Summary -

Apartment 9 Merchants Quay,46-54, Close,NEWCASTLE UPON TYNE,NE1 3RF

NE1 3RF

2 bed 2 bath Flat

Income-producing 2-bed flat in central Newcastle with tenant in place and immediate yield.

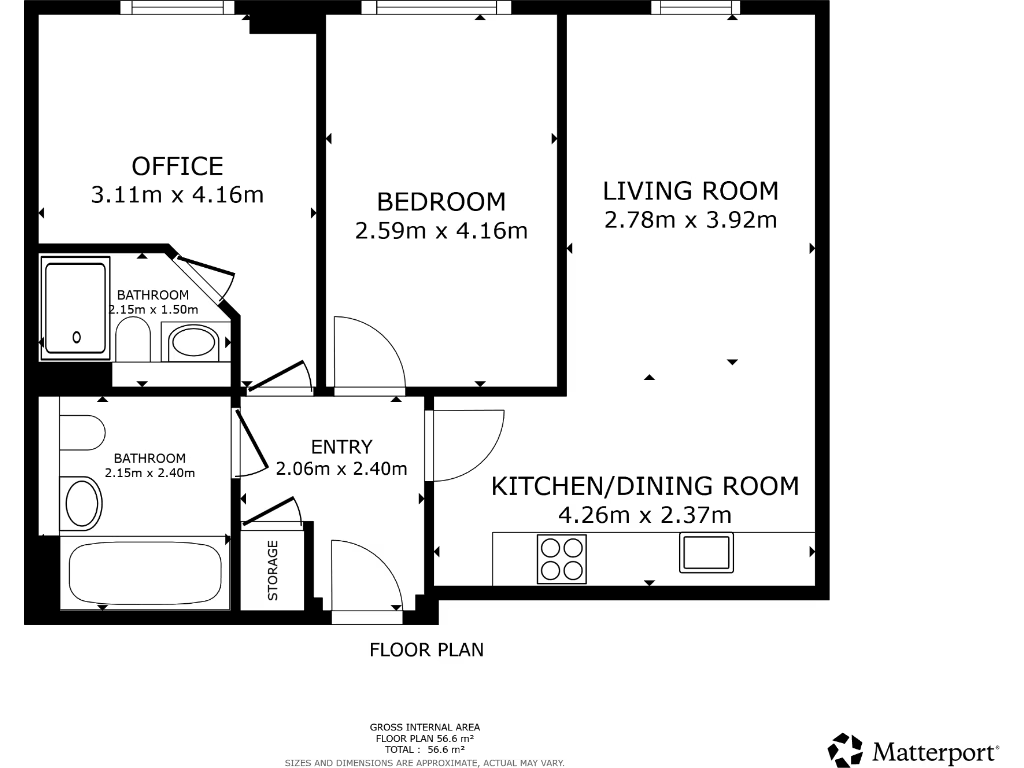

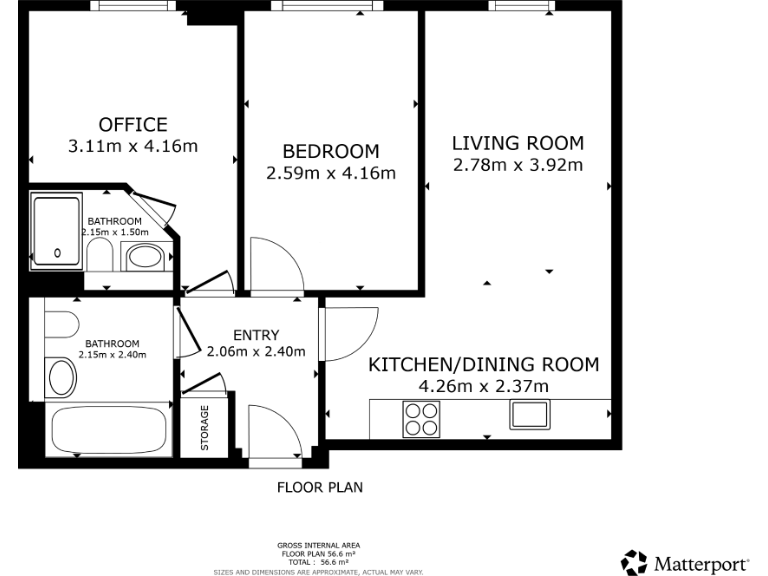

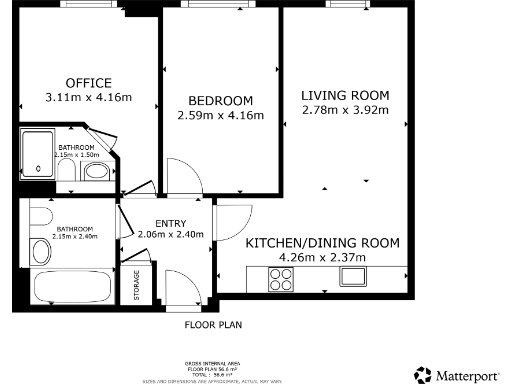

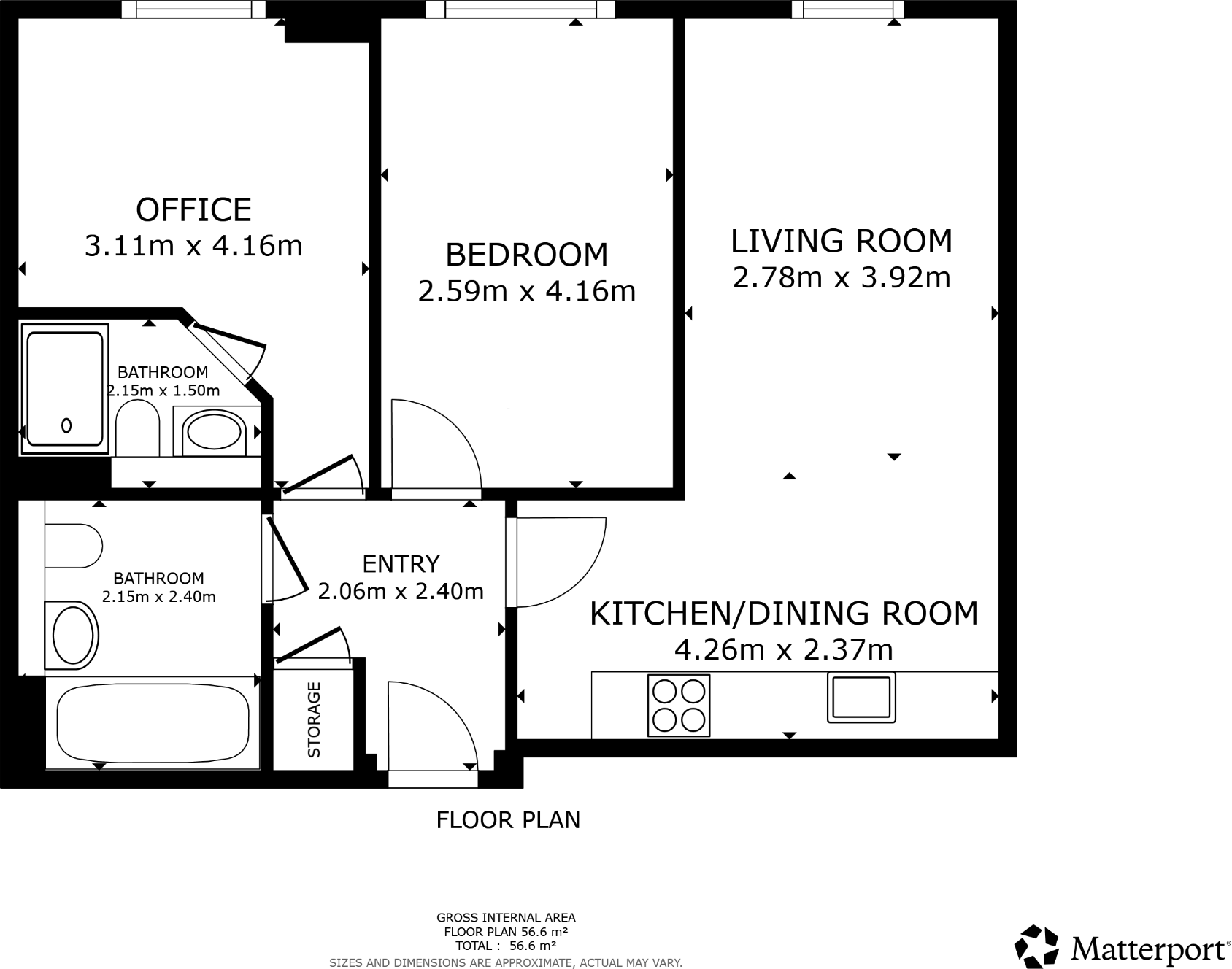

Two bedrooms and two bathrooms in a 603 sq ft city-centre flat

A compact two-bedroom, two-bathroom apartment in central Newcastle (NE1) offered with a long-term tenant in situ. The property produces an annual gross income of £12,000, making it a straightforward buy‑to‑let addition for an investor seeking immediate yield and minimal void risk. The building is modern, city-centre and well connected to transport and local amenities.

Important practical points are clear: the flat is leasehold, approximately 603 sq ft, and located in a neighbourhood described as deprived with very high local crime rates. These factors will affect resale prospects and may impact insurance costs and tenant mix—important considerations for portfolio risk.

The unit suits investors who want an income-producing, low‑management addition rather than an owner-occupier seeking outdoor space or a quiet suburban setting. There appears to be limited external or communal amenity space. Full details on tenancy, income and legal pack are available in the Let Property Pack; a buyer’s premium applies to secure the purchase.

Viewing should focus on lease length/terms, service charges, building management, and local safety/insurance implications. The established tenancy and city-centre location are clear value drivers for buy‑to‑let investors prepared to manage the area-specific risks.

2 bedroom flat for sale in Akenside Terrace, Newcastle Upon Tyne, NE2 — £170,000 • 2 bed • 1 bath • 688 ft²

2 bedroom flat for sale in Akenside Terrace, Newcastle Upon Tyne, NE2 — £170,000 • 2 bed • 1 bath • 688 ft² 2 bedroom apartment for sale in Pudding Chare, City Centre, Newcastle upon Tyne, Tyne and Wear, NE1 1UD, NE1 — £125,000 • 2 bed • 1 bath • 574 ft²

2 bedroom apartment for sale in Pudding Chare, City Centre, Newcastle upon Tyne, Tyne and Wear, NE1 1UD, NE1 — £125,000 • 2 bed • 1 bath • 574 ft² 1 bedroom flat for sale in Amen Corner, St. Nicholas Chambers, Newcastle Upon Tyne, NE1 — £107,500 • 1 bed • 1 bath • 329 ft²

1 bedroom flat for sale in Amen Corner, St. Nicholas Chambers, Newcastle Upon Tyne, NE1 — £107,500 • 1 bed • 1 bath • 329 ft² 2 bedroom apartment for sale in Citygate, Bath Lane, Newcastle upon Tyne, Tyne and Wear, NE1 — £175,000 • 2 bed • 2 bath • 625 ft²

2 bedroom apartment for sale in Citygate, Bath Lane, Newcastle upon Tyne, Tyne and Wear, NE1 — £175,000 • 2 bed • 2 bath • 625 ft² 2 bedroom flat for sale in West Farm Avenue, Newcastle Upon Tyne, NE12 — £80,000 • 2 bed • 1 bath • 667 ft²

2 bedroom flat for sale in West Farm Avenue, Newcastle Upon Tyne, NE12 — £80,000 • 2 bed • 1 bath • 667 ft² 2 bedroom apartment for sale in Citygate, Bath Lane, Newcastle upon Tyne, Tyne and Wear, NE1 — £170,000 • 2 bed • 2 bath • 641 ft²

2 bedroom apartment for sale in Citygate, Bath Lane, Newcastle upon Tyne, Tyne and Wear, NE1 — £170,000 • 2 bed • 2 bath • 641 ft²