Summary - 10a, Station Road, COLWYN BAY LL29 8BU

1 bed 1 bath Retail Property (high street)

Large freehold retail let to William Hill — transport links and strong yield.

Retail shop let to William Hill at £15,000 p.a.; CPI-linked review Jan 2028

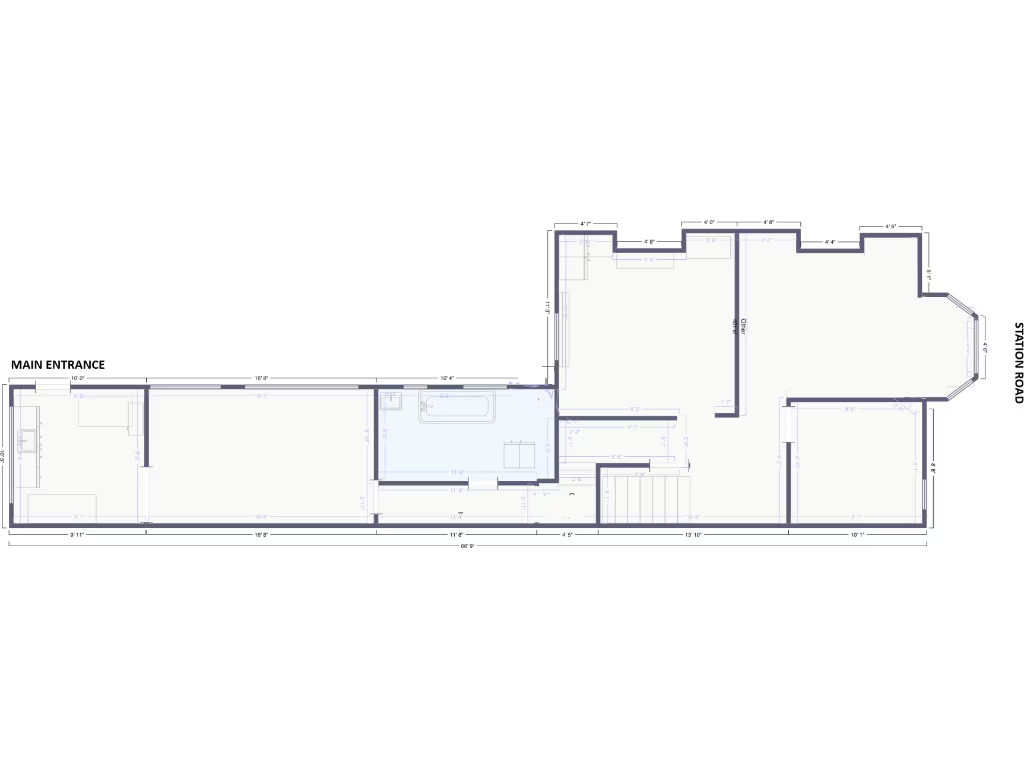

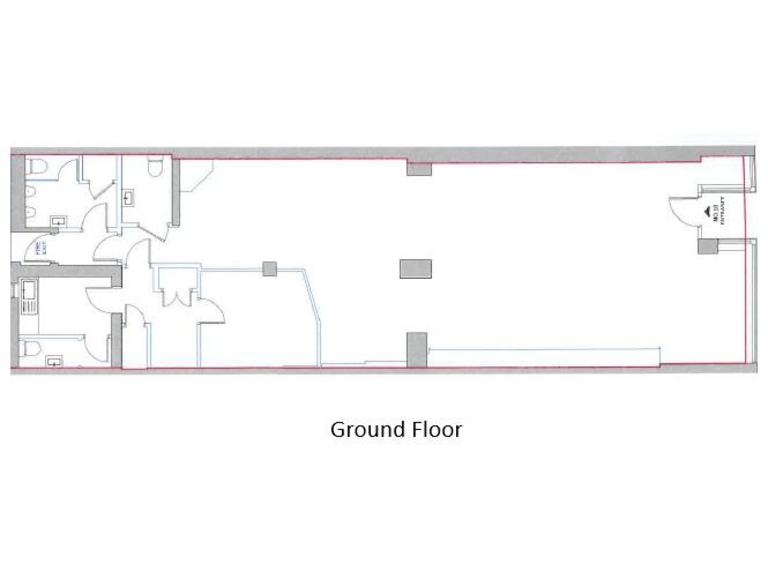

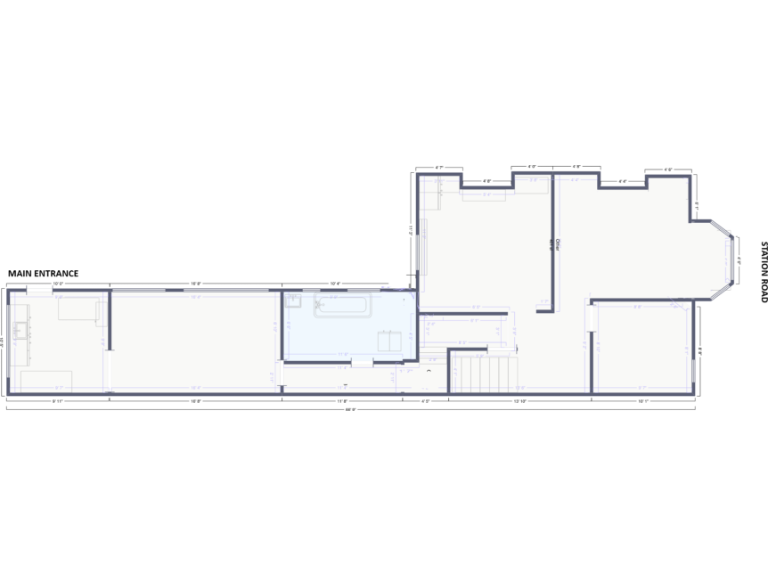

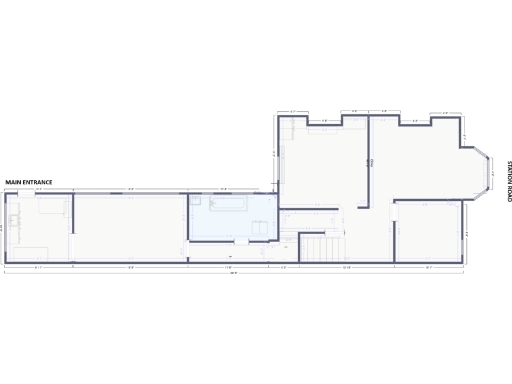

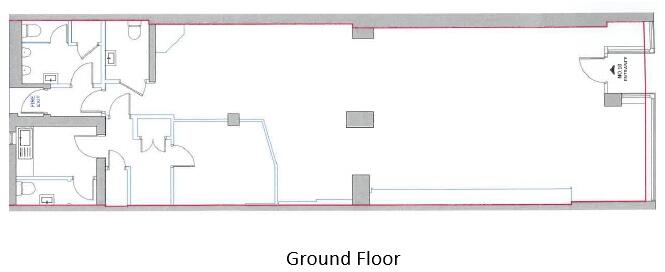

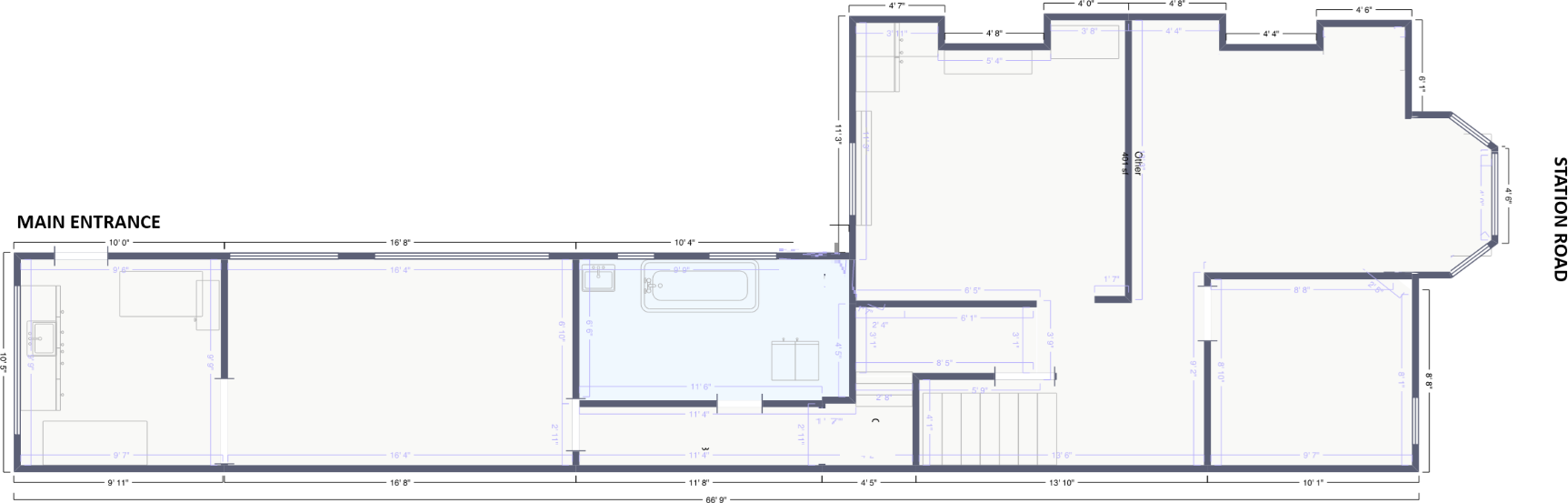

Large retail footprint: 1,777 sq ft (ground + basement) with strong street frontage

Gross initial yield 8.82% at asking price £170,000; VAT not applicable

Freehold; upper residential flat sold-off on a 999-year lease (peppercorn ground rent)

Close to Colwyn Bay Station and A55; strong local footfall from multiples nearby

Tenant has option to determine in Jan 2033—medium-term lease break risk

Local area classified very deprived with very high crime — impacts re-letting risk

Residential income not included; active management or refurbishment possible

An unusually large freehold high-street investment in Colwyn Bay, offered with a long-term William Hill retail lease producing £15,000 p.a. The retail shop extends to 1,777 sq ft across ground and basement, with a gross initial yield of 8.82% at the asking price of £170,000. The lease runs from January 2023 for 15 years on full repairing and insuring terms; a CPI-linked rent review in January 2028 includes a 2.5% collar (minimum increase to £16,900 p.a.).

The property benefits from a central, transport-led location close to Colwyn Bay Station and the A55, with national and local multiples adjacent (Domino’s, Betfred, Santander, KFC). The building is Victorian in character and offers obvious frontage and footfall advantages for a betting shop or alternative retail use. VAT is not applicable and there is a long 999-year lease on the sold-off upper flat (peppercorn ground rent), so ownership is straightforward freehold for the retail element.

Material considerations are explicit: the surrounding area is classified as very deprived with very high local crime figures, which can affect rental security and re-letting. The tenant holds an option to determine in January 2033 (six months’ minimum notice), creating medium-term lease break risk. The residential flat has been sold separately and does not form part of the current rental income stream. Broadband and amenity mix are average to good, and there is no flood risk recorded.

This lot will suit an investor seeking an immediately income-producing, transport-accessible high-street asset with value uplift at the 2028 rent review. It also suits a buyer willing to monitor tenant covenant and neighbourhood risk, or to consider active asset management or refurbishment once vacant.

High street retail property for sale in 10 Station Road, Colwyn Bay, Conwy (County of), LL29 — £170,000 • 1 bed • 1 bath • 1777 ft²

High street retail property for sale in 10 Station Road, Colwyn Bay, Conwy (County of), LL29 — £170,000 • 1 bed • 1 bath • 1777 ft² Shop for sale in 10/10A Station Road, Colwyn Bay, Clyyd, LL29 8BU, LL29 — £140,000 • 1 bed • 1 bath • 1777 ft²

Shop for sale in 10/10A Station Road, Colwyn Bay, Clyyd, LL29 8BU, LL29 — £140,000 • 1 bed • 1 bath • 1777 ft² Shop for sale in Sea View Road, Colwyn Bay, Conwy, LL29 — £150,000 • 1 bed • 1 bath • 1873 ft²

Shop for sale in Sea View Road, Colwyn Bay, Conwy, LL29 — £150,000 • 1 bed • 1 bath • 1873 ft² 2 bedroom mixed use property for sale in Bedford Street, Rhyl, Denbighshire LL18 1SY, LL18 — £210,000 • 2 bed • 3 bath • 2255 ft²

2 bedroom mixed use property for sale in Bedford Street, Rhyl, Denbighshire LL18 1SY, LL18 — £210,000 • 2 bed • 3 bath • 2255 ft² Shop for sale in Lloyd Street, Llandudno, Conwy, LL30 — £300,000 • 1 bed • 1 bath • 3753 ft²

Shop for sale in Lloyd Street, Llandudno, Conwy, LL30 — £300,000 • 1 bed • 1 bath • 3753 ft² High street retail property for sale in Market Street, Abergele, Conwy, LL22 7AA, LL22 — £199,000 • 1 bed • 1 bath • 1916 ft²

High street retail property for sale in Market Street, Abergele, Conwy, LL22 7AA, LL22 — £199,000 • 1 bed • 1 bath • 1916 ft²