Summary - 19 PALMERSTON GARDENS ST ANNS NOTTINGHAM NG3 1NH

3 bed 2 bath End of Terrace

Chain-free three-bedroom HMO near city centre, 8.25% net yield..

HMO opportunity with tenancy secured to September 2025

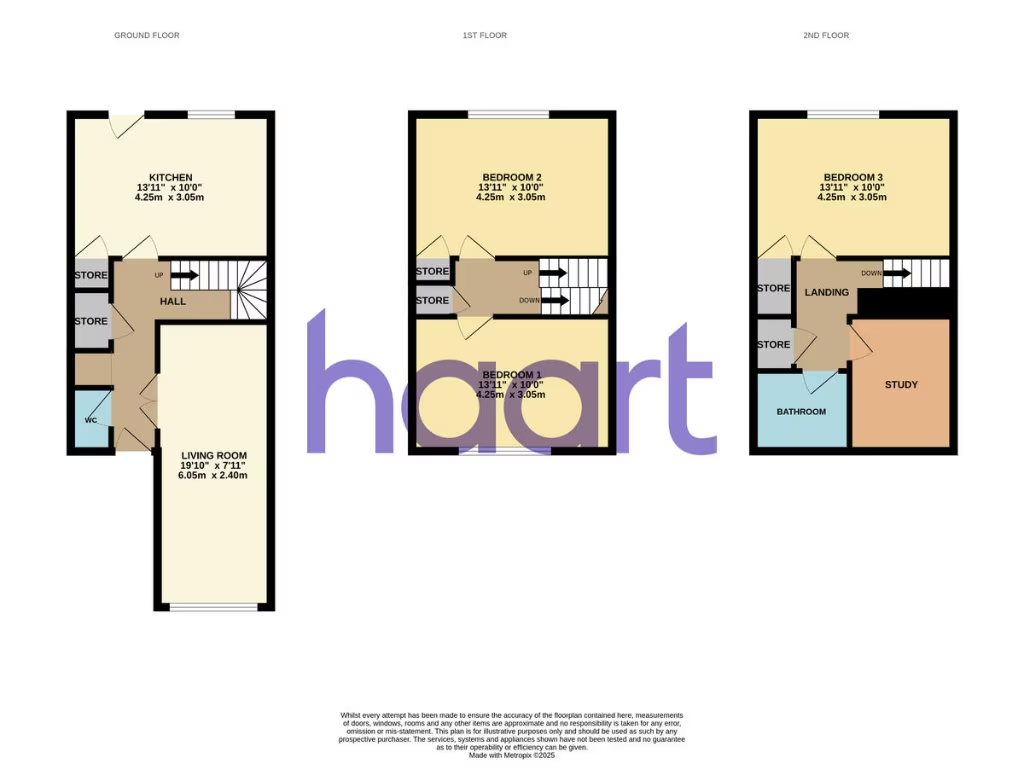

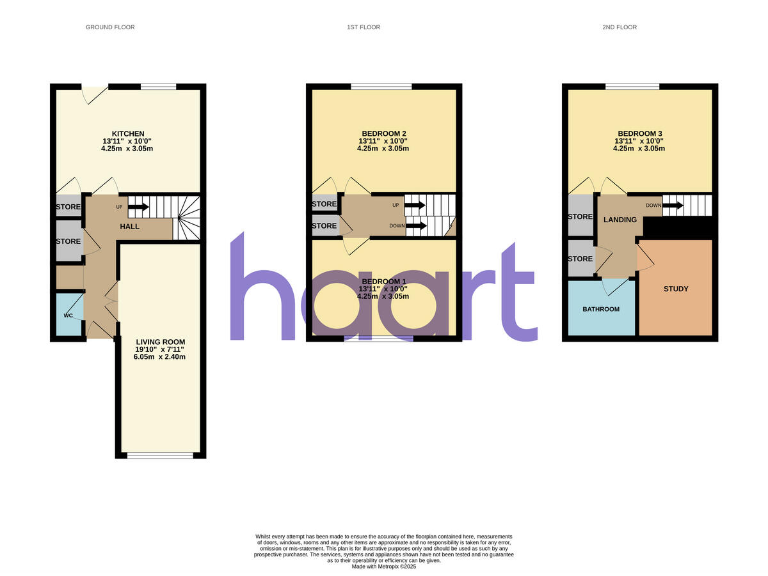

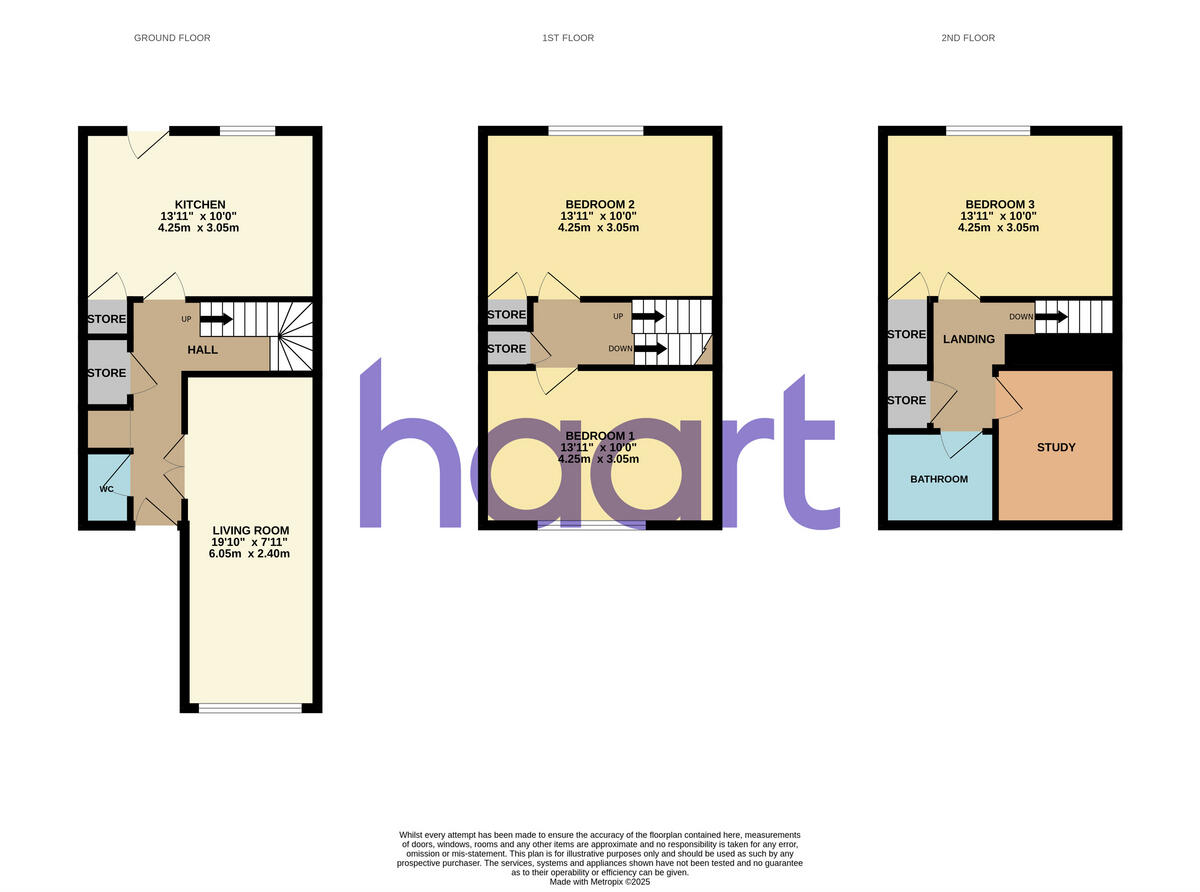

A practical HMO-ready end-of-terrace in St Anns, this three-bedroom property is presented as a straightforward investment with an established income stream. Currently let with a tenancy in place to September 2025, the advertised net rental yield is 8.25%, making it attractive for landlords targeting Nottingham’s student and young-renter market. The layout provides generous communal space — lounge and kitchen/diner — plus three double bedrooms, a separate study and two bathrooms, suited to shared occupancy.

The location is a major selling point: walking distance to the city centre, fast broadband and excellent mobile signal, with wide local amenities and transport links nearby. Practical extras include off-street parking for two cars, a low-maintenance rear garden and freehold tenure with no onward chain. Council tax is noted as very cheap, supporting rental affordability for tenants.

Buyers should be clear about material drawbacks. The area scores high for crime and is classified as very deprived; this impacts tenant profiles and may affect long-term capital growth. The building is a post‑war, system-built construction with assumed lack of insulation in the walls and relies on a community gas heating scheme — both factors that could raise running costs or require future investment. The property shows some exterior wear and requires modernization in places.

This is best suited to investors or landlords seeking an immediate HMO income with scope to improve rental value through targeted refurbishment. For buyers prioritising low-risk neighbourhoods or premium finishes, the location and fabric issues mean this will require hands-on management and active asset maintenance.

3 bedroom semi-detached house for sale in St Ann's, Nottingham, NG3 — £240,000 • 3 bed • 1 bath • 580 ft²

3 bedroom semi-detached house for sale in St Ann's, Nottingham, NG3 — £240,000 • 3 bed • 1 bath • 580 ft² 5 bedroom terraced house for sale in St. Anns Valley, Nottingham, Nottinghamshire, NG3 — £220,000 • 5 bed • 1 bath • 915 ft²

5 bedroom terraced house for sale in St. Anns Valley, Nottingham, Nottinghamshire, NG3 — £220,000 • 5 bed • 1 bath • 915 ft² 4 bedroom house for sale in Scarborough Street, Nottingham, Nottinghamshire, NG3 — £210,000 • 4 bed • 1 bath • 958 ft²

4 bedroom house for sale in Scarborough Street, Nottingham, Nottinghamshire, NG3 — £210,000 • 4 bed • 1 bath • 958 ft² 5 bedroom end of terrace house for sale in Nugent Gardens, Nottingham, Nottinghamshire, NG3 — £220,000 • 5 bed • 1 bath • 905 ft²

5 bedroom end of terrace house for sale in Nugent Gardens, Nottingham, Nottinghamshire, NG3 — £220,000 • 5 bed • 1 bath • 905 ft² 4 bedroom terraced house for sale in Leighton Street, Nottingham, Nottinghamshire, NG3 — £200,000 • 4 bed • 1 bath • 947 ft²

4 bedroom terraced house for sale in Leighton Street, Nottingham, Nottinghamshire, NG3 — £200,000 • 4 bed • 1 bath • 947 ft² 3 bedroom terraced house for sale in Leslie Road, Forest Fields, Nottingham, NG7 — £180,000 • 3 bed • 1 bath • 819 ft²

3 bedroom terraced house for sale in Leslie Road, Forest Fields, Nottingham, NG7 — £180,000 • 3 bed • 1 bath • 819 ft²