Summary - Flat 1, 1 Chapel Road, ILFORD IG1 2AF

1 bed 1 bath Bar / Nightclub

Huge sports bar with late licence and central station location — short lease, cash buyers ideal.

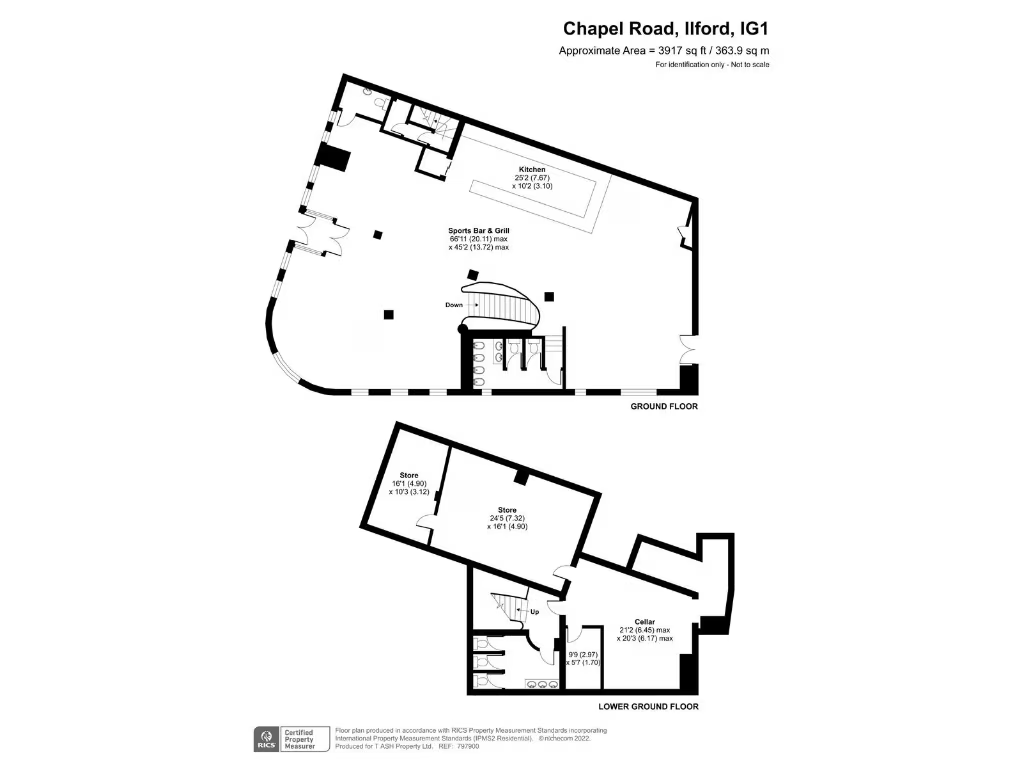

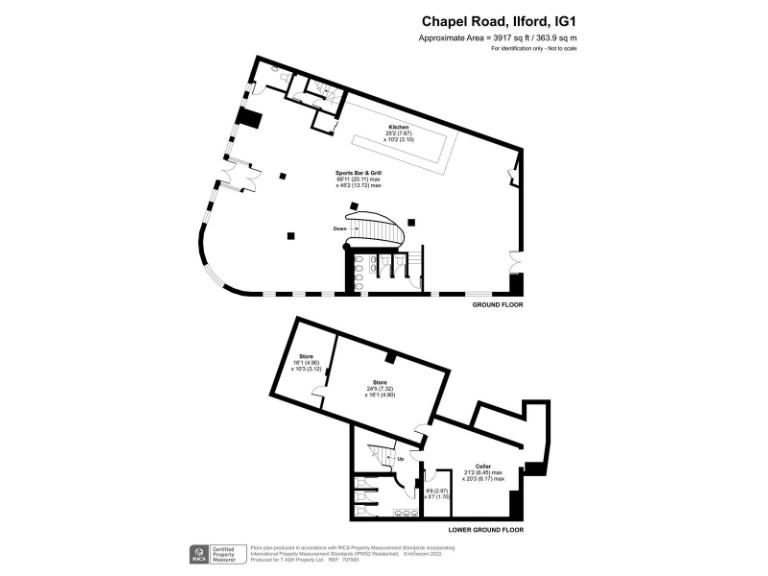

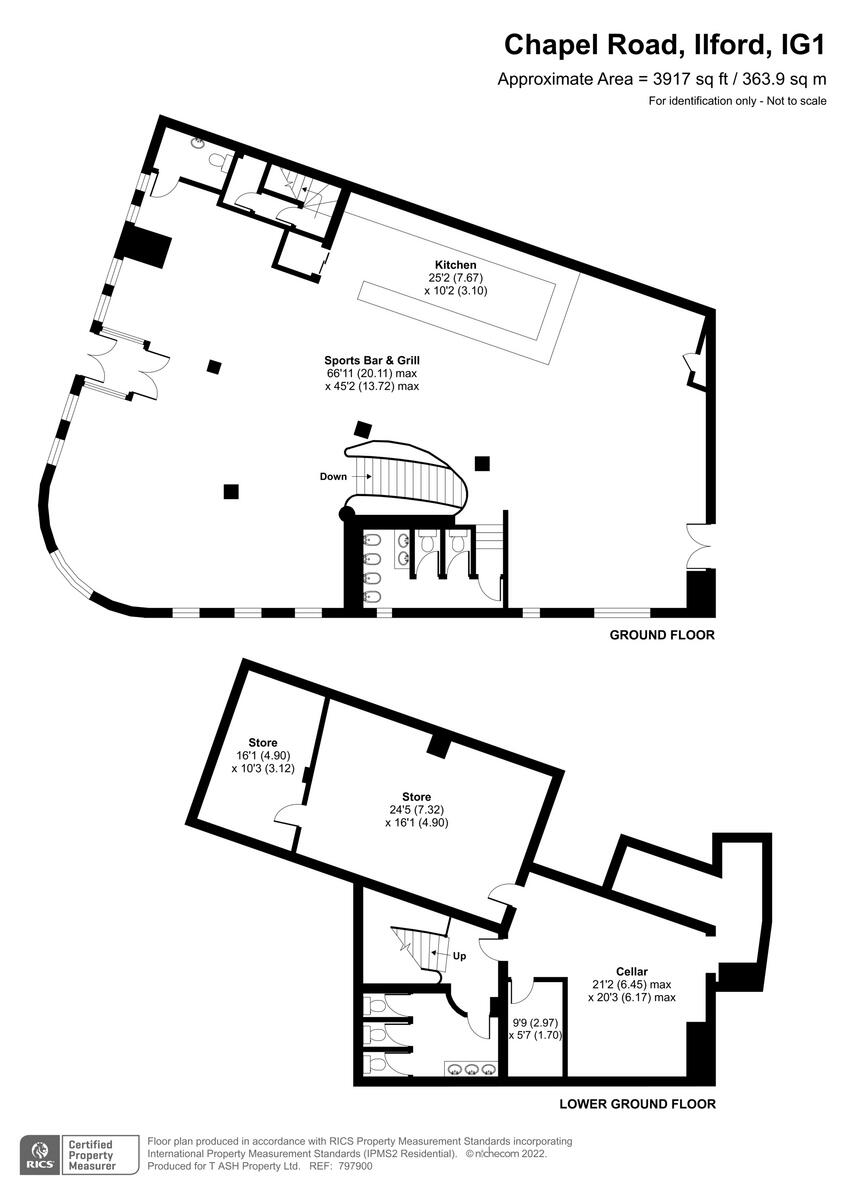

Extremely large 6,027 sq ft multi-level bar and nightclub space

Late licence to 3am Fridays and Saturdays, high evening revenue potential

Seating 105, full capacity 250; 13 screens—sports-bar concept proven

Rent £43,500 pa; rateable value £36,000 (rates payable circa £4,321)

Only ~10–11 years remaining on lease — mortgage lenders likely to refuse

Located in a very high crime area — expect higher insurance/security costs

Electric room heaters, timber-frame with partial insulation — refurbishment needed

Close to Ilford Station (Elizabeth Line), excellent transport and fast broadband

This substantial multi-level bar and nightclub occupies 6,027 sq ft in central Ilford, laid out for sports-led hospitality with 13 screens, high ceilings and a 105-seat (250 total) capacity. The premises benefit from a late licence until 3am on Fridays and Saturdays, proven strong pre-Covid takings and close proximity (1 minute) to Ilford station and local amenities—appealing for an operator or investor seeking instant trading potential.

Important financing and condition points are clear: only around 10–11 years remain on the lease, which will likely prevent mortgage lending and reduces long-term security for some buyers. The unit is electrically heated with room heaters, has timber-frame walls with assumed partial insulation, and is located in a very high crime area—factors that affect operating costs, insurance and refurbishment budgets.

Operational positives include an active late licence, a trade kitchen, staff room with toilet/shower, manager’s office, and a three-bedroom flat on site. Rent is £43,500 per annum; rateable value c. £36,000 (rates payable £4,321). Sellers state strong historic weekly sales (pre-Covid £8–10k typical; peaks much higher), indicating upside for a new operator willing to stabilise turnover.

This property suits investors or experienced leisure operators who can buy as a business or convert use (change of use option open to negotiation). Buyers must factor in lease-renewal risk, potential lender refusal, refurbishment and higher local security costs. For a cash buyer or a buyer able to secure specialist lending, the large footprint and central transport links offer clear redevelopment or trading potential.

Bar / nightclub for sale in Great Eastern Street, London, EC2A — £350,000 • 1 bed • 1 bath

Bar / nightclub for sale in Great Eastern Street, London, EC2A — £350,000 • 1 bed • 1 bath Bar / nightclub for sale in Old Street, London, EC1V — £100,000 • 1 bed • 1 bath

Bar / nightclub for sale in Old Street, London, EC1V — £100,000 • 1 bed • 1 bath High street retail property for sale in Longbridge Road, Barking, London, IG11 — £500,000 • 1 bed • 5 bath

High street retail property for sale in Longbridge Road, Barking, London, IG11 — £500,000 • 1 bed • 5 bath Restaurant for sale in Restaurant, Gants Hill, IG2 — £170,000 • 1 bed • 1 bath • 1500 ft²

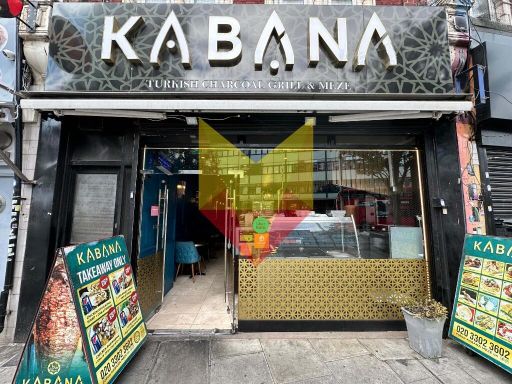

Restaurant for sale in Restaurant, Gants Hill, IG2 — £170,000 • 1 bed • 1 bath • 1500 ft² Restaurant for sale in Chapel Road, Ilford, London, IG1 — £150,000 • 1 bed • 2 bath

Restaurant for sale in Chapel Road, Ilford, London, IG1 — £150,000 • 1 bed • 2 bath Leisure facility for sale in Stunning Exclusive, Commercial Restaurant, For Sale, Ilford IG1 — £155,000 • 1 bed • 2 bath • 1075 ft²

Leisure facility for sale in Stunning Exclusive, Commercial Restaurant, For Sale, Ilford IG1 — £155,000 • 1 bed • 2 bath • 1075 ft²