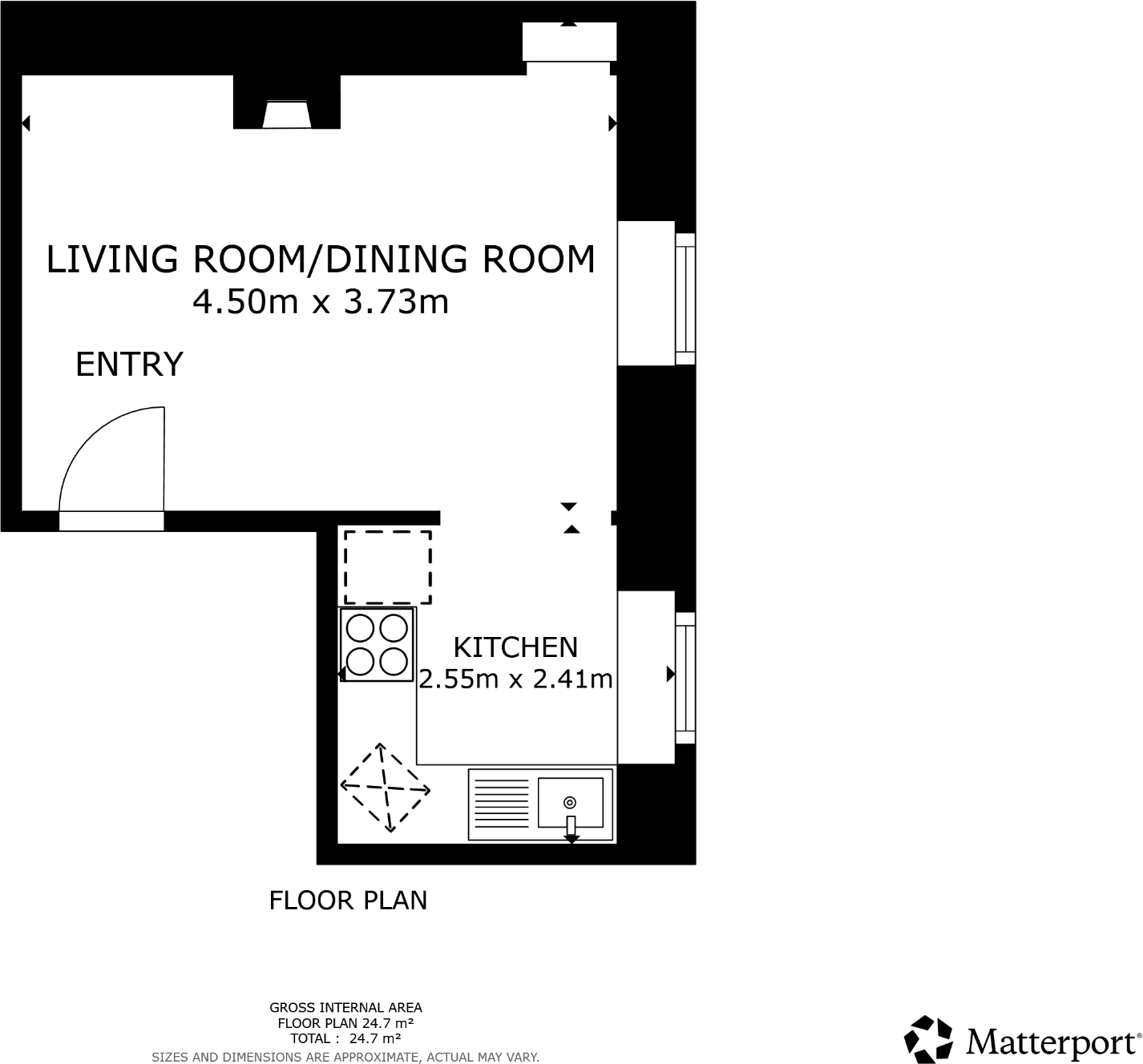

Freehold 2‑bed flat circa 667 sq ft; studio layout recorded

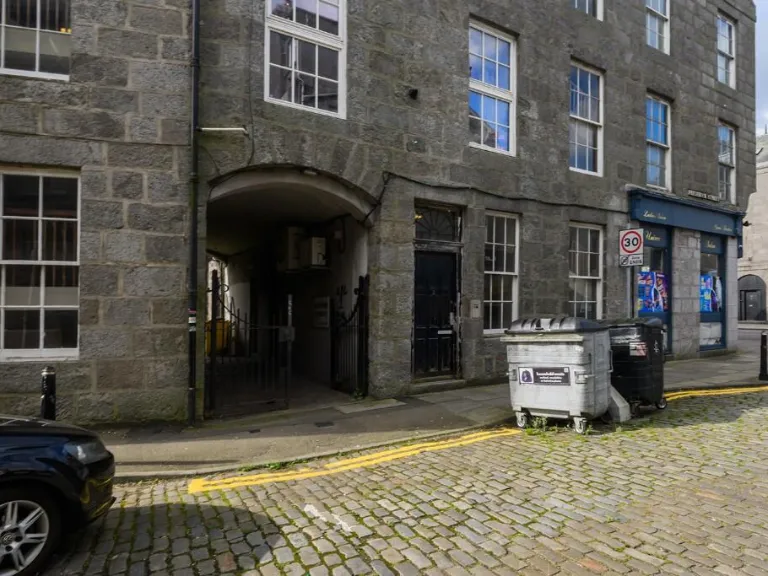

Traditional granite building with high ceilings and sash windows

City‑centre location with excellent mobile and fast broadband

Area classified as very deprived; student and diverse community profile

No flood risk; no obvious private outdoor garden or views

Buyers Premium applies on sale — factor additional purchase costs

May suit investors/developers; refurbishment could uplift rent

Set within a traditional granite building on Frederick Street, this two‑bedroom flat offers immediate rental income and long‑term investment potential. The current tenant has occupied the property for several years and pays an annual gross rent of £7,500, providing predictable cashflow from day one. The flat is Freehold and sits in a city‑centre, amenity‑rich location suited to buy‑to‑let portfolios focused on Aberdeen’s central lettings market.

Internally the home shows period features: high ceilings, sash windows, a fireplace and wooden floors that help retain tenant appeal. The overall footprint is around 667 sq ft, with a lounge, kitchen, bathroom and two bedrooms arranged within a layout currently recorded as a studio. There is no flood risk and mobile and broadband connectivity are reported as strong — practical advantages for long‑term occupancy and lettings demand.

Buyers should note material points before viewing. The wider area is classified as very deprived and a cosmopolitan, student‑dense neighbourhood with a notable Eastern European community; this affects tenant mix, demand patterns and management needs. A Buyers Premium will apply on sale, and the property is marketed with the tenant in situ who is not intending to vacate — suitable for investors but not for buyers seeking vacant possession.

The flat is well‑placed for an investor seeking a hands‑off income or a developer evaluating longer‑term repositioning. The Let Property Pack contains full tenancy and income detail for due diligence. The building’s period charm and city‑centre address support lettings appeal, while the income and tenancy stability reduce initial vacancy risk. Remodel or refurbishment could increase rent but will require additional capital and management planning in this area.

2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft²

2 bedroom flat for sale in Holburn Street, Aberdeen, AB10 — £80,000 • 2 bed • 1 bath • 570 ft² 2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft²

2 bedroom flat for sale in Gallowgate, Aberdeen, Aberdeenshire, AB25 — £85,000 • 2 bed • 1 bath • 635 ft² 2 bedroom flat for sale in Rosemount Place, Aberdeen, Aberdeenshire, AB25 — £108,000 • 2 bed • 1 bath • 721 ft²

2 bedroom flat for sale in Rosemount Place, Aberdeen, Aberdeenshire, AB25 — £108,000 • 2 bed • 1 bath • 721 ft² 2 bedroom flat for sale in Erskine Street, Aberdeen, Aberdeenshire, AB24 — £58,000 • 2 bed • 1 bath

2 bedroom flat for sale in Erskine Street, Aberdeen, Aberdeenshire, AB24 — £58,000 • 2 bed • 1 bath 4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath

4 bedroom flat for sale in Seamount Road, Aberdeen, Aberdeenshire, AB25 — £103,000 • 4 bed • 2 bath 1 bedroom flat for sale in Skene Street, Aberdeen, AB10 — £60,000 • 1 bed • 1 bath

1 bedroom flat for sale in Skene Street, Aberdeen, AB10 — £60,000 • 1 bed • 1 bath