Summary - KENNETH HOUSE, WEST ROAD, BUXTON SK17 6HF

1 bed 1 bath Not Specified

Turnkey income with short-term rental upside for hands-on investors.

Produces £54,758.85pa income excluding vacant unit

Five of six suites currently let; one suite vacant at £10,500pa market rent

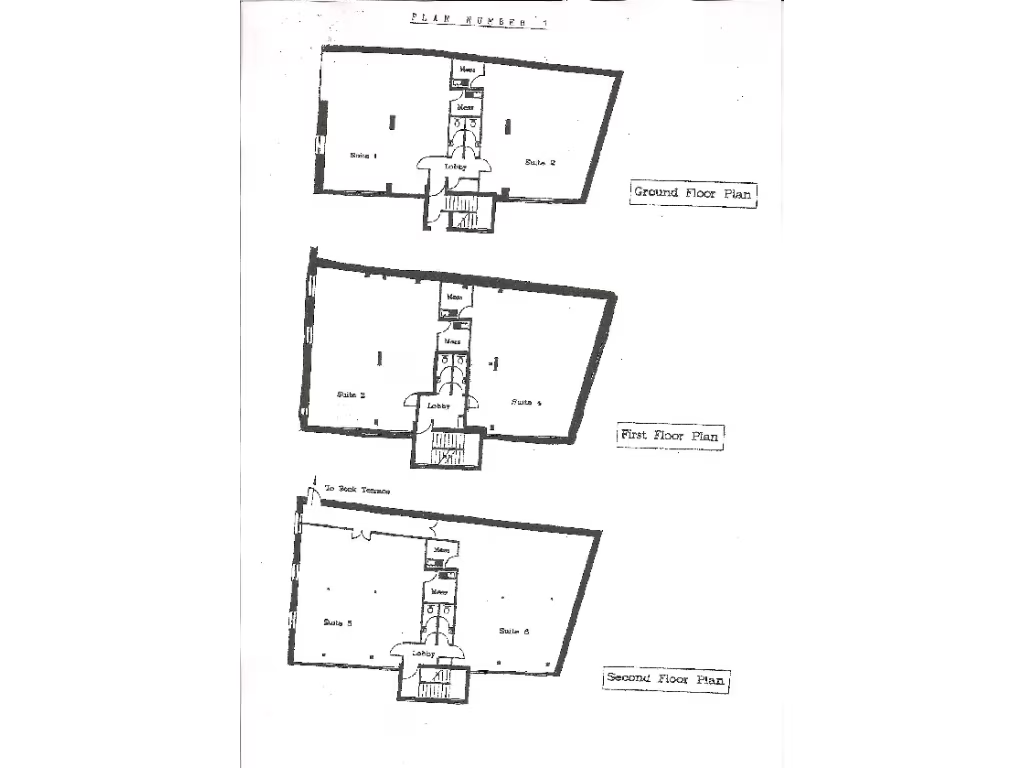

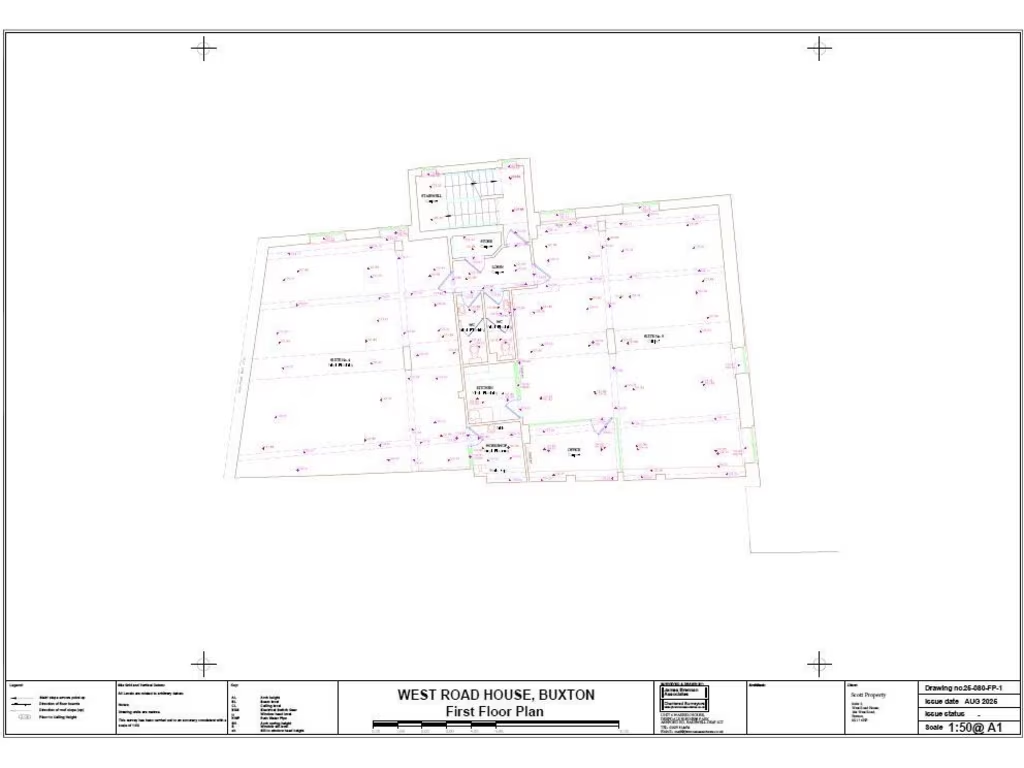

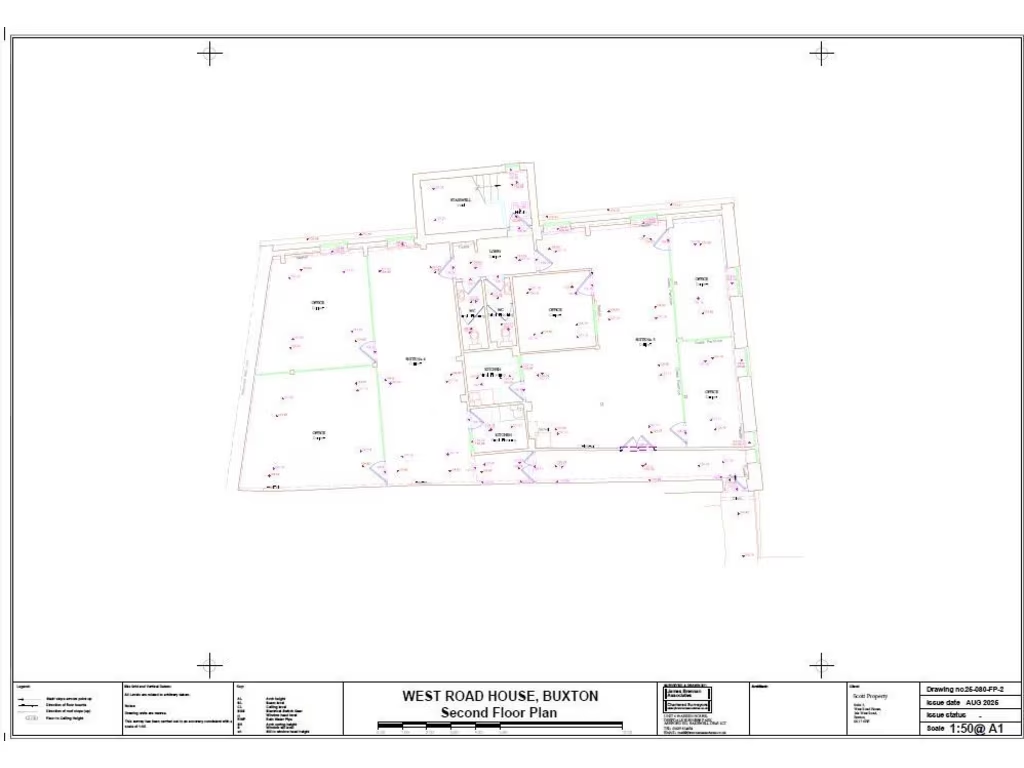

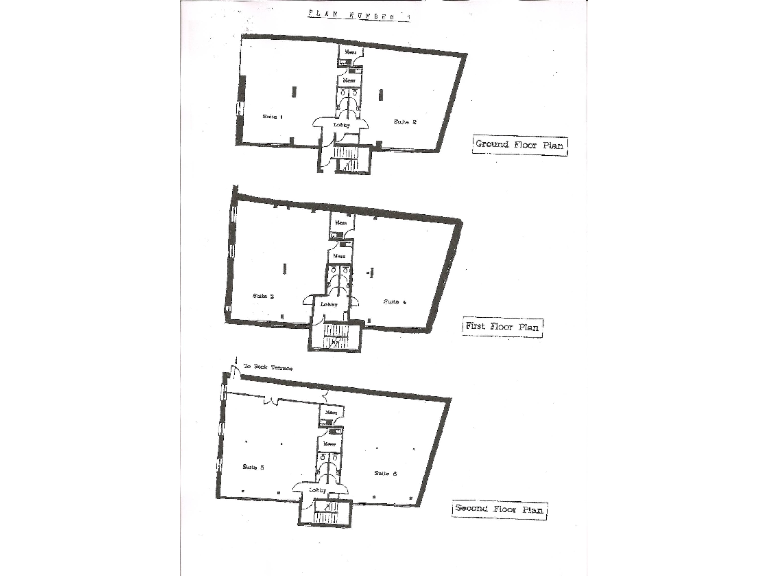

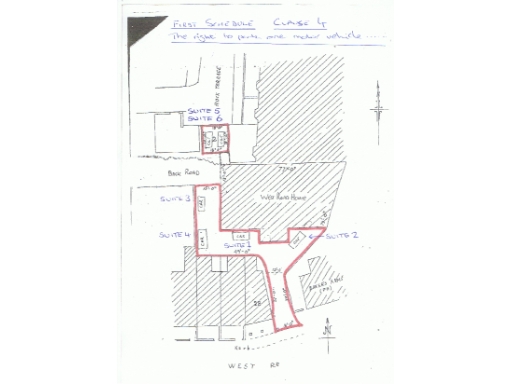

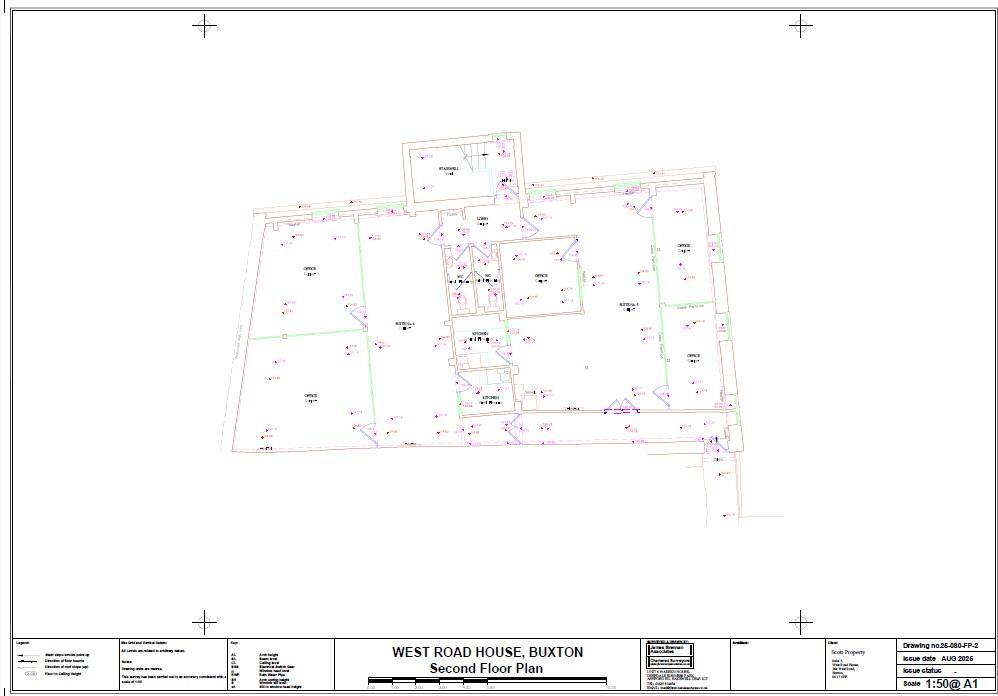

Freehold title; building established as offices in 2007

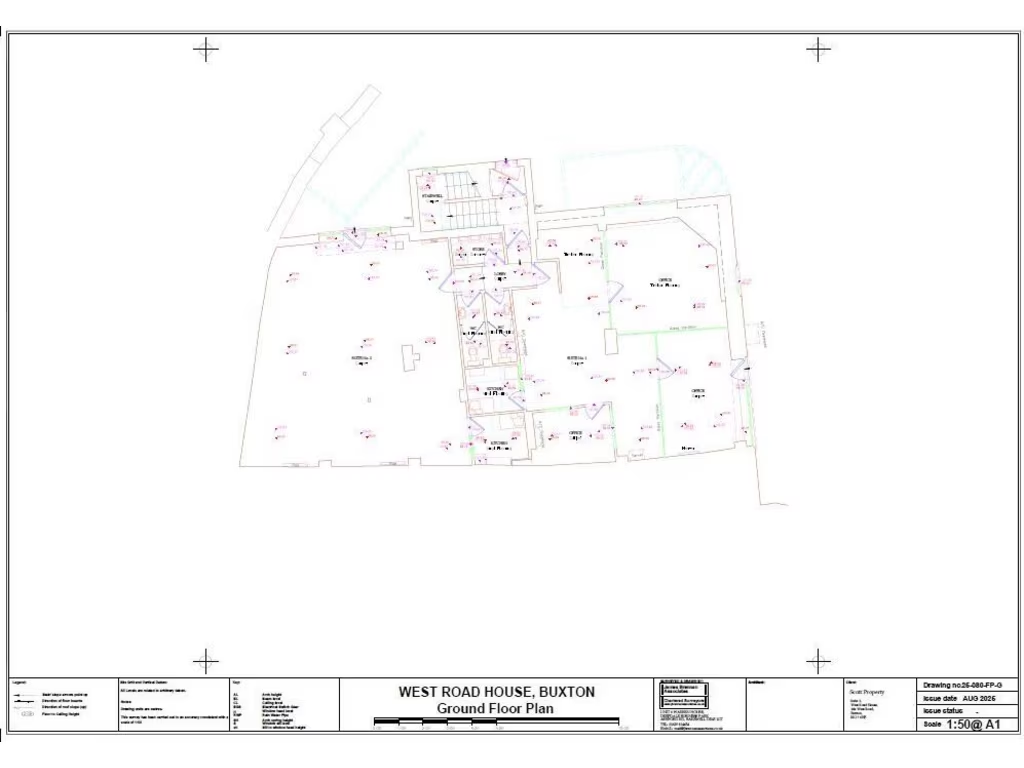

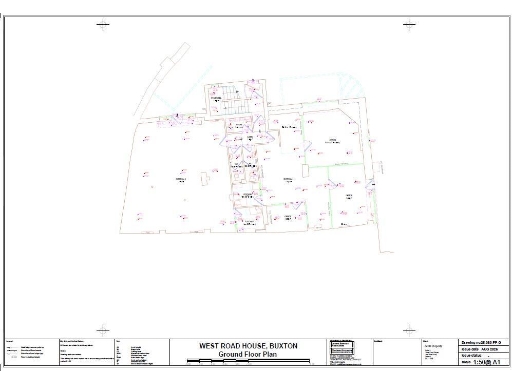

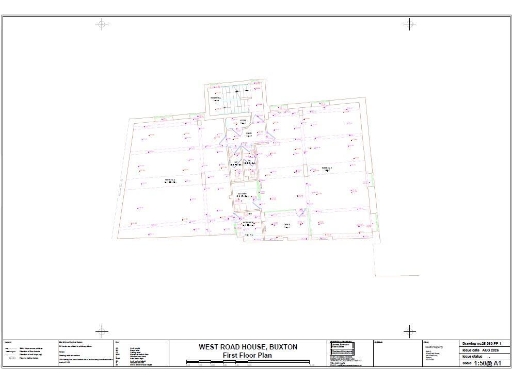

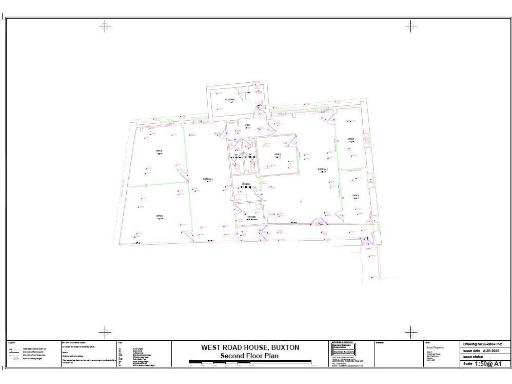

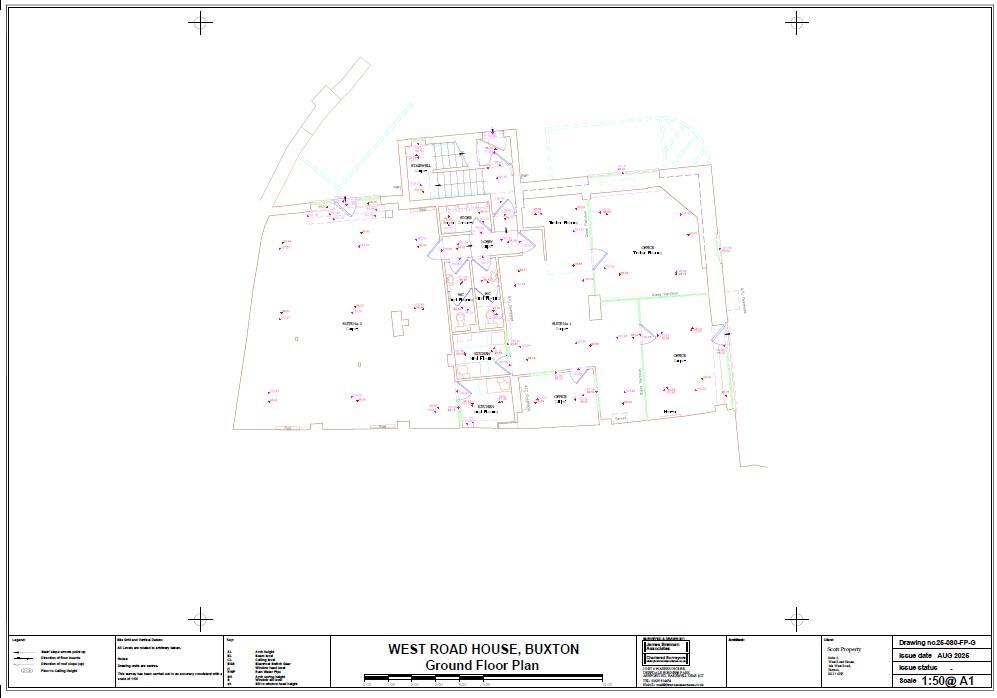

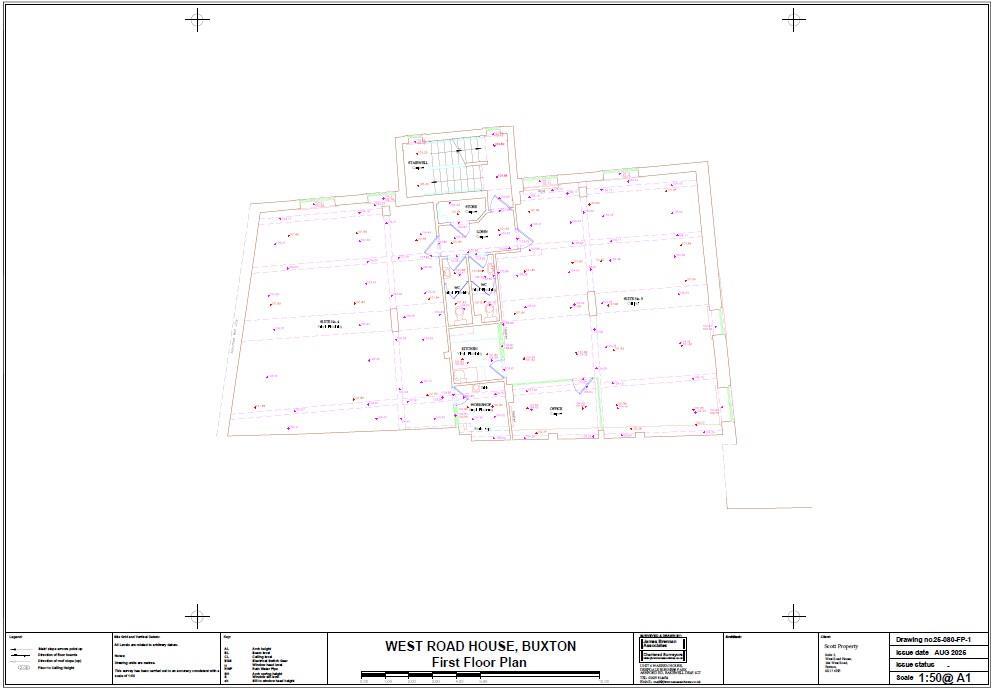

Newly renovated with double glazing and communal kitchens/WCs

DP3 alarm, full fire alarm system and CCTV throughout

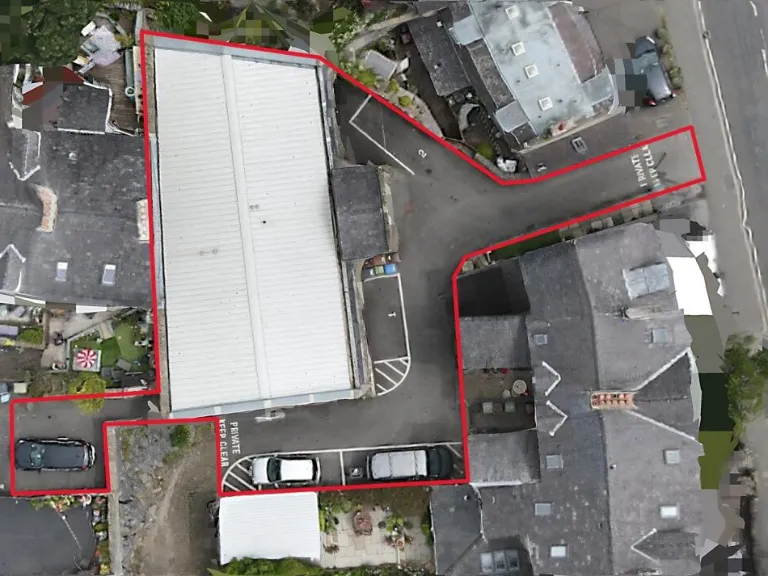

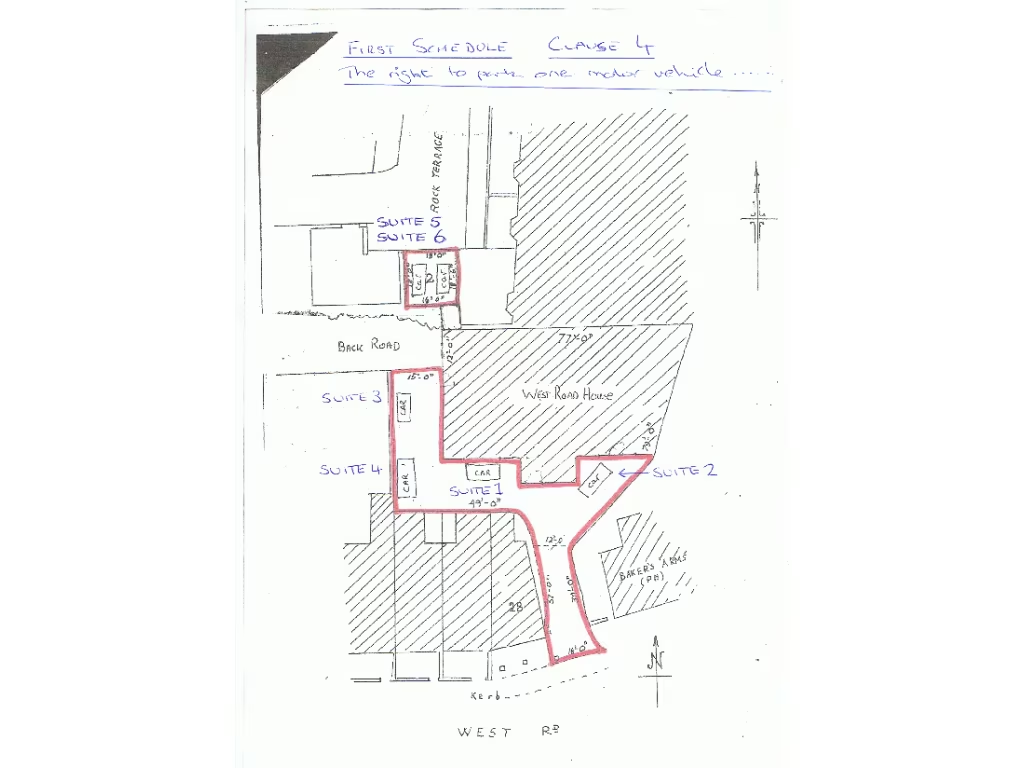

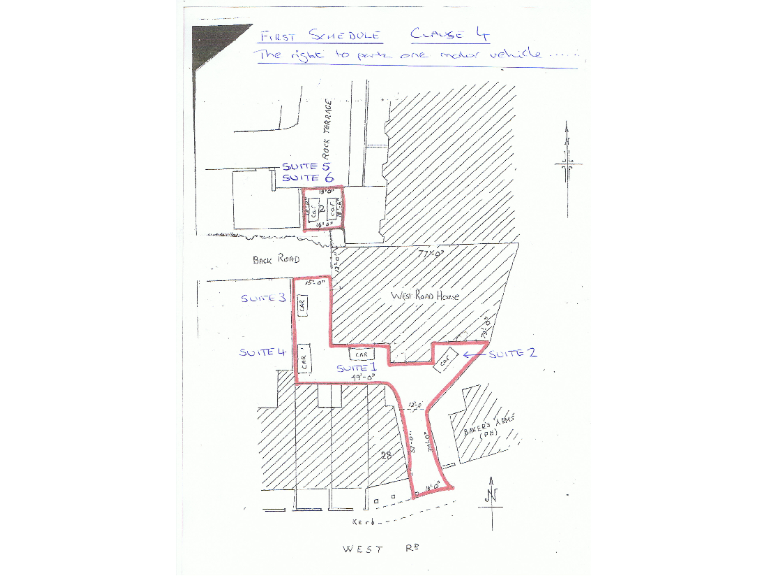

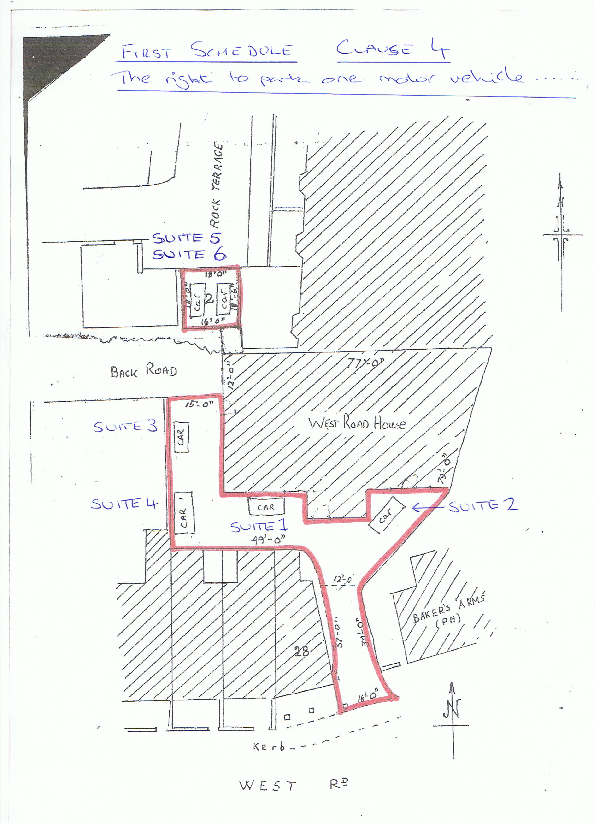

Dedicated off-street parking; one space allocated per suite

Service charge £1,240.56 per unit per annum (ongoing cost)

Local area: student neighbourhoods and higher crime — affects insurance/rent profile

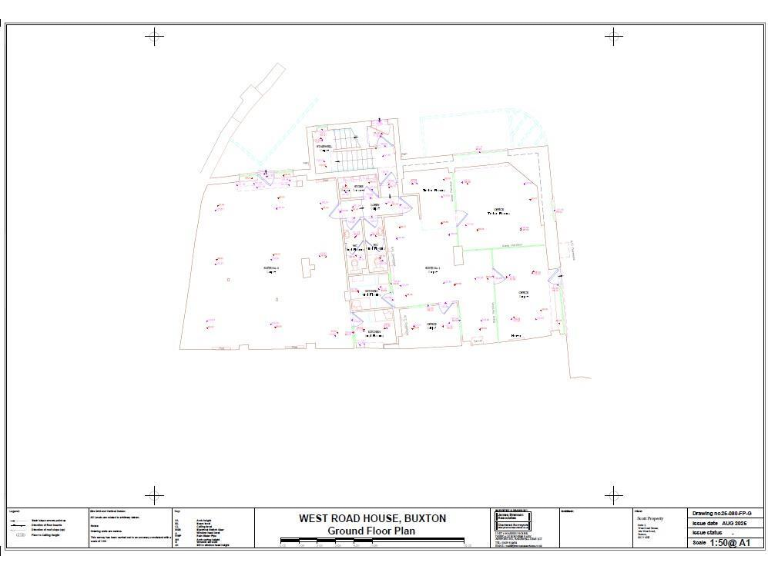

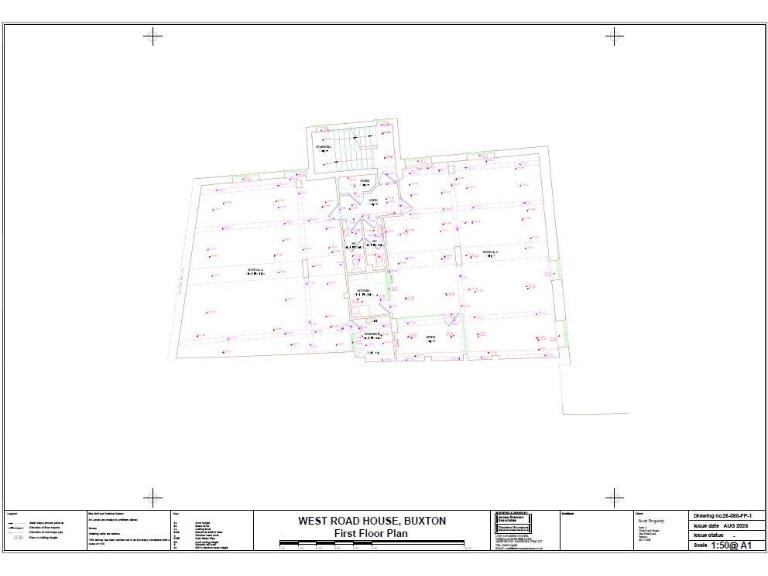

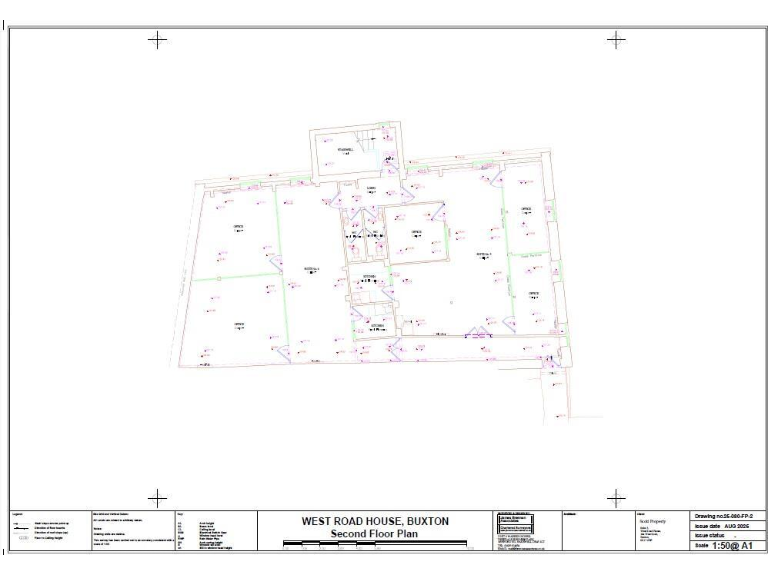

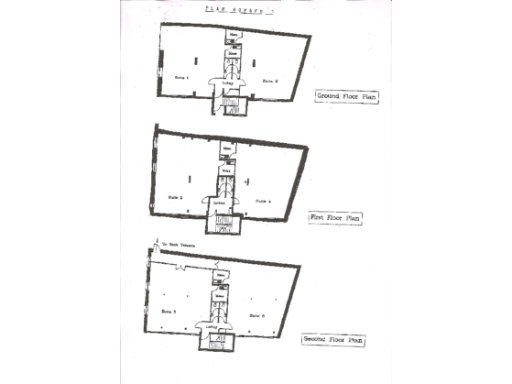

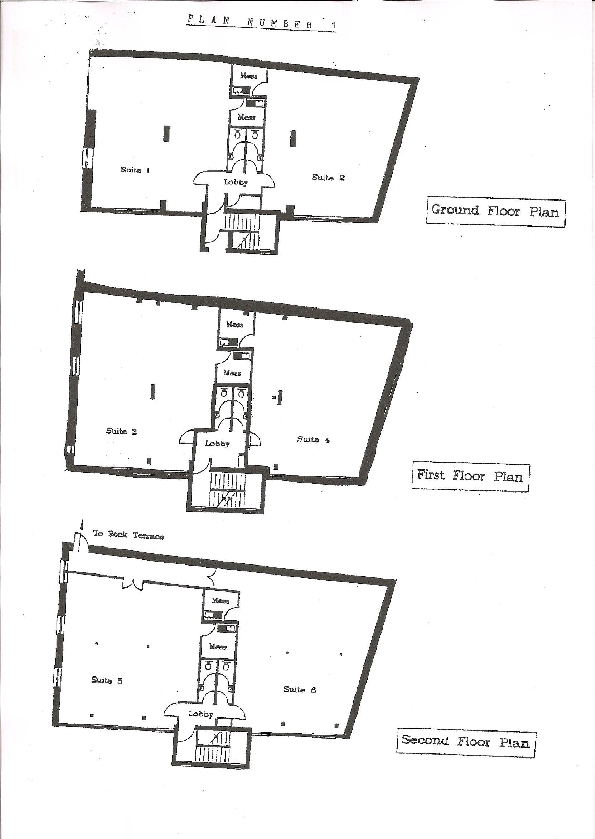

A substantial three-storey converted stone building on West Road, offered freehold and refurbished in recent years. Established as dedicated business offices in 2007, the property comprises six open-plan suites with modern windows, heating, double glazing and kitchen and WC facilities on each floor. Five suites are currently let, producing an annual income of £54,758.85 (excluding the vacant unit), making this a ready-made income opportunity for investors.

The building benefits from commercial-grade security — DP3 alarm, full fire alarm and CCTV — plus off-street parking with a dedicated space per suite. Recent investment in infrastructure and a newly renovated presentation reduce immediate capital expenditure and help attract quality tenants. Fast broadband and excellent mobile signal support modern office occupiers.

Notable practical considerations are a small plot and a service charge of £1,240.56 per unit, per annum. One suite is currently vacant and marketed at £10,500pa, so rental income can be increased quickly. The local area is classified as cosmopolitan student neighbourhoods within a wider families-in-terraces-and-flats area; this brings a steady demand profile but also corresponds with a higher local crime rate, which buyers should factor into underwriting and insurance costs.

Overall, this is a compact, well-specified multi-let commercial building for a buyer seeking immediate income and low near-term refurbishment needs. The freehold title and recent upgrades make it straightforward to manage, while the vacancy and local area dynamics present clear upside and risk to model.

Commercial development for sale in INVESTMENT PROPERTY PORTFOLIO, Derbyshire, SK17 — POA • 1 bed • 1 bath

Commercial development for sale in INVESTMENT PROPERTY PORTFOLIO, Derbyshire, SK17 — POA • 1 bed • 1 bath Office for sale in 25 Church Street, Ashbourne, Derbyshire, DE6 — £299,000 • 1 bed • 1 bath • 1868 ft²

Office for sale in 25 Church Street, Ashbourne, Derbyshire, DE6 — £299,000 • 1 bed • 1 bath • 1868 ft² Commercial property for sale in The Old Schoolhouse, 12 Market Street, Buxton SK17 6LD, SK17 — £272,000 • 1 bed • 1 bath • 1066 ft²

Commercial property for sale in The Old Schoolhouse, 12 Market Street, Buxton SK17 6LD, SK17 — £272,000 • 1 bed • 1 bath • 1066 ft² Office for sale in 34 Altrincham Road, Wilmslow, Cheshire, SK9 — £495,000 • 1 bed • 1 bath • 1406 ft²

Office for sale in 34 Altrincham Road, Wilmslow, Cheshire, SK9 — £495,000 • 1 bed • 1 bath • 1406 ft² Plot for sale in 20 Dale Road, Buxton, SK17 — £750,000 • 6 bed • 2 bath • 1558 ft²

Plot for sale in 20 Dale Road, Buxton, SK17 — £750,000 • 6 bed • 2 bath • 1558 ft² Office for sale in 6B Royal Oak Place, Bakewell, DE45 1ES, DE45 — £520,000 • 1 bed • 1 bath • 803 ft²

Office for sale in 6B Royal Oak Place, Bakewell, DE45 1ES, DE45 — £520,000 • 1 bed • 1 bath • 803 ft²