Summary - 61a, Junction Road N19 5QU

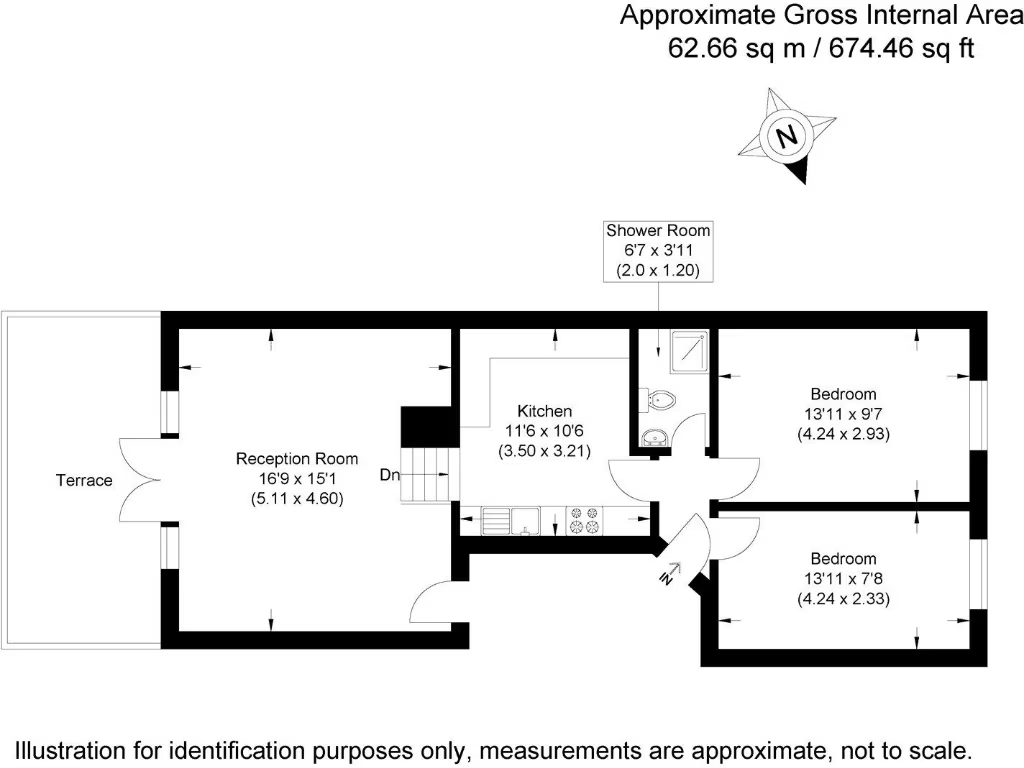

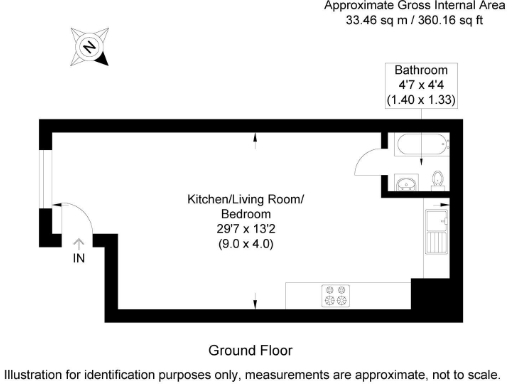

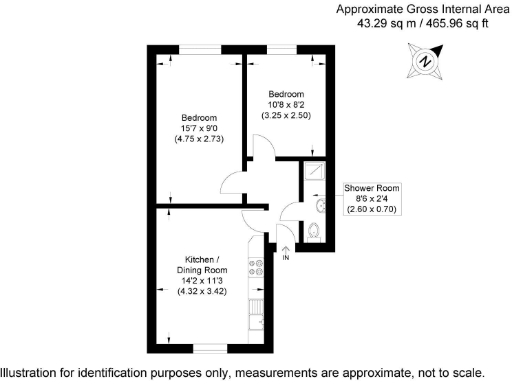

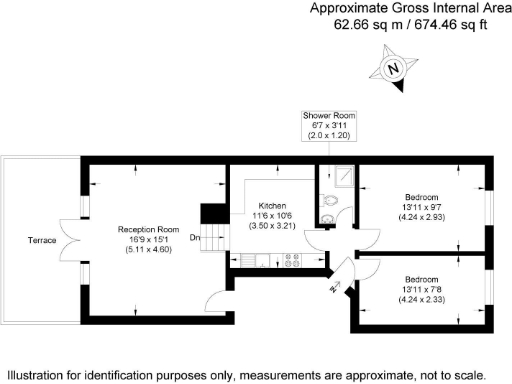

1 bed 1 bath Land

Central N19 freehold with strong income, short lease risk—cash buyers or specialist lenders preferred.

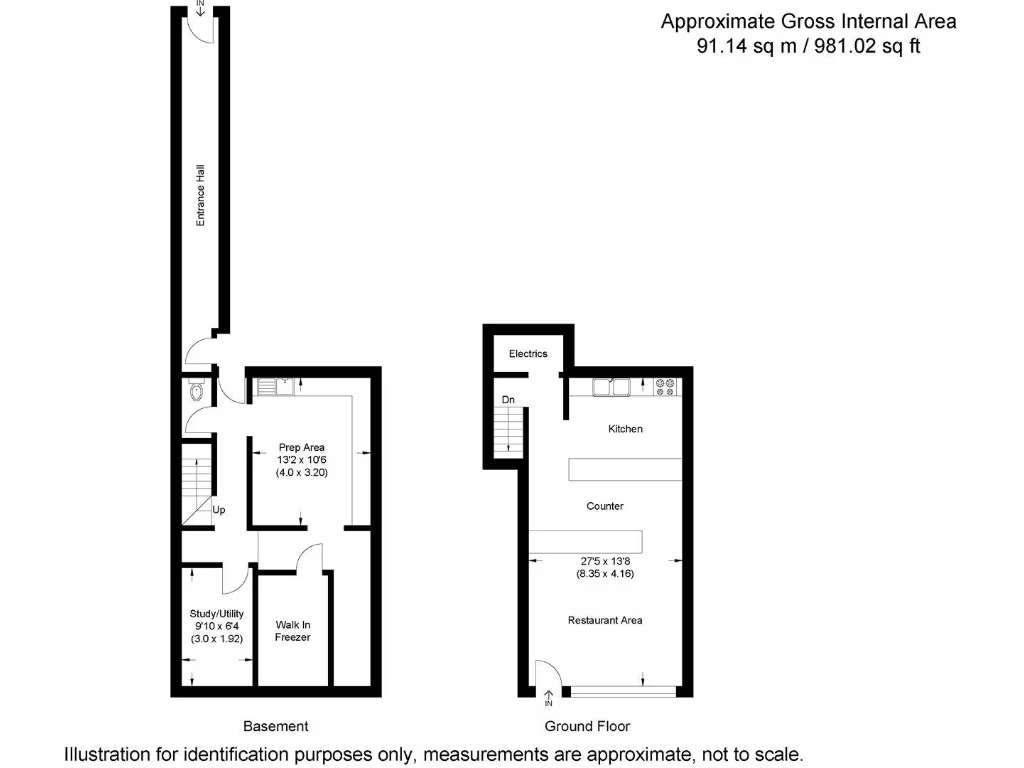

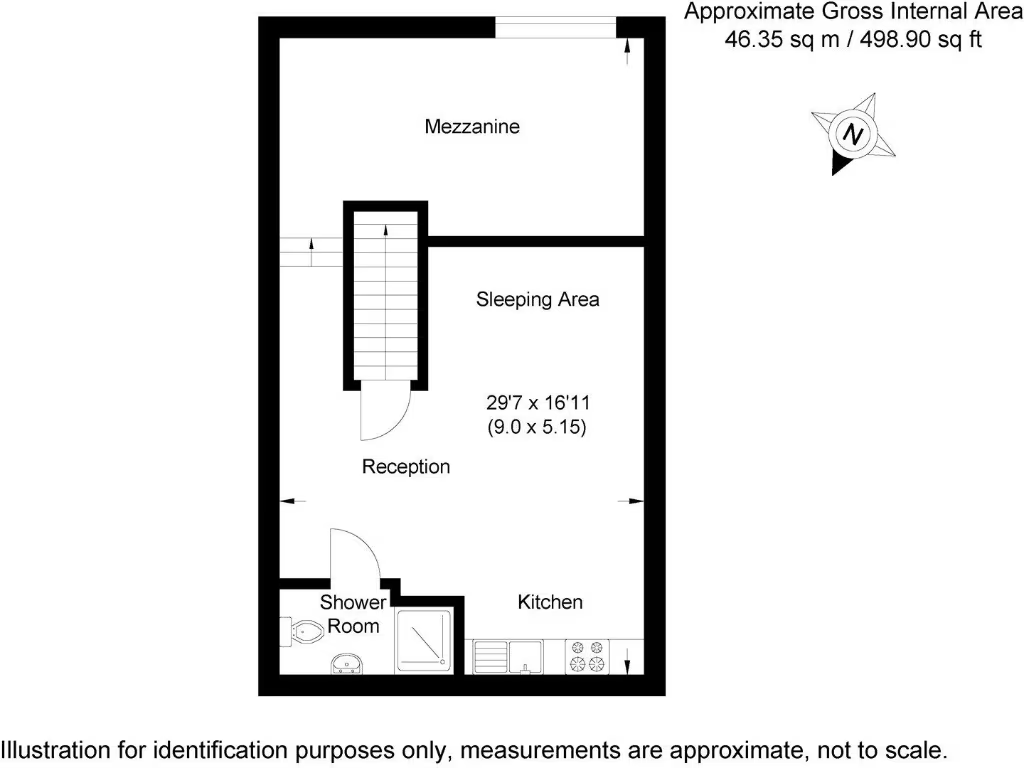

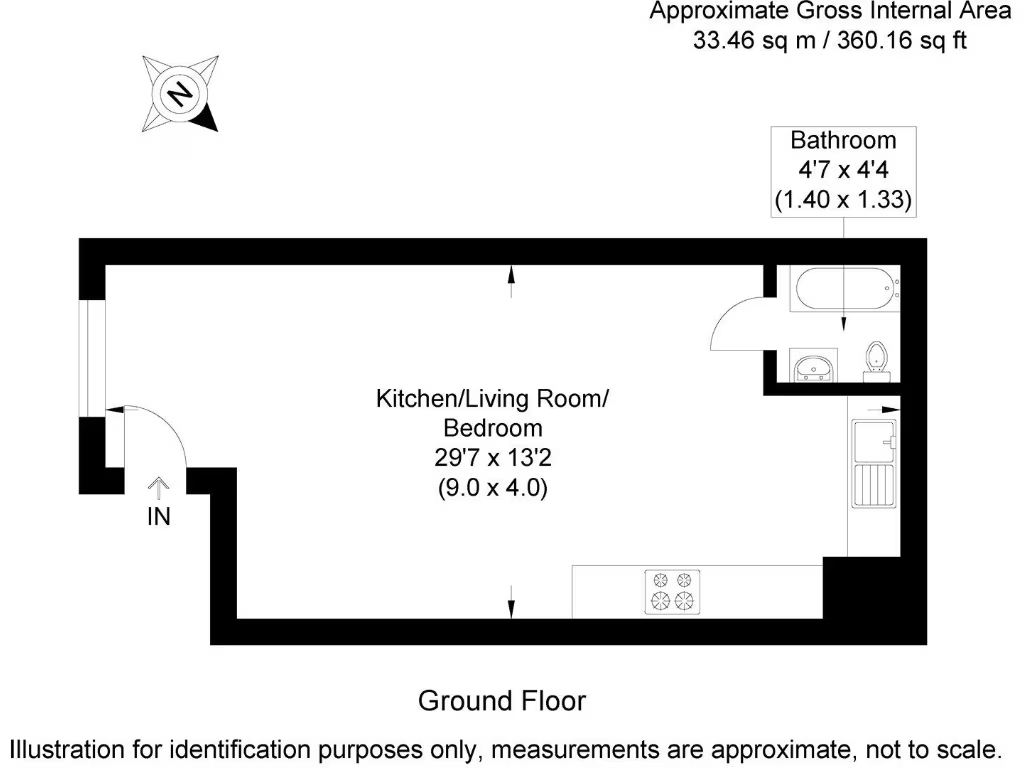

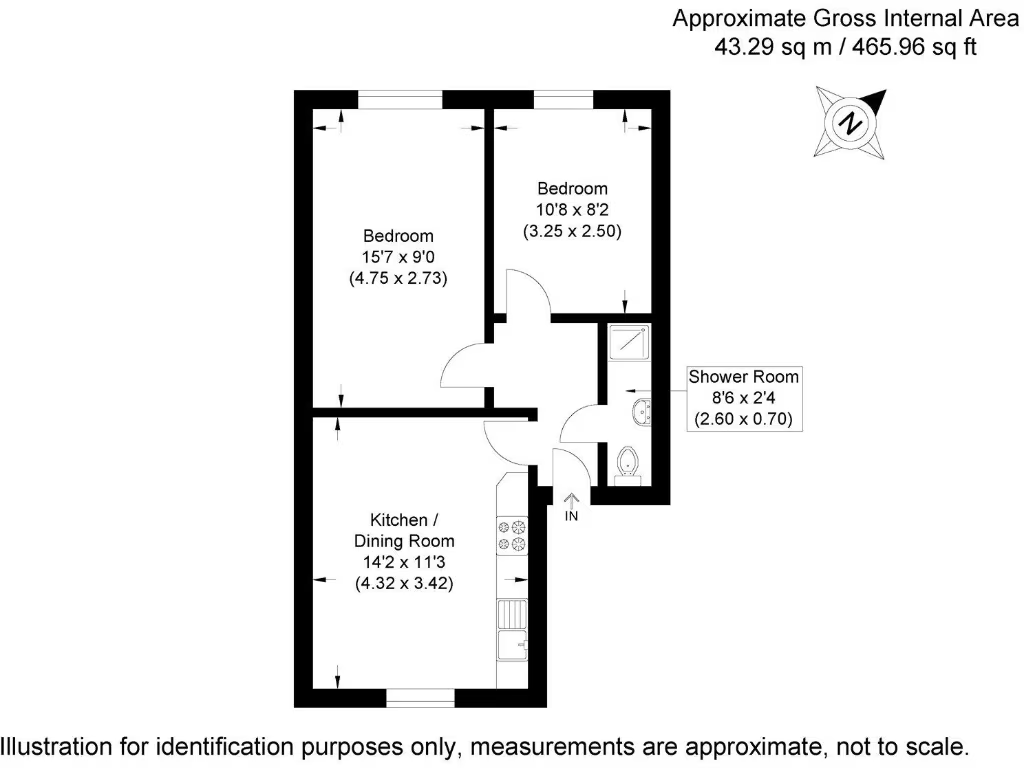

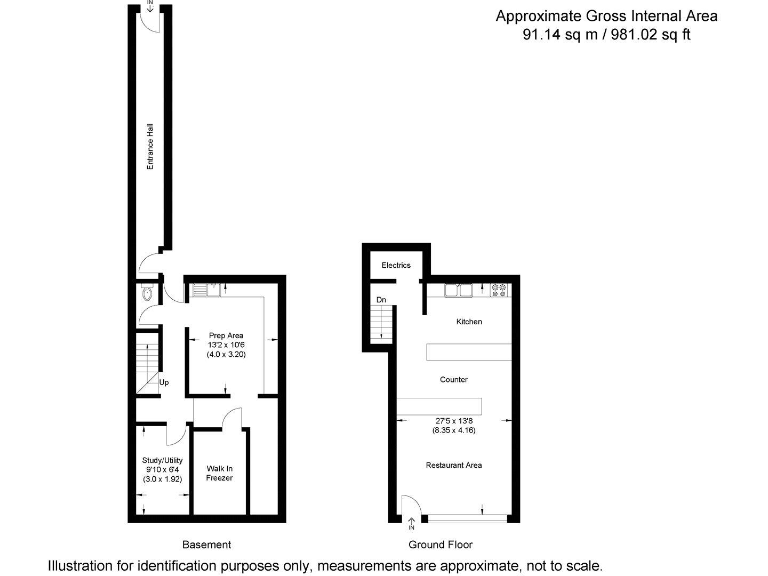

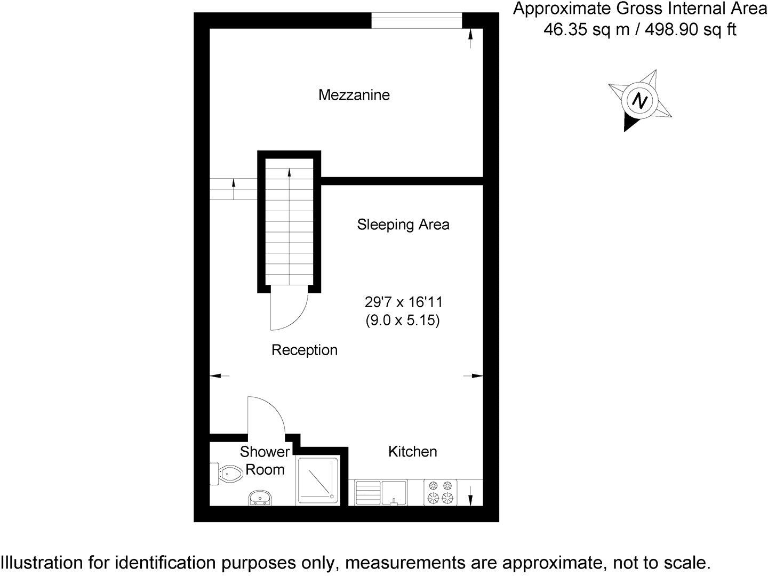

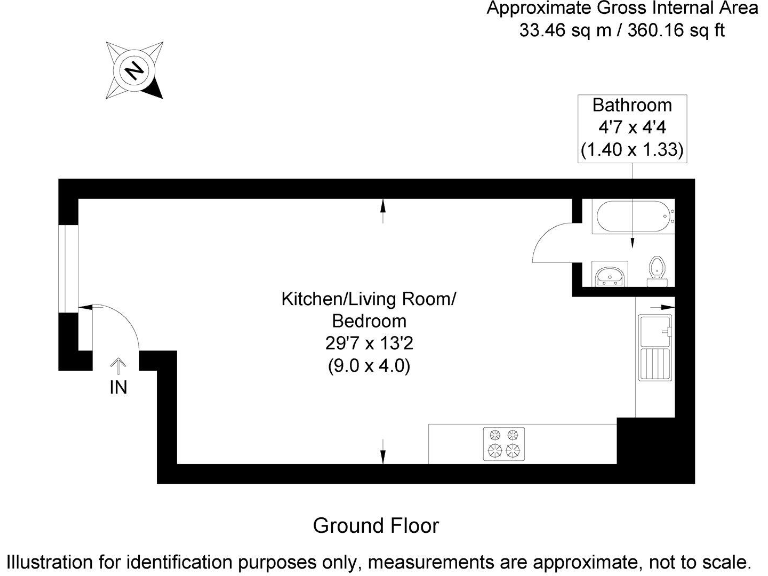

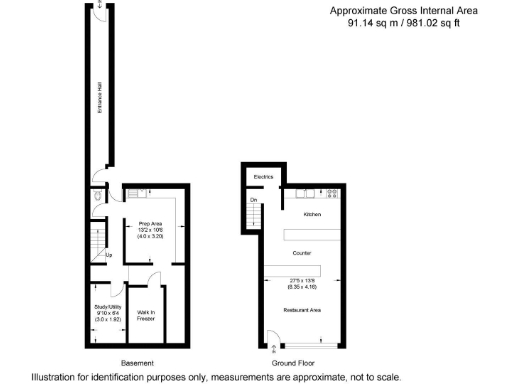

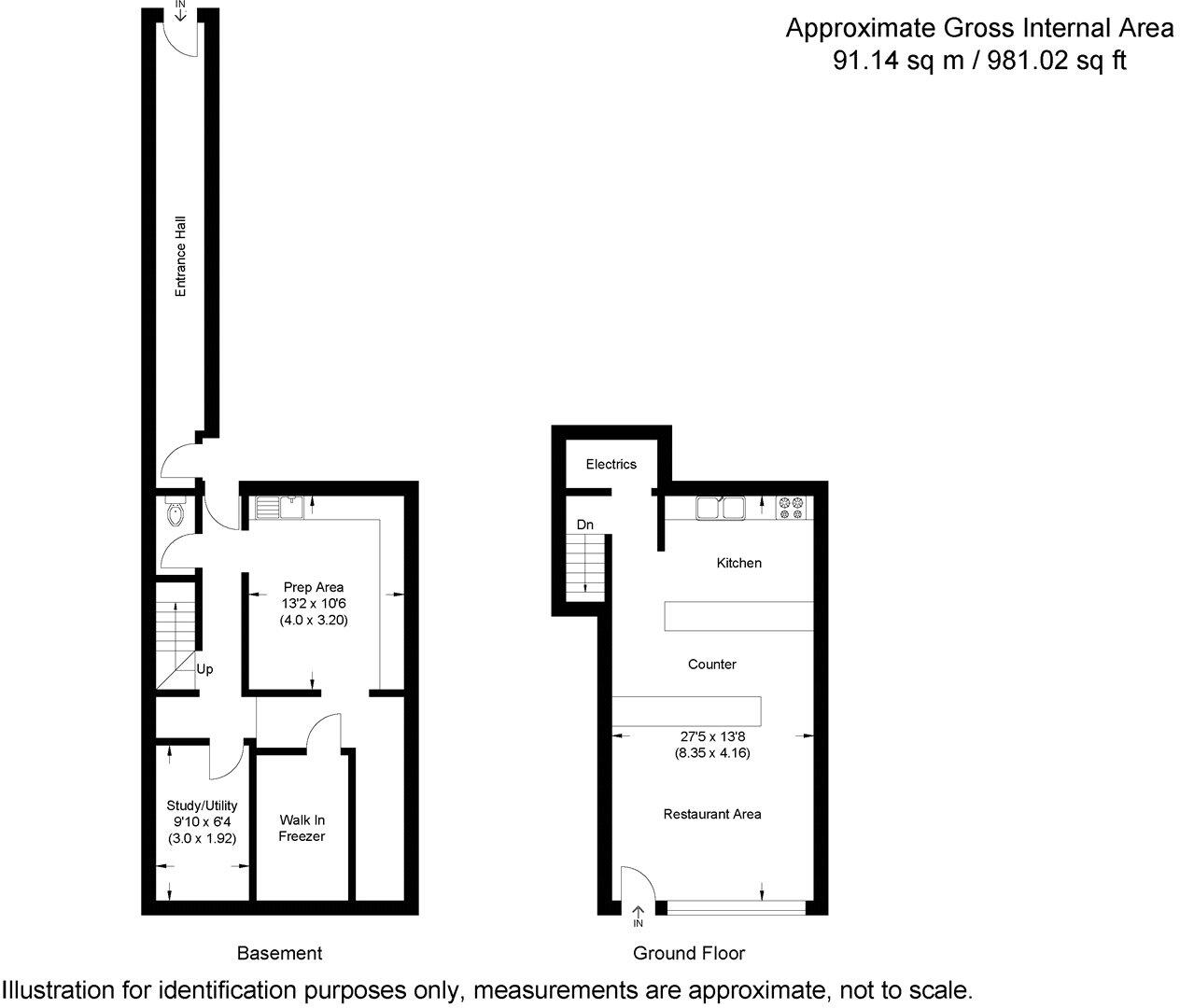

- Freehold mixed commercial/residential building with £91,224 pa reported rental income

- Ground-floor commercial tenant holding over (current rent £25,000 pa)

- Only 10 years remaining on lease; likely to deter mainstream mortgage lenders

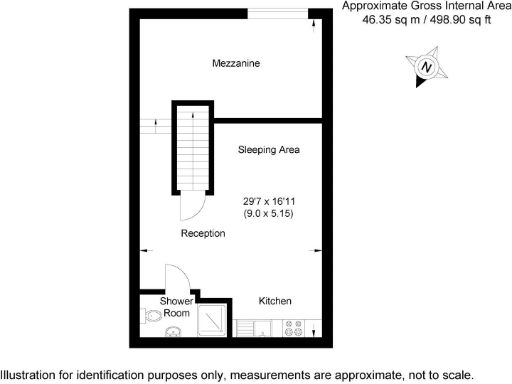

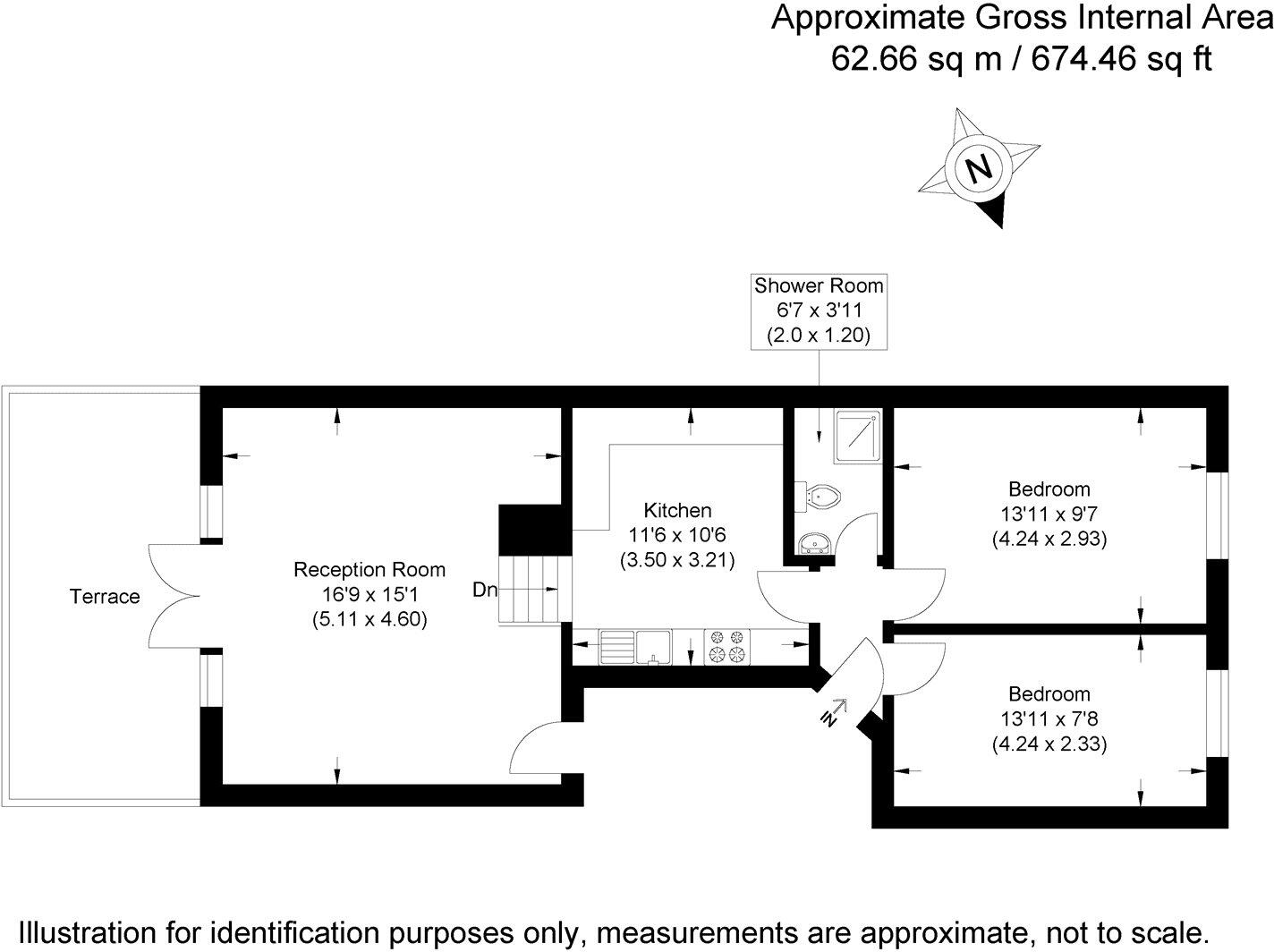

- Small plot and compact footprint; limited outdoor amenity (roof terrace)

- Modern fittings and double glazing; timber frame walls assumed uninsulated

- High-crime area and local deprivation could affect insurance and tenant risk

- Excellent transport links: Northern Line and Overground nearby

- Fast broadband and excellent mobile signal throughout

A compact freehold terrace in N19 offered with immediate rental income and mixed commercial/residential use. The building produces a reported total rental income of £91,224 pa and includes a ground-floor shop (tenant holding over) plus four upper residential units, making it suitable for an investor seeking an income-producing central London asset. The location is highly accessible between Tufnell Park and Archway (Northern Line) and Upper Holloway (Overground), with strong local amenities and excellent mobile and broadband connectivity.

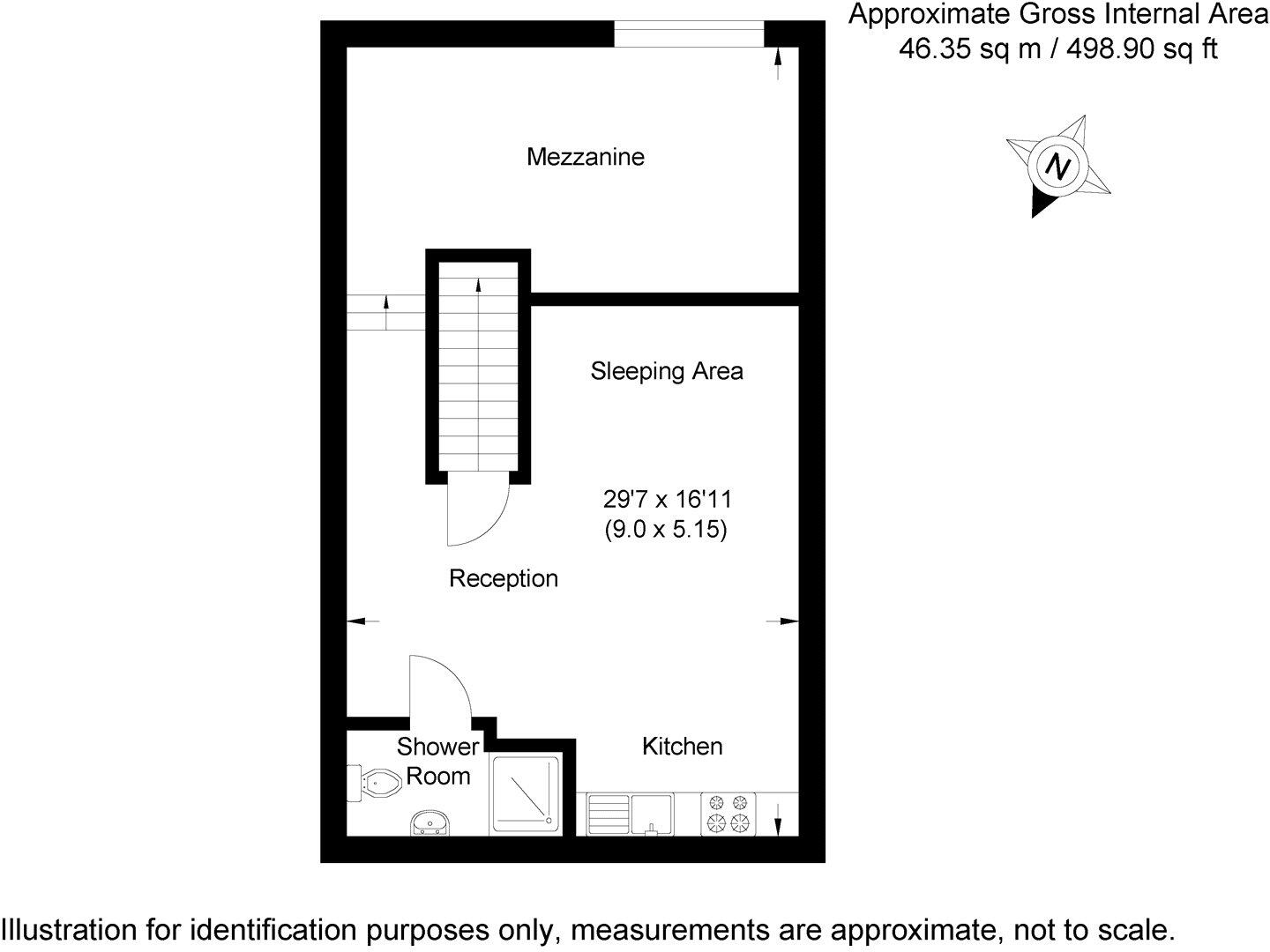

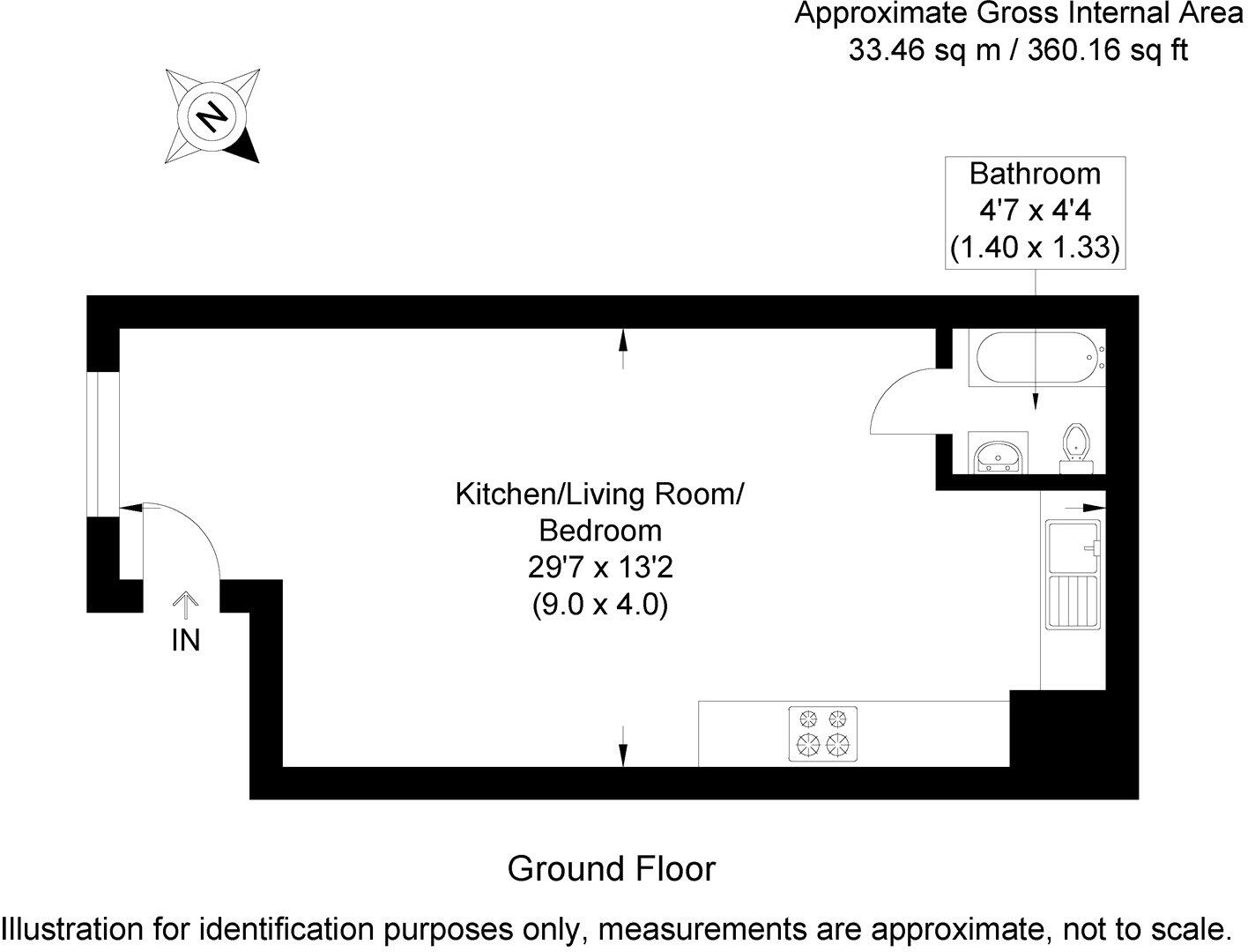

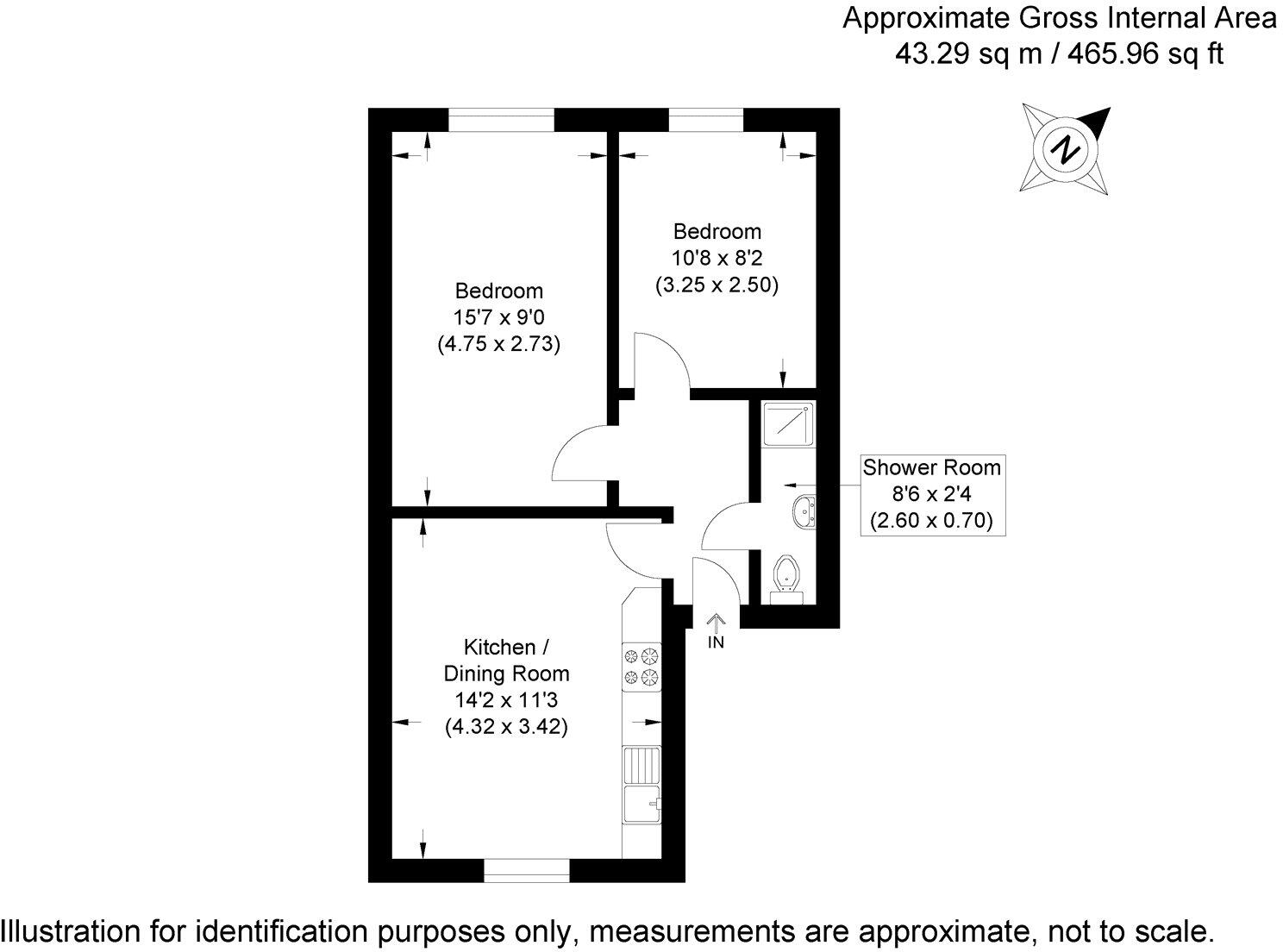

Important lender and tenure considerations are clear: the property currently carries only 10 years remaining on a lease element, which is likely to cause mortgage lenders to refuse standard residential lending. This materially affects purchase options and refinancing — buyers should assume cash buyers or specialist lending will be required. The site footprint and plot are small, and the building is compact with limited outdoor amenity (small roof terrace and minimal forecourt).

The fabric shows modernised elements (double glazing, contemporary kitchens, boiler/radiator heating) but also features timber-frame walls with assumed no insulation and a compact layout; some units appear mid-range in finish and may need ongoing maintenance or targeted refurbishment to maximise rents. The local area is inner-city and cosmopolitan with a strong professional presence, but it also registers very high crime and higher deprivation indices — factors to consider for risk, insurance costs and tenant profile.

For an investor who understands inner-London asset management and the constraints of short residential leases, this property offers immediate revenue and upside through lease restructures, rent reviews or sensible refurbishment. Buyers reliant on mainstream residential mortgages should not plan to finance with standard loans without addressing the lease term and lender requirements first.

High street retail property for sale in 2 Wellington Terrace, Turnpike Lane, London, N8 0PX, N8 — £850,000 • 1 bed • 1 bath • 2116 ft²

High street retail property for sale in 2 Wellington Terrace, Turnpike Lane, London, N8 0PX, N8 — £850,000 • 1 bed • 1 bath • 2116 ft² High street retail property for sale in 95 Seven Sisters Road and 165 & 167 Hornsey Road, London N7 6RA, N7 — £1,200,000 • 1 bed • 1 bath • 3163 ft²

High street retail property for sale in 95 Seven Sisters Road and 165 & 167 Hornsey Road, London N7 6RA, N7 — £1,200,000 • 1 bed • 1 bath • 3163 ft² 4 bedroom block of apartments for sale in Parkhurst Road, London, N7 — £1,850,000 • 4 bed • 3 bath • 2302 ft²

4 bedroom block of apartments for sale in Parkhurst Road, London, N7 — £1,850,000 • 4 bed • 3 bath • 2302 ft² Commercial property for sale in 82-84 Seven Sisters Road, Holloway, N7 6AE, N7 — £1,750,000 • 1 bed • 1 bath • 2776 ft²

Commercial property for sale in 82-84 Seven Sisters Road, Holloway, N7 6AE, N7 — £1,750,000 • 1 bed • 1 bath • 2776 ft² 5 bedroom mixed use property for sale in Fairbridge Road, Archway, London, N19 — £1,650,000 • 5 bed • 4 bath • 1891 ft²

5 bedroom mixed use property for sale in Fairbridge Road, Archway, London, N19 — £1,650,000 • 5 bed • 4 bath • 1891 ft² Shop for sale in St. Pauls Road, London, N1 — £450,000 • 1 bed • 1 bath • 474 ft²

Shop for sale in St. Pauls Road, London, N1 — £450,000 • 1 bed • 1 bath • 474 ft²