Summary - MERCHANTS QUAY, 46 - 54 APARTMENT 1 CLOSE NEWCASTLE UPON TYNE NE1 3RF

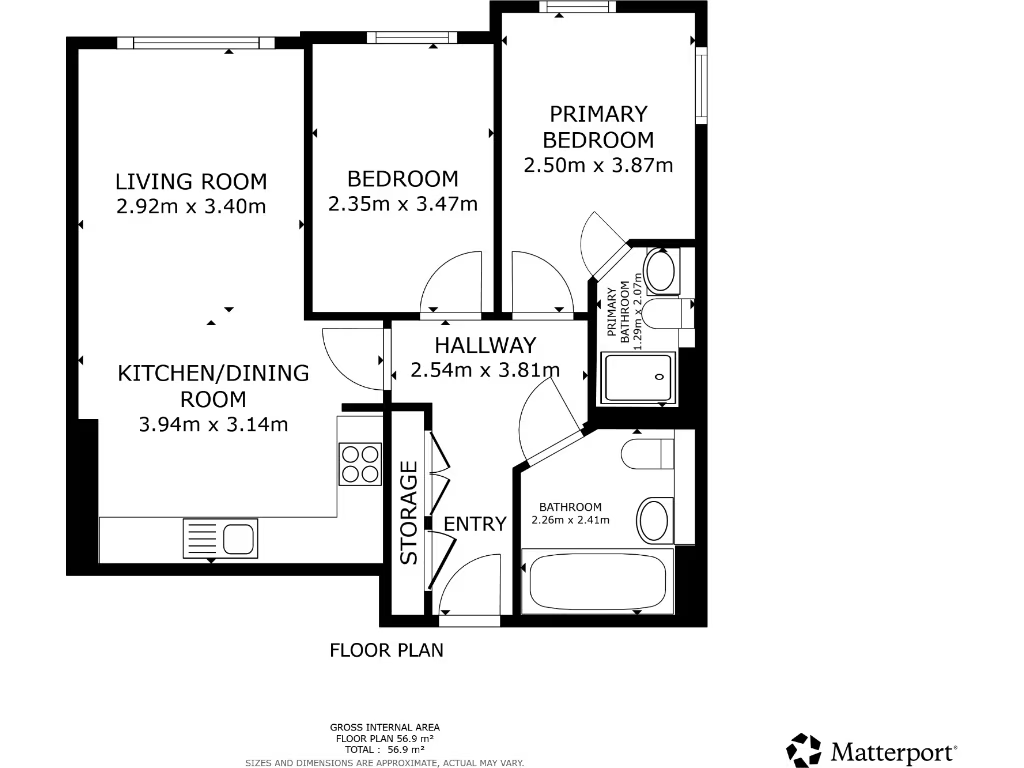

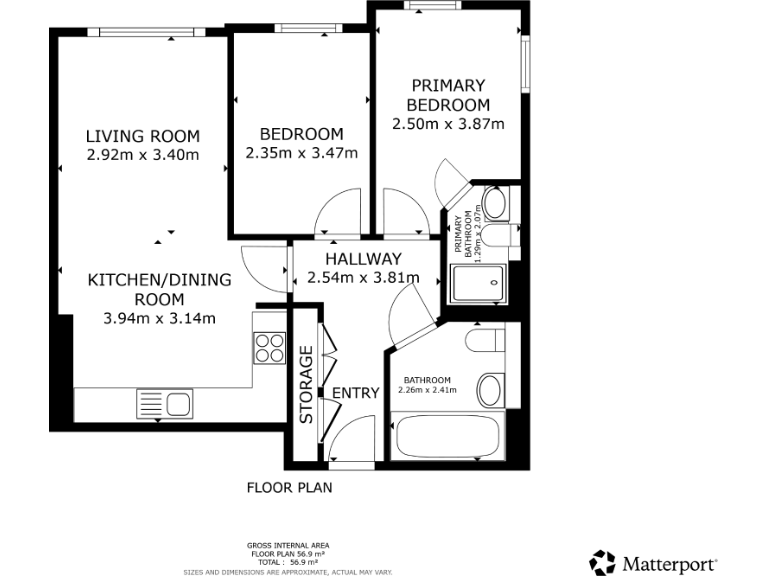

2 bed 2 bath Flat

Immediate rental income with long-term tenant in a modern city-centre block.

Current gross rental income £12,000 per year (tenant in situ)

Approximate gross yield c.7.1% at £170,000 purchase price

Leasehold tenure — check remaining term and service charges

Shared off-street parking; no private garden or outdoor space

Located in NE1 city centre with strong rental demand and amenities

Area classified as deprived with very high local crime rates

Long-term tenant intends to remain — limited vacant possession risk

Buyer's premium may apply; commission full inspection and let pack review

This two-bedroom leasehold flat in central Newcastle (NE1) is being offered as a let investment with a long-term tenant in situ. The property currently produces £12,000 pa gross, giving an approximate gross yield of 7.1% at the listed price of £170,000. It sits in a modern mid-rise block with shared off-street parking and straightforward access to city-centre amenities and transport links.

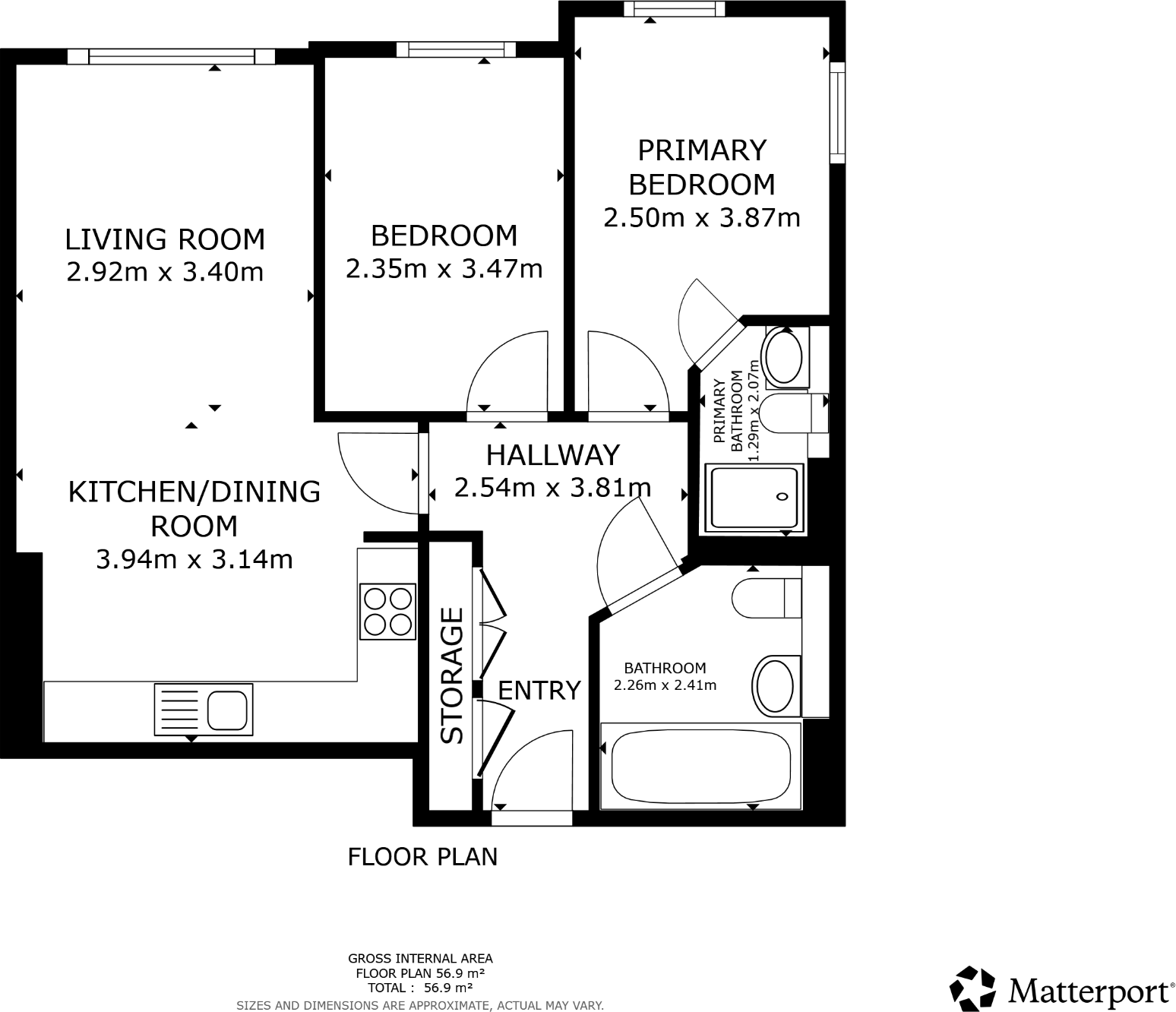

The tenant has occupied the property for several years and has a consistent payment record; they have indicated an intention to remain, so the sale is likely to suit buyers seeking immediate rental income. The building appears well-presented externally and the flat is described as well-kept, but no internal floorplan or full condition report is provided here. Investors should review the Let Property Pack and commission a full inspection to confirm exact size and condition before purchase.

Important considerations: the property is leasehold, located in a densely populated, deprived area with very high local crime levels reported. These factors can affect future re-letting, insurance costs and resale. There is no private garden and the flat is typical of city-centre apartments with limited communal external space. Buyers should also note a buyer’s premium may apply to secure the sale.

Overall, this is a straightforward buy-to-let opportunity for investors seeking immediate income from a centrally located two-bedroom flat. It offers visible rental performance now but requires due diligence on lease terms, service charges, local market risks and any building-specific matters before purchase.

2 bedroom flat for sale in Close, Newcastle Upon Tyne, NE1 — £175,000 • 2 bed • 2 bath • 603 ft²

2 bedroom flat for sale in Close, Newcastle Upon Tyne, NE1 — £175,000 • 2 bed • 2 bath • 603 ft² 2 bedroom flat for sale in Akenside Terrace, Newcastle Upon Tyne, NE2 — £170,000 • 2 bed • 1 bath • 688 ft²

2 bedroom flat for sale in Akenside Terrace, Newcastle Upon Tyne, NE2 — £170,000 • 2 bed • 1 bath • 688 ft² 1 bedroom flat for sale in Amen Corner, St. Nicholas Chambers, Newcastle Upon Tyne, NE1 — £107,500 • 1 bed • 1 bath • 329 ft²

1 bedroom flat for sale in Amen Corner, St. Nicholas Chambers, Newcastle Upon Tyne, NE1 — £107,500 • 1 bed • 1 bath • 329 ft² 2 bedroom flat for sale in Dukesfield, Newcastle Upon Tyne, NE27 — £115,000 • 2 bed • 2 bath • 710 ft²

2 bedroom flat for sale in Dukesfield, Newcastle Upon Tyne, NE27 — £115,000 • 2 bed • 2 bath • 710 ft² 2 bedroom flat for sale in Connaught Mews, Newcastle Upon Tyne, NE2 — £160,000 • 2 bed • 1 bath • 678 ft²

2 bedroom flat for sale in Connaught Mews, Newcastle Upon Tyne, NE2 — £160,000 • 2 bed • 1 bath • 678 ft² 2 bedroom flat for sale in Knightsbridge Court, Newcastle Upon Tyne, NE3 — £175,000 • 2 bed • 2 bath • 549 ft²

2 bedroom flat for sale in Knightsbridge Court, Newcastle Upon Tyne, NE3 — £175,000 • 2 bed • 2 bath • 549 ft²