Summary - 153 CHESTNUT AVENUE EXETER EX2 6DW

3 bed 1 bath Semi-Detached

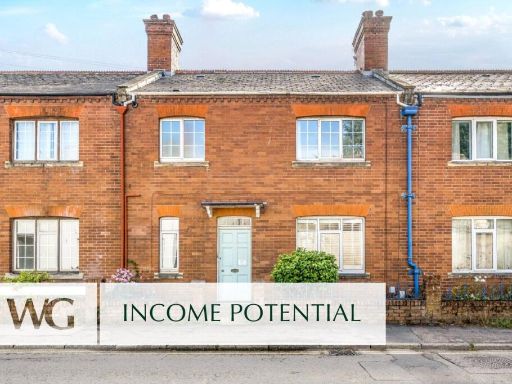

Tenant-occupied with steady income and a generous rear garden, ideal for buy-to-let portfolios.

Freehold three-bedroom semi-detached property

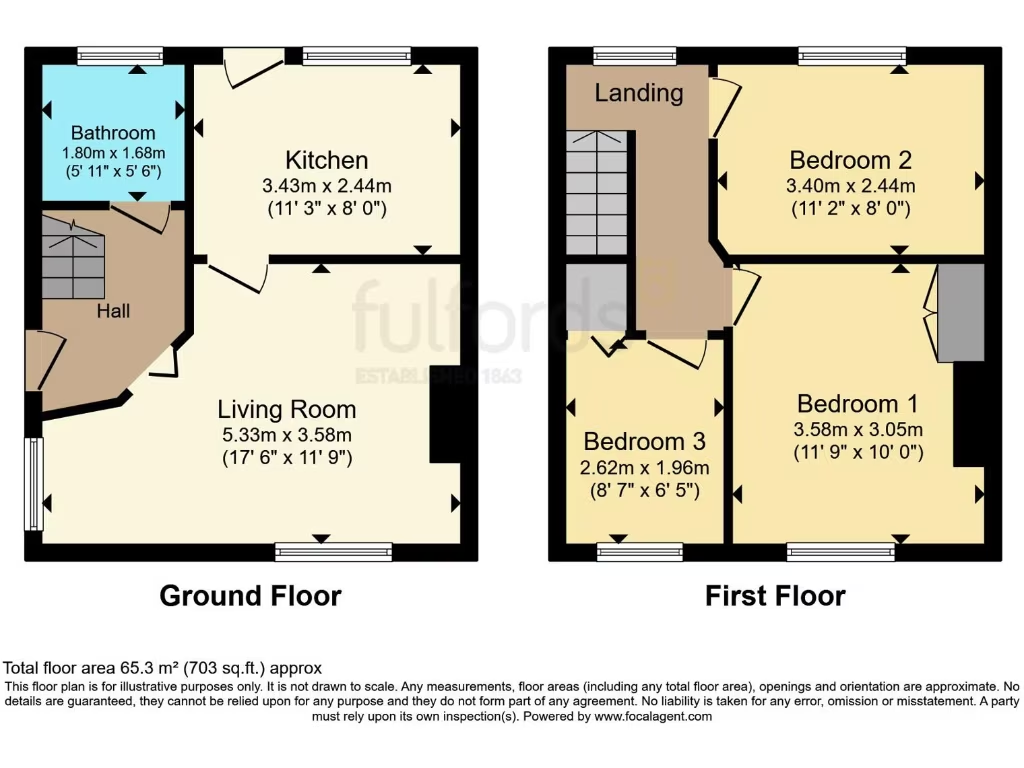

This freehold, three-bedroom semi-detached house on Chestnut Avenue is offered with tenants in situ and producing £1,100pcm. At around 703 sq ft the property is compact but efficiently laid out, with a generous rear garden and a modern wood-finish kitchen. Heating is by mains gas boiler with radiators and the windows are double glazed (installation date unknown).

For investors the figures are straightforward: the current rental income equates to an approximate gross yield of about 5.4% at the asking price. Broadband speeds are listed as fast and mobile signal is excellent — practical advantages for tenants. The property is well presented internally and has an easily managed small plot, reducing maintenance overheads.

Buyers should note the neighbourhood context: the wider area is classified as very deprived with an ‘industrious hardship’ profile and local social indicators that may affect long-term capital growth. Crime is described as average. School standards nearby are mixed, with some state primaries rated as requiring improvement and local secondaries rated good.

Practical negatives to factor in: the house is relatively small, has a single bathroom, and is being sold with tenants in place which limits immediate vacant possession. The filled cavity walls date the construction to the 1950s–1960s era; double glazing installation date is unknown. These are straightforward matters for a buy-to-let investor but important to inspect and budget for if planning upgrades.

3 bedroom semi-detached house for sale in Tennyson Avenue, Exeter, Devon, EX2 — £245,000 • 3 bed • 1 bath • 731 ft²

3 bedroom semi-detached house for sale in Tennyson Avenue, Exeter, Devon, EX2 — £245,000 • 3 bed • 1 bath • 731 ft² 3 bedroom semi-detached house for sale in Blacksmiths Drive, Exeter, EX1 — £350,000 • 3 bed • 2 bath

3 bedroom semi-detached house for sale in Blacksmiths Drive, Exeter, EX1 — £350,000 • 3 bed • 2 bath 3 bedroom semi-detached house for sale in Ashleigh Mount Road, Exeter, EX4 — £325,000 • 3 bed • 1 bath • 980 ft²

3 bedroom semi-detached house for sale in Ashleigh Mount Road, Exeter, EX4 — £325,000 • 3 bed • 1 bath • 980 ft² 3 bedroom terraced house for sale in Monkswell Road, Exeter, Devon, EX4 — £350,000 • 3 bed • 1 bath • 1008 ft²

3 bedroom terraced house for sale in Monkswell Road, Exeter, Devon, EX4 — £350,000 • 3 bed • 1 bath • 1008 ft² 3 bedroom semi-detached house for sale in East Avenue, Heavitree, Exeter, Devon, EX1 — £400,000 • 3 bed • 1 bath • 960 ft²

3 bedroom semi-detached house for sale in East Avenue, Heavitree, Exeter, Devon, EX1 — £400,000 • 3 bed • 1 bath • 960 ft² 3 bedroom terraced house for sale in Exeter, Devon, EX4 — £400,000 • 3 bed • 2 bath • 1120 ft²

3 bedroom terraced house for sale in Exeter, Devon, EX4 — £400,000 • 3 bed • 2 bath • 1120 ft²