Summary - 5 FOUNDER CLOSE COVENTRY CV4 8BS

5 bed 2 bath Semi-Detached

Income-ready student tenancy with immediate cashflow and refurbishment upside.

Estimated gross yield around 8%

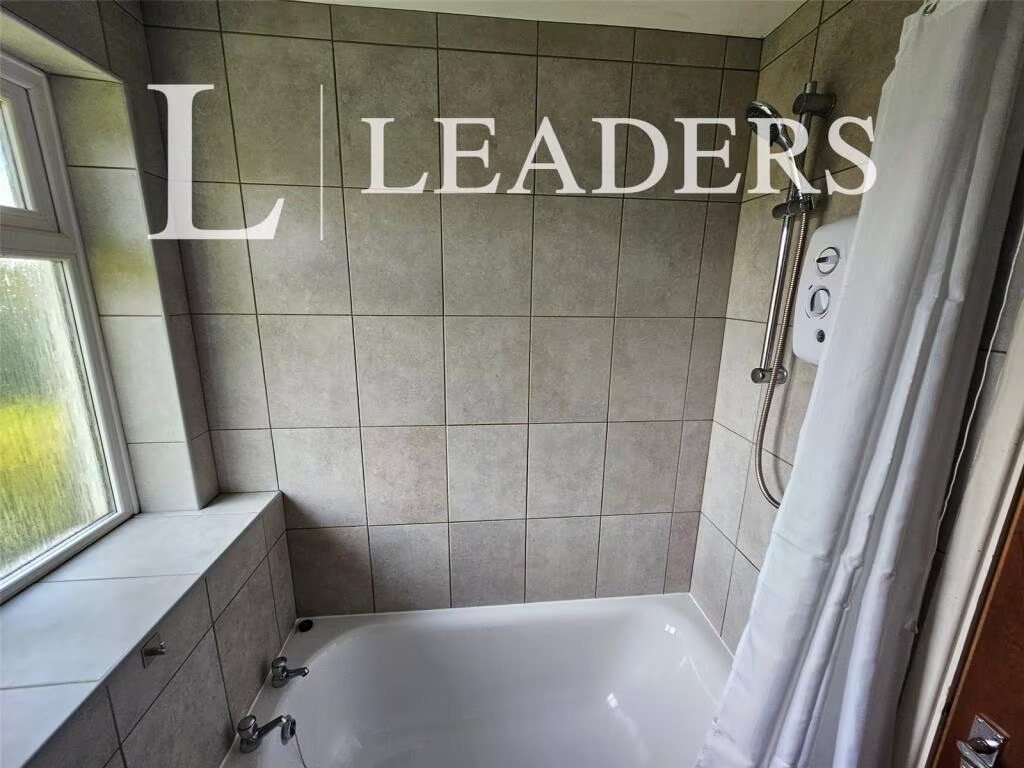

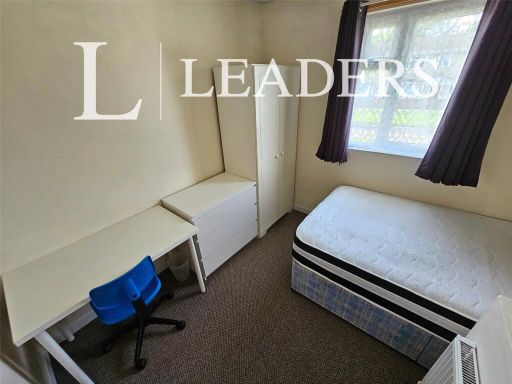

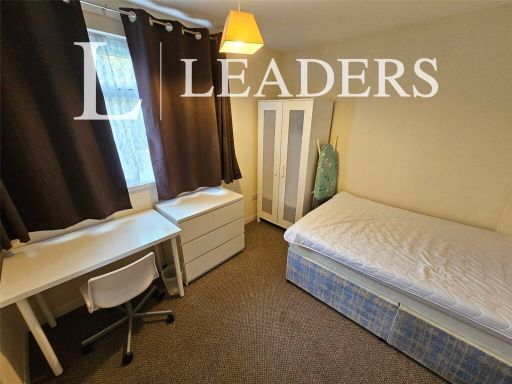

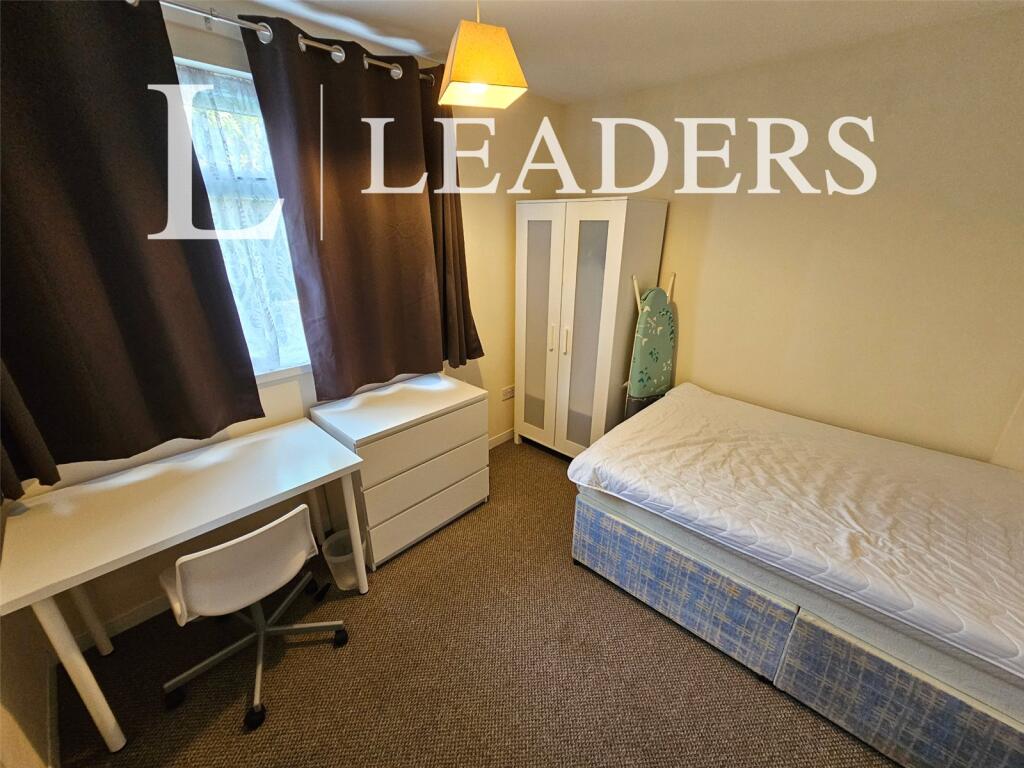

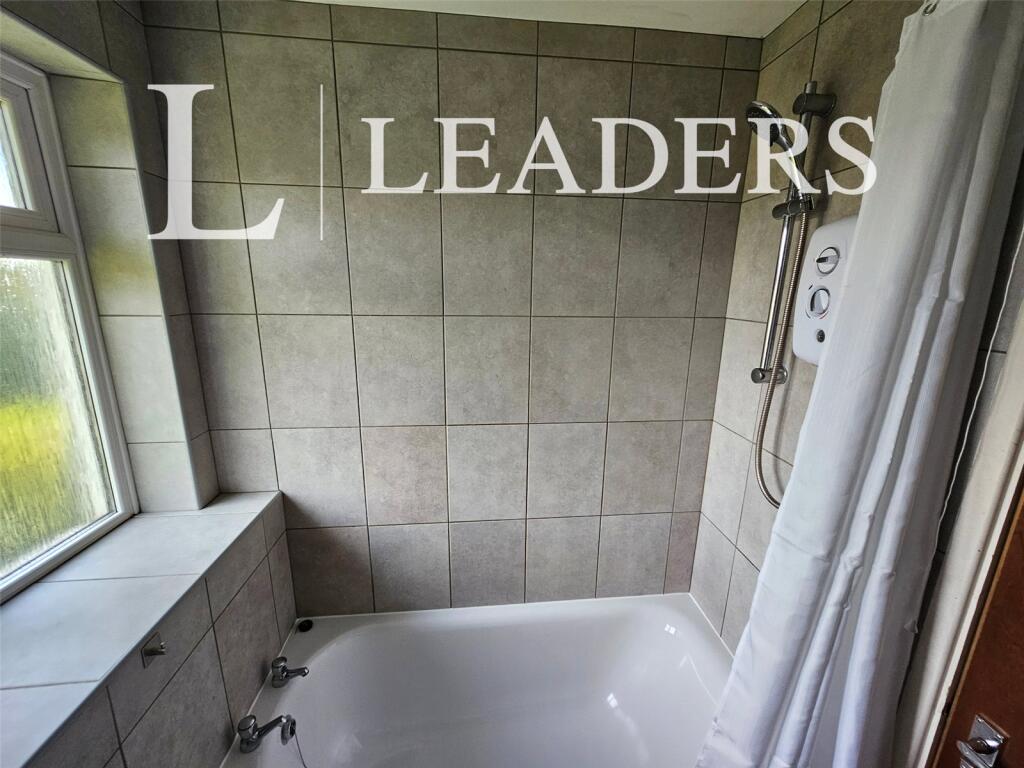

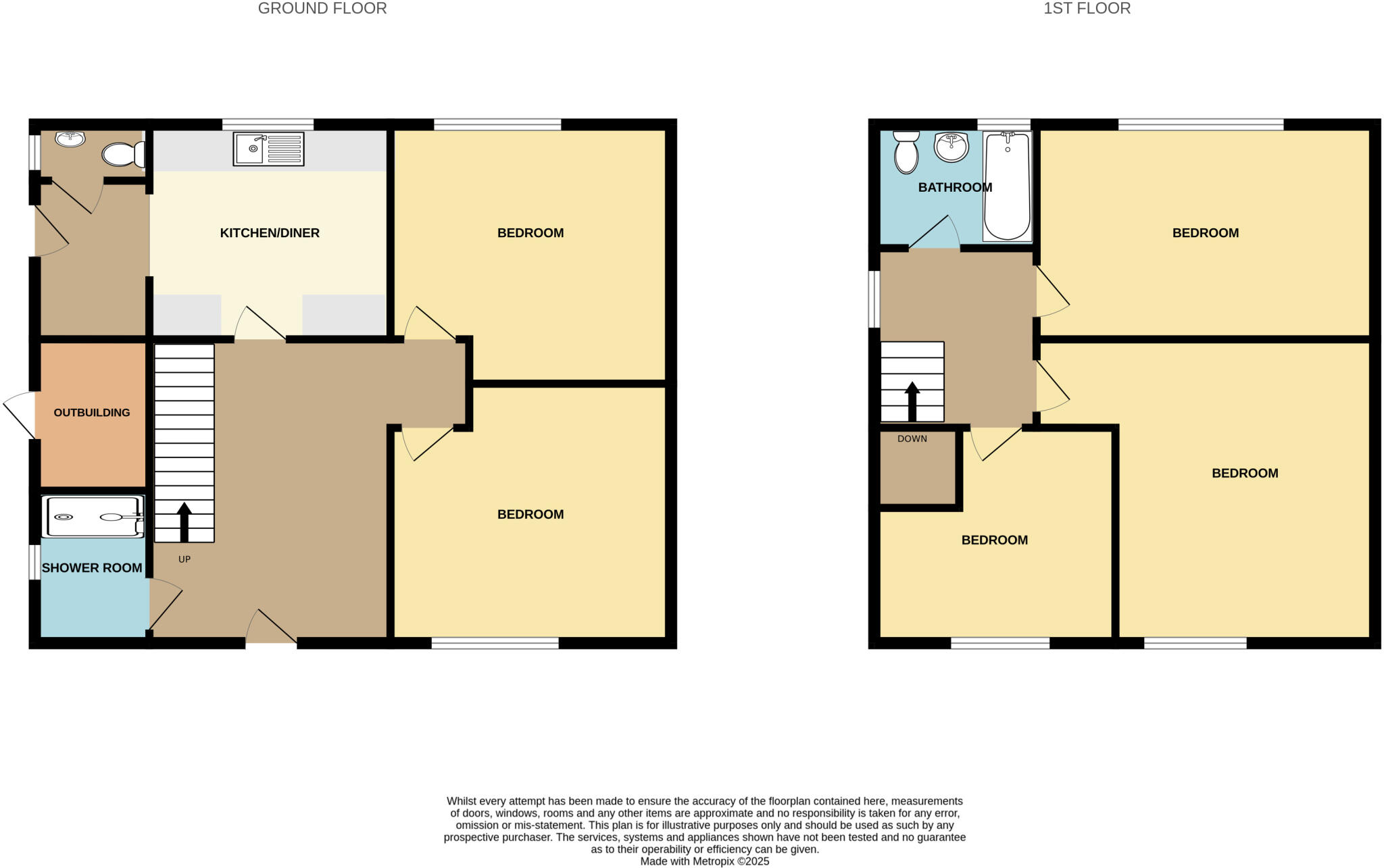

A five-bedroom HMO near the University of Warwick offering immediate rental income and an estimated gross yield of around 8%. Tenants are in situ and signed for the 2025 student year, so the property delivers predictable cashflow from day one. The house includes two bathrooms, a fitted kitchen/dining area and communal living space suited to student sharers.

The building is a mid-20th-century, system-built semi-detached with external insulation and double glazing. That construction type is non-standard for some lenders—buyers should confirm mortgage eligibility before committing. The property shows cosmetic wear and would benefit from targeted modernisation to improve rents and long-term appeal.

Location is the main investment draw: close to Warwick University and local transport links, with good mobile signal and fast broadband for tenants. However, the immediate area is classified as very deprived with hampered neighbourhood indicators; crime is average. These factors keep purchase costs and council tax low but may affect long-term capital growth.

This is an investor-focused purchase: strong short-term returns and low vacancy risk thanks to existing tenancies, but expect ongoing management duties, possible refurbishment spend, and lender checks because of the construction type.

Commercial property for sale in 14 Charter Avenue, Coventry, CV4 8GE, CV4 — £510,000 • 1 bed • 1 bath • 1668 ft²

Commercial property for sale in 14 Charter Avenue, Coventry, CV4 8GE, CV4 — £510,000 • 1 bed • 1 bath • 1668 ft² Commercial property for sale in 18 Sheriff Avenue, Coventry, CV4 8FD, CV4 — £450,000 • 1 bed • 1 bath • 1425 ft²

Commercial property for sale in 18 Sheriff Avenue, Coventry, CV4 8FD, CV4 — £450,000 • 1 bed • 1 bath • 1425 ft² 6 bedroom terraced house for sale in Pershore Place, Coventry, CV4 — £350,000 • 6 bed • 2 bath • 1055 ft²

6 bedroom terraced house for sale in Pershore Place, Coventry, CV4 — £350,000 • 6 bed • 2 bath • 1055 ft² 4 bedroom semi-detached house for sale in Burnsall Grove, Coventry, CV5 — £310,000 • 4 bed • 4 bath • 853 ft²

4 bedroom semi-detached house for sale in Burnsall Grove, Coventry, CV5 — £310,000 • 4 bed • 4 bath • 853 ft² 5 bedroom end of terrace house for sale in Berry Street, Coventry, CV1 — £227,500 • 5 bed • 2 bath • 1115 ft²

5 bedroom end of terrace house for sale in Berry Street, Coventry, CV1 — £227,500 • 5 bed • 2 bath • 1115 ft² 8 bedroom semi-detached house for sale in Charter Avenue , CV4 8EB, CV4 — £490,000 • 8 bed • 8 bath • 1690 ft²

8 bedroom semi-detached house for sale in Charter Avenue , CV4 8EB, CV4 — £490,000 • 8 bed • 8 bath • 1690 ft²