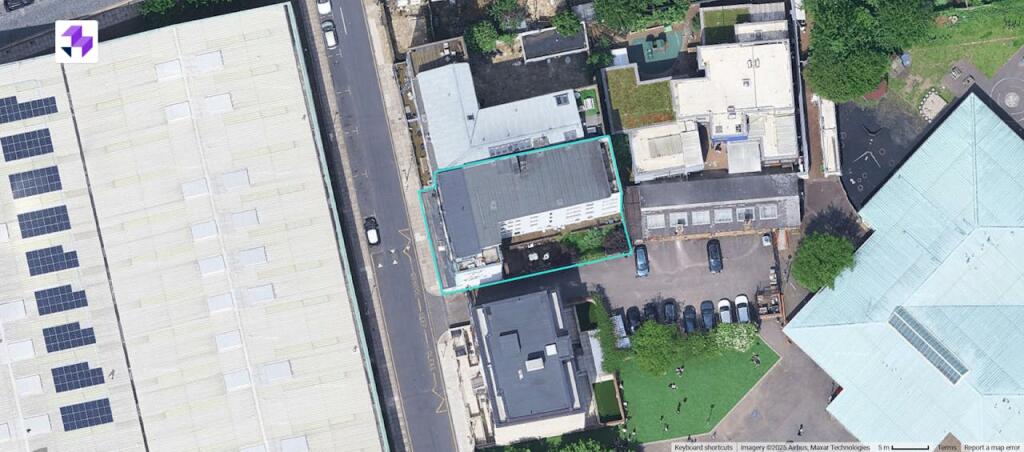

Summary - 20 MOWLEM STREET LONDON E2 9HE

1 bed 1 bath Land

Freehold 18-flat block with strong income and refurbishment upside in E2..

Rental income £418,440 pa from 18 flats

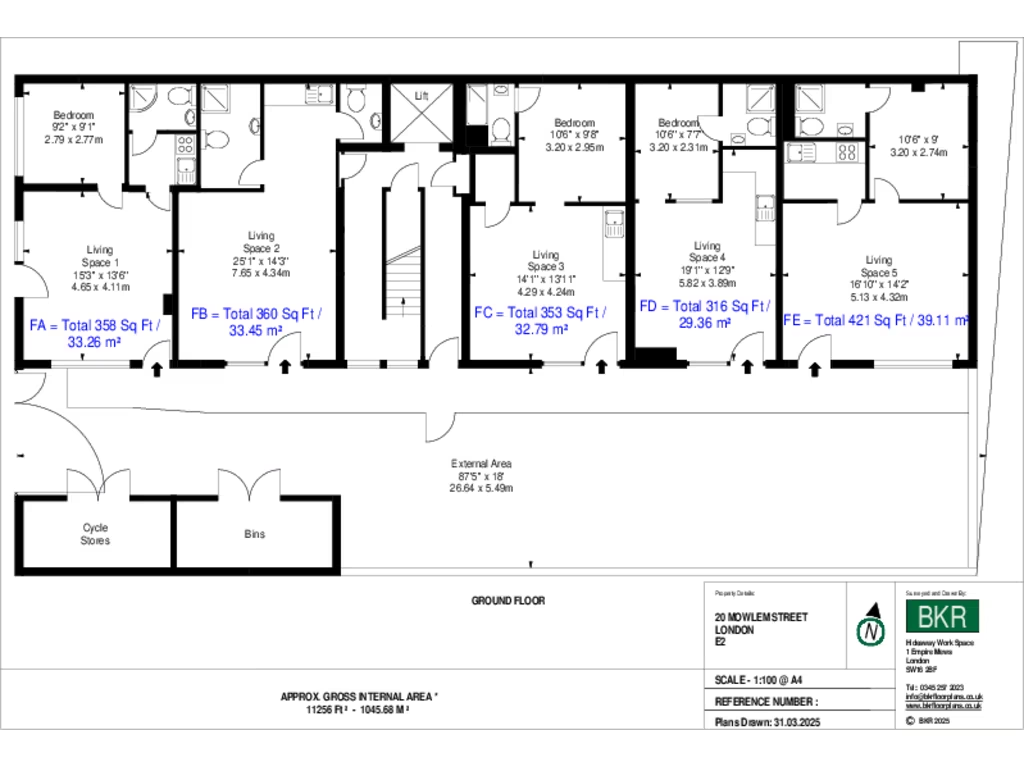

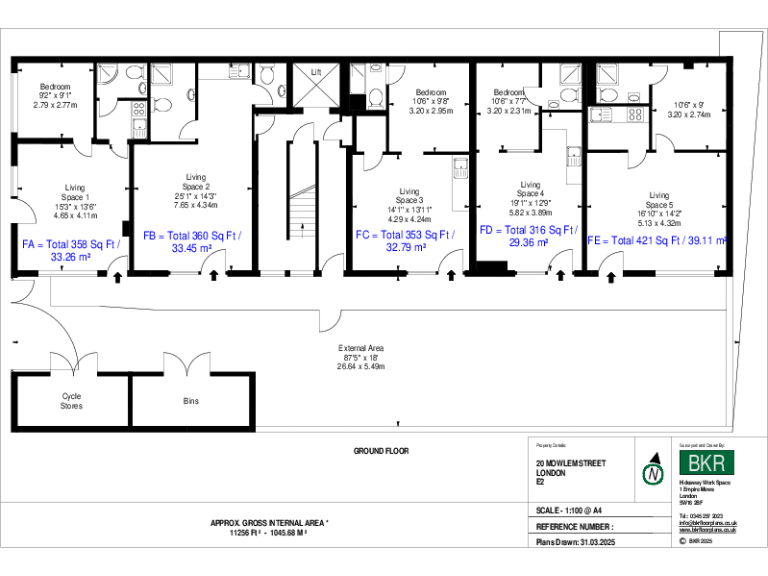

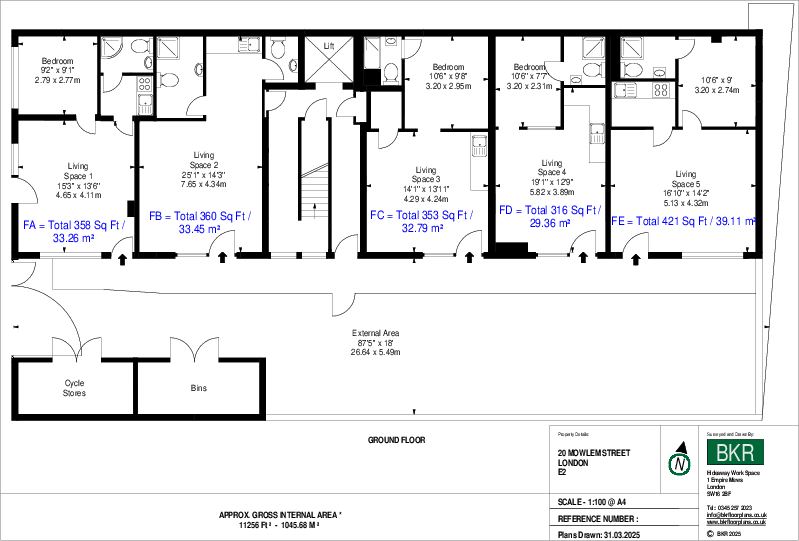

Freehold five-storey block — 11,256 sq ft total

Fully let — immediate income stream on completion

Priced at approx. £763 per sq ft — potential upside

Scope for refurbishment and rent uplift across units

Attractive communal garden and secure cycle storage

Good transport links: Cambridge Heath Ovlng and Bethnal Green Tube

Area is deprived with average crime — factor management costs

A substantial freehold block in East London offered with a strong income profile and clear reversionary potential. The five-storey building comprises 18 self-contained flats producing £418,440 pa, currently fully let so the purchase delivers an immediate income stream. The size (11,256 sq ft) and pricing (£7,650,000) present an opportunity to enhance yield through selective refurbishment and active asset management.

The property includes attractive communal garden space and secure cycle storage—features that aid tenant retention in this popular, well-connected area. Ground-floor studios were created from former commercial space, increasing unit count and rental scope. Cambridge Heath Overground is about a 3–4 minute walk and Bethnal Green tube is under half a mile, keeping the location highly accessible for commuters and young professionals.

Key practical points are straightforward: freehold tenure, no flood risk, and a garage for parking. The local area is inner-city cosmopolitan with strong rental demand but also recognised as comparatively deprived; average crime levels should be factored into pricing and management costs. EPCs and the tenancy schedule are available on request and should be reviewed as part of due diligence.

This asset suits investors seeking a mid-sized block with immediate cashflow and scope to add value through refurbishment, rent reviews, or reconfiguration. Material considerations include the need to inspect individual flat condition, confirm service charge and maintenance history, and assess opportunities against local market dynamics and ongoing nearby developments.

6 bedroom block of apartments for sale in Stepney Way, London, E1 — £1,400,000 • 6 bed • 6 bath • 1689 ft²

6 bedroom block of apartments for sale in Stepney Way, London, E1 — £1,400,000 • 6 bed • 6 bath • 1689 ft² Commercial property for sale in 1-3 Pollard Row, London, E2 — £2,500,000 • 1 bed • 1 bath • 1205 ft²

Commercial property for sale in 1-3 Pollard Row, London, E2 — £2,500,000 • 1 bed • 1 bath • 1205 ft² Plot for sale in Millers Terrace, London, E8 — £1,750,000 • 5 bed • 5 bath • 2282 ft²

Plot for sale in Millers Terrace, London, E8 — £1,750,000 • 5 bed • 5 bath • 2282 ft² 16 bedroom block of apartments for sale in Regency Court, Harrow Road, London, E11 — £2,500,000 • 16 bed • 8 bath

16 bedroom block of apartments for sale in Regency Court, Harrow Road, London, E11 — £2,500,000 • 16 bed • 8 bath 5 bedroom apartment for sale in Cambridge Heath Road, London, E2 — £1,200,000 • 5 bed • 3 bath • 1159 ft²

5 bedroom apartment for sale in Cambridge Heath Road, London, E2 — £1,200,000 • 5 bed • 3 bath • 1159 ft² 7 bedroom flat for sale in Casson Street, London, E1 — £1,500,000 • 7 bed • 2 bath

7 bedroom flat for sale in Casson Street, London, E1 — £1,500,000 • 7 bed • 2 bath