Summary - 70 WOOD ROAD PONTYPRIDD CF37 1RH

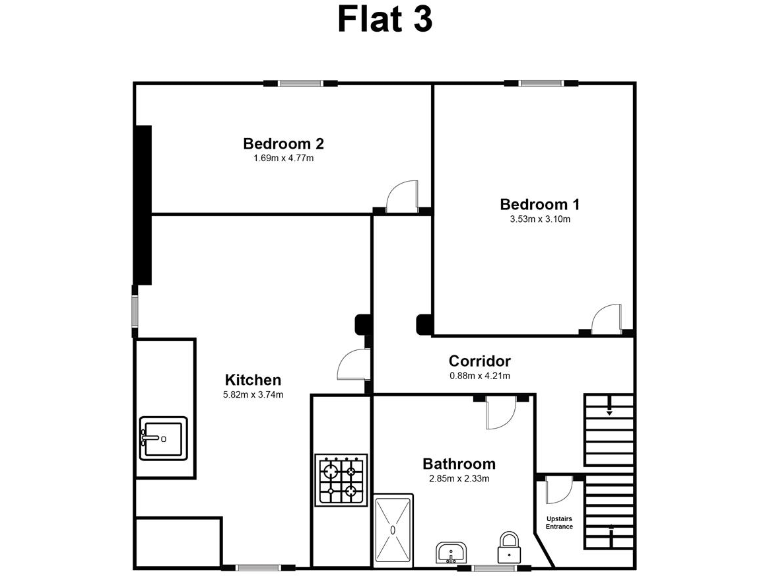

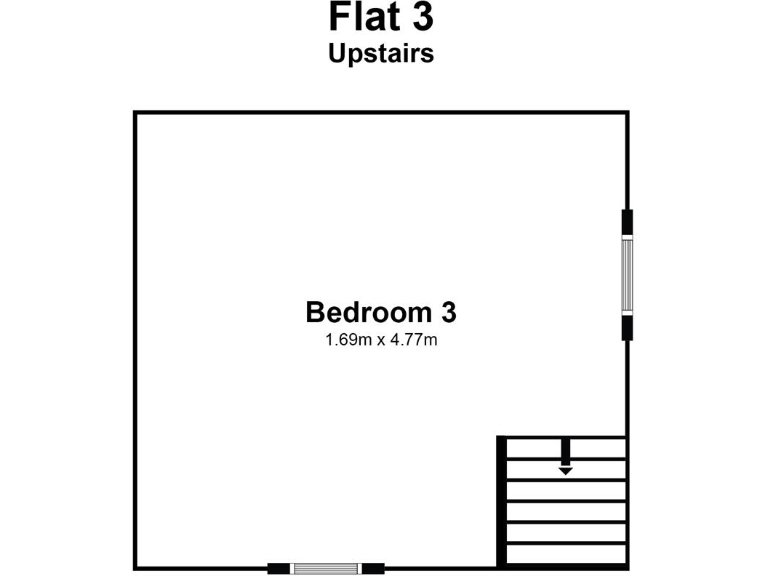

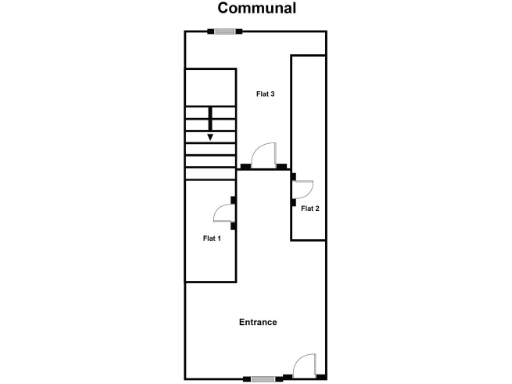

6 bed 3 bath Flat

Three-flat HMO near university — licensed, tenanted, high yield for investors..

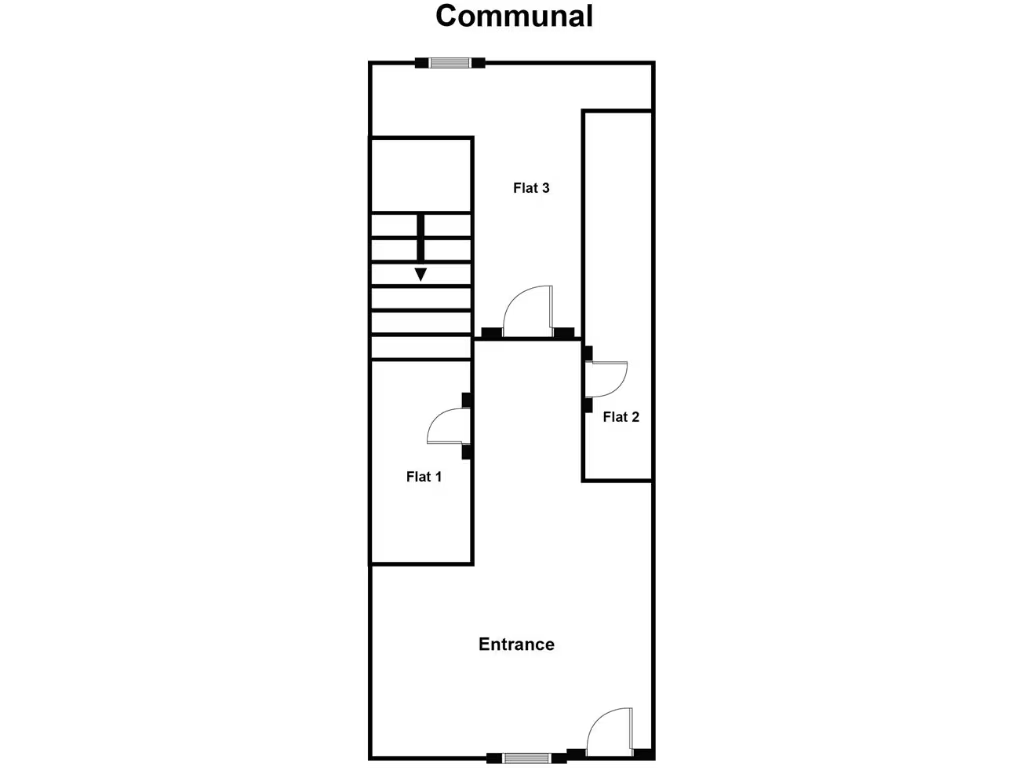

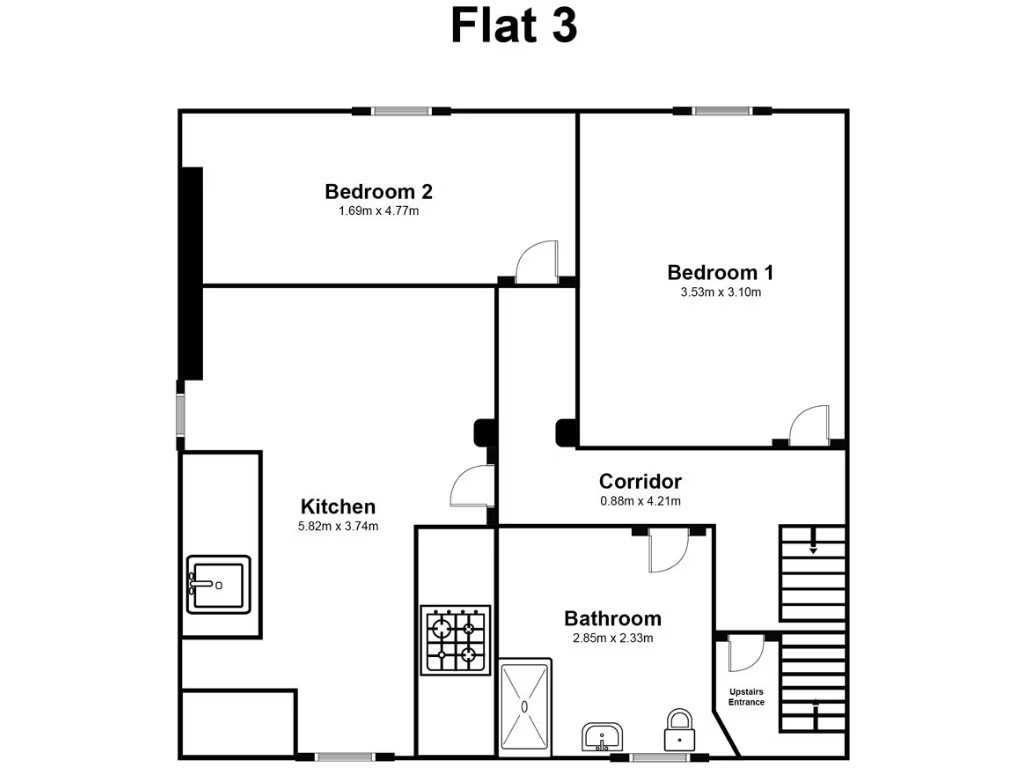

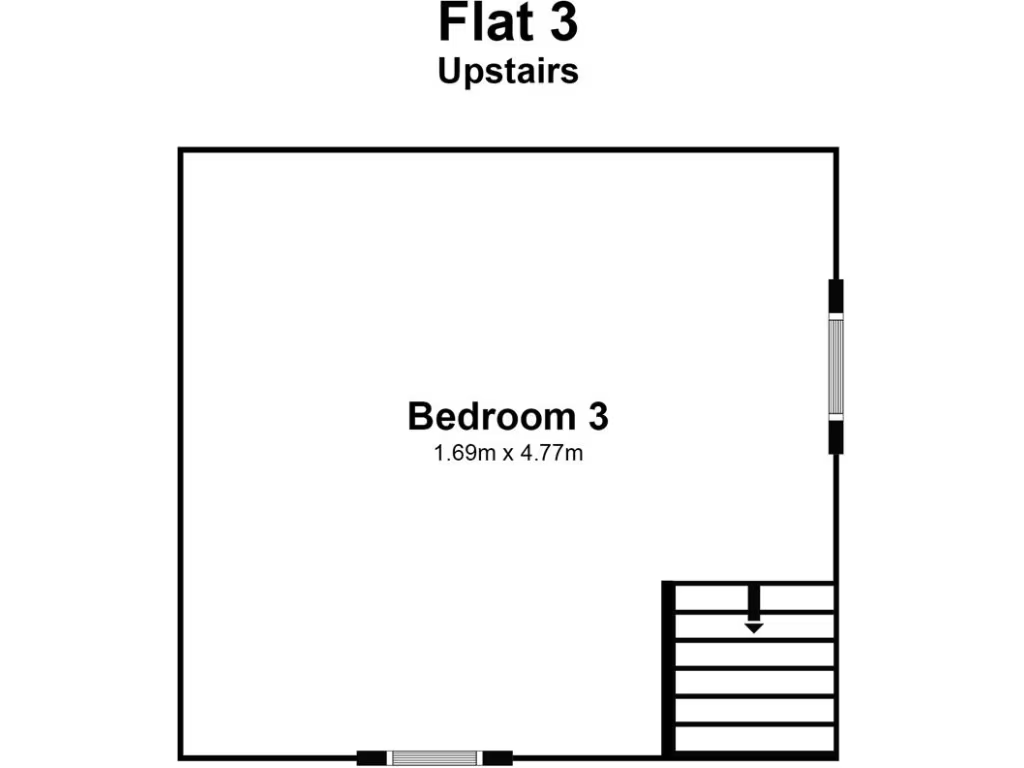

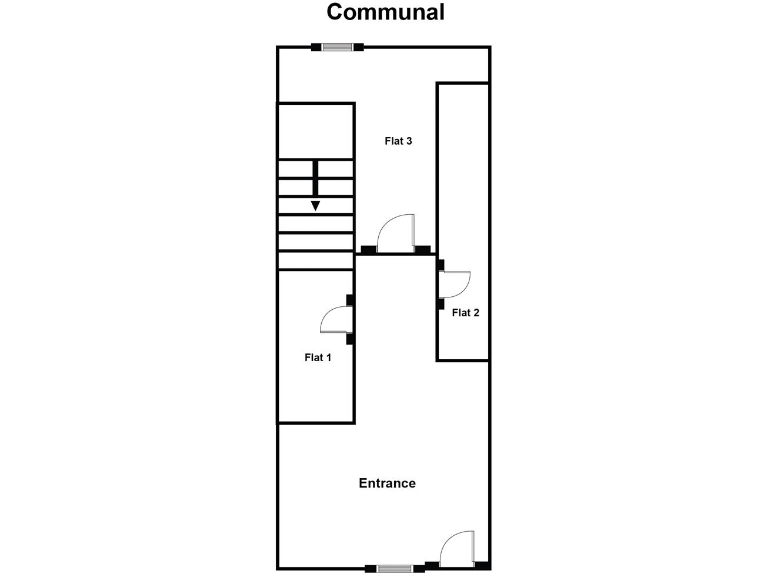

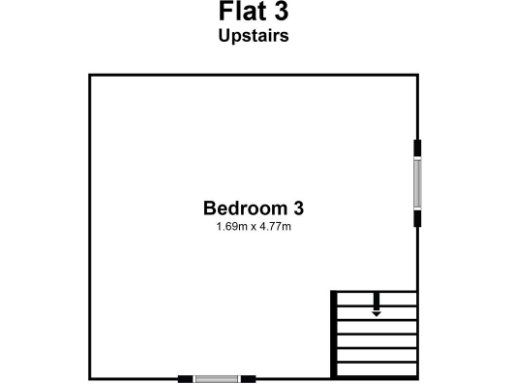

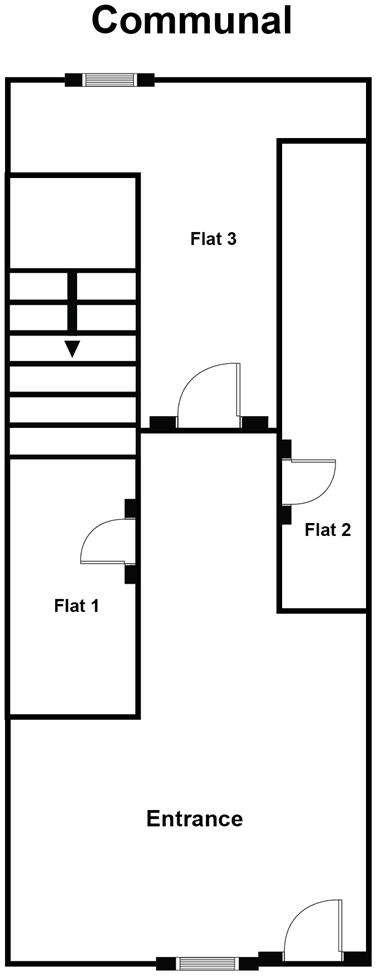

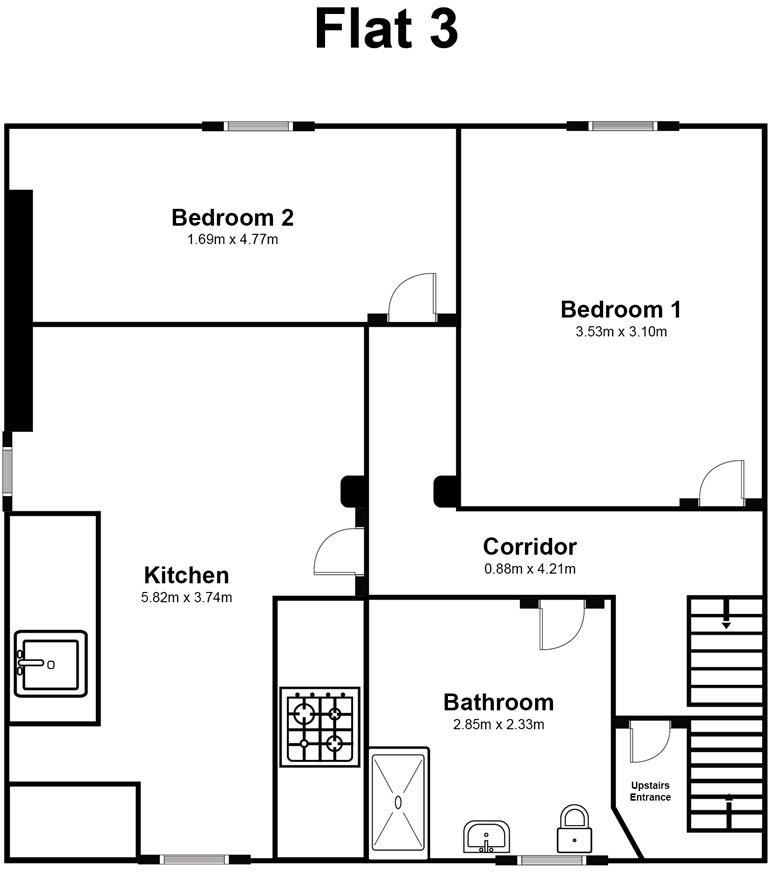

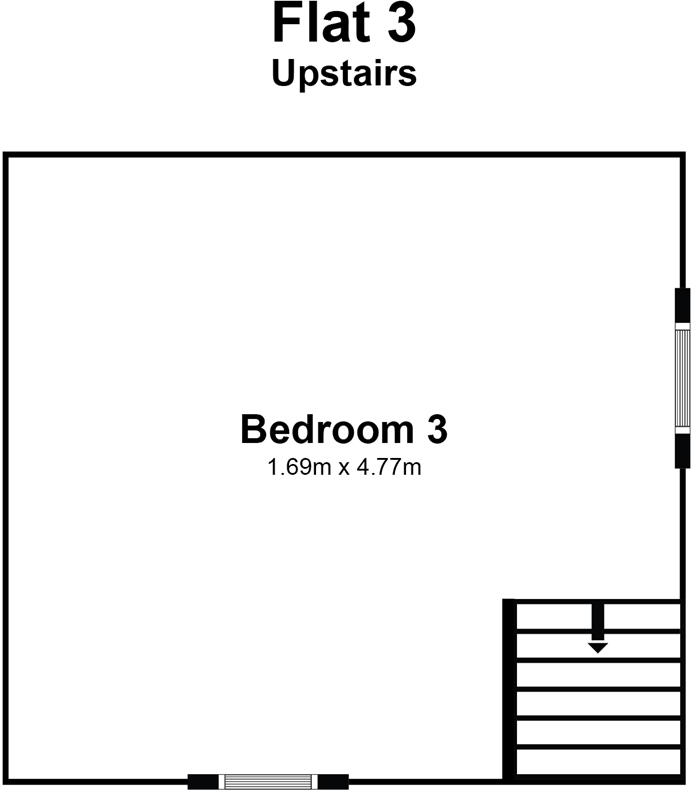

- Freehold HMO: three flats (3-bed, 2-bed, 1-bed)

- 11.74% gross yield; £2,495 pcm + bills projected

- HMO licensed; tenanted next academic year

- Walking distance to train station and university

- EPC D (potential C); likely no wall insulation

- Electric room heaters; dated heating and services

- Small overall size (≈550 sq ft); compact flats

- Located in a very deprived area; average crime levels

This freehold HMO presents three self-contained flats (3-bed, 2-bed, 1-bed) arranged over basement, middle and top floors, marketed specifically to investors. Located within easy walking distance of Treforest Train Station and the University of South Wales, the property benefits from strong student demand and is HMO-licensed with tenants expected for the next academic year. Advertised gross yield is 11.74% (£2,495 pcm + bills).

The building is a Victorian end-terrace of sandstone/limestone construction, double-glazed and heated by electric room heaters. EPC is D with potential to improve to C; walls are assumed uninsulated which limits energy efficiency. The overall internal size is small (approx. 550 sq ft), so individual flats are compact and likely best suited to student occupiers rather than families.

Key advantages for investors are the location, HMO licence, imminent tenancies and low council tax (Band A). Material drawbacks include dated services and heating, probable lack of wall insulation, modest EPC, and the property sitting in a very deprived area — factors that may affect long-term capital growth and maintenance costs. The building will require ongoing upkeep and some modernization to improve energy performance and long-term lettability.

3 bedroom house for sale in Oakwood Street, Treforest, Pontypridd, CF37 — £114,950 • 3 bed • 1 bath • 326 ft²

3 bedroom house for sale in Oakwood Street, Treforest, Pontypridd, CF37 — £114,950 • 3 bed • 1 bath • 326 ft² 3 bedroom end of terrace house for sale in Wood Road, Treforest, Pontypridd, CF37 1RQ, CF37 — £129,950 • 3 bed • 1 bath • 730 ft²

3 bedroom end of terrace house for sale in Wood Road, Treforest, Pontypridd, CF37 1RQ, CF37 — £129,950 • 3 bed • 1 bath • 730 ft² 5 bedroom terraced house for sale in King Street, Pontypridd, CF37 — £170,000 • 5 bed • 2 bath • 1012 ft²

5 bedroom terraced house for sale in King Street, Pontypridd, CF37 — £170,000 • 5 bed • 2 bath • 1012 ft² 3 bedroom terraced house for sale in New Park Terrace, Treforest, Pontypridd, CF37 — £135,000 • 3 bed • 1 bath • 829 ft²

3 bedroom terraced house for sale in New Park Terrace, Treforest, Pontypridd, CF37 — £135,000 • 3 bed • 1 bath • 829 ft² 3 bedroom house for sale in Stow Hill, Pontypridd, CF37 1RZ, CF37 — £135,000 • 3 bed • 1 bath • 1140 ft²

3 bedroom house for sale in Stow Hill, Pontypridd, CF37 1RZ, CF37 — £135,000 • 3 bed • 1 bath • 1140 ft² 5 bedroom end of terrace house for sale in Llantwit Road, Treforest, Pontypridd, CF37 — £156,000 • 5 bed • 2 bath • 956 ft²

5 bedroom end of terrace house for sale in Llantwit Road, Treforest, Pontypridd, CF37 — £156,000 • 5 bed • 2 bath • 956 ft²